- Foreword

- Delivering our Blueprint for responsible investment

- How we work

This Annual Report sets out how our work over the past year contributes to the goals of our 10-year Blueprint for responsible investment.

We'd love to hear what you think

Foreword

The PRI will continue to guide, support and represent signatories to the six Principles, but as ever the real work is done by our signatories themselves. This international community of forward-thinking investors continues to drive responsible investment forwards. We look forward to making more progress together in the years ahead.

Empower asset owners

Regulators are increasingly catching up to the idea that for asset owners to fulfil their duties to beneficiaries, their responsibilities must extend beyond the risk/return profile to include the wider role that investments play in real economies and societies.

Find out moreSupport investors incorporating ESG issues

Our biggest ESG incorporation projects in 2017/18 have been focused on driving ESG considerations out of the niche of self-identified responsible investors, and into the mainstream investment market.

Find out moreFoster a community of active owners

Our work on active ownership is increasingly about focusing on the quality of engagement, rather than just the quantity, and how we can support signatories to see real results from their active ownership activities.

Find out moreShowcase leadership and increase accountability

For signatory status to be meaningful, and for beneficiaries to see the benefits they are entitled to, we must ensure that signatories are living up to the commitments they make when signing up to the Principles.

Find out moreConvene and educate responsible investors

Connecting signatories with each other, bringing insights from the academic world and providing formal training are all crucial to expanding collective knoweldge on responsible investment.

Find out moreChallenge barriers to a sustainable financial system

As awareness of sustainability’s importance to financial systems has grown, recent years have seen the proliferation of sustainable finance expert groups around the world. Supporting these national and regional partnerships of investors and policy makers has been a key part of our work to create a more sustainable financial system.

Find out moreDrive meaningful data throughout markets

Reliable, timely information is needed for beneficiaries to understand and influence their investments, for asset owners to monitor their managers and for investment managers to accurately price assets and assess risk.

Find out moreChampion climate action

Climate change continues to be the number one issue of concern for signatories, but there is still a considerable gap between investor awareness and investor action if the Paris Agreement target is to be met.

Find out moreEnable real-world impact

Beyond the need to improve how ESG issues’ financial relevance is captured throughout the market, investors increasingly need to better demonstrate the impact that their investment decisions have in the real world.

Find out moreEnhance our digital capacity

We launched a new website rebuilt from the ground up on a professional-grade publishing platform, to better drive content towards signatories and other stakeholders.

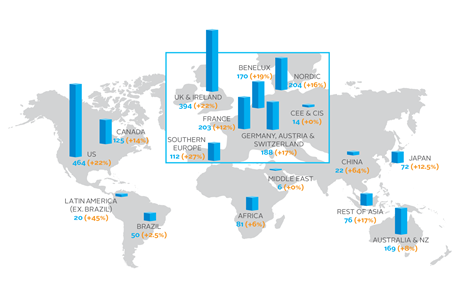

Enhance our global footprint

More experienced relationship managers and a tiered relationship management system are enabling better understanding of our signatory base, thus enhancing the service we can provide to signatories.

Develop our staff

After more than 10 years in operation, the PRI is more mature in many areas – including as an employer. We are increasingly seen as a desirable place to work.