Financial report

Income

Between 1 April 2018 and 31 March 2019, total income grew to £13.2 million, up from £10.4 million in 2017/18.

| Actual 2017/18 (£000s) | Actual 2018/19 (£000s) | Budget 2019/20 (£000s) | |

|---|---|---|---|

| Membership fee - renewal | 8,414 | 10,150 | 11,951 |

| Membership fee - new | 690 | 1,227 | 775 |

| Grants, donations, other* | 462 | 1,138 | 1,581 |

| PRI in Person income surplus | 597 | 107 | 1,011 |

| PRI Academy | 285 | 533 | 575 |

| Total Income | 10,448 | 13,154 | 15,892 |

*Projects funded through grants, donationa and other income included: Transition Pathway Initiative, Inveitable Policy Response: Act Now, ClimateWorks Foundation, Investor Initiative for Sustainable Forests with Ceres, Climate Action 100+ and the ESG in Credit Ratings initiative.

Signatory fees

All signatories pay annual fees, based on their total assets under management or, for service providers, number of employees. In 2018/19, income from new and existing signatories came to £11.4 million, up from £9.1 million in 2017/18.

Fee discounts

Asset owners headquartered in a country classified by the IMF as an emerging market or developing economy are entitled[1] to apply for a fee discount. The PRI will bill service providers based on only their investment staff, where that service provider has distinct divisions that provide distinct services. If one of those divisions provides a service that is not relevant to investors (and therefore the principles), this division will be excluded from the fee calculation.

| Account Name | HQ Country | Signatory Category |

|---|---|---|

| Old Mutual | South Africa | Asset Owner |

| Funcef | Brazil | Asset Owner |

| FUNCESP | Brazil | Asset Owner |

| Government Employees Pension Fund of South Africa | South Africa | Asset Owner |

| GRUPO FINANCIERO BANORTE S A B DE C V | Mexico | Asset Owner |

| Infraprev | Brazil | Asset Owner |

| Khazanah Nasional Berhad | Malaysia | Asset Owner |

| Economus | Brazil | Asset Owner |

| LA Retirement Fund | South Africa | Asset Owner |

| MMI Group Limited | South Africa | Asset Owner |

| Petros - Fundação Petrobras de Seguridade Social | Brazil | Asset Owner |

| PREVI - Caixa de Previdência dos Funcionários do Banco do Brasil | Brazil | Asset Owner |

| Real Grandeza | Brazil | Asset Owner |

| Retirement Fund (Incorporated) (KWAP) | Malaysia | Asset Owner |

| Sanlam Limited | South Africa | Asset Owner |

| Valia | Brazil | Asset Owner |

| Brasilprev Seguros e Previdência | Brazil | Asset Owner |

| The Consolidated Retirement Fund for Local Government | South Africa | Asset Owner |

| Normandin Beaudry | Canada | Service Provider |

| PBI Actuarial Consultants Ltd. | Canada | Service Provider |

Expenditure

Between 1 April 2018 and 31 March 2019, total expenditure excluding PRI in Person grew to £12.5 million, up from £10.2 million in 2017/18.

| Actual 2017/18 (£000s) | Actual 2018/19 (£000s) | Budget 2019/20 (£000s) | |

|---|---|---|---|

| Staff Costs (incl networks, recruitment, training & development) | 6,441 | 7,755 | 9,342 |

| Bought-in services, consulting and research** | 1,171 | 1,863 | 2,254 |

| Travel expenses | 787 | 970 | 1,083 |

| Premises costs | 435 | 564 | 635 |

| IT costs and telephone | 593 | 665 | 741 |

| Events, meetings conferences & hospitality | 220 | 297 | 368 |

| Legal & professional services | 124 | 115 | 113 |

| Subscriptions, reports & printing | 100 | 139 | 219 |

| Academy commissions & marketing | 69 | 57 | 0 |

| Other expenditure (Insurance, postage, office supplies,bank charges) | 240 | 116 | 251 |

| Total (PRI in Person expenditure not included) | 10,181 | 12,541 | 15,008 |

**Significant bought-in services, consulting and research include: Energy Transition Advisors (Climate Transition Work Programme); London School of Economics (Investing in Just Transition); London School of Economics (TPI); Regnan (Environmental Issues); Vivid Economics (IPR Funding); Danyelle Guyatt (Implications for Strategic Asset Allocation); Freshfields (EU Sustainable Finance Action Plan); Clean Returns Pty Ltd (IPR Implementation Guidance).

Expenditure by area

| Actual 2017/18 (£000s) | Actual 2018/19 (£000s) | Budget 2019/120 (£000s) | |

|---|---|---|---|

| Management and Operations | 2,305 | 2,582 | 2,958 |

| Global Outreach and Networks | 2,210 | 2,720 | 3,123 |

| Communications & Events | 886 | 957 | 1,319 |

| Policy, Research & Climate | 1,228 | 1,220 | 837 |

| Content team | 563 | ||

| Investment Practices & SDGs | 856 | 1,033 | 1,118 |

| ESG Engagements & Stewardship | 642 | 641 | 893 |

| Reporting and Assessment | 690 | 825 | 793 |

| Premises costs | 434 | 492 | 633 |

| Grants, other | 394 | 994 | 1,581 |

| PRI Academy | 377 | 453 | 418 |

| Partnerships | 157 | 214 | 209 |

| Consulting and research (separated in 2018/19) | 410 | 565 | |

| Total | 10,181 | 12,541 | 15,008 |

Number of staff by department

| March 2019 | Forecast March 2020 | |

|---|---|---|

| Reporting & Assessment, Investment Practices, SDGs, ESG Engagements | 28 | 38 |

| Global Outreach and Networks | 29 | 33 |

| Management & Operations, HR, Partnerships & PRI Academy | 23 | 25 |

| Communications & Events | 10 | 14 |

| Policy, Research & Climate | 9 | 10 |

| Content team | 5 | 5 |

| Executive | 2 | 3 |

| Grants | 6 | 10 |

| Total | 112 | 138 |

Cash reserves

Cash increased to £6.1 million at the end of the year, up from £4.6 million at the end of 2017/18. This included receiving both sponsorship and delegate fees for PRI in Person Paris.

Reserve policy

The amount of cash designated as a minimum level is regularly reviewed by the board. This has varied over the years. At present it is deemed to be equivalent to four months of payroll.

Operating surplus

After taking into account interest receivable, depreciation and tax, the PRI achieved a surplus of £554,140 for 2018/19, up from £193,185 for 2017/18.

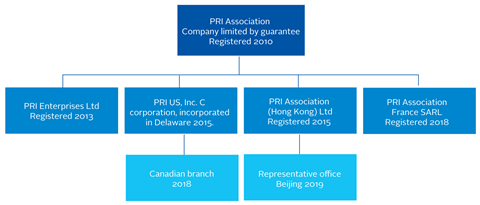

Corporate structure

The PRI group comprises seven entities, with PRI Association being the ultimate holding company. Signatory fees are collected by PRI Association and disbursed across the group. Entities are established where there is a specific operating or regulatory requirement.

PRI Enterprises Ltd is the home of the PRI Academy and is primarily funded by course fees.

Partnerships

KEY TARGETS

Work with our partners generated £995,063 (PRI target: £750,000)

Organisations can partner with the PRI by:

- sponsoring or exhibiting at PRI in Person and other events

- working with the PRI on research or a publication;

- hosting a signatory event;

- supporting the PRI Network in their region;

- collaborating with the PRI Academy, Academic Network and Research Forum.

The PRI thanks the following organisations for providing financial or in-kind support during the year, such as providing complementary access to research and data, and sponsoring or hosting PRI events and publications.

Our partners this year

PRI in Person 2018

- Lead: MFS Investment Management

- Gold: Bloomberg, DWS, Hermes Investment Management, RBC Global Asset Management

- Silver: Comgest, ClearBridge Investments, ISS-ESG, MSCI, Neuberger Berman, Russell Investments, UBS

- Bronze: Barrow, Hanley, Mewhinney & Strauss, LLC, Beyond Ratings, East Capital, Four Twenty Seven, FTSE Russell, HSBC Global Asset Management, Martin Currie Investment Management, PIMCO, Prosperity Capitla Management, Wellington Management Company LLC

Academic Network Conference 2018

Bursary: S&P Global

Grants

The PRI wishes to acknowledge the following organisations for their support:

- Bloomberg Philanthropies, Ceres, ClimateWorks Foundation, Department for Business, Energy and Industrial Strategy, European Climate Foundation, Generation Foundation, Gordon & Betty Moore Foundation, KR Foundation, the William and Flora Hewlett Foundation

In-kind donations

The PRI also wishes to thank the following organisations for proving in-kind access to data:

- FTSE Russell, MSCI, RepRisk, Vigeo Eiris

Downloads

PRIA financial statements year ended 31.03.2019

PDF, Size 0.36 mb

References

[1] See IMF’s World Economic Outlook 2016 (Statistical Appendix, p.209) for a full list of eligible countries.