Responsible investment approaches for hedge funds

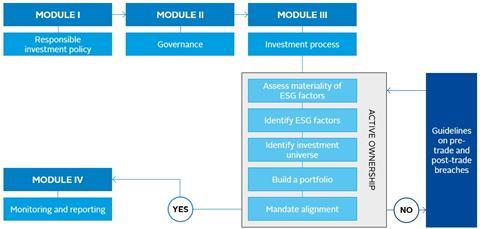

This section looks at all stages of the investment process and draws on other PRI and industry guidance to provide suggested approaches. It is divided into four modules:

- Module I: RI policy development and implementation;

- Module II: Governance of a RI policy at the firm and fund level;

- Module III: Investment process and active ownership;

- Module IV: Monitoring and reporting.

It outlines approaches that might be undertaken at various stages of the investment process but due to the breadth of hedge fund strategies it is not a definitive list. The section follows the structure of the current PRI Reporting and Assessment framework.

Responsible investment approach - for investment managers

The four modules focus on areas that are specific to hedge fund investment managers. It outlines where these investment managers might want to incorporate RI into the investment process, asset selection, active ownership and monitoring and reporting. Due to the breadth of hedge fund strategies it does not address all strategies.

Figure 9: An RI approach for investment managers in the hedge fund industry

Module I - Responsible investment policy

An RI policy has many purposes, including:

- to be a starting point to discuss the organisation’s position on ESG issues with external and internal stakeholders;

- clarifying how an investor interprets its fiduciary responsibilities to beneficiaries and clients;

- guiding external investment managers on how they should handle ESG issues;

- demonstrating the organisation’s responsible investment approach to regulators, clients and other stakeholders;

- influencing and informing the investment decisionmaking process.

The adoption and implementation of an RI policy might follow a three-stage process:

Policy development

The PRI has a range of resources specific to the introduction of an RI policy.

Data portal sample policies

An introduction to RI - policy, structure & process

Crafting an investment strategy

Investment policy - process & practice

Writing a responsible investment policy

Broadly, these outline two approaches to adopting an RI policy:

- Development at investment manager or firm level, where a policy might cover a range of issues or approaches that are understood by and applicable across the entire client base, AUM, portfolio and organisation (asset owner or investment manager).

- Development at fund or portfolio level (pooled fund or a segregated managed account). Each fund type is likely to have a different approach to developing, reporting and monitoring RI policies to asset owner requirements.

We acknowledge that policy development may be different across different funds and/or strategies. Nonetheless, these different approaches reflect the hedge fund governance structures that are outlined in the next section.

Policy implementation

The implementation of this policy might involve a series of steps that have implications for internal processes and policies and external relationships.

Internal RI training can raise awareness of a policy and ensure information and tools are available to meet stated policy commitments. This might be particularly important for investment decision makers, compliance and risk teams. The introduction of clear RI procedures relating to, for example, pre- and post-trade issues, will reduce the possibility of breaches of process or fund criteria.

External agreements including Trading and Prime Brokerage Agreements (especially where the firm or fund has introduced an exclusion list) and the Administration Agreement (to extend the agreement to include monitoring the portfolio for non-compliant positions) may also need reviewing. These counterparty service-level agreements may need adapting to formalise any change in requirements, outline processes where policies are changed or processes when ‘non-compliant’ positions are held.

Policy disclosure and communication

At an investment manager level, a hedge fund manager will need to ensure that its RI policy is adequately disclosed to its current and prospective investors. This might include incorporating policy details in public documentation, offer documents or side letters. Disclosure of the RI policy might also be incorporated into the Investment Management Agreement in sufficient detail to enable the asset owner to provide informed consent. At a fund level, where screens are used, documentation should include approaches on what constitutes a breach and how that would be remedied.

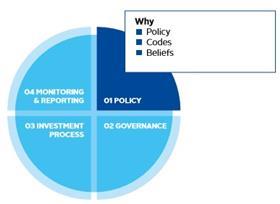

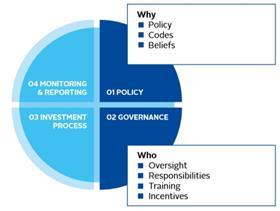

Module II - governance

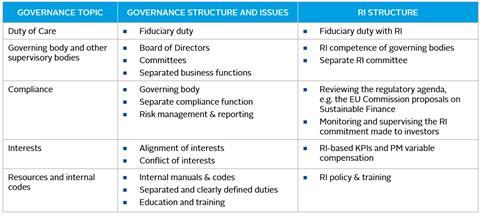

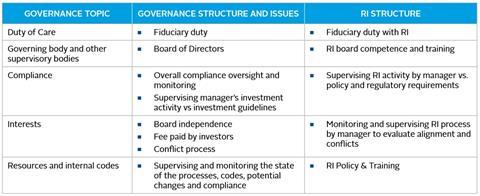

Hedge funds often have governance structures or frameworks covering both investment managers’ governance and fund governance. Governance of an RI policy might need to cover both.

Dual set up - investment manager or firm and fund levels

Larger hedge fund managers often have their own internal governance arrangements ranging from boards of directors to investment committees and incorporating business functions like Chief Operating Officers and Chief Compliance Officers.

Figure 10: Governance structures

These internal governance roles are key in delivering commitments to investors. Smaller hedge fund managers may outsource the compliance function - this relationship may need reviewing to incorporate or develop a new policy.

Figure 11: Investment manager or firm governance

The fund structure typically offers a second level of governance and in many jurisdictions the fund structure has a separate board of directors or similar governing body which supervises the interest of fund investors. At both levels, RI should not be an overlay, but rather core to how an investor understands governance.

Figure 12: Fund governance

Fiduciary duty

The PRI defines fiduciary duty as a set of responsibilities imposed upon a person or an organisation which exercise some discretionary power in the interests of another person in circumstances that give rise to a relationship of trust and confidence. Though hedge funds have different regulatory controls to many other financial investors, the concept of fiduciary duty is still highly relevant.

Figure 13: Fiduciary duty. Source: Fiduciary in the 21st Century

Fiduciary duties (or equivalent obligations) exist to ensure that those who manage other people’s money act in the interests of beneficiaries, rather than serve their own interests.

The most important of these duties are:

Loyalty: Fiduciaries should act in good faith in the interests of their beneficiaries, should impartially balance the conflicting interests of different beneficiaries, should avoid conflicts of interest and should not act for the benefit of themselves or a third party.

Prudence: Fiduciaries should act with due care, skill and diligence, investing as an ‘ordinary prudent person’ would do.

The legal interpretation of fiduciary obligations differs depending on regulatory controls and guidance. Over the past decade, there has been relatively little change in the law relating to fiduciary obligations. However, there has been a significant increase in ESG disclosure requirements for asset owners and investment managers and in the use of soft law instruments such as stewardship codes. These stewardship codes encourage investors to engage with listed securities or issuers in which they are invested or promote better practice across other asset classes. There have also been developments in the understanding of the relationship between ESG factors, security returns and corporate financial performance and the broader responsibilities of investment managers. Consequently, the interpretation of fiduciary duty has broadened. This necessarily changes the standards of conduct required of fiduciaries to satisfy their duties under the law.

For hedge funds these fiduciary duties are of particular relevance where the investment strategy is complex and the beneficiary has limited ability to monitor or oversee the actions of the entity acting in their interests.

PRI resources:

Fiduciary duty in the 21st century

Responsible investment regulation map

Governing body, internal compliance and establishing diversity

RI is still often seen as a “soft” commitment the manager has made to investors through an RI policy. To strengthen the implementation of this policy, at a firm or fund level, a manager needs to make its own internal governance arrangements to monitor and supervise the activity undertaken to comply with a policy. Governing and other supervisory bodies are often formed to oversee aspects of a specific fund or firm and governance arrangements might include a separate RI advisory or oversight committee to help supervise and oversee all aspects of the RI process.

Board structure is also under scrutiny. For example, board diversity has become a high-profile topic across the corporate and fund management industry with the emergence of standards or commitments such as the 30% Club (see table below). Adoption of commitments such as the 30% Club have become increasingly widespread as part of an RI policy.

Figure 14: 30% Club – aims and commitment

The 30% Club aims to develop a diverse pool of talent for all businesses through senior management commitment to better gender balance at all levels of their organisations. The 30% Club identified five factors that create a replicable formula for success in promoting diversity through an organisation:

- a measurable goal with a defined timetable;

- supportive public policy that acknowledges a change to the status quo is required;

- change driven by senior management;

- openness to collaborate;

- a concerted and consistent series of actions and programmes.

Diversity should be emphasised at the investment team level as well as board level. According to some industry associations4, hedge fund managers are beginning to recognise the role that diversity can play in making better decisions and delivering better investment outcomes. No matter the size or resources, there are steps that every hedge fund can take to improve its diversity and inclusion.

Aligning interests

A well-governed hedge fund has fee structures and other mechanisms to align the interests of the investment manager with investors. Hedge fund managers should introduce a public conflict of interest policy to provide transparency around potential conflicts of interest. This might cover specific processes and controls around the appointment and monitoring of service providers.

Ensuring the managers’ clients’ and fund boards’ interests are aligned, the investment manager may also want to consider introducing relevant quantitative or qualitative RI-related KPIs for its portfolio managers and making these KPIs part of the variable or fixed compensation programme.