Climate change is the highest priority ESG issue facing investors

Protecting investments, protecting the planet

Our signatories tell us that climate change is their number one concern.

Meeting the goals of the Paris Agreement and the SDGs is paramount to protecting investors’ portfolios, and acting in the best interest of beneficiaries, and the societies in which they live. We have worked this year to help signatories tackle the problems presented by climate change, as well as expose them to opportunities in the shift to a low-carbon environment.

Uniting in the fight against climate change

With our partners, we launched the Investor Agenda, an initiative to accelerate actions critical to tackling climate change and achieving the Paris Agreement goals. It provides comprehensive guidance for investors to transition the world’s financial capital to low-carbon opportunities, and includes a mechanism to report on progress. Investors are encouraged to act in four areas: investment, corporate engagement, investor disclosure and policy advocacy.

We developed the Investor Agenda in partnership with: Asia Investor Group on Climate Change, CDP, Ceres, Investor Group on Climate Change, Institutional Investors Group on Climate Change and UNEP Finance Initiative

Active ownership on climate risks

Investors have a critical role to play in insisting that companies take action to limit the risks and maximise the opportunities of climate change.

As part of the engagement area of the Investor Agenda, we launched Climate Action 100+ at the One Planet Summit, a five-year initiative led by investors to engage with the world’s largest corporate greenhouse gas emitters. The initiative aims to improve governance on climate change, curb emissions and strengthen carbon-related financial disclosures. To date, 279 investors representing nearly US$30 trillion in assets have signed up.

Identifying stranded assets

Along with Carbon Tracker, we released the ground-breaking report 2 degrees of separation: transition risk for oil & gas in a low carbon world. It is the first tool to rank the oil and gas industry company by company and identify where shareholders’ money could be most exposed to the low-carbon transition. It found that five of the six largest oil companies risk wasting more than 30% of possible spending on upstream projects that are high cost and surplus to supply needs in a 2 degree world.

Driving disclosure

Without better climate disclosure, investors cannot manage the physical and transition risks associated with climate change for their clients and beneficiaries. Last year, the Task Force on Climate-related Financial Disclosures (TCFD) released a set of recommendations for the transition to a low-carbon economy, providing a framework for financial disclosures by companies and investors.

Nearly 400 investors representing US$22 trillion in assets have publicly called on the G20 to support the Paris Agreement, drive investment into the low-carbon transition and support the TCFD recommendations.

With Baker McKenzie, we reviewed a number of markets – France, the US, the UK, Japan, the European Union, Canada and Brazil – to gauge how the TCFD recommendations could be implemented.

The reviews found that climate change is a material risk and that the TCFD recommendations will significantly help the implementation of material risk disclosure regulation for companies.

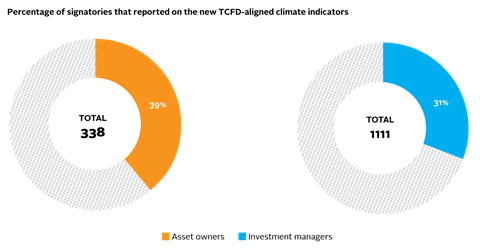

To support investor disclosure, we have aligned our Reporting Framework with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). This marks an important step forwards on tackling climate change and recognising the risks – and opportunities – climate change brings.

Pilot reporting against the new indicators will help signatories:

- inform climate strategy and investment practices;

- align with the TCFD recommendations;

- demonstrate climate reporting gaps;

- implement emerging best practice.

Out of the 1,449 reporting signatories this year, over 480 (28% AO, 72% IM) opted into submit information.

A ticking clock

Time is not on our side to halt the devastating effects of climate change. The only way to do this is to bend the emissions curve by 2020 – something that will require US$800 billion in private resources each year. But for investors to change the direction of travel, they must have a deep understanding of the current state of play.

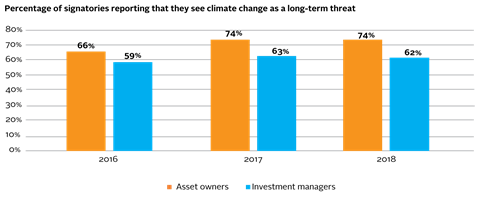

We released the report Investor action on climate change. It found that while momentum is strong (in 2017, 74% of asset owners stated they see climate change as one of the most important long-term trends for investments), more urgent investor action is required.

The role of stock exchanges

Stock exchanges also have an important role to play in stopping climate change as they can promote green products and services that mobilise financial resources for climate action. In collaboration with the Sustainable Stock Exchanges initiative, we published guidance to provide stock exchanges in any market with a solid platform to ensure the development of green finance initiatives and to support the Paris Agreement.