Los Angeles County Employees Retirement Association (LACERA)

- Signatory type: Asset owner

- Asset owner type: Pension fund

- HQ country: US

Diversity, equity, and inclusion (DEI) are integral components of our investment process and stewardship initiatives and are detailed in our guiding investment policy.

Why we consider DEI in our investment process and stewardship initiatives

We focus on DEI to help produce, protect, and provide the promised benefits to 170,000 beneficiaries in the most populous county in the US. Organisations that embrace and excel at cultivating diverse, equitable and inclusive workplaces benefit across numerous dimensions, including:

Performance |

Diverse teams correlate with better financial performance |

Innovation |

Diversity of thought to inform better decisions |

Talent |

Broader recruitment, retention, and engagement of employees |

Risk Mitigation |

Risks of "groupthink" |

Complliance |

Legal, regulatory risk of discrimination and harassment |

Reputation |

Inclusion enhances employee, client, stakeholder perceptions |

Efficiency |

Wasted resources when firms are in "response mode" and reactive rather than being proactive and forward-thinking |

We believe that effectively accessing and managing diverse talent leads to improved outcomes. We consider diversity broadly, including varied backgrounds, age, experience, race/ethnicity, sexual orientation, gender, gender identity, disability, religion, national origin and culture.

We evaluate all external investment partners on how they access and retain diverse and inclusive leadership and investment teams. We believe asset managers who cast the widest net for talent will deliver the best results. And we actively exercise stewardship rights through corporate engagement and proxy voting to advance DEI within portfolio companies to preserve and create value.

How we consider DEI in our investment process and stewardship initiatives

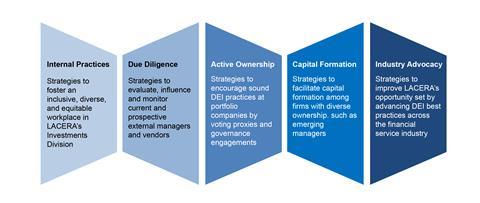

Our T.I.D.E (Towards Inclusion, Diversity and Equity) initiative pursues comprehensive strategies to advance DEI throughout all aspects of our investment process. It is driven by our fiduciary duty and organised into five core pillars:

We conduct robust upfront due diligence and monitor all asset managers who seek to manage capital on our behalf. Our standard five-part DEI due diligence allows us to assess which firms are best positioned to steward our capital based in part on their demonstrated commitment, track record, and momentum in line with our T.I.D.E objectives.

We look at asset managers’ DEI policy commitments, demonstrated board oversight of DEI strategies and track records of inclusion on investment and executive teams. We also consider any history of legal or regulatory infractions related to equal employment opportunity or workplace harassment.

We assess how asset managers promote adherence to their DEI commitments, such as asking whether they conduct internal pay equity analyses or have clawback provisions in the event of employee misconduct or violation of DEI policies.

We try to discern to what extent managers are seeking to move the needle on DEI within their own practices. Recognising that we operate in an industry with historic patterns of underrepresentation, we probe if they have identified any shortcomings in achieving their DEI objectives and, if so, what they are doing to address them.

Lastly, we explore how asset managers in all asset classes incorporate DEI into their own investment research and portfolio management in the mandates they manage on our behalf.

Our due diligence of all investment partners’ and asset managers’ DEI practices informs an ongoing “Manager Scorecard”. The Manager Scorecard includes DEI alongside factors such as performance, fees, and ESG integration to form a holistic view of asset managers’ quality. Instead of separately weighting the components of the assessment, we reference absolute and relative performance on each factor to inform decisions whether to increase, decrease, or terminate allocations.

Investment management agreements include provisions where we expect asset managers to regularly report on their DEI practices so that we can continue to monitor asset managers’ DEI strengths or developing risks.

Example: Recent evidence of our work on DEI

We emphasise the power of dialogue in our investment stewardship, including advancing our DEI objectives with external asset managers, industry associations, and portfolio companies.

Asset Manager Engagement: By engaging asset managers on their DEI practices, we can promote progress. For example, we recently reviewed the DEI practices of an existing asset manager with a small investment team and solid financial performance, but a weak record of gender inclusion. Through discussion, the firm committed to enhance DEI policies and identified new strategies to attract and retain diverse talent, and we will monitor the results and progress.

Industry Collaboration: We work with industry peers to advance more robust and consistent due diligence of asset managers’ approach to DEI, including in private market asset classes. The Institutional Limited Partners Association and the Alternative Investment Managers Association have developed due diligence templates for industry use and work to advance leading practices.

Portfolio Company Active Ownership: We encourage sound DEI practices at portfolio companies through proxy voting and dialogues. Last year, we voted against director nominees at about 1,000 companies for failing to maintain a credible record of inclusion in board recruitment practices.

Approximately 250 women and people of colour have been appointed to corporate boards at about 150 companies that we have engaged to encourage more expansive board recruitment and governance policies inclusive of gender, race, and the LGBTQ community.