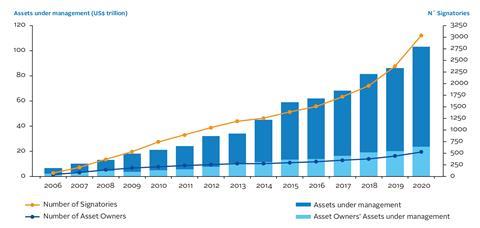

The number of investor signatories increased by 29%, from 2092 to 2701, over the last year, while the number of asset owner signatories increased by 21% to reach 521.

The collective AUM represented by PRI signatories increased by 20% over the period, from US$86.3 trillion to US$103.4 trillion as of 31 March 2020, across 3038 signatories (2701 investors and 337 service providers).

AUM based on active signatories as of 31/03/2020. Double counting resulting from subsidiaries and externally managed assets by PRI signatories accounts for 12.3% and has been removed. AUM based on active signatories as of 31/03/2020. Double counting resulting from subsidiaries and externally managed assets by PRI signatories accounts for 12.3% and has been removed.

Key targets

Signatories per relationship manager: 144

(PRI target: 100)

Membership share among US asset owners*: 14%

(PRI target: 35%)

Membership share among Apac asset owners*: 43%

(PRI target: 35%)

Membership share among largest asset owners*: 61%

(PRI target: 35%)

Signatory review meetings with overall signatory base: 33%

(PRI target: 33%)

Signatory review meetings with asset owners: 70%

(PRI target: 80%)

This year our signatory relationship managers held over 850 meetings with signatories, covering just over a quarter of our signatory base and roughly 69% of signatory AUM.

Spotlight on emerging markets

Issues such as climate change and meeting the SDGs disproportionately impact emerging markets. As such, we have made a concerted effort to work with signatories in emerging markets to mitigate any likely negative effects, where possible, and help them adapt and respond to opportunities, where these present themselves, through responsible investment. We recognise that as emerging markets grow, there is an opportunity for them to do so sustainably, particularly in the context of recovering from the ongoing COVID 19 pandemic.

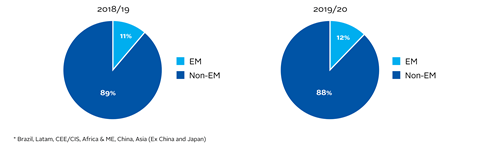

Proportion of signatories headquartered in an emerging market*

*Brazil, Latam, CEE/CIS, Africa & ME, China, Asia (Ex China and Japan)

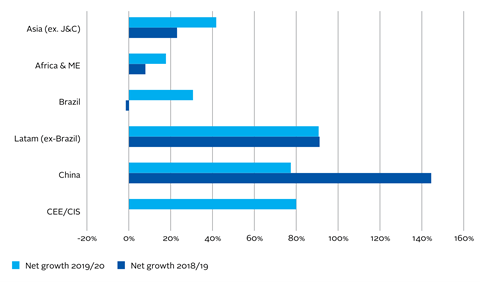

We saw net growth in signatories1 across all emerging market regions this year.

Net growth of signatories based in an emerging market

Africa and the Middle East

Over the last year, our regional relationship managers have been working with African & Middle Eastern signatories to encourage increased engagement with various PRI platforms, including working groups and advisory committees. Interest in what signatories can do about issues such as climate change and income inequality has been growing, as has the call for a forum to convene regionally-focused discussions. In response, we launched the PRI Africa Discussion Group, which included in-person presentations from PRI technical specialists.

As part of our commitment to educating asset owners, we have developed the African Asset Owner Climate Awareness Course, to be hosted on the PRI Academy platform with professional accreditation from African financial sector capacity development organisation, Batseta. The course, aimed at improving the capacity of African investors to understand and take appropriate action with respect to context-specific ESG risks and opportunities, will launch by the end of 2020.

LatAm (ex-Brazil)

Since 2018, when PRI put in place a new strategy to interact with existing and potential signatories in Spanish-speaking countries in Latin America, we have seen a rapid uptake in responsible investment, demonstrated by signatories growing by 90%, from 21 to 40 as of 31 March 2020. Last year, our signatory relationship managers held a series of workshops in Mexico, Chile, Colombia and Peru, focused on our series of introductory guides (see Asset owner section), to support new signatories in developing a responsible investment strategy.

Brazil

The number of PRI signatories headquartered in Brazil increased by 30% over the last year, reaching 65, against a backdrop of ESG-related regulatory changes related to the country’s pensions industry. We have continued to focus on enhancing investor awareness and building capacity on ESG issues by coordinating engagements projects and participating in seminars and roundtables, in partnership with key network supporters and investors.

In partnership with the Investors Association of Financial Market Analysts, we coordinated and moderated an SDG Dialogues roundtable discussing the challenges and opportunities in Brazilian energy and infrastructure sectors. Signatory relationship managers also convened investors for a workshop on climate change and TCFD, focused on scenario analysis and disclosure.

China

We have had a presence in mainland China since October 2017. Our signatories have increased significantly since then, growing by 77% in the last year to reach 39 by 31 March 2020, including two asset owners. This growth has contributed to an increasing awareness and evolution of responsible investment in China, alongside drivers such as foreign capital inflows and shifting government priorities towards green and high-quality development.

China has been a focus of the PRI’s policy engagement work, with the publication of ESG data in China: recommendations for primary ESG indicators and ESG and Alpha in China. Our local signatory relationship managers have supported these endeavours by hosting a series of conferences and workshops to launch reports, consult with Chinese investors and build their capacity on ESG issues and responsible investment practices. Efforts to recruit local signatories for initiatives such as Climate Action 100+ were also successful, with five investors signing up.

To improve our communication of PRI activities and responsible investment in the market, we established a presence on two Chinese social media channels, and increased our Chinese-language resources.

Asia (ex-Japan)

While most of our Asian signatories are headquartered in Japan, Hong Kong SAR, China and Singapore, we have been increasingly looking to support the development of responsible investment in emerging Asian markets. Though many signatories are early in their responsible investment journey, their growing participation in initiatives such as Climate Action 100+ and the PRI’s Sustainable Palm Oil collaborative engagement and investor working group is encouraging.

Over the last year, PRI representatives have participated in industry events in Thailand, Malaysia and India, while building on dialogue with key stakeholders to explore and identify opportunities for collaboration and local market education in 2020 and beyond. We continue to grow our regional network supporters, most recently welcoming the Asia Pacific Association for Fiduciary Studies, whose membership includes institutional investment funds. We are collaborating on events and capacity-building workshops to promote prudent stewardship by asset owner trustees in Small Island Developing States, many of which are already impacted by climate change.

Central Eastern Europe & the commonwealth of independent states

While not all countries in the CEE & CIS region are defined as emerging markets, responsible investment and ESG incorporation practices are still developing there. As such, our outreach efforts have continued to focus on understanding the markets barriers to responsible investment and on raising awareness of ESG materiality. During the year, PRI participated at industry events in Azerbaijan, Bulgaria (virtually), Poland, Russia and Turkey to build dialogue with investors, stock exchanges and other stakeholders.

As part of its engagement effort to support the implementation of the EU Action plan on sustainable finance, we worked with a local think tank WiseEuropa to prepare a briefing on sustainable finance in Poland, which mapped the market structures supporting or hampering ESG integration. Our signatory relationship managers also took part in local initiatives to support signatories playing a key role in ensuring that responsible investment becomes mainstream in Poland.

We have also seen interest in sustainable finance from signatories and stakeholders in Russia and Turkey. We provided comments to the Draft Project on Recommendations by the Central Bank of Russia on responsible investment and shared its insights into the global development of ESG regulation – especially the EU Taxonomy – with a taskforce in Turkey. Our dialogue with asset managers from CEE and CIS countries is well established, but we have also starting to see more interest from local asset owners.

References

1Includes service providers