Environmental, social and governance issues affect investment performance across companies, sectors, regions and asset classes

10-year Blueprint commitments:

- increase the depth of insight and practice in asset classes where ESG incorporation is mature and penetration high;

- build the foundations for ESG incorporation in asset classes where it is still new; and

- lead signatories’ awareness and response to existing and emerging ESG issues.

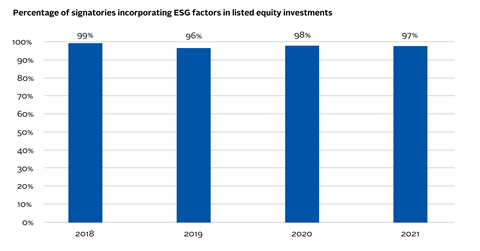

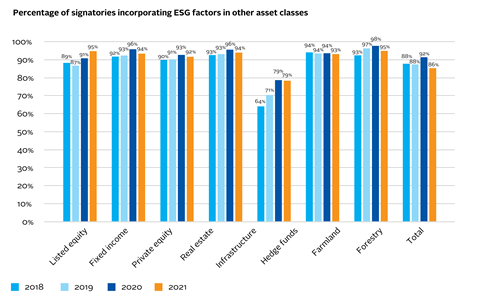

Some 97% of asset owner and investment manager signatories reported that they incorporate ESG factors into their listed equity investments, while 86% reported doing so across other asset classes.

Key targets

Signatories incorporating ESG issues in other asset classes: 86%

(PRI target: 80%)

Signatories incorporating ESG issues in listed equity investments: 97%

(PRI target: 100%)

Fixed income

ESG in Credit Risk and Ratings

The ESG in Credit Risk and Ratings Initiative aims to enhance the transparent and systematic integration of ESG factors in credit risk analysis. The Statement on ESG in Credit Risk and Ratings – still open to sign – is so far supported by 171 investors with over US$36 trillion of AUM, and 26 credit rating agencies (CRAs).

Launched in 2016, the initiative initially nurtured a dialogue only between buy-side credit analysts and CRAs. Over the past year, we have broadened our outreach to other stakeholders (issuers, ESG information providers, consultants, and ESG vendors) through a series of events and other supporting materials. The Bringing credit analysts and issuers together: workshop series summarises key themes from workshop discussions held so far, during which participants considered how the financial materiality of ESG factors varies by country, sector, and debt issuer and shared challenges and possible solutions.

The CRA quarterly updates provide investors with resources they can use to make their investment decisions, such as research reports and rating actions, while allowing CRAs to show how they are signposting ESG factors in their analysis.

Securitised products

ESG incorporation in securitised products lags other fixed income sub-asset classes and is in its infancy – largely due to the complex nature of the market. However, investor interest is growing.

In response to increasing signatory demand, we published ESG in securitised products: The challenges ahead. It explores current market practices and what information investors need to build a rigorous framework for assessing ESG factors in mainstream securitised products and ESG-labelled products, which are growing rapidly.

Sovereign debt

We published an engagement guide for sovereign debt investors – for more detail, see Foster a community of active owners.

Listed equity

We published a data snapshot report exploring how approaches to ESG incorporation, active ownership and proxy voting in listed equities have changed since 2017, and an introductory guide on screening. In the coming year, we will publish a revised technical guide on ESG integration in listed equity alongside other materials highlighting leading ESG incorporation practices.

Private markets

As investors hold private market assets, such as private equity, real estate and infrastructure, for longer periods, and have greater control over them, they can have a powerful role in promoting the responsible investment agenda.

Infrastructure and real assets

Investors are under increasing pressure to demonstrate that their investments support improved ESG outcomes. Given their long-term nature, infrastructure assets lend themselves well to responsible investment analysis, and crucially, play an essential role in meeting the Sustainable Development Goals.

We published two reports focused on infrastructure and the SDGs alongside a series of case studies:

- Are national infrastructure plans SDG-aligned, and how can investors play their part? reviews the national infrastructure strategies of the UK, Malaysia, Chile, Canada, Australia, and Kenya to assess the extent to which they incorporate the SDGs and/or sustainability factors more generally.

- Bridging the gap: how infrastructure investors can contribute to SDG outcomes outlines how infrastructure investors already consider the SDGs in their investment approaches and the challenges that must be overcome for this to become widespread, meaningful and consistent.

Applying TCFD recommendations to real assets

As investors look at how to report on climate-related issues across specific asset classes, we published our second guide on applying the recommendations of the Taskforce for Climate-related Financial Disclosures, focused on real assets.

Private equity

We commissioned a legal memorandum from law firm Debevoise & Plimpton to seek a better understanding of what the law says regarding US directors’ duties in relation to ESG factors. It provides guidance to investment professionals that sit on the boards of private equity-backed, Delaware-incorporated, portfolio companies.

We continued to encourage signatories to join the Initiative Climat International (iCI), a first-of-its-kind climate initiative for private equity, and called on the industry to accelerate its climate action. iCI members commit to sharing knowledge, tools, experience and best practice among peers to help build and manage climate-aligned and climate-resilient portfolios. Read more about our climate-focused work here.

We also supported new investment manager signatories that invest in private equity and venture capital – these have grown by 58% over the year to reach 792. More information on signatory growth can be found in Enhance our global footprint.

Introductory guides

We added guides on ESG incorporation to our Introduction to responsible investment series, including on screening and selecting, appointing, and monitoring investment managers.