Heading the investment chain, asset owners wield enormous power and influence

10-year Blueprint commitments:

- championing ESG incorporation throughout organisations;

- enabling asset owners to effectively oversee and monitor investment managers, consultants, and others to meet their responsibilities to beneficiaries;

- demonstrating how long-term global trends will shape the investment environment of tomorrow; and

- establishing that asset owners’ responsibilities to their beneficiaries extend beyond the risk/return profile of their investments.

Selection, appointment and monitoring

Responsible investment principles should be at the core of the relationship between asset owners and investment managers and should be incorporated into all stages of the investment manager relationship.

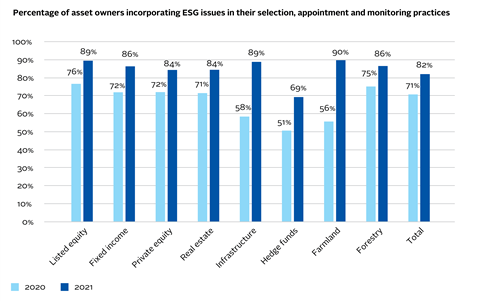

Indeed, 82% of reporting asset owners[1] said they incorporated ESG factors into their selection, appointment, and monitoring processes this year, with notable improvements across alternative asset classes such as farmland and infrastructure (see chart below). Some 86%[2] reported implementing ESG requirements in their requests for proposals, investment management agreements, limited partnership agreements and other appointment processes.

We published three detailed guides to assist our asset owner signatories further with their responsible investment practices across selection, appointment and monitoring. Each guide is accompanied by tools – such as sample ESG scoring methodologies, disclosure questions and standard ESG clauses that can be inserted into legal documentation.

We also published an introductory guide, which forms part of a series to support early-stage signatories in their incorporation of ESG issues.

In the coming year, we will produce work on ESG considerations in mandate design, to help asset owners close the gap between internal responsible investment governance and their manager relationships.

Strategy, policy and strategic asset allocation

Having a responsible investment policy and reflecting this in their investment strategies and strategic asset allocation allows asset owners to show how they are financing a sustainable economy, inclusive of environmental and social issues.

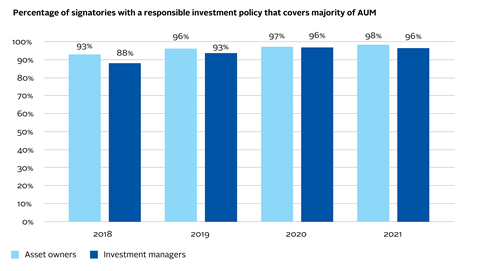

Some 98% of asset owner signatories reported having a responsible investment policy, while 96% of investment managers did so, reflecting a well-established practice among all respondents.

We published a series of signatory case studies, as well as guidance on the implications of the Inevitable Policy Response for ESG incorporation. More detail on this work can be found at Strategy, policy and strategic asset allocation.

Understanding and aligning with beneficiaries’ sustainability preferences

Understanding beneficiaries’ ESG and sustainability preferences is of increasing importance to asset owners and should inform their investment strategy, policy, and strategic asset allocation, including investment manager relationships.

We researched how beneficiaries’ sustainability preferences have been understood to date and how our signatories are trying to improve their understanding of this topic, publishing guidance to educate asset owners and their trustees.

Net-Zero Asset Owner Alliance

- 14 members joined in 2020/21, with membership tripling to 37 since its 2019 launch

- As of May 2021, 19 asset owners have set 2025 targets

The Net-Zero Asset Owner Alliance is an ambitious climate leadership group, co-convened by the PRI and UNEP FI. Members make a public commitment to transitioning investment portfolios to net-zero greenhouse gas emissions by 2050, consistent with a maximum temperature rise of 1.5°C above pre-industrial temperatures. PRI CEO Fiona Reynolds serves on the steering group, while the alliance is supported by WWF and Global Optimism, an initiative led by Christiana Figueres, former Executive Secretary of the United Nations Framework Convention on Climate Change.

The Net-Zero Asset Owner Alliance published several reports this year, including:

- the Inaugural 2025 Target Setting Protocol, which sets out how alliance members will issue and report on their intermediary targets for 2020–2025, in line with the Paris Agreement;

- a Thermal Coal Position paper, setting out how members will decarbonise their portfolios to contribute to global efforts to avoid a global average temperature increase above 1.5°C;

- a study, Sectoral Pathways to Net Zero Emissions, b ased on the 2019 One Earth Climate Model by the Institute for Sustainable Futures at the University of Technology Sydney, mapping out possible 1.5 °C pathways for five high-emitting sectors: energy, utilities, materials in specific steel and cement, and transport; and

- a tool for investment manager engagement on climate-related proxy voting.

The alliance was initiated by Allianz SE, Caisse des Dépôts, Caisse de dépôt et placement du Québec (CDPQ), Folksam Group, PensionDanmark, and SwissRe. It is open to all PRI signatory asset owners to join.

Key targets

Asset owner signatories typically implementing ESG and other requirements in contracts (RFPs, IMAs, LPAs) and typical processes: 86%

(PRI target: 50%)

96% of asset owner signatories’ missions, strategies and/or investment policies that cover the majority of their AUM reference ESG, responsible investment, sustainability, or a related concept.

(PRI target: 85%).

Asset owner signatories incorporating ESG factors into selection, appointment, and monitoring processes: 82%

(PRI target: 75%)

Asset owner signatories using the PRI data portal: 85%

(PRI target: 75%)

All of our resources for asset owners can be found in a dedicated section of our website.

References

[1] All reporting data referenced in the Annual Report relates to the 2771 signatories that were required to report to the PRI in 2021. It excludes new signatories as they do not have to report in their first year. For more information, see The reporting process.

[2] Due to changes in the Reporting Framework methodology, asset owners whose externally managed assets were held in pooled investment vehicles were excluded from answering this question.