Environmental, social and governance issues affect investment performance across companies, sectors, regions and asset classes

KEY TARGETS

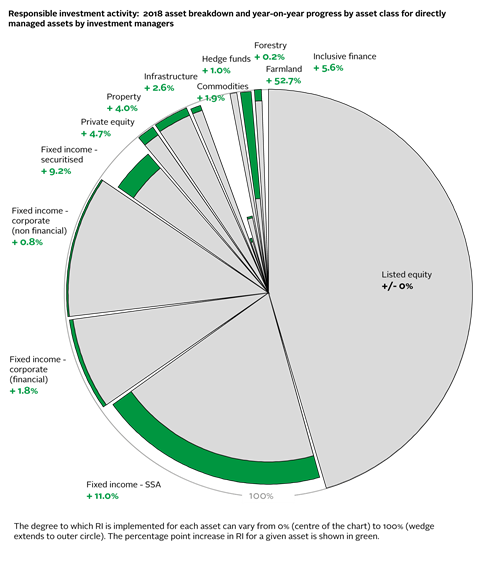

87% of signatories report considering ESG integration in directly managed assets (PRI target: 80%)

54% of signatories report considering ESG factors in porfolio construction (against a target of 50%)

We have continued to produce guides and resources for investors to assist them in incorporating ESG considerations in their investments across asset classes.

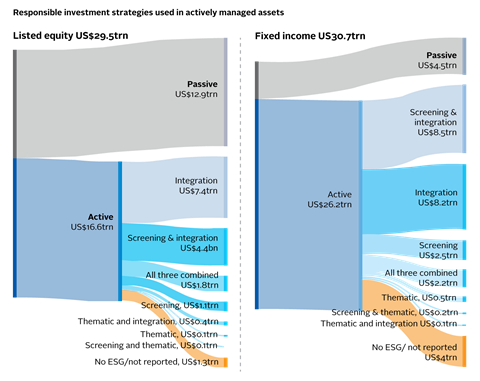

This year, we turned our attention to asset classes where responsible investment has been traditionally seen as challenging – fixed income, for example.

With bond markets totalling over US$120 trillion, fixed income investors have a critical role to play in putting a price on risk drivers such as climate change and labour disputes. And, as crucial providers of capital, fixed income investors are in a powerful position to influence a company’s ESG activities.

We held our first full-day fixed income conference in San Francisco. Over 100 delegates gathered to discuss the latest developments in fixed income. Arunma Oteh, Vice President and Treasurer of the World Bank gave the keynote speech: “While the focus on sustainability can help us tackle income inequality, address negative issues associated with populist tendencies and climate risk, it also presents vast investment opportunities, and will drive innovation and create jobs,” she said.

Also for fixed income investors, we published ESG engagement for fixed income investors: managing risks, enhancing returns. Read more about our work on active ownership.

We also published the second in a series of reports on credit rating agencies. ESG, credit risk and ratings: part 2 - exploring the disconnects presents the main findings of roundtables organised by the PRI which engaged credit practitioners from investors and CRAs on environmental, social and governance (ESG) topics for the first time in this format and at this scale.

The discussions addressed misconceptions such as the difference between assessing the impact of ESG factors on credit risk and evaluating a bond issuer’s ESG exposure.

The building blocks of sustainability

A country’s infrastructure provides essential services to society. Given the long-term nature of infrastructure investments, investors should take into account a broad range of material ESG issues that could affect the asset – such as economic developments, demographic shifts, climate change impacts and relationships with local communities.

Not considering these issues is a recipe for setbacks including delays, legal disputes and a negative effect on commercial viability – with recent examples such as the Dakota Access Pipeline making headlines.

To show how the six Principles apply to infrastructure investing, we published a Primer on responsible investment in infrastructure.

We also brought investors together to discuss the issues at a series of events in Melbourne, New York and London.

A systematic approach

We have been working to drive a more systematic and accountable approach towards responsible investment in private equity.

We delivered the third in the trilogy of tools designed to support LPs and GPs throughout manager selection, appointment and monitoring. Incorporating responsible investment requirements into private equity fund terms identifies current and emerging best practice and offers practical options to LPs and GPs that are considering how they might incorporate responsible investment into fund terms.

There is a growing expectation that businesses carry out human rights due diligence. Failure to identify, prevent and address adverse human rights impacts may lead to reputational, operational, financial and legal risk. To help private equity investors navigate this, we published a human rights in private equity discussion paper.

Find out more about our human rights work

Embedding sustainability

Considering ESG risk and opportunity in the supply chains of investee companies in private markets has traditionally been lacking, as transparency, disclosure and company capacity to manage supply chains may be limited. Yet the business case for effective management of ESG risk, including in the supply chain, is clear. To create peace of mind when managing risk to company value, investors must address the topic with investee companies.

To assist with this, we published Managing ESG risk in the supply chains of private companies and assets. It provides practical initial steps investors can take to assess and manage supply chain risk. Collectively, investors can be at the forefront of driving supply chain ESG risk management up the corporate agenda.