The ERISA retirement system brings together distinct stakeholders with diverse incentives and objectives. These range from the plan sponsors to pension consultants to the investment managers, independent advice providers and, ultimately, the plan beneficiaries.

The plan sponsors, with the assistance of pension consultants, structure the plans and make decisions about investment options, although, in the case of DC plans, the plan beneficiaries are required to make investment selection decisions and bear the investment performance risk.

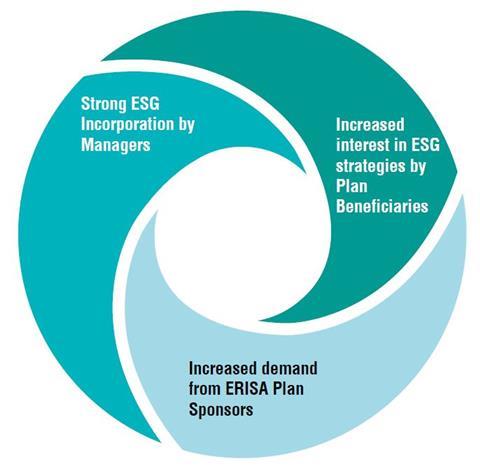

The agency problems and misaligned incentives built into this structure remain significant hindrances to the retirement system in general as well as to the ability of plan beneficiaries to exercise their options to integrate ESG into their retirement portfolios. By exploring the role of each of the stakeholders along with the specific incentives and challenges they face in the incorporation of ESG factors, a series of recommendations for action emerge.

| Factors | Plan sponsors (PS)/ Fiduciaries | Consultants | Investment managers | Independentadvice providers | Beneficiaries |

|---|---|---|---|---|---|

|

Role |

|

|

|

|

|

|

ESG incentives |

|

|

|

|

|

|

ESGChallenges |

|

|

|

|

|

|

ESG stakeholder Recommendations |

|

|

|

|

|

|

ESG Policy Recommendations |

|

||||

Plan sponsors: Balancing business objectives and fiduciary duties

While ESG incorporation has grown tremendously over the years, as shown by the US SIF Trends data, plan sponsor surveys report that ERISA plans have lagged in interest and adoption. However, conversations with leading investment consultants indicate that companies are starting to address ESG in their DC plans, driven by a desire to have their company values reflected in the retirement benefits they offer their employees. This is consistent with research signaling that a majority of employees care about their retirement plans being aligned with their company’s social and environmental commitments.

Nevertheless, plan sponsors’ low adoption is reflected in New England Pension Consultants’ 2018 ESG survey of its corporate and healthcare retirement clients, showing that just 12% incorporated ESG factors into their manager selection and monitoring. Of the plans that did incorporate ESG, 70% were DC. Of the DB and DC plans that did not, nearly a third (29%) stated they are interested in exploring ESG incorporation, signaling that plan sponsor interest is increasing.

Plan sponsor snapshot: Bloomberg LP

Bloomberg is a global information and technology company that provides business and financial news, data and analytics. Sustainability and stewardship are central to the company’s culture and are well integrated in its products and services. ESG data for almost 9,500 companies in 83 countries is available on the Bloomberg Terminal. Founded in 1981, Bloomberg has over 19,000 employees in 176 countries.

Role of ESG

In 2015, Bloomberg added the Parnassus Core Equity Fund (US large-cap equity) as an ESG-themed option in its US$2.5 billion DC plan. Around the same time, Bloomberg updated its investment policy statement to include incorporating ESG factors into fund monitoring and selection. This meant including at least one ESG-oriented fund in every fund search. Cathy Bolz, Global Head of Benefits, commented: “Bloomberg decided to integrate ESG into its 401(k) plan because the company determined it was in the best interest of the plan and participants to provide them with this type of diversity in (their) fund lineup.”

In October 2017, Bloomberg became the first US-domiciled corporate retirement plan to become a signatory to the PRI. Bloomberg is in the business of providing ESG data and insights to its customers, and it recognizes that companies that manage ESG factors well often have better returns. Providing its employees – who are long-term investors – the opportunity to incorporate ESG into their retirement planning strategy was “a logical next step”, according to Dom Maida, Investment Committee Chair and Global Head of Global Data.

Investment consultants: leading clients from behind

For ERISA plans, investment consultants have not typically been proactive in discussing with plan sponsors the potential for including funds that consider ESG factors in the investment process. However, as mentioned above, plan sponsors are beginning to push their consultants and question whether their corporate values are reflected in their firm’s retirement plan. Consequently, some corporate plans are considering adding a global sustainability fund and/or including ESG analysis in their quarterly performance reports. In addition, nearly half (47%) of the 77 DC investment consultants responding to PIMCO’s 12th annual Defined Contribution Consulting Support and Trends Survey say they recommend ESG as an additional stand-alone strategy within the core line-up. Even though these 77 consulting firms advise roughly 60% of US DC assets (over US$4.4 trillion), this recommendation does not yet show up in the equivalent percentage of DC plans.

Consultants are recognizing the growing interest in ESG incorporation throughout their client base, and some are conducting client surveys and producing white papers. For the last five years, Callan Institute has polled its client base and found that consideration of ESG options leveled off in 2016 and 2017 at 37% across client types, and slightly dipped among corporates (with both DB and DC plans) from 30% to 25%.29 New England Pension Consultants issued its first ESG survey this year, noting that both DB and DC plan sponsors are in the early stages of incorporating ESG investing. In Top Priorities for DC Plan Sponsors for 2018, Mercer includes “Consider ESG Options” as one of the top 10 priorities for sponsors to consider.

Meanwhile, Marquette Associates’ 2017 white paper, Bracing for impact: How to Prepare for the Next Generation of Defined Contribution Plans, lays out the rationale for ESG incorporation and proposes a checklist for those plan sponsors beginning to consider ESG issues. Given that the millennial generation is the most ethnically diverse demographic in the US and will make up the majority (75%) of the global workforce by 2025, Marquette states “ESG strategies seem like an inevitable trend for this generation.”

Marquette’s suggestion, shown in the checklist below, is for plan sponsors to educate their clients, ensure they know their beneficiaries, and start to incorporate ESG data.

|

1 |

Review the fund’s investment policy and current fund line-up |

|

2 |

Educate the decision-makers Seek education from consultants and recordkeepers and address all questions and concerns. |

|

3 |

Survey plan participants Determine level of interest in ESG options, as well as areas of importance (i.e. climate change or labor relations). |

|

4 |

Outline criteria for search and selection Define whether you seek ESG integration, a thematic fund (such as water or carbon reduction), or other alternatives. |

|

5 |

Make selection and add to line-up Discuss options, select best candidate, and initiate transition. |

|

6 |

Educate plan participants Prepare communications to explain the new line-up and rationale behind it. |

Investment managers: Key to ESG product quality and authenticity

While investment managers of both DC and DB ERISA plans clearly play an important role in pension fund management, they generally respond to the product requirements of plan sponsors and their consultants. Investment managers are therefore unlikely to drive future adoption of the intentional use of ESG fund options in retirement plans but are rather the creators of the ESG products, and thus can strongly influence the quality and approaches of ESG products and strategies.

Unfortunately, most investment managers of ERISA plan assets have not, to date, embraced the need for or value of ESG incorporation. Offsetting this is the increased use or discussion of ESG incorporation in standard investment processes. While increased use of ESG factors is a positive development for the investment management industry, these factors are rarely at the heart of the investment process and are frequently ignored if they do not clearly impact immediate financial considerations.

Investment managers in the DC space face added challenges to ESG incorporation because providing ESG-based funds does not ensure their adoption by plans or selection by individual beneficiaries. In addition, pressure to provide low-cost options has made some investment managers reluctant to invest in ESG resources, such as services from data providers or dedicated analysts. That said, the cost of ESG incorporation is falling and data is becoming more readily available, as noted in a recent report on ESG integration in US investing.

As beneficiaries make the ultimate investment decisions, the entire chain of advisors and advice engines must be educated or adapted to reflect beneficiary preferences for ESG factors in the funds available to them. Investment managers must also compete with shrinking “shelf space” as plan sponsors seek to make their DC plans easier to navigate by reducing the number of fund options available to beneficiaries. This trend is directly pitting ESG-oriented funds against other investment options.

Investment manager snapshot – Nuveen Asset Management

Nuveen Asset Management is the investment management affiliate of TIAA, a financial services company headquartered in New York. Nuveen has US$970 billion in assets under management, which includes the management of assets within the DC retirement plans of 15,000 employers who use TIAA to provide recordkeeping and/or investment funds. The bulk of these 15,000 employer-sponsored plans are with academic and research institutions, and some of these plans are governed by ERISA. TIAA was founded in 1918 by Andrew Carnegie and the Carnegie Foundation for the Advancement of Teaching to provide a fully-funded pension system for professors and employees of academic institutions in the US. TIAA is now a diversified financial services company with banking and other subsidiaries. It acquired Nuveen Investments in 2014.

Role of ESG

Through its TIAA funds, Nuveen has a longstanding history of ESG-related strategies. The firm’s client base of employees and employers in higher education has yielded a consistent interest in and demand for ESG-related strategies. The firm’s CREF Social Choice Account (SCA) was launched in 1990 and remains one of the largest funds for individual investors – accessed mostly through their retirement plans – with US$14 billion in assets under management. As a balanced fund, SCA includes ESG screening of domestic and international equity segments as well as ESG screening of its domestic fixed income component. Within the last 15 years, TIAA has launched specialized funds for ESG-screened domestic equity (TIAA Social Choice Equity), international equity (TIAA International Equity), and domestic fixed income (TIAA Social Choice Fixed Income), based on its experience managing the CREF Social Choice Account. In 2016, following the Nuveen acquisition, the mutual fund and annuity line-up was supplemented with five ESG ETFs (exchange-traded funds). ESG funds and ETFs can be available in ERISA and non-ERISA plans with ETFs requiring a brokerage “window” option.

ERISA and ESG

Nuveen and TIAA funds are used in a wide range of non-ERISA and ERISA-governed plans. The firm’s ESG offerings benefit from the long-term (i.e., 20 plus years), competitive investment track record of ESG funds such as CREF Social Choice and TIAA Social Choice Equity. These track records illustrate that competitive performance with comprehensive ESG screening is possible. And, with close to US$20 billion in total ESG screened assets, beneficiary and plan sponsor demand is clearly a driver.

Independent advice providers: Emerging actors in ESG decision making

ERISA DC plans increasingly rely on independent advice providers to help beneficiaries develop an asset allocation and select funds. This advice is usually delivered through some combination of software (“engines” or “algorithms”) and professional advisors, with the goal of providing unbiased advice that is independent of the investment manager. Independent advice providers, such as Financial Engines, are typically hired by the investment manager or plan record keeper.

These independent advice providers’ work with beneficiaries often begins with an automated questionnaire that solicits responses from plan beneficiaries on their goals, timeframes, and risk preferences. Other beneficiary preferences might, for example, include the willingness or not of the plan beneficiary to include international funds in their asset allocation.

Even if available under a DC plan as an investment option, ESG funds are typically excluded from the independent advice provider’s recommendations, simply due to the lack of an ESG question in the advice software that would influence the final fund selection advice. Independent advice providers therefore represent new stakeholders in the DC world that must be convinced of the rationale for ESG inclusion in ERISA and non-ERISA DC plans.

ERISA plan beneficiaries are the primary and ultimate drivers of the increased use of ESG factors in DB investments and DC fund options. However, they typically lack awareness of their ability to effect change through plan sponsors. In the DB market, this is also complicated by a lack of transparency around the investment strategies employed and even a lack of understanding of the plan’s structure and stakeholders.

Rigorous financial analysis, including all financial and ESG factors, benefits the end investor, in this case the plan beneficiary. It is incumbent upon the plan sponsor to require all of its service providers (e.g., investment consultants and investment managers) to account for their due diligence and investment processes, as well as their results.

In the DC market, plan beneficiaries face additional challenges including:

- Lack of awareness: many beneficiaries are unsure whether their plan even offers an ESG option, and most beneficiaries are not asking for ESG incorporation;

- Fund overload: too many fund options (perhaps squeezing out ESG options) lead to beneficiary paralysis and defusing of interest in ESG funds;

- Fund “greenwashing”: investment manager or fund marketing materials may claim ESG incorporation as a marketing device, while the reality is fund managers pay only lip service to ESG factors; and

- Inadequate advice or algorithm engines: these tools often help beneficiaries in areas such as asset allocation and/or fund selection. Typically they do not ask beneficiaries about their ESG preferences, so beneficiaries cannot incorporate those preferences into their portfolios.

Industry initiatives and collaborations: Opportunities to accelerate ESG adoption

ESG adoption will be significantly accelerated by intentional and focused collaboration between plan sponsors and service providers (e.g., investment consultants, investment managers, ESG data providers, and independent advice providers). Current initiatives seek to provide thought leadership, best practice and support for plan sponsors. For example, the World Business Council for Sustainable Development launched its “Aligning Retirement Assets” project in June 2018. Its goal is to shift 1% of members’ retirement assets (amounting to some US$10 billion) into ESG-oriented investments by 2020. The task force will produce two toolkits for plan sponsors addressing questions such as: ‘what is sustainable retirement?’ and ‘how to develop a sustainable retirement plan’.

Another project underway is the ESG Subcommittee of the Defined Contribution Institutional Investment Association (DCIIA), a non-profit membership organization with the mission to “enable America’s workers to retire with financial security.” The membership includes corporations, consultants, asset managers, law firms and record keepers. The ESG Subcommittee is open to all members and its objective is to “encourage best practice for the incorporation of environmental, social, and governance factors in defined contribution plans.” It provides a forum for promoting and conducting research, sharing best practice, producing thought leadership, and influencing policy makers.

Untangling stakeholders for broader impact: ERISA plans and ESG incorporation

- 1

- 2

- 3

- 4

Currently reading

Currently readingStakeholder chain

- 5

- 6