Environmental, social and governance issues affect investment performance across companies, sectors, regions and asset classes

To support investors incorporating ESG issues, we have committed to:

- increase the depth of insight and practice in asset classes where ESG incorporation is mature and penetration high;

- build the foundations for ESG incorporation in asset classes where it is still new; and

- lead signatories’ awareness and response to existing and emerging ESG issues.

This year we have continued to increase the depth of thought leadership and practice in fixed income (sovereign credit and credit rating agencies), as well as in alternative asset classes – primarily private equity and real assets.

ESG incorporation across all asset classes

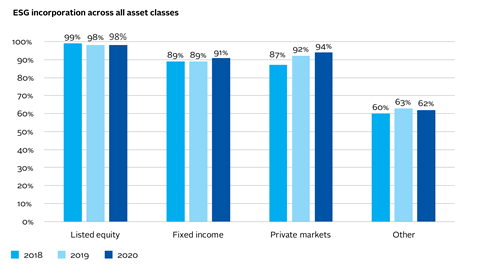

Some 98% of asset owner and investment manager signatories reported that they incorporate ESG factors into their listed equity investments, while 91% reported ESG incorporation in fixed income and private markets.

Key targets

Signatories incorporating ESG issues in listed equity investments: 98%

(PRI target: 100%)

Signatories incorporating ESG issues in other asset classes: 84%

(PRI target: 80%)

Fixed income

ESG in credit risk and ratings

The ESG in Credit Risk and Ratings Initiative aims to enhance the transparent and systematic integration of ESG factors in credit risk analysis. The initiative’s Statement on ESG in Credit Risk and Ratings – still open to sign – is so far supported by 160 investors with over US$30 trillion of AUM, and 21 credit rating agencies (CRAs).

This year, we organised roundtables in mainland China and Latin America, completing a global series that gathered credit practitioners from investors and CRAs to discuss ESG topics. Its credit focus and scale made the series the first of its kind, with 21 forums held in 15 countries.

We published Takeaways from the EM forums – the fourth publication to come out of the initiative, adding to the results documented in the trilogy, Shifting perceptions: ESG, credit risk and ratings.

We also held a workshop in Paris, bringing credit analysts from the buy and sell side and CRAs together to engage with representatives from debt issuers’ corporate finance departments. The key takeaways from this workshop, which marked the first of what will be a series taking place in 2020, can be found here.

Finally, we launched a CRA quarterly update to track the progress that CRAs are making in their commitment to the ESG in Credit Risk and Ratings Statement. The update allows fixed income investors to use the CRA latest resources as a tool in their ESG integration process and creates opportunities to continue the investor-CRA dialogue that we initiated.

Sovereign bonds

Sovereign debt represents an important asset classes for PRI signatories. While some ESG factors have always been part of sovereign credit analysis, risk management and client demand are encouraging investors to develop more systematic approaches to integrating these into sovereign debt valuations and investment decisions.

In 2019/20, we published a technical guide on ESG incorporation in sovereign debt, to help all participants – investment managers, service providers and debt management offices – in the space. It was launched at a sovereign debt-focused panel session at PRI in Person. We also hosted a series of webinars on the subject.

Listed equity

Passive investment strategies

Passive investments and ESG have been two key themes in asset management over the last 10 years. We published a discussion paper, How can a passive investor be a responsible investor, which identifies some of the issues associated with the developments in this investment practice. This was followed by a consultation process and two industry events. The results of this consultation are synthesised in a public summary report, covering ESG incorporation (focused on the development of ESG indexes) and active ownership (focused on engagement approaches across passive or quant-based strategies). This was accompanied by a series of case studies to share leading practice.

Private markets & alternatives

Private equity

We published its third iteration of a technical guide on how responsible investment can be applied by limited partners, providing an update on how the private equity landscape has changed since the previous edition was published in 2011.

The private equity industry is increasingly looking at how it can report on climate-related issues, and in recognition of this, we published a technical guide on the application of the FSB’s Task Force on Climate-related Financial Disclosures (TCFD) recommendations in this asset class. Read more about our climate-related work.

Real assets

We hosted a series of global infrastructure workshops focused on exploring how the UN Sustainable Development Goals are, or should be, applied in this asset class. This will result in the publication of a discussion paper and further case studies in 2020.

We also produced a guide to help investors take a holistic approach to responsible forestry investing, including looking at certification, land rights and usage.

Hedge funds

We published a technical guide on responsible investment in the hedge fund industry. Due to the heterogeneous nature of hedge fund strategies, the guide focused on how ESG issues can be incorporated across various asset classes and addressed practices such as stock lending and short selling.