Case study by Nuveen, a TIAA Company

- Signatory type: Investment manager

- HQ country: United States

Of the various types of real asset, farmland is particularly exposed to climate change. As a process of growing and selling biological assets, farming depends on the stability of weather conditions. The scientific consensus is that rising global temperatures will lead to higher variability in local weather patterns, negatively impacting crop yields.

Why physical climate risk matters for farmland investors

At the global scale, the threat posed to agriculture by climate change is a humanitarian one. It risks undermining food security, especially in regions where impacts are expected to be greatest. For investors in and managers of farmland, the problem is one of risk and reward: are the risks properly understood and are they appropriately priced?

Physical climate risks can be critical for farmland. For example, in the last five years, the wine-growing regions in northern California experienced their two largest wildfires ever recorded. But farmland is also directly exposed to less well-understood impacts from long-term chronic physical risks, such as rising temperatures and changes in water availability.

Farmland investors therefore need to understand both the acute and chronic physical risks posed by climate change. For acute physical risks, such as floods and wildfires, investors need to understand if the likelihood of such events is increasing over time. For chronic risks, such as degradation in crop yields in a hotter world, investors need to understand if long-term underwriting assumptions will stand the test of time. The task becomes complex given the need to account for various regions, microclimates, crop varietals, operating strategies and farming practices.

How we integrate physical climate risks into farmland investments

We have developed a climate risk framework for farmland investments to complement our investment process and to ensure that we manage the risks appropriately.

The first step of the risk management framework is to assess risk. Given the nascent state of physical climate risk analytics for land-based investments, we are pursuing an in-house approach that leverages data and tools from various third-party providers to inform different stages of our climate risk analysis and management efforts.

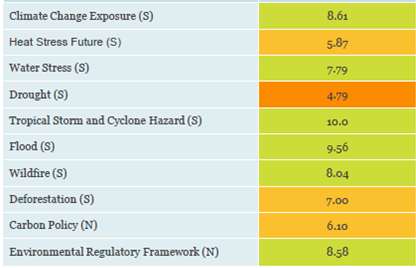

For example, we have developed a customised risk report, generated by third-party vendor software, for all prospective transactions (see Figure 1). This includes utilising a qualitative heat map-based approach to understand physical climate risk exposure and to stress test portfolios under different emissions scenarios. When any risk factor is rated high, our investment teams conduct additional due diligence to develop strategies to effectively manage the risks.

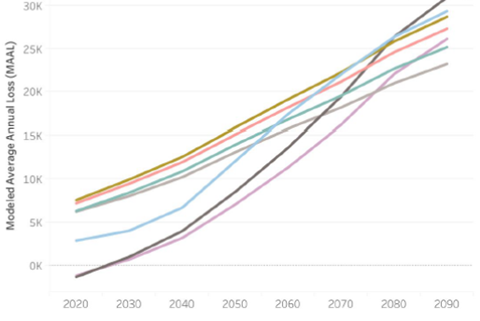

We also apply a generalised impact model for crop yields to all of our existing exposure and to prospective investments in farmland. Working with a third-party vendor, we have developed linear impact functions to model yield sensitivities to various hazard metrics, such as rising temperatures, for 24 crops in over 500 farms across the six countries in which we operate. By applying consensus climate forecasts to extrapolate local weather conditions and water availability, the analysis helps us identify potential hotspots.

For further, more complex, risk modelling needs, we are working with consultants to apply machine learning to better calibrate climate projections. This is tackling questions such as how portfolios’ exposure to wildfires can be better understood, particularly around how smoke can travel, and how yield impact can be better modelled to account on a daily basis for deviations away from ideal growing conditions.

Once our portfolio managers have understood the risks, they can manage those risks using one of four options: avoid, mitigate, transfer or accept. We believe that our farms are being operated optimally given the current state and expectations around weather risks. For example, we are already choosing not to operate in regions where we are not paid for the risks involved (avoid), while we buy crop insurance where it makes sense (transfer) and apply best farming practices to reduce risks (mitigate). For the risks that we accept, we earn a risk premium. The question that continually needs to be asked, however, is whether our strategy and practices continue to be optimal, and how risk premiums might change in a future with climate change. This is an area of continued research and development.

Example: Managing wildfire risks to vineyards

A core component of our farmland portfolio is our vineyards, of which we currently manage over 8,000 hectares. A key risk for these investments is their exposure to wildfires. Wildfires can impact the value and operations of vineyards in two ways. First, the fire, if it occurs on or near the vineyard, can destroy the vines and irrigation infrastructure. Second, the smoke from the fire can bind to molecules in the grapes and alter the flavour of the wine, reducing its quality.

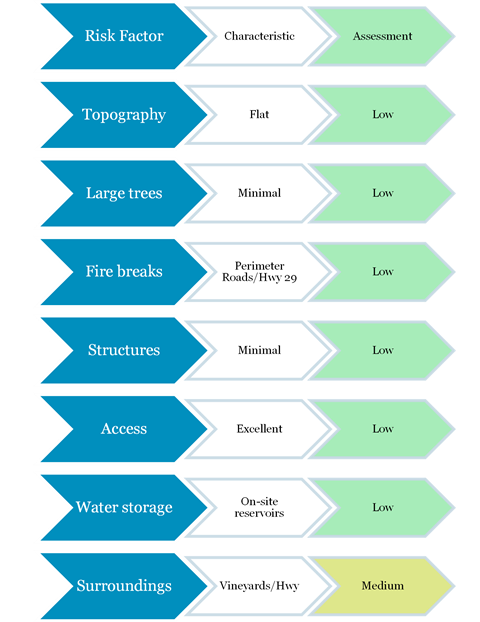

The first part of our framework is to assess risk. In many of the core regions where we operate, such as California, the wildfire risk ratings are high; this high rating in turn triggers additional due diligence. Our viticulture investment team has developed a bottom-up risk assessment tool to perform additional due diligence on wildfire risks across a number of factors. As seen in the example in Figure 3, most attributes of this vineyard register as at low risk of wildfires, but the property is not protected by other vineyards or highways. This level of assessment allows us to better understand options and trade-offs as our managers look to execute on the next step of the framework – to act across the four options: avoid, mitigate, transfer or accept.

- Avoid: Wildfires tend to start and spread most rapidly in heavily wooded hillsides. We therefore try to avoid investing in vineyards adjacent to lands that have high potential for fires to start. Other features we avoid, if possible, are trees, bush or major structures within vineyards.

- Mitigate: An effective mitigant against wildfire is to acquire properties surrounded by other vineyards and other natural firebreaks, such as roads, to eliminate potential for tinder in adjacent areas. Other mitigation strategies include action plans for fire events, such as repurposing irrigation equipment to saturate the vineyards.

- Transfer: We purchase crop insurance where it makes sense to do so. Crop insurance is a cost-effective way of transferring some of the risks that can arise from wildfires. A typical payoff structure for crop insurance is for the insured to be paid a predetermined percentage of expected revenues. However, this does not protect against physical damage to vines, which can impact future yield.

- Accept: Given all the risks considered and mitigated or transferred, investors ultimately accept some level of residual risks from wildfires in their vineyard investments. Vineyard investors have historically been financially rewarded for assuming this wildfire risk. Through bottom-up risk analysis and on-the-ground due diligence, we seek to continue generating superior risk-adjusted returns in the context of climate change and a changing risk environment.