Heading the investment chain, asset owners wield enormous power and influence

To ensure we empower asset owners, we are committed to:

- championing ESG incorporation throughout organisations;

- enabling asset owners to effectively oversee and monitor investment managers, consultants and others to meet their responsibilities to beneficiaries;

- demonstrating how long-term global trends will shape the investment environment of tomorrow;

- establishing that asset owners’ responsibilities to their beneficiaries extend beyond the risk/return profile of their investments.

Net-Zero Asset Owner Alliance

The UN-convened Net-Zero Asset Owner Alliance is an ambitious climate leadership group, launched in September 2019 at the UN Secretary General’s Climate Summit. The PRI and UNEP FI are co-convening the alliance, which has made a public commitment to transitioning investment portfolios to net-zero greenhouse gas emissions by 2050, consistent with a maximum temperature rise of 1.5°C above pre-industrial temperatures.

Members set and publicly report on intermediate targets in line with the Paris Agreement. PRI CEO Fiona Reynolds serves on the steering group, while Mission2020 and WWF provide strategic advice.

The alliance was initiated by Allianz SE, Caisse des Dépôts, Caisse de dépôt et placement du Québec (CDPQ), Folksam Group, PensionDanmark, and SwissRe.

It is open to all PRI signatory asset owners to join.

Net-zero Asset Owner Alliance members

In 2020/21, the alliance plans to advance its commitment through several tracks of work, including monitoring, reporting and verification; engagement with asset managers and corporates; policy advocacy and investment.

Investment consultants

Investment consultants advise on how trillions of dollars are invested worldwide, but most fail to consider the role that ESG issues play in investment performance, despite growing evidence demonstrating their financial materiality. This can lead to asset owners mispricing risk and making poor investment decisions.

To help asset owners ensure that the services they get from their consultants align with responsible investment objectives, strategies and policies, we published a guide to provide insights for investment policy and strategy and manager selection and appointment services.

Strategic asset allocation

Strategic asset allocation plays a fundamental role in determining long-term returns. As ESG issues, such as climate change, shifting demographics and resource depletion, are often long term and systemic in nature, they impact expected asset class returns and should be incorporated into this process, alongside the consideration of other real-world impacts.

We published a discussion paper to identify several ways in which ESG incorporation in strategic asset allocation might be done, such as:

- setting objectives that can maximise positive real-world impacts;

- reviewing SAA targets and ranges to account for long-term ESG risks and opportunities; and

- reviewing the opportunity set to widen the potential investment universe to capture those opportunities and mitigate risks through asset, region, sector and sub-asset class allocation.

We gathered feedback and ideas from signatories during a dedicated session at 2019 PRI in Person and hosted a workshop in the Netherlands to explore this topic in more detail.

Next year we plan to publish a series of signatory case studies exploring and sharing leading practice in this area and continue a series of related blogs.

Asset owners: A growing signatory base

Asset owners sit at the top of the investment chain and wield enormous power, driving change among the companies and assets they invest in as well as influencing investment managers regarding their consideration of ESG issues. The number of asset owner signatories has continued to increase, growing by 21% over the last year, from 432 to 521. Our 500th asset owner signatory was Protección SA. This corporate pension fund also marked our first asset owner signatory in Colombia, with debut signings made in Singapore, Portugal, China and Uruguay as well. We now have 99 insurance company signatories, with insurers overtaking corporate pension funds as second-largest asset owner type to adhere to the Principles, after non-corporate pension funds.

Key targets

Asset owner signatories typically implementing ESG and other requirements in contracts (RFPs, IMAs, LPAs) and typical processes: 73%

(PRI target: 50%)

97% of asset owner signatories’ missions, strategies and or investment policies that cover the majority of their AUM reference ESG, responsible investment, sustainability or a related concept.

(PRI target: 85%)

Asset owner signatories incorporating ESG into selection, appointment and monitoring processes: 67%

(PRI target: 75%)

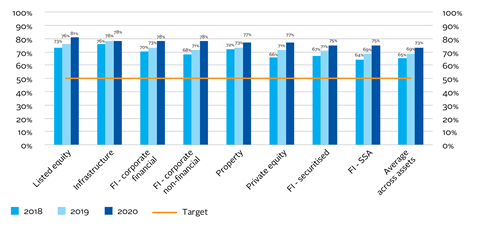

Percentage of asset owners considering responsible investment and ESG in contracts and typical processes

Consistent with the asset owner signatory growth we have experienced, we saw a 17% increase in the number of asset owners reporting to the PRI this year; including those reporting for the first time and those that have been less advanced in their responsible investment practices. Factors impacting the percentage of asset owners reporting to the PRI include holding a small percentage of assets in a given asset class and having constrained resources.

On average 73% of asset owners considered responsible investment in their manager appointment processes last year, including requests for proposals, investment management agreements and limited partnership agreements across all asset classes.

All of our resources for asset owners can be found in a dedicated section of our website.