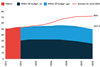

Exposure to capex outside the 2D budget varies widely throughout the curve.

Companies that have a lower percentage of unneeded capex can be seen as more aligned with a 2D budget; companies with a greater percentage of unneeded capex warrant further attention from investors. Further disclosure could be requested to explain how the company is attempting to be more “future proof” by expressly cancelling or selling high-cost projects, or reconsidering its business model entirely.

For a sample universe of companies, the percentage of total potential capex that is outside the 2D budget is shown below. Percentage of upstream capex has been arranged into bands, with companies with more than a third of capex outside of 2D having higher than average exposure.

| Company | Country of headquarters | % of upstream capex outside 2D budget (% band) | 2017-2035 carbon budget (GtCO2) | Potential CO2 outside 2D carbon budget (GtCO2) |

|---|---|---|---|---|

| Source: Rystad Energy, CTI analysis | ||||

| Southwestern Energy | United States | 60% - 70% | 1.0 | 0.6 |

| Apache | United States | 60% - 70% | 1.1 | 1.0 |

| Cabot Oil and Gas | United States | 50% - 60% | 0.6 | 0.4 |

| Energen | United States | 50% - 60% | 0.2 | 0.1 |

| Murphy Oil | United States | 50% - 60% | 0.4 | 0.3 |

| Concho Resources | United States | 50% - 60% | 0.4 | 0.3 |

| Imperial Oil (Public traded part) | Canada | 50% - 60% | 0.4 | 0.2 |

| Vermilion Energy | Canada | 50% - 60% | 0.1 | 0.1 |

| Oil Search | Papua New Guinea | 50% - 60% | 0.2 | 0.1 |

| Encana | Canada | 50% - 60% | 1.0 | 0.6 |

| Chesapeake | United States | 40% - 50% | 1.8 | 1.2 |

| Inpex | Japan | 40% - 50% | 1.4 | 0.3 |

| ExxonMobil | United States | 40% - 50% | 8.6 | 3.1 |

| Husky Energy | Canada | 40% - 50% | 0.9 | 0.3 |

| Woodside | Australia | 40% - 50% | 0.7 | 0.3 |

| Suncor Energy | Canada | 40% - 50% | 2.3 | 0.4 |

| EQT Corporation | United States | 30% - 40% | 1.2 | 0.4 |

| Devon Energy | United States | 30% - 40% | 1.6 | 0.5 |

| Chevron | United States | 30% - 40% | 6.4 | 2.0 |

| Eni | Italy | 30% - 40% | 4.6 | 1.1 |

| Shell | Netherlands | 30% - 40% | 9.9 | 2.7 |

| Galp Energia SA | Portugal | 30% - 40% | 0.3 | 0.1 |

| Canadian Natural Resources (CNRL) | Canada | 30% - 40% | 2.0 | 0.5 |

| Noble Energy | United States | 30% - 40% | 1.3 | 0.6 |

| Repsol | Spain | 30% - 40% | 1.8 | 0.3 |

| Newfield Exploration | United States | 30% - 40% | 0.4 | 0.2 |

| Total | France | 30% - 40% | 6.3 | 1.2 |

| Crescent Point Energy | Canada | 30% - 40% | 0.2 | 0.1 |

| Hess | United States | 30% - 40% | 0.8 | 0.2 |

| Origin Energy | Australia | 30% - 40% | 0.3 | 0.1 |

| Rosneft | Russia | 30% - 40% | 9.5 | 1.3 |

| Continental Resources | United States | 20% - 30% | 0.7 | 0.3 |

| Anadarko | United States | 20% - 30% | 2.5 | 0.6 |

| Cimarex Energy | United States | 20% - 30% | 0.7 | 0.1 |

| Occidental Petroleum | United States | 20% - 30% | 1.6 | 0.5 |

| BP | United Kingdom | 20% - 30% | 6.5 | 1.5 |

| Lukoil | Russia | 20% - 30% | 5.0 | 0.5 |

| PetroChina | China | 20% - 30% | 9.6 | 0.7 |

| ConocoPhillips | United States | 20% - 30% | 3.8 | 0.8 |

| EOG Resources | United States | 20% - 30% | 2.3 | 0.6 |

| CNOOC | China | 20% - 30% | 2.9 | 0.5 |

| Gazprom | Russia | 20% - 30% | 17.8 | 2.0 |

| Santos | Australia | 20% - 30% | 0.4 | 0.1 |

| Statoil | Norway | 20% - 30% | 4.3 | 0.6 |

| Rice Energy | United States | 20% - 30% | 0.7 | 0.1 |

| RSP Permian | United States | 10% - 20% | 0.4 | 0.1 |

| Marathon Oil | United States | 10% - 20% | 1.1 | 0.2 |

| OMV | Austria | 10% - 20% | 0.5 | 0.1 |

| QEP Resources | United States | 10% - 20% | 0.4 | 0.1 |

| Cenovus Energy | Canada | 10% - 20% | 0.9 | 0.1 |

| Tullow Oil | United Kingdom | 10% - 20% | 0.3 | 0.0 |

| Parsley Energy | United States | 10% - 20% | 0.2 | 0.0 |

| Ecopetrol | Colombia | 10% - 20% | 0.8 | 0.1 |

| Lundin Petroleum | Sweden | 10% - 20% | 0.3 | 0.0 |

| Sinopec | China | 10% - 20% | 2.3 | 0.2 |

| Pioneer Natural Resources | United States | 0% - 10% | 1.8 | 0.2 |

| Peyto | Canada | 0% - 10% | 0.3 | 0.1 |

| Petrobras | Brazil | 0% - 10% | 5.9 | 0.4 |

| Surgutneftegas | Russia | 0% - 10% | 2.0 | 0.0 |

| Tatneft | Russia | 0% - 10% | 1.1 | 0.0 |

| Range Resources | United States | 0% - 10% | 2.0 | 0.0 |

| Saudi Aramco | Saudi Arabia | 0% - 10% | 30.2 | 0.4 |

| Novatek | Russia | 0% - 10% | 2.8 | 0.1 |

| Arc Resources | Canada | 0% - 10% | 0.5 | 0.0 |

| Gulfport Energy | United States | 0% - 10% | 0.8 | 0.0 |

| Tourmaline Oil | Canada | 0% - 10% | 1.0 | 0.0 |

| Diamondback Energy | United States | 0% - 10% | 0.4 | 0.0 |

| Antero Resources | United States | 0% - 10% | 1.3 | 0.0 |

| Seven Generations Energy | Canada | 0% - 10% | 0.7 | 0.0 |

It is clear that some companies would have to forego the majority of their options in a 2D future, significantly impacting growth plans. Other companies are already highly resilient to this scenario, including Saudi Aramco for example. Oil sands operators generally do not perform well, which reflects the ongoing challenges to expanding production with both carbon limits and export infrastructure constraints. Shale operators are spread along the cost curve, with some positions performing better than others.

Optionality and flexibility

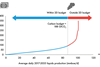

Discussions with oil companies indicate that there is a desire to retain a certain amount of optionality to allow flexibility depending on which future emerges, responding to possible changes in oil price. In other words, to retain some higher-cost projects as future development possibilities without committing if not warranted in the price environment at the time. This is understandable, but will only deliver a 2D aligned scenario if all companies choose not to exercise this optionality. Different types of project also offer greater flexibility. For example, US shale producers have relatively short cycle options which offer greater ability to reduce investment and lower production quickly. Conversely, major projects with high initial capital investment and long payback periods such as greenfield oil sands projects or LNG plants are more difficult to wind down and expose developers to longer periods of risk.

However, such optionality is not entirely cost free – for example, companies may have to pay fees to acquire acreage even if it is not developed, or licence terms may commit them to an exploration programme. Furthermore, companies that are encouraged by higher oil prices to press ahead with such projects run the risk of being caught out by prices deteriorating after they have committed material capital, like some of those sanctioned prior to 2014’s downturn.

Company carbon budgets equivalent to the UK

It is also worth noting how significant the production of the oil majors and NOCs are in terms of the remaining carbon budget. As context, the UK-estimated carbon budget for the period 2018-32 is 6.26 GtCO2 according to the UK Climate Change Committee. This means that a single major company is producing enough oil and gas to use up the UK’s entire carbon budget for the period. This demonstrates the importance of investors tackling climate change by ensuring major oil companies are aligning with climate objectives.

High cost projects – examples of projects outside the 2D budget

The largest projects that are outside the 2D budget can be put forward as examples of high cost options that should not be pursued in a demand-constrained world. In this exercise, high risk projects are listed in order of capex, giving an indication of the possible financial risk of developing them. The list is limited to projects which are “new”, meaning either at the discovery stage or not yet discovered (i.e. excluding projects which are already in production or under development). Undeveloped projects have lower sunk costs, and are thus easier to cancel than projects which have already received significant capital, and would therefore require the company to write that expenditure off.

Companies may have already decided to defer or cancel some of these projects, and revisit a final investment decision in the future. This is where companies can provide transparency about which projects they see are part of their future strategy, or how they think they are aligned or not with a 2D scenario. This list highlights projects that the cost curve data indicates are not consistent with a 2D scenario – the companies are best placed to indicate where in their project pipeline a project sits. Whilst a certain degree of optionality around the marginal production point is sensible, the highest cost projects are clearly those that are most at risk in a 2D world (and indeed are highest risk and lowest return in any demand scenario).

For example, the five oil projects with the highest capex not needed outside the 2D budget are shown in the table below.

| Project | Kashagan, KZ | Junin-6, VE | Lulu, NS | Bonga Southwest- Aparo, NG | Bonga, NG |

|---|---|---|---|---|---|

| Source: Rystad Energy, CTI analysis | |||||

| Asset | Kashagan (Phase 2), KZ | Junin-6 (Phase 2), VE | Lulu, NS | Bonga Southwest, NG | Bonga North, NG |

| Companies | Total, Eni, KazMunaiGaz (parent), Shell, CNPC (parent), Samruk Kazyna, ExxonMobil, Inpex | PDVSA, Rosneft, Gazprom, Gazprom Neft (Public traded part) | Saudi Aramco, Kuwait Petroleum Corp (KPC) | Eni, Chevron, Total, Shell, Lukoil, ExxonMobil | Eni, Shell, ExxonMobil, total |

| Life cycle stage | Discovery | Discovery | Discovery | Discovery | Discovery |

| Category |

Conventional (land/shelf) |

Extra heavy oil | Conventional (land/shelf) | Deep water | Deep water |

| 2017-2025 potential capex | 33.5 | 17.9 | 10.2 | 9.6 | 9.2 |

| Breakeven band (15% IRR) | 110-120 | 90-100 | 150+ | 100-110 | 90-100 |

| 2017-2035 carbon emissions | 0.5 | 0.2 | 0.1 | 0.1 | 0.1 |

At the global level, some of the largest projects outside the 2D budget will be in the hands of state-owned companies, making them less transparent and moving the risks to taxpayers rather than private investors.

View the full report

-

2 degrees of separation: Transition risk for oil and gas in a low carbon world

July 2017

Produced in collaboration with Carbon Tracker

![]()

2 degrees of separation: Transition risk for oil and gas in a low carbon world

- 1

- 2

- 3

- 4

- 5

- 6Currently reading

Company and project exposure

- 7