Climate change is the highest priority ESG issue facing investors

To champion climate action, we have committed to:

- work with our UN partners to meet the Paris Agreement;

- empower investors to assess how well-positioned companies, issuers and their portfolios are for a just transition to a low carbon economy;

- align the PRI Reporting Framework with the Financial Stability Board’s Task Force on Climate-related Financial Disclosures;

- convene investor engagement with companies on climate risks and opportunities;

- encourage investors to make substantial allocations to clean assets and technologies;

- demonstrate the investment implications of national governments’ climate change goals; and

- collaborate with policy makers to address the barriers investors face in scaling up clean investments.

Climate change is a systemic risk and a priority ESG topic for PRI signatories. We have called on governments to implement the Paris Agreement and urgently step up in ambition, while seeking to empower investors, including asset owners, to an act on climate-related risks and opportunities.

We support the Paris Agreement mid-century goal to reach net-zero emissions by 2050, which would provide a 50% chance of containing global warming to 1.5°C this century. This represents a significant challenge. All sectors will need to transition and all actors – governments, cities, states, regions, civil society, business and investors – will need to play a role.

Our major PRI climate initiatives seek to support investors in taking ambitious climate action:

- Climate Action 100+;

- the UN-convened Net Zero Asset Owner Alliance;

- Task Force on Climate-Related Financial Disclosures;

- the Inevitable Policy Response.

We also participated in the Paris Agreement Conference of the Parties (COP25) and have seconded staff to the office of the COP26 Champions team, to mobilise the investor community ahead of COP26, the most important climate summit since the Paris Agreement was approved.

For further detail on Climate Action 100+ and the UN-convened Net Zero Asset Owner Alliance, visit the sections on Stewardship and Asset Owners respectively.

Climate change action among signatories

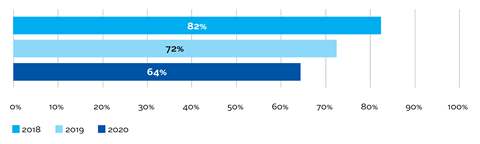

There has been an uptake in signatories acting on climate change, with 85% of asset owners explicitly factoring climate-related risks and opportunities into their investment strategies or products, compared to 81% of investment managers.

Key targets

Signatories explicitly factoring climate-related risks and opportunities into investment strategies or products: 82%

(PRI target: 75%)

Asset owner and investment manager signatories allocating assets to, or managing funds based on, specific environmental themed areas: 36%

(PRI target: 40%)

The Inevitable Policy Response (IPR)

The IPR is a pioneering project seeking to support PRI signatories in understanding the implications of a delayed, forceful and disruptive transition, based on technology and policy drivers.

This year we launched the first outputs from the IPR programme of work at PRI in Person Paris to 1,800 global investors. PRI signatories have engaged positively with the project, with a signatory poll taken during the event finding that over 60% see the IPR as the most likely scenario.

The project provides practical climate analysis and tools at the macroeconomic, regional, sector, and asset-class level, encouraging signatories to prepare and act now. We commissioned Vivid Economics and Energy Transition Advisors to provide the IPR Forecast Policy Scenario – a high-conviction, comprehensive and detailed picture of how a policy response will likely unfold.

The project’s outputs have included research briefing notes providing in-depth insights into topics ranging from the just transition to renewable energy and nature-based solutions; policy forecasts including a policy databook with transparency on assumptions; and a portfolio sensitivity tool with asset class data. In 2019/20, we produced research outlining the implication of IPR on listed equity valuations and we will provide results for additional asset classes in the next year.

Read more about our IPR work here.

The Investor Agenda

We are a founding partner of the Investor Agenda, a collaborative initiative to accelerate and increase the investor actions that are critical to tackling climate change and achieving the goals of the Paris Agreement with the aim of keeping average global temperature rise to no more than 1.5°C.

We lead on the Investor Agenda’s investment and disclosure sections, while its asset class work also supports the initiative. This year, we contributed to mobilising investor action and improving how the initiative communicates externally with key audiences.

The Investor Agenda has been an important mechanism for collaborative global investor policy advocacy. In 2019, over 600 investors supported a Global Investor Statement on Climate Change, urging governments to step up in ambitious Nationally Determined Contributions, carbon pricing, phasing out coal with a just transition and introducing policies to scale up clean energy.

Task force on climate-related financial disclosures (TCFD)

This year we made reporting on a sub-set of TCFD-based PRI climate reporting indicators mandatory in the PRI Reporting Framework, as part of our program to drive forward TCFD implementation. We conducted significant outreach to ensure high signatory completion by the reporting deadline. In total, 2,097 investors reported on these indicators in 2020, representing US$97 trillion in assets. This represents a 3.5-fold increase, as a result of the mandatory reporting requirement, over the 591 investors who reported in 2019.

We also built on existing guidance for asset owners by publishing a technical guide, which was co-authored with asset management consultant INDEFI, aiming to support private equity general partners in implementing the TCFD recommendations and better assess and mange climate-related risk.

Alongside seven signatories, we also convened an environmental disclosure pilot group in China. This initiative has established a leading group of UK – Chinese financial institutions to advance climate reporting practice in both countries. More information can be found here.