Case study by Standard Life Investments

Our fundamental, bottom-up approach to selecting stocks is partly informed by ESG research (available to all our investment professionals), which is supported by our in-house Responsible Investment Team. The Responsible Investment Team provides ongoing analysis, as well as additional research on any issues that cause concern, and frequently contributes to internal meetings held by our investment teams to highlight trends, emerging risks/ opportunities and company-specific analysis.

Analysing the ESG issue

In April 2015, the European Commission voted in favour of implementing ‘real world’ NOX emissions testing procedures in the automobile industry.

Our Responsible Investment Team and members of the equity teams explored what this change would mean for vehicle manufacturers and companies in their supply chains, as well as the risks and opportunities that a trend of increasingly stringent environmental regulation might present for investors.

We analysed the pollution reduction solutions available to vehicle manufacturers and identified companies that would benefit or suffer from a shift away from diesel engines to other types of internal combustion engine or alternative vehicles. The analysis was informed by discussions with a range of industry participants including vehicle manufacturers, auto part suppliers, catalysis producers and environmental NGOs.

In particular, we considered:

- the options available to cut NOX emissions from diesel engines, including exhaust gas recirculation (EGR), selective catalytic reduction (SCR) and lean NOX trap (LNT);

- the cost for vehicle manufacturers to comply with the more stringent emissions regulation under real world testing procedures;

- the raw material content required by different solutions, and who the key providers are;

- the implications for the mix of diesel compared to petrol;

- the outlook for alternative vehicles, including hybrids and plug-in electric vehicles.

NOX emissions under scrutiny

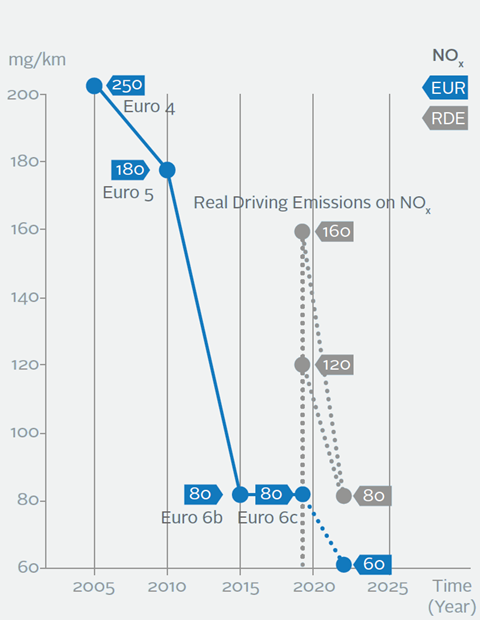

Managing NOX emission levels, of which automobiles are a major source, is a challenge for heavily populated and industrialised economies struggling with air pollution and its related health consequences.

Pressure on the industry has been further increased by the emissions scandal that began in 2015, where some manufacturers were found to be misrepresenting emission levels during testing, and a study by International Council on Clean Transport (ICCT) in October 2015 that found that permitted loopholes in emissions testing, such as driving on an unrealistically smooth surface and taping over door and window gaps, means that the average diesel vehicle emits seven times more NOx emissions under real driving conditions than stated.

Consequently, the European air pollution regulation, intended to cut NOX emissions by 68% between 2005 and 2015, has not been achieved.

Impact on valuation

We came to two conclusions that informed stock selection across our equity fund range:

- Margins and R&D budgets at traditional auto manufacturers will be under increasing pressure to comply with more stringent emission regulations.

- Some aspects of internal combustion (e.g. SCRs, platinum group metals in catalysts) might benefit, but we will also see manufacturers shift their R&D focus from internal combustion engine efficiency to greater electrification (e.g. hybrid, plug-in hybrid and pure electric).

Examples of how these conclusions have influenced portfolio construction include the following:

- We assessed the extent to which a company may need to pass the cost of complying with increasing regulation on to their customers and/or supply chain. This is particularly pertinent for manufacturers of medium and small diesel vehicles given those vehicles f lower sale price. This has informed our bottom-up stock selection of certain auto part suppliers in global and US equity funds.

- We analysed a number of companies based on their capability and strategy with electric and hybrid vehicles, particularly for our emerging market equity funds.

- We looked at companies that are well-placed to serve/support electrification efforts in the market, for example certain battery manufacturers.

Example: Valuing potential opportunity of electric vehicles for LG Chem

Korean integrated petrochemical manufacturer LG Chem is, amongst other things, a leading lithium-ion battery manufacturer, and has won contracts to supply electric vehicle batteries for international automotive manufacturers. LG Chem has been investing in new kinds of battery technology and we expect the electric vehicle segment to break even in 2016.

1) Valuing the opportunity

- LG Chem is targeting Korean won 2 trillion (US$1.73 billion) revenue from batteries by 2017. Using discounted cash flow analysis with an assumed operating margin and weighted average cost of capital, the analysts value the net present value of the electric vehicle battery revenue stream for the company to be US$1.5bn-US$3bn, representing 9%-18% of the company’s current market value. This is based on LG Chem’s currently known capacity plans and contracts, but still assumes a very small penetration of electric vehicles globally.

2) ESG assessment

- Our assessment was that LG Chem has a good safety track record and can demonstrate extensive road testing. It has a strong history of good business execution and a positive reputation with customers and investors. These factors should position the company to be a preferred supplier of the new generation of battery technologies to the large manufacturers.

3) Market price

- The market tends to be slow to price in structural changes, and LG Chem’s electric battery segment is yet to contribute materially to its profits. Comparing the share price to peers, Lotte Chemical is a Korean petrochemical company with no exposure to electric vehicles and has outperformed LG Chem over 2015 on the back of a strong petrochemical cycle. In early 2016, Lotte and LG Chem trade at similar price-to-book valuations.

Our view was that the market was at that time not pricing in LG Chem‘s US$1.5bn-US$3bn electric vehicle potential. The long-term structural drivers of increasing environmental regulation for vehicle manufacturers and falling battery costs, as well as LG Chem’s strong ESG profile, increase the probability that the company will achieve its revenue target from electric vehicle batteries and we believe that this could lead to a re-rating of the company by the market.