Environmental, social and governance issues affect investment performance across companies, sectors, regions and asset classes

Achieving our Mission for an “economically efficient, sustainable global financial system [that] benefits the environment and society as a whole” relies on investors right across the industry taking account of ESG issues in their investments. In addition to continuing to deepen signatory practice on incorporating ESG issues into investment processes, our biggest ESG incorporation projects in 2017/18 – with CFA and on credit ratings – have been focused on driving ESG considerations out of the niche of self-identified responsible investors, and into the mainstream investment market.

Working with CFA

We collaborated with CFA Institute to host workshops that drew in investment professionals from CFA’s extended network across 17 markets. Attendees came from right throughout the finance industry, well beyond the core ESG practitioner typical to most PRI events. The programme resulted in a suite of ESG integration guides for listed equity and fixed income investments, more than 30 case studies, and – vitally – new relationships between the PRI and local CFA societies. CFA also released a position statement saying that it believes ESG integration is consistent with fiduciary duty.

Read Guidance and case studies for ESG integration: equities and fixed income

Explore the regional reports:

We have also collaborated with CFA, through expertise and endorsement, to integrate ESG into their accreditation programme.

Read about our work on training for investment professionals under Action 5: Convene and educate responsible investors

KEY TARGETS

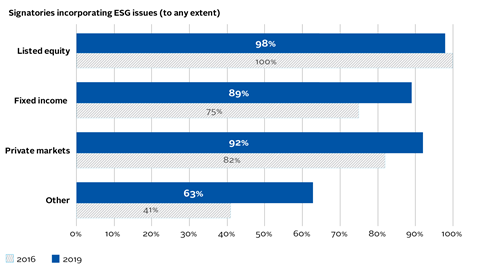

Signatories incorporating ESG issues in listed equity investments: 96%

(PRI target: 100%)

Signatories incorporating ESG issues in other asset classes: 83%

(PRI target: 80%)

ESG in credit ratings

The ESG in Credit Ratings initiative goes from strength-to-strength. The statement committing to incorporate ESG into credit ratings and analysis in a systematic and transparent way has been signed by more than 150 institutional investors (representing US$30trn of AUM) and 19 credit rating agencies. Having started out as an exploratory project, it has now spurred the largest agencies into action in a dramatic way, and they are actively vying for industry leadership in the area.

We have convened 20 forums targeting credit analysts in 16 countries, and this year we completed our three-part series of reports by publishing ESG, credit risk and ratings: part 3 - from disconnects to action areas, which explores the emerging solutions to the areas of misalignment between investors and rating agencies identified by the previous reports.

Explore the ESG in Credit Ratings initiative

Private debt

Also in fixed income, we looked at how responsible investment can be applied to the emerging area of private debt, through an introductory report, several case studies and a due diligence questionnaire.

Private equity

This year we published the monitoring portion of our three-part project to cover limited partners’ selection, appointment and monitoring of general partners.

We have also worked extensively with partner organisations in private equity, including: endorsing French PE initiative ic20; working with ILPA on their Principles 3.0, model LPA document and PortCo Monitoring Template; and contributing to the G20 Sustainable Finance Study Group on the role of private equity and venture capital in catalysing sustainable investment.

Explore our private equity resources