This first QFT update covers the period from October 2021 (when the 2021 FPS 1.8°C FPS and 1.5°C RPS was released, pre-COP 26) to mid-April 2022

In Q1, Quarterly Forecast Trackers (QFTs) have confirmed long term forecasts, with some evidence of deceleration of forecasts shorter term

Major events in late 2021 and developments in early 2022 have confirmed/reinforced IPR long term forecast impacts, with some signaling an acceleration in policy action coming from COP 26, Germany, France, UK and China:

- At COP 26, over 100 countries including Brazil pledged to end deforestation by 2030, a stronger statement on forestry than in previous COP sessions

- Germany announced plans to bring forward coal phaseout timeline from 2038 to 2030, France is accelerating plans for clean power by announcing increased nuclear capacity, and the UK is exceeding its forecast IPR targets for EV deployment

- China has published new policy documents on greening the Belt and Road Initiative and has signalled an increased awareness of agricultural emissions, including mentioning of cultivated meat in its Five-Year Agricultural Plan (released January)

There has also been some evidence of stagnation or deceleration of policy action that needs monitoring in the US and Brazil:

- In the U.S. new climate legislation has not yet passed, banned solar component imports could contract the sector and slow the adoption of renewables short term; and court action against EPA could limit the ability to reduce power sector emissions absent federal legislation

- In Brazil, a proposed bill allowing mining on indigenous lands, combined with its recent NDC and high current deforestation levels could impact IPR forecasts for deforestation end dates

- The war in Ukraine has led to policymakers increasing focus on ‘security’ as a driver and while short term there is some disruption, longer term developments are likely to favor clean energy

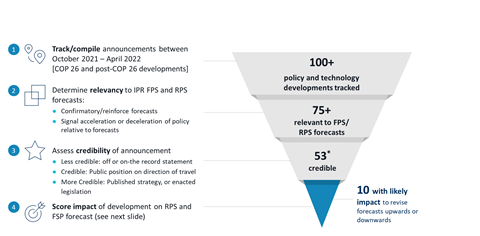

Quarter 1 Assessment Process

IPR QFT assessments adopts a multi-step approach to assessing key policy and technology developments impacting FPS and RPS

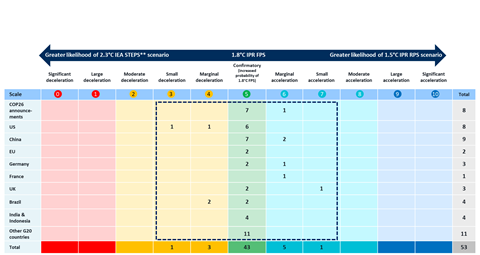

The Quarter 1 Heat Map

Between COP26 and end of March 2022, majority of energy/land policy & technology developments reinforce IPR forecasts and scenarios (excluding Ukraine Developments)

The IEA’s ‘Stated Policy Scenario’ or STEPS reflects current policy settings based on a sector-by-sector assessment of the specific policies that are in place, as well as those that have been announced by governments

Impact of the Ukraine War

We express our sympathies with all those suffering in this war

For IPR Forecasts we see 3 meta developments at this stage:

Reinforcement of medium (3-5 Years) and long term IPR renewable energy and Green Hydrogen policies and sector forecasts

- Short term (1-2 Years) energy supply crisis for EU with many uncertainties, local gas and coal use and sourcing of fossil fuel supplies outside of Russia which points at least short term to an all of the above approach – a security back up could leave fossil fuels in the system longer

- To achieve current IPR forecasts, it would require policy makers to avoid lock in of actual generation or high-capacity utilization of these fossil fuel assets. Energy security will come at a cost but there does not have to be a trade-off with climate policy.

- For the IPR Forecast Policy Scenario (FPS) this means that the fossil fuel sector supply dynamics will need reassessing e.g. split between piped natural gas and LNG, geography of origin etc.

But we do not see any divergence from trend in demand side sectors, if anything in medium term an eventual acceleration towards more green outcomes*

Read more

IPR Special Paper: Ukraine War: The new geo-politics of energy and implications for climate policy. Initial implications for climate policy as a result of Russia’s invasion and war in Ukraine.

QFT in 2022

Each QFT release will be accompanied by a Webinar discussing key findings. The next QFT and Webinar is planned for the last week of June.

Scheduling and details will be posted on PRI Events Page and IPR Social Media:

IPR Briefings

For more information on IPR, signatory briefings and presentations, please contact us at [email protected]

Downloads

Q1 2022 Quarterly Forecast Tracker

PDF, Size 1.64 mb