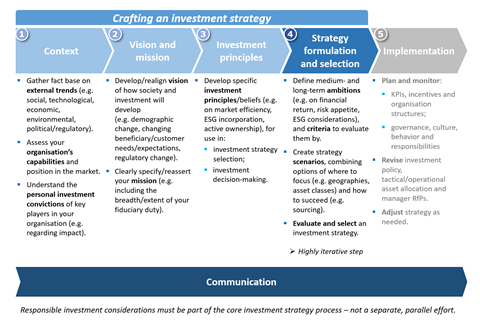

Crafting an investment strategy is the first step within an asset owner’s overall investment process.

Asset owners should craft a clear and explicit investment strategy that comprehensively considers: all long-term trends affecting their portfolios, how the fund fulfils the asset owner’s fiduciary duty and how it can operate as efficiently as possible for beneficiaries and other stakeholders.

A methodical approach is crucial. Common pitfalls include: skipping steps, lack of consensus/board-alignment, lack of detail/flexibility or creating a strategy without sufficient consideration of how it will be implemented.

The strategy process starts broadly, with a wide survey of the external and internal context in which it will be developed (Step 1). This is used to define the organisation’s vision for the future and its mission (Step 2), followed by a more specific set of investment principles (Step 3). The process then narrows in on selecting executable strategies and strategically allocating capital (Step 4). Once completed, the investment strategy will be translated into initiatives for implementation.

To be effectively embedded in the organisation, any responsible investment considerations must be part of the core investment strategy process.

An evolving industry: Future-proofing the investment strategy

There are a number ways in which the investment industry is evolving, and is likely to evolve in the coming years. How ready the organisation is for these changes can be measured through answers to a few key questions:

- Does your fiduciary duty extend beyond strictly financial benefits for stakeholders?

- Is positive real-world impact an explicit part of your primary objective for investment results?

- Do you view ESG factors as material (risks and/or opportunities)?

- Do you incorporate ESG factors into your investment analysis?

- Do you actively engage with your invested companies?

An asset owner answering yes to all of the questions above may consider their strategy highly likely to be future-proofed against a changing investment landscape, whereas answering no to everything above may be considered a warning sign that the strategy has a short shelf-life and will need to be re-evaluated as the operating environment evolves.

Real-world impact

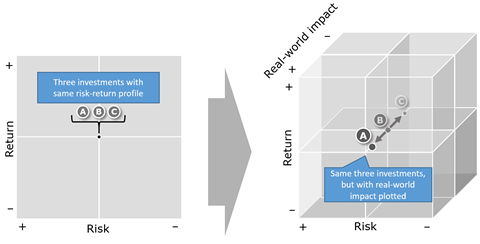

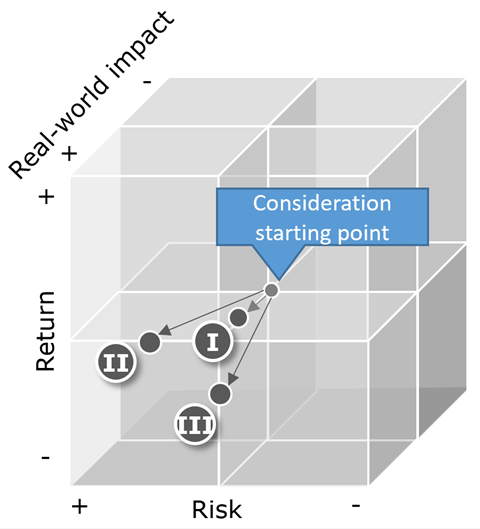

Answering yes to “Does your fiduciary duty extend beyond strictly financial benefits for stakeholders?” and/or “Is positive real-world impact an explicit part of your primary objective for investment results?” puts an asset owner in agreement with an emerging view that extends the traditional two dimensional view of risk versus return (which should already include all material ESG factors, based on current interpretations of fiduciary duty), with a third dimension that charts the real-world impact that investments can have, on the natural environment and/or society.

This transition is as important for the 21st century as the addition of risk to return was in the 20th.

Each investor will decide what weight to give real-world impact in their choice of investment strategies and investment decisions.

A growing number of investors frame their real-world impact aspirations – as driven by long-term beneficiary considerations – in terms of the UN’s Sustainable Development Goals.

Downloads

How to craft an investment strategy

PDF, Size 1.31 mb资产所有者策略指南:如何制定投资策略

PDF, Size 1.87 mbCómo elaborar una estrategia de inversión

PDF, Size 1.72 mbComo elaborar uma estratégia de investimento

PDF, Size 1.22 mbアセット・オーナー戦略ガイド:投資戦略の策定方法

PDF, Size 4.28 mb

Asset owner strategy guide: how to craft an investment strategy

- 1

Currently reading

Executive summary

- 2

- 3

- 4

- 5

- 6

- 7

- 8