This starter guide introduces the topic of climate change to asset owners. It aims to explain the importance and relevance of climate change in the context of the investment process and to outline how asset owners might incorporate this into responsible investment policies, investment processes and stewardship practices.

The guide is split into two parts:

- Part 1: The relevance of climate change, covering: why it matters to investors; the science; why government action matters to investors.

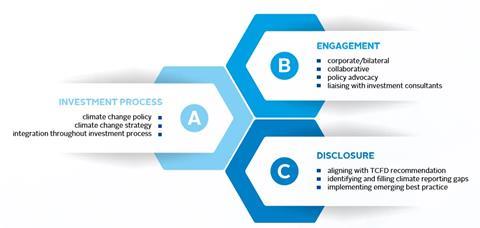

- Part 2: Approaches that asset owners should adapt in their (A) Investment process (B) Engagement (C) Disclosures, and: possible actions to be taken; available resources; introductory questions to ask investment managers.

The PRI is working to help investors protect their portfolios from climate-related risks, to identify new opportunities and outline processes to help asset owners engage on the topics. Selected further reading is provided throughout. For more information on anything in this guide, or climate change more broadly, please get in touch.

The PRI’s key climate collaborations and programmes:

- Climate Action 100+

- The Investor Agenda

- UN-convened Net-Zero Asset Owner Alliance

- Inevitable Policy Response (IPR)

- FSB Taskforce on Climate-Related Financial Disclosure (TCFD)

Part 1: The relevance of climate change

Why does it matter to investors?

Climate change will have significant physical and economic impacts on many different aspects of human activity, as identified by bodies including the Intergovernmental Panel on Climate Change (IPCC), the IMF and the Bank of England.

Climate change is a systemic issue which affects all asset types and sectors. As such, it will impact the portfolio returns, asset valuations and asset allocation processes of asset owners with diversified, global portfolios.

It will provide new investment opportunities. For example, the IPCC forecast that new public and private investment in energy will need to grow to around U$2.4 trillion annually to 2035 – representing around 2.5% of the global GDP.

Climate change also introduces new risks.

Country level:

- Since 2015, failing to adapt to climate change has been cited as a top-five risk by the World Economic Forum.

Sector level:

- The physical changes of climate change have already had tangible financial implications for some sectors, such as insurance. Overall losses from world-wide natural catastrophes in 2019 totalled US$150 billion1.

- Expected returns on others, such as energy, utilities, consumer staples and telecoms, will also be significantly impacted. According to some consultants and analysts, company or asset valuations will be affected by how corporations choose to respond to climate issues2.

These implications coincide with an increasing focus from regulators on the importance of ESG incorporation for fiduciary duty. Some countries have already introduced stricter requirements to consider climate change preferences of clients and beneficiaries, including reporting on how these obligations are implemented.

Asset owners will inevitably invest in assets and sectors whose behaviour and business models have to adapt. Climate change will result in changes to weather, consumer demands and societal expectations, and will result in the development of new regulation and technology – important considerations when setting an investment policy, engaging an asset manager, working with investment consultants and fulfilling fiduciary duty.

Investors cannot avoid climate-related risks, but they can protect their portfolios against them.

PRI resources:

The science

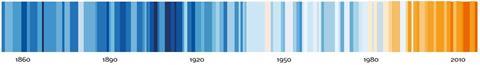

The Earth’s temperature is now rising faster than any time in recent history – evident in more numerous and volatile weather events, rising sea levels and warming marine temperatures. Global temperature rises have been particularly marked since the industrial revolution and since the 1970s each subsequent decade has been successively warmer than the last (see Figure 1).

Figure 1: Global temperature change (1850-2019), Show your stripes

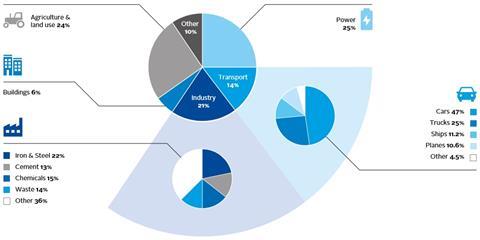

Activities such as manufacturing, transport, agriculture and power generation (see Figure 2) increase the atmospheric concentration of greenhouse gas (GHG) emissions, resulting in the greenhouse effect, which traps the sun’s heat and contributes to global temperatures rising.

Human activities are contributing to approximately 1.0°C of global warming above pre-industrial levels. Current emission patterns indicate that this could reach 1.5°C by 20403.

Figure 2: Global emissions by sector, Accelerating the low-carbon transition, Brookings Institution

Why government action matters to investors

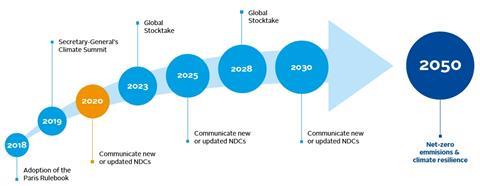

Governments are starting to respond. Based on the IPCC findings, the Paris Agreement is the best example of international action. It binds the 197 countries that ratified the United Nations Framework Convention on Climate Change to a common cause – to undertake ambitious efforts to combat climate change and adapt to its effects, with enhanced support available to assist developing countries. It aims to stop global temperatures rising by more than 2.0°C above pre-industrial levels this century and to limit that increase even further to 1.5°C.

Figure 3: Ambition mechanism in the Paris Agreement

The Paris Agreement commits governments to a ratchet mechanism which requires a tightening of regulation and action if the science points to a global warming trajectory beyond this central target. A delay in taking action will have significant financial implications; as outlined in the PRI’s Inevitable Policy Response work.

Whilst government action matters, asset owners are responsible for the delivery of their own climate commitments, independent of whether governments meet targets. Given that many asset owners have future liabilities, there is a strong incentive to consider the investment implications of global warming and encourage emissions reductions now, rather than later.

New regulation – such as the EU Taxonomy – will also increase the reporting requirements on investors.

Limiting global warming to 1.5°C needs increased investment and societal changes. To meet these targets, changes are required in the way society and businesses travel, consume resources and generate energy.

Part 2: How should asset owners respond?

A three-step approach to implementing a climate change response

How asset owners will respond to this important challenge will vary, but actions could include:

- introducing a standalone climate policy;

- reviewing investment decisions;

- challenging fund managers; and

- engaging with companies and policymakers.

This section outlines the approaches that asset owners could take to protect their portfolios from the systemic risks posed by climate change.

Principle 1: “We will incorporate ESG issues into investment analysis and decision-making processes.”

There is no one-size-fits-all approach to the integration of ESG factors – including climate change issues – into an investment process.

Possible actions on climate change:

- Address ESG issues in investment policy statements.

- Support development of ESG-related tools, metrics, and analyses.

- Assess the capabilities of internal and external investment managers to incorporate ESG issues.

- Ask investment service providers (such as financial analysts, consultants, brokers, research firms, or ratings companies) to integrate ESG factors into evolving research and analysis.

- Encourage academic and other research on this theme.

- Advocate ESG training for investment professionals

Asset owners can incorporate a climate change response into an investment process in three stages:

- Devise an investment policy

- Develop an investment strategy

- Integrate throughout the investment process

The PRI has developed this framework and resources to help asset owners incorporate these steps:

1. Devise an investment policy

| Stage | Resources |

|---|---|

|

Policy purpose |

|

|

Policy introduction |

|

|

Responsible investment policy roadmap |

2. Develop an investment strategy

| Stage | Resources |

|---|---|

|

Investment strategy purpose |

|

|

Planning, principles & governance on boards |

|

|

Responsible investment policy roadmap Boards are accountable for the strategic integration of climate risks, which should ensure that alignment with netzero by 2050 is prioritised. |

|

|

Investing in climate solutions |

|

|

Asset owners phasing out their exposure to fossil fuels should do so in a way that ensures a just transition; the social dimension beneath policy reform in the long-term interests of society. |

|

|

Constructing a portfolio

|

3. Integrate throughout the investment process

| Stage | Resources |

|---|---|

|

Implementing the TCFD recommendations |

|

|

Scenario analysis |

|

|

Integrating climate change into investment processes |

|

|

PRI Reporting Framework |

|

|

Asset owners can join several initiatives |

|

|

The Science Based Targets Initiative provides a target-setting approach for financial institutions and corporates, including guidance and validation of targets and methodologies. |

|

Principle 2: “We will be active owners and incorporate ESG issues into our ownership policies and practices.”

The commitment to engagement that all signatories make has recently been expanded through the PRI’s Active Ownership 2.0. framework, which encourages collaborative action on systemic issues such as climate change.

Possible actions on climate change:

- Develop and disclose an active ownership policy consistent with the Principles

- Exercise voting rights or monitor compliance with voting policy (if outsourced).

- Develop an engagement capability (either directly or through outsourcing).

- Participate in the development of policy, regulation, and standard setting (such as promoting and protecting shareholder rights).

- File shareholder resolutions consistent with longterm ESG considerations.

- Engage with companies on ESG issues

- Participate in collaborative engagement initiatives

- Ask investment managers to undertake and report on ESG-related engagement.

Asset owners can be active owners and engage on climate change specifically through:

- Corporate climate engagement: focusing on the direct and indirect influence4 that companies have on climaterelated public policy.

- Collaborative engagement: working with other investors to promote initiatives that are aligned to the Paris Agreement.

- Policy engagement: promoting policy and regulation that supports governments in meeting the aims and objectives of the Paris Agreement and encourages decisions for a sustainable economic recovery, following the COVID-19 pandemic.

- Liaising with investment consultants: to frame a more holistic response to climate change.

The PRI has a range of collaborative partners and resources available for its signatories, set out in the table below, to help asset owners deliver successful engagement programmes:

| Collaborative initiative | What it provides |

|---|---|

|

Climate Action 100+ |

A global collaborative engagement targeting the world’s biggest GHG emitters to curb emissions, strengthen climate-related financial disclosures and improve governance of climate change issues. |

|

UN-convened Net-Zero Asset Owner Alliance |

A climate leadership initiative with UNEP FI established to drive the investment industry’s response to transitioning portfolios to net-zero GHG emissions by 2050. |

|

The Investor Agenda |

A framework for investors to increase transformative investments and inspire governments to step up their ambition / action to mitigate the effects of climate change. |

|

The Universal Owner hypothesis |

Institutional investors can collaborate to encourage policymakers and companies to reduce environmental impacts. |

|

Network for Greening the Financial System (NGFS) |

A forum to help banks and financial regulators address the transition to low-carbon economy. Its recommendations5 align with the TCFD and support country-level collaboration. |

Principle 3: “We will seek appropriate disclosure on ESG issues by the entities in which we invest.”

Principle 6: “We will each report on our activities and progress towards implementing the Principles.”

Asset owners should disclose their own climate-related policies and actions, as well as requiring disclosure from portfolio companies and asset managers in this regard.

Possible actions on climate change:

- Disclose how ESG issues are integrated within investment practices.

- Disclose active ownership activities (voting, engagement, and/or policy dialogue).

- Disclose what is required from service providers in relation to the Principles.

- Communicate with beneficiaries about ESG issues and the Principles.

- Report on progress and/or achievements relating to the Principles using a comply-or-explain approach.

- Seek to determine the impact of the Principles.

- Make use of reporting to raise awareness among a broader group of stakeholders.

Asset owners can report on the implementation of material risk disclosures on climate change by:

- Aligning with TCFD recommendations

- Identifying and filling climate reporting gaps

- Implementing emerging best practice

Increasing numbers of asset owners have taken a first step in undertaking and publishing the carbon ‘footprints’ of their portfolios. The TCFD recommendations go further, suggesting an approach that incorporates and reports on physical and transitional risks which may not be captured in carbon footprints. The PRI Reporting Framework is now aligned with the recommendations of the TCFD and will help asset owners to report against these recommendations.

The table below sets out the resources available for climate disclosure:

| Disclosure frameworks for asset owners | Resources available |

|---|---|

|

Climate reporting |

|

|

Carbon footprint |

|

|

PRI Leaders’ Group 2020 |

|

|

TCFD |

|

|

EU Taxonomy |

The following questions could be used as a basis for discussion between asset owners and asset managers during a due diligence or review process. They follow the structure of the TCFD recommendations. More detailed questions on manager monitoring will be available in an upcoming PRI technical guide6.

1. Organisation-wide support for the TCFD recommendations

- Does your organisation support the TCFD recommendations?

- If not, please explain the rationale behind this decision.

- If yes, when do you anticipate implementing the recommendations?

2. Governance

- Has your organisation included the monitoring of climate-related impacts as part of the board’s and/or management group’s oversight responsibilities?

- How is progress reviewed, by whom and how often?

3. Strategy

-

Is there a firm-wide strategy in place to identify the risks and opportunities related to climate change?

-

Has the organisation considered the impact of climate-related scenarios on future outcomes in terms of expected risk and return, as well as the identification of new opportunities?

4. Risk management

- Has a process been established to assess and integrate climate-related investment risks (transition and physical impacts) into investment decisions?

- What is your process for monitoring these risks?

5. Metrics

- What climate-related metrics, if any, does your organisation use?

- Can you describe how these metrics have impacted investment decisions

6. Challenge, targets and next steps

- Has the organisation prepared disclosures on its climate commitments in line with the TCFD recommendations and ahead of the upcoming EU taxonomy regulation?

- Has the organisation introduced steps to transition investment portfolios to net-zero GHG emissions by 2050?

- Has the organisation prepared and modelled for scenarios such as the Inevitable Policy Response?

Downloads

Climate change for asset owners

PDF, Size 3.3 mbCambio climático para propietarios de activos (Spanish)

PDF, Size 3.27 mbアセット・オーナー向け 気候変動入門ガイド (Japanese)

PDF, Size 1.63 mb资产所有者气候变化指南 (Chinese)

PDF, Size 3.74 mbLes changements climatiques pour les investisseurs institutionnels (French)

PDF, Size 1.49 mb

References

1 Insurance Information Institute’s Facts + Statistics: Global catastrophes

2 See for example Wood Mackenzie’s How can Big Oil stay investible through the energy transition?

3 See IPCC’s Global warming of 1.5°C and the IPCC’s Fifth Assessment Report, 2013

4 UN Global Compact’s Guide for Responsible Corporate Engagement in Climate Policy

5 See Central bankers step up on climate risk

6 Technical guide: Monitoring investment managers