Engaging companies on ESG issues improves their sustainability, their management and their risk/return profiles

To ensure we foster a community of active owners, we are committed to measures including:

- increasing signatories’ understanding of how to exercise their investor rights;

- coordinating collaborative engagements to maximise investors’ collective impact;

- promote alignment of proxy voting practices with responsible investment beliefs;

- enhance the PRI Collaboration Platform to make it a global hub for active ownership.

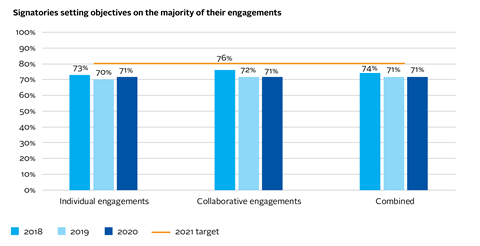

Signatories setting objectives on the majority of their engagements

Just over 70% of asset owner and investment manager signatories have a policy on active ownership and have implemented organisational measures to effectively execute that policy in their listed equity holdings, as measured by setting objectives of the majority of their engagements.

The decline in percentage of signatories doing this reflects the fact that many investors join engagements in a supporting, as opposed to lead, capacity, making them less likely to set targets themselves. Additionally, there has been growth in the use of engagement service providers by signatories, where the setting of objectives would be conducted by the service provider as opposed to the signatory.

Key targets

Signatories setting objectives for a majority of their (individual and collaborative) engagement activities: 71%

(PRI target: 80%)

Companies engaged with as part of a PRI-led engagement improve their overall performance against the initiative’s objectives: 79%

(PRI target: 85%)

Number of posts to the Collaboration Platform: 22% decrease

(PRI target: 14% increase)

Active Ownership 2.0

This year we launched a major new programme of work, entitled Active Ownership 2.0, which puts forward a vision for the future of stewardship through a proposed aspirational standard. It sets out areas for leading practice by investors, based on an assessment that the aggregate impact of current stewardship practices is failing to meaningfully reduce systemic risks or address the SDGs.

Active Ownership 2.0 builds on existing practice and expertise but explicitly prioritises the seeking of outcomes over process and activity, and common goals and effort over narrow interests. The first report from the programme, Active Ownership 2.0, sets out the case for change and a high-level framework for what the standard could involve. It was launched, alongside presentations of Active Ownership 2.0, at PRI in Person 2019 and at PRI Forums in Frankfurt, The Hague and Stockholm.

Signatories were consulted online and in one-to-one meetings We received lots of positive feedback, and signatories are keen for further detail on how to implement the framework in different areas of practice.

We will not mandate the adoption of Active Ownership 2.0 but will encourage it for those who wish to do so, by aligning the 2020/2021 Reporting Framework, leadership standards and the services we provide to signatories with the new standard.

Acting in concert

Collaboration with other investors offers one of the most effective mechanisms through which PRI signatories can achieve change amongst investees.

Some, however, have raised concerns that the regulatory environment in certain markets has hampered investors’ willingness and ability to engage collaboratively. Through the Acting in concert guides, we aim to address these concerns, by working with law firms to clarify where barriers do, or do not, exist. This year, we commissioned Linklaters and Bowmans to provide legal guidance for the UK and South Africa respectively, in which several typical collaborative engagement scenarios were assessed to determine whether they would trigger regulatory requirements. Crucially both law firms found that, in most cases, collaborative engagement on ESG issues with companies in those markets is unlikely to trigger regulatory requirements.

This work fits within our broader stewardship and active ownership strategy which, among other things, seeks to address a number regulatory and system barriers that prevent signatories from conducting effective stewardship activities.

Climate Action 100+

Climate Action 100+ is one of the world’s largest investor‐led engagement initiatives, with more than 450 global investor signatories across 28 markets, representing more than US$40 trillion in assets under management. It aims to ensure that the world’s largest corporate greenhouse gas emitters take necessary action on climate change, with engagement already securing public commitments from energy companies Shell and EDF and shipping group Maersk.

The PRI is one of five investor networks leading the initiative’s engagement work. As well as chairing the multi-region working group, PRI CEO Fiona Reynolds sits on the global steering committee governing Climate Action 100+.

As Climate Action 100+ is the first large-scale collaborative engagement on climate that has been undertaken in Asia, the region has been a focus this year. To ensure engagement will be successful, we established the Asia Advisory Group with AIGCC to provide strategic insights and assist with fostering greater understanding of the local market context. As part of this effort, we also increased our presence and resources in Asia, appointing staff who understand the markets and languages, and can further develop local relationships. More detail on our staff development can be found here.

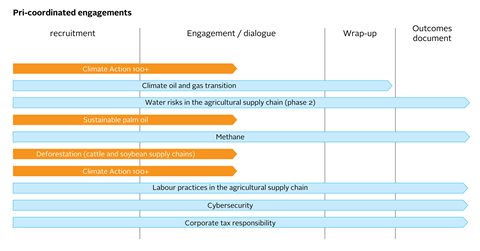

PRI-coordinated engagements

Ongoing engagements include:

- Climate Action 100+

- Climate oil and gas transition

- Sustainable palm oil

- Deforestation

- Responsible sourcing of cobalt

- Tailings dam safety

Five engagements closed in 2019/2020:

Tax

81% of companies responding to the engagement committed to avoiding aggressive tax planning

Corporate taxation that is effective and fit for purpose can drive sustainable development, mitigate rising inequality and support inclusive growth and prosperity. In addition to financing much-needed public services, it can enable governments to fund social and environment programmes to address some of the pressing global challenges we face today. To meet these objectives, however, the global tax system must evolve and adapt, and businesses must embrace corporate tax responsibility.

We ran a collaborative engagement on corporate tax transparency between 2017 and 2019, building on previous work in this area including benchmark research, engagement guidance and investor recommendations. The engagement sought to create awareness within companies of investor concerns around aggressive corporate tax practices and expectations of responsible tax practice; improve company disclosures across tax policy, governance and financial reporting; and identify best practice. Read the results of our engagement here.

Cyber security

42% of companies disclosed 10 or more cyber governance and risk management indicators

Cyber security is one of the biggest risks the world will face in the next 10 years and is an area that institutional investors must continue to assess. However, poor corporate disclosure and a lack of advanced technical expertise make it difficult for investors to understand how companies are addressing this growing challenge. As the incidence of cyber attacks and the costs of security failures increase, institutional investors want to be on the front foot in assessing portfolio exposure to cyber security-related risks. Read the results of our engagement here.

Labour practices in agricultural supply chains

70% of companies disclosed the location of suppliers and volumes of product sourced at the end of the engagement

Companies around the world are failing to address labour abuses in their supply chains. An estimated 40.3 million people are subject to some form of modern slavery, with the agriculture, forestry and fishing sector accounting for 11% of this number, and the wholesale and trade sector another 9%. An estimated US$150bn each year is generated from the theft of their labour. It is imperative that businesses and their investors understand their responsibilities toward workers in relation to a range of labour rights issues. Read the results of our engagement here.

Water risks in agricultural supply chains (part 2)

100% of companies are beginning to map the locations of tier-one suppliers for key commodities.

Since 2015, we have coordinated a collaborative engagement on water risks in agricultural supply chains. The engagement focused on these supply chains because agriculture is a major user of water, responsible for the withdrawal of 70% of the world’s freshwater. PRI investor signatories therefore engaged companies with significant dependencies on agriculture supply chains in the following sectors: food, beverages, agricultural products, apparel and retail (supermarkets). The engagement took place over two phases: phase one (2015-2017) involved 32 companies, while phase two (2018-2019) involved the 17 laggard companies from phase one. Read the results of the second phase of engagement here.

Methane

81% of companies improved their overall disclosure of methane emissions since the engagement began

Between 2017 and 2019, we coordinated a collaborative engagement on methane with the oil and gas and utilities sector. Thirty-six global institutional investors representing approximately US$4.2 trillion engaged with 31 companies across the oil and gas and utilities value chain. The objective was for companies to measure, manage and reduce their methane emissions. In addition, investors sought to improve company disclosure and their own understanding of methane risks. Read the results of the engagement here.

Creating a global standard on Tailings Management

Following the tragic tailings dam collapse at Brumadinho in Brazil on 25 January 2019, we co-convened a global tailings review alongside the United Nations Environment Programme and the International Council on Mining and Metals. The Global Tailings Review has led to the development of a standard on tailings management that can be applied to existing and future tailings facilities globally. A first-of-its-kind, the standard will strengthen current practices in the mining industry by integrating social, environmental, local economic and technical considerations into the entire tailings facility lifecycle – from site selection, design and construction, through management and monitoring, to closure and post-closure. Going forward, we will work with investors to support all mining companies in implementing the standard.