Signatory type: Private equity investor / Asset owner

Operating region: Developing countries

Assets under management: €180 million

SDG targets: SDGs 3, 4, 6, 7, 8, 9, 10, 11 & 13

Practice area: Engagement for impact

Why we use the SDGs for engagement

STOA’s1 mandate is to support socio-economic development and tackle climate change in Africa and developing countries in other regions. Our core aims therefore align closely with several of the SDGs, and the goals themselves provide us with a framework for assessing how we can align environmental and social outcomes more effectively, rather than looking at each issue on a standalone basis.

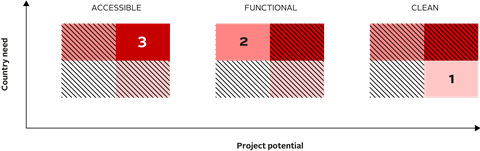

We make targeted investments in infrastructure and energy projects: by investing in accessible, functional and clean energy projects in emerging economies, STOA can contribute to positive climate action and create maximum benefits for local communities (as shown in the diagram below). For each investment, the organisation defines strategic impact objectives to achieve positive and measurable social and environmental outcomes aligned with the SDGs.

Figure 1. STOA’s investment process

How we consider the SDGs in investment

STOA integrates SDG considerations at each stage of the investment cycle: the goals are embedded in our approach, implemented through an impact-centred screening and investment decision methodology, and monitored using SDG indicators at a project and portfolio level.

At a strategic level, we target 30% of our funds on projects with an inherent climate benefit (i.e. infrastructure or energy projects that provide lower carbon solutions/options than typical alternatives), in support of SDG 13 on Climate Action; and 50% of funds on bridging the infrastructure gap in Africa (in line with SDG 9 on Industry, Innovation and Infrastructure). Other indicators such as job creation, in line with SDG 8 on Decent Work and Economic Growth, and the share of women in management positions, in support of SDG 5 on Gender Equality, are also fundamental to all projects that we invest in.

These goals are then integrated into STOA’s global impact scoring tool, which forms an essential part of our due diligence process. Through its application we can identify a project’s potential outcomes, and thereby select projects that contribute positively to the SDGs for our portfolio. Any project we select must fall into at least one of three pre-defined outcome areas: accessible, functional and clean. We use the SDG Index2 as a reference in assessing a project’s potential and the country’s needs.

Our impact framework is based on three key tools: a screening system, a set of measurement indicators, and an impact modelling tool. The first tool generates an impact score by measuring how accessible, functional, and clean a project is. The second helps measure the progress made following an investment, using 65 indicators selected from providers such as the Harmonized Indicators for Private Sector Operations (HIPSO), and the Global Impact Investing Network (GIIN)’s IRIS+ system. The third models STOA’s impacts on a macroeconomic scale.

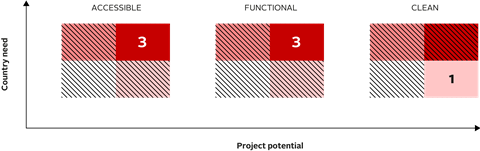

Figure 2: Sample project screening tool

In our screening tool, each outcome area is scored between 0 and 3 using the following criteria:

- High impact – High country need (top-right) - Projects with high potential to improve a country’s infrastructure service, where need is high, score 3 points;

- Low impact – High country need (top-left) - Projects with low potential to improve a country’s infrastructure service, where need is high, score 2 points;

- High Impact – Low country need (bottom-right) - Projects with high potential to improve a country’s infrastructure service, where need is low, score 1 point;

- Low impact – Low country need (bottom-left) - Projects with low potential to improve a country’s infrastructure service, where need is low, score 0 points.

These scores are then submitted to the board alongside other financial and ESG due diligence materials as part of the final decision-making process for an investment.

Once a project is in STOA’s portfolio, we collect direct and indirect outcomes-related data – for example, on employment, general economic activity, and carbon emissions – on an annual basis. STOA records the data in its impact modelling tool, which generates a project scorecard and updates the portfolio dashboard.

Example: Hydroelectric Power Project, Cameroon

In 2018, STOA invested in a major hydroelectric power project in Cameroon alongside Électricité de France (EDF), the Cameroonian State, the International Finance Corporation (IFC) and infrastructure investment platform Africa 50.

The project, led by the Cameroonian Nachtigal Hydro Power Company (NHPC), will see the construction and operation of a 420MW run-of-river hydroelectric power plant that will eventually supply 30% of the country’s power generation. Due to be commissioned in 2023, it will be the largest Public-Private Partnership (PPP) ever developed in Africa in the energy sector.

The project aims to meet demand for increased electricity in Cameroon while generating energy at a competitive cost and playing a decisive role in the country’s energy transition. This should support outcomes in line with SDG 7 on Affordable and Clean Energy and SDG 13 on Climate Action.

Scoring 2.3/3, it is one of the highest-scoring projects in STOA’s investment portfolio.

Figure 3. Hydroelectric Power Project screening score

During our due diligence, Cameroon was identified as having a very high need for a greater and more reliable supply of electricity. Only 60% of the population has access to electricity3 and on average, 8 power outages occur each month4.

Once fully operational, the project is expected to supply clean energy equivalent to the consumption of 10 million people in Cameroon – approximately 40% of the country’s current population. Moreover, nearly 850 kilotons of CO2 are expected to be avoided each year, compared with using other current or projected sources of electricity in the country.

A focus on SDG outcomes and consideration of frameworks such as the IFC Performance Standards helped guide the development of an ambitious management system targeting a range of environmental and social issues related to the project.

This includes a local economic development action plan and measures dedicated to biodiversity. These aim to avoid, reduce and compensate for negative outcomes associated with the project during the construction and development phases, and support more positive outcomes in line with different SDGs.

For example, working with the IFC and six specialised local non-governmental organisations, NHPC trained its staff in the prevention of gender-based violence, in support of SDG 5 on Gender Equality.

Moreover, the infrastructure project is one of a small number that meets the G7 Development Finance Institutions’ 2X Challenge criteria regarding female employment5, further highlighting our alignment with SDG 5 and SDG 8 on Decent Work and Economic Growth.

References

1 STOA is an investment vehicle resulting from the collaboration between two French major public financial institutions. Our processes and capabilities are informed by and benefit from Agence Française de Développement’s internal capacity on sustainable development and Caisse des Dépôts et Consignations’ track record on structuring infrastructure projects at a national scale.

2 Sustainable Development Report 2020

3 The World Bank: Databank.Sustainable Energy for All

4 The World Bank: Enterprise Surveys

5 2X Challenge