Executive summary

US municipal (muni) bonds play an important role in funding public services and infrastructure, hence they are fundamentally well positioned for responsible investment strategies. Muni bond issuers affect the quality of life of most Americans and will be key in the transition to a low carbon economy.

Like their peers across many fixed income asset classes, muni bond investors have started to address ESG factors more explicitly to mitigate risk in their portfolios. Some have also gone beyond seeking better risk-adjusted investment performance to adopt an ESG thematic strategy, which involves allocating capital to themes or assets that are tied to certain environmental or social outcomes. This approach, and more broadly weighing the real-world outcomes of muni bond holdings (both positive and negative), is less common than the risk mitigation approach, but momentum is building.

The two approaches are not necessarily mutually exclusive and could deploy the same techniques (for example exclusion or engagement). If anything, the US muni bond market is well suited to embracing both ESG strategies simultaneously, given the many public benefits funded by proceeds.

This paper highlights:

- The tailwinds that support muni bond investors’ adoption of a thematic ESG approach;

- The ways in which both labelled and unlabelled muni bonds can contribute to sustainability outcomes;

- The state of the labelled muni bond market, illustrated through examples;

- The need for investors to perform due diligence on labelled and unlabelled bonds.

About this paper

As part of its workstream on the incorporation of ESG factors into sub-sovereign debt, the PRI has started to focus on the US muni bond market.

This is the second report in a series and highlights the benefits of muni bonds for investors using a thematic ESG approach to responsible investment. The first report, ESG Integration in Sub-Sovereign Debt: The US Municipal Bond Market, concentrated on the ESG integration approach, where ESG factors are considered from the perspective of optimising risk-adjusted returns. See the first paper for a more detailed overview of the features of the US muni bond market.

This report is based on desk-based research and draws on the experience of the members of the sub-sovereign debt advisory committee. As a next step, the PRI intends to explore engagement between investors and muni bond issuers.

With these publications, the PRI is expanding its fixed income work beyond ESG incorporation in corporate and sovereign bonds, private debt and securitised products. Anyone new to responsible investment concepts should refer to the PRI’s series of guides, An introduction to responsible investment and to the Reporting Framework glossary. The PRI’s fixed income resources can be found on its fixed income page.

Market overview

The muni bond market is one of the largest and most liquid sub-sovereign bond markets in the world, measured at US$4trn in 2022.[1] Muni bonds finance much of the country’s public services and infrastructure through issuers including cities, counties, school districts, utilities, universities and hospitals. The issuer base is diverse, spanning local administrations, government enterprises and agencies, non-profits and private entities. Bond structures also vary: for example revenue bonds are serviced from cashflow generated by the funded project, such as an electric system.

Investment decisions in this market are greatly affected by the securities’ tax status: interest on most muni bonds is not included in gross income for the purposes of federal tax and it may also be exempt from state and other taxes. Domestic investors are therefore willing to accept a lower investment yield. As a result, on the buyside, retail investors are a sizeable presence, with the proportion of securities held by households and non-profits at about 40%.[2]

Because of various unique features, including their tax status, institutional investors treat US muni bonds as a separate asset class to corporate and sovereign bonds and often manage them separately. Interestingly, the proportion of foreign investors in the muni market, albeit still small (at 2.9% of the total outstanding volume) has grown in recent years.[3] One potential factor may be that insurers in the EU and the UK receive favourable capital treatment under Solvency II rules for investments in revenue muni bonds that fund infrastructure.[4]

Thematic ESG approaches

According to data from the PRI’s Reporting Framework, some signatories are using muni bonds to align investment objectives with UN Sustainable Development Goals, or, alternatively, exclude bonds linked to revenue from certain sectors, such as tobacco.

Funds that specifically target sustainability outcomes have also emerged. Some strategies exist for particular types of outcomes, such as racial and social justice concerns or climate-focused projects. Others have focused on muni green bonds.[5] The type of funds offering an outcomes-based approach also appears to be broadening, for example including the exchange-traded fund (ETF) format.[6]

The remainder of this section highlights the tailwinds and headwinds faced by those taking a thematic ESG approach to muni bond investing.

Tailwinds

- Muni bonds are well placed for a thematic ESG approach. First, they fund services and infrastructure that have the potential to affect in a very tangible way environmental and social outcomes for people living in those communities: in other words, the public good. Second, the variety of muni bonds – across different sub-sectors and with different structures – provides multiple ways for investors to contribute to sustainability outcomes.

- Retail investors increasingly seek to contribute to sustainability outcomes. Seventy-nine percent of US individual investors are interested in making investments in companies or funds that aim to achieve market-rate financial returns while considering positive social and/or environmental impact, according to a 2021 survey.[7]

- The opportunities to fund climate-related projects are growing. The rising frequency and cost of natural disasters put greater focus on the resilience of local infrastructure, for example in the water and power industries.[8] The federal government has introduced a US$1.2trn infrastructure plan, which may increase muni bond supply where issuers decide to borrow against the federal funds they receive.[9] Tax credits under the Inflation Reduction Act may also stimulate some municipal bond issuers to finance green projects through tax-exempt debt.[10]

- Focus on racial justice has moved up the investor agenda. This trend sharpened in the wake of protests over George Floyd’s death in 2020 and disparities made apparent by the coronavirus pandemic. Recent research has highlighted how municipalities’ financial and funding policies are linked to racial and wealth inequalities. Examples of these links include:

-

- Municipalities issuing bonds that cover settlement payments following claims of police brutality;

- Municipalities servicing bonds through revenues from fines levied disproportionately against marginalised groups;

- Bonds funding projects that disproportionately benefit privileged groups.[11]

In response, attention has turned to addressing racial justice in investment decisions, or more generally quantifying social impact. [12]

Headwinds

- Political controversy. In some US states, politicians and state or local officials have pushed back against aspects of ESG incorporation in finance, including by opposing the idea of requiring ESG disclosure by issuers, forcing state entities to divest from investment firms that are perceived to be boycotting the fossil fuel industry, and by requiring issuers to be more restrictive with muni-bond underwriters, if the underwriters have ESG-related exclusion lending lists.[13]

- Gauging and measuring an investor’s influence on sustainability outcomes through municipal bonds is difficult. Investors will have different sustainability objectives, and sufficient data on outcomes may not be available. In addition, it is unclear how to link an investment in a muni bond to any given outcome achieved by a municipality, for example:

-

- In the case of bonds bought on the secondary market;

- If the investment was not critical for the bond finding demand or for the project going ahead.

A focus on outcomes

Muni bonds can contribute to positive or negative environmental and social outcomes in many ways (see Figure 1).[14]

Figure 1: Examples of potential perceived positive and negative outcomes of muni bond investment. Source: PRI

| Positive outcomes | Negative outcomes | |

|---|---|---|

|

Environmental |

|

|

|

Social |

|

|

While thematic ESG investing in fixed income is often associated with labelled bonds, which we discuss in greater detail below, unlabelled bonds can also bring about positive or negative outcomes, regardless of the intention of the issuer or the investor.

Indeed, even unlabelled muni bond proceeds are often designated for specific projects, meaning they can more easily be linked to outcomes. Therefore, a large volume of unlabelled muni bonds could fit within a thematic ESG strategy.

Bonds linked to revenue from contentious sources

Certain types of muni bonds depend on revenue from sectors often viewed as incompatible with some ESG approaches, such as tobacco, gambling, alcohol and oil and gas. Whether these bonds are suitable for ESG thematic investment strategies is up for debate. These bonds are either repaid by revenues generated by the local administration, or, more commonly, by tax or settlement payments from companies operating in these sectors.

Tobacco bonds are the most common of this category and comprise 12% of the Bloomberg Barclays Muni High Yield index. These bonds are repaid from proceeds from a settlement between states and tobacco companies. States receive annual payments from tobacco companies, which in return are absolved from liabilities from tobacco-related healthcare costs. The states can issue bonds backed by these payments. As the volume of payments varies according to cigarette consumption, bondholders can suffer when tobacco consumption falls, although bonds vary in structure and may have features to offset declining tobacco consumption.[15]

Other such bonds include:

- Gaming/lottery bonds: repaid from a tax on gambling or related activities, or from an issuer’s own revenues linked to these activities.[16]

- Liquor bonds: repaid using revenues tied to a municipality’s alcohol sales.[17]

- GOMESA bonds: repaid with revenues from offshore oil and gas production in the Gulf of Mexico. The Gulf of Mexico Energy Security Act (GOMESA) grants a share of revenue to Alabama, Louisiana, Mississippi and Texas along with coastal municipalities in those states.[18] They can then issue bonds backed by this revenue stream.

While some investors who focus on sustainability criteria screen out these types of bonds, others do not, finding that the way the bond proceeds are used – for instance towards an environmentally or socially beneficial project – can outweigh concerns about the source of funds. For example, green GOMESA bonds have been issued.[19]

Labelled bonds

Since the Commonwealth of Massachusetts issued the first green US muni bond in 2013, a new bond market segment has started to develop, employing green or social labels to emphasise the bonds’ environmental or socially beneficial features.[20] Labelled bonds enable issuers to earmark funding for projects that deliver specific sustainability outcomes. Labelled muni bonds allow investors pursuing an ESG thematic approach to signal their participation in such projects and monitor outcomes.

However, the extent to which such instruments are genuinely supporting sustainable finance rests on how robust and rigorous the standards used to issue the labelled bonds are, as well as on the underlying data and methodologies used to structure the bond.

In the muni market, the most common external standards for labelled bonds come from the International Capital Markets Association (ICMA), which has produced Green Bond Principles, Social Bond Principles and Sustainability Bond Guidelines.

The core components for alignment with these relate to:[21]

- Use of proceeds

- Process for project evaluation and selection

- Management of proceeds

- Reporting

Some issuers appoint an external reviewer to confirm adherence to existing standards, including ICMA’s. While this may provide more assurance and verification, buyers should examine the fine print and the credentials of the issuer itself before buying such bonds.

In 2021, 64% of muni green bonds had an external review, a smaller figure than the 73% in 2020. For social and sustainability bonds, the proportion receiving external reviews was even lower – 52% for social bonds and 30% for sustainability bonds.[22] This indicates that a significant proportion of entities are self-labelling their bonds without external reviews. Issuers may decide not to solicit an external review if they have difficulty devoting staff, time and funds towards these processes.

The main advantage of choosing to issue a labelled muni bond rather than an unlabelled one is that it signals to stakeholders, including citizens and local governing bodies, the issuer’s commitment to sustainability, especially if the bond forms part of a wider sustainability strategy.

Another benefit may come in the form of savings from the “greenium”, where the yield on labelled bonds is lower than for non-labelled equivalents because the former attract investors with a specific ESG mandate, in addition to ordinary investors. There is anecdotal evidence of a greenium of several basis points for taxable muni bonds but limited evidence of one for tax-exempt debt.[23]

Use-of-proceeds labelled bonds (more below) are also less burdensome for muni bond issuers than sovereign and corporate issuers because ringfencing of proceeds is already the norm.

The main disadvantage, especially for smaller issuers, is the cost and resources needed to design a framework for the bond. In addition, labelled bonds carry a reputational risk of greenwashing.

Best practice after issuing labelled bonds is to provide post-issuance reporting to investors and, while this type of reporting has increased, it is not yet widespread or conducted in a standardised manner.[24] On top of resource constraints, issuers may decide not to report for the following reasons:[25]

- State or city budget reporting already incorporates similar information;

- A high proportion of use of proceeds goes towards refinancing, which is less relevant for post-issuance reporting;

- Issuers feel reporting on use of proceeds is unnecessary for tax-exempt bonds because they must follow Internal Revenue Service rules, which, for example, place limitations on proceeds going to private business use.[26]

Yet adequate disclosure is essential for the credibility of the labelled muni bond market. External reviews and post-issuance reports help investors ascertain that the bonds are based on a robust ESG framework and that proceeds are being deployed appropriately.

Labelled bonds across fixed income markets take two different forms:

- Use of proceeds: The issuer earmarks the bond’s use of proceeds for specific sustainable projects. These are often called green, social or sustainability bonds (the latter term refers to bonds where proceeds go to both green and social projects).

- Sustainability targets: The bond’s contractual features link to sustainability targets, for example through introducing a step-up or step-down coupon or different prices at which the issuer can call the bond.

Figure 2 details the differences between some of the most popular types of labelled bonds.

Figure 2: Types of labelled bonds. Source: PRI

| Labelled bond type | Use of proceeds | Financial terms linked to targets |

|---|---|---|

|

Green bond |

Environmental projects |

None |

|

Social bond |

Social projects |

None |

|

Sustainability bond |

Environmental and social projects |

None |

|

Sustainability-linked bond |

Not specified |

Environmental or social targets |

|

Environmental impact bond |

Environmental projects |

Sometimes environmental targets |

The next sections cover the current state and the potential of the nascent market for each of use-of-proceeds labelled bonds and labelled bonds with targets. The following pages also include some examples of labelled bonds, illustrating how muni bond issuers are using this designation.

Use-of-proceeds bonds

Use-of-proceeds bonds have been the most popular form of labelled bonds to date. Although still in its infancy, this market segment has significant potential. It is:[27]

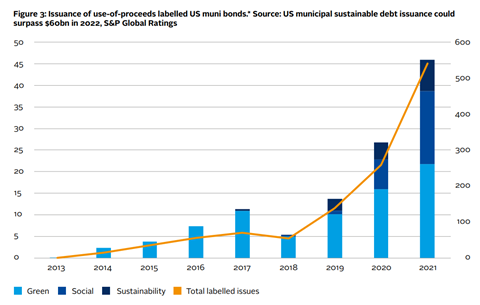

- Growing: In 2021, muni bond issuers raised US$45.9bn through use-of-proceeds labelled debt, in what was the third consecutive year of growth of at least 70% year-on-year (see Figure 3). As a proportion of total muni bond new issuance, it also increased to 9.7%, from 5.5% in 2020 and 3.2% in 2019.

- Regionally skewed: Issuance is skewed to the US northeast and the west coast. The four states where a par amount of more than US$5bn was issued between 2013 and 2021 were New York, California, Massachusetts and Washington. That said, there were issuers in 44 states over that period.

- Concentrated: Despite the breadth of the muni bond market overall, with around 36,000 active issuers that have bonds outstanding[28], the largest 10 issuers of use-of-proceeds labelled muni bonds represent 35% of the total issuance (see Figure 4).

- Used for larger deals: The average par amount was US$86m for labelled use-of-proceeds debt in 2021 and around US$100m in each of 2018, 2019 and 2020, compared with a general muni bond average of less than US$40m annually over the same period.

Figure 3: Issuance of use-of-proceeds labelled US muni bonds.* Source: US municipal sustainable debt issuance could surpass $60bn in 2022, S&P Global Ratings

Left axis: volume by type (US$bn); right axis: number of issues. In 2013, US$100m of green bonds were issued in one issue; the first sustainability bonds were issued in 2017; and the first social bonds were issued in 2018.

Figure 4: Top 10 issuers of use-of-proceeds labelled US muni bonds 2013-2021.* Source: US municipal sustainable debt issuance could surpass $60bn in 2022, S&P Global Ratings

| Issuer | Volume issued USD$m | Percentage of total |

|---|---|---|

|

New York Metropolitan Transportation Authority |

11,028 |

9.4 |

|

New York City Housing Development Corporation |

6,468 |

5.5 |

|

New York State Housing Finance Agency |

4,241 |

3.6 |

|

CSCDA Community Improvement Authority |

4,220 |

3.6 |

|

San Francisco Public Utilities |

3,243 |

2.8 |

|

Indiana Finance Authority |

2,964 |

2.5 |

|

Massachusetts Water Resources Authority |

2,400 |

2.1 |

|

California Infrastructure and Economic Development Bank |

2,357 |

2.0 |

|

Los Angeles County Metropolitan Transportation Authority |

2,246 |

1.9 |

|

Central Puget Sound Transit Authority |

2,212 |

1.9 |

*Figures refer to par amount issued. CSCDA stands for California Statewide Communities Development Authority.

As noted earlier, the market for use-of-proceeds labelled bonds has been growing. A wide variety of drivers are included in Figure 5 and illustrated by the examples that follow.

Figure 5: Examples of use-of-proceeds labelled bonds.*

| Green bonds | Social bonds |

|---|---|

|

Transportation systems needing to fund environmentally friendly projects. |

Builders of affordable housing. |

|

Utilities replacing fossil fuel power with renewable energy. |

Educational institutions seeking to improve social outcomes. |

|

Governments pursuing energy efficiency and greener building standards. |

Philanthropic foundations taking advantage of low interest rates. |

*Sources: SSDAC; Financial Times (June 2020) US foundations issue first social bonds to fund $1.7bn coronavirus fightback; S&P Global Ratings (February 2021) 2021 Sustainable Finance Outlook: Large Growth In Green, Social, Sustainable Labels As Municipal Market Embraces ESG

Climate adaptation

Municipalities are on the front line of defence against climate change. Unlike corporate issuers, they cannot change location. In addition, they often provide the infrastructure for climate change adaptation, for example flood defences. This explains an increase in muni securities linked to climate change adaptation and resilience, rather than mitigation. The San Francisco Public Utilities Commission, the City of Boston, Central Arkansas, the Village of Key Biscayne, Miami, Miami Beach and the State of Michigan are among entities with bonds approved or issued with features that link to adaptation and resilience.[29]

It is also possible for issuers to turn to capital markets for insurance against extreme weather risk, for instance by selling catastrophe (cat) bonds. Investors receive a fixed coupon but lose principal on the bond in the event of a catastrophe that meets predetermined conditions.

The cat bond market was pioneered by the US insurance industry and, while the investor base is distinct from that of the muni bond market, it may represent another option for issuers seeking to protect themselves against extreme weather. The New York Metropolitan Transportation Authority, which has issued several cat bonds covering storm surges and earthquakes, is a good example.[30]

| Issuer | City of Tacoma, Washington[31] |

|---|---|

|

Type |

Externally verified green bond |

|

Size |

US$122m |

|

Date of issuance |

September 2021 |

|

Context |

The city issued revenue bonds, to be paid using revenues from its electric system. Tacoma Power, which operates the system, has been working on environmentally friendly capital projects. The utility relies heavily on hydroelectric power and is well-placed to meet a state mandate to have no carbon emissions in its power supply by 2045, according to Fitch Ratings. |

|

Use of proceeds |

The bonds are earmarked for financing improvements to Tacoma Power, via refinancing debt that was used as a short-term borrowing facility to fund capital projects. The original debt financed maintenance and improvement to infrastructure; energy efficiency projects, like LED lighting upgrades; and projects to protect migrating fish. The improvements support Tacoma Power’s 100% renewable hydropower electric system, according to Kestrel Verifiers. The new bonds were verified to conform with ICMA’s Green Bond Principles by Kestrel Verifiers. |

| Issuer | Massachusetts Housing Finance Agency[32] |

|---|---|

|

Type |

Self-labelled social bond |

|

Size |

US$90m |

|

Date of issuance |

September 2021 |

|

Context |

The issuer states that the use of proceeds aligns with ICMA’s Social Bond Principles and, via the latter’s mapping, to the UN Sustainable Development Goals 1, 8, 10 and 11. |

|

Use of proceeds |

Proceeds are earmarked to finance mortgage loans, including down payment assistance loans, for first-time buyers with low or moderate incomes. |

Bonds with sustainability targets

While less common than use-of-proceeds bonds, bonds that link financial terms to project outcomes have also been used by some municipal entities. These sustainability-linked or environmental impact bonds are accompanied by either social or environmental targets. Adoption of sustainability-linked bonds has lagged in US debt capital markets relative to Europe.[33] The work required to design a bond and have it approved may be one of the barriers in the US muni bond market.

| Issuer | Buffalo Sewer Authority[34] |

|---|---|

|

Type |

Environmental impact bond, green bond (self-labelled) |

|

Size |

US$49m |

|

Date of issuance |

June 2021 |

|

Context |

The city of Buffalo, New York, is forecast to receive potentially up to four inches of extra annual rainfall by 2050, which raises the risk of heavy flooding. |

|

Use of proceeds |

Proceeds are earmarked to design and put in place infrastructure that captures stormwater and reduces combined sewer overflows. |

|

Targets |

The issuer has a target to manage at least 200 additional acres of impervious surface area through green infrastructure under its Rain Check 2.0 Program. If it meets this target by 2028, it will be able to call the bond at par; otherwise, after that, until the target is met or until June 2031 (whichever is earlier) it would only be able to call it at a higher set price. A third party, Arcadis, will report on the use of proceeds and on whether the target has been met. |

| Issuer | Arizona Industrial Development Authority[35] |

|---|---|

|

Type |

Externally verified sustainability-linked bond |

|

Size |

US$200m |

|

Date of issuance |

February 2022 |

|

Context |

The Arizona Industrial Development Authority issued a conduit bond for NewLife Forest Restoration, a sustainable forestry company and lumber mill operator. |

|

Targets |

The bond has two key performance indicators (KPIs), which will be assessed by an external party. These are: 1) NewLife restoring 36,000 acres and 2) deriving more than 80% of processed logs from restoration activities by the end of its fiscal year 2024.

If the first KPI is missed, the interest rate will increase by 100 basis points; if the second is missed, it will rise by 50 basis points; if both are missed, it will increase by 150 basis points. This adjustment would start in 2025. |

Bonds with sustainability targets may have one of the following uses:

- To align the issuer’s financial incentives with positive sustainable performance by rewarding it for good performance or penalising it for poor performance (see Buffalo Sewer Authority and Arizona Industrial Development Authority case studies).

- To share risk and/or reward between issuer and investor when developing an untested project. Unlike in the previous bullet point, investors do not receive a financial benefit from issuers’ poor sustainability performance (see DC water case study).

| Issuer | DC Water[36] |

|---|---|

|

Type |

Environmental impact bond |

|

Size |

US$25m |

|

Date of issuance |

September 2016 |

|

Context |

The utility DC Water wanted to develop a green infrastructure project to reduce sewage overflow. |

|

Targets |

Under its environmental impact bond, if it underperformed on overflow reduction, investors would make a risk share payment to the issuer; if it exceeded expectations, the issuer would pay investors a contingent outcome payment in light of its long-run savings. The projects ended up meeting expectations, so no additional payments were made on either side. |

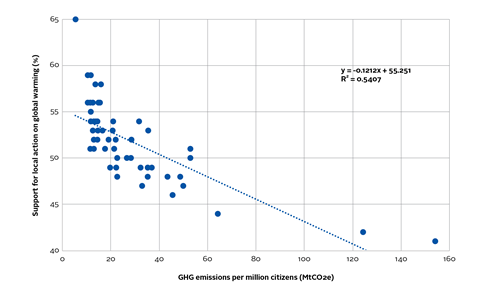

- To provide transition finance for issuers that are carbon intensive, either because they have high direct emissions or because they are a local administration with heavily polluting industries. Such issuers may lack adequate capital projects to fund with use-of-proceeds bonds. While it may seem counterintuitive to buy debt from carbon-intensive issuers, target-linked transition finance would provide an investment opportunity for investors seeking to shape outcomes on emissions. Transition financing in regions with high emissions may have positive second-order effects by boosting buy-in among local communities for climate transition policies. In the US, the carbon intensity of the local economy is correlated to local aversion to policies to combat climate change, as shown in Figure 6. Fears of job losses in carbon-heavy industries can in turn lead to hostility to climate policies among elected officials. Carbon-intensive economies are the least well-adapted to the transition to a green economy, reinforcing intransigence on climate issues.[37]

Figure 6: Support for local action on climate change plotted against state emissions.* Source: Climate Watch, World Resources Institute, Yale Program on Climate Change Communication, PRI.

*The x-axis plots total GHG emissions excluding land use change and forestry (MtCO2e) per one million people, as of 2018, according to Climate Watch data accessed through World Resources Institute. The y-axis plots the estimated percentage of adults who think their local officials should do more to address global warming, as of 2020, according to the Yale Program on Climate Change Communication.

Next steps

This report aims to help investors frame some key issues around the thematic approach in the US muni market. Many traditional muni bonds are inherently suited for this approach. However, the growing labelled bond market is making such a fit even more apparent, and helping investors improve their assessment of and reporting on the environmental and social outcomes of their investments.

Many US muni bonds are self-labelled, and it is crucial that issuers provide sufficient information on the use of proceeds, pre- and post-issuance, as well as any available performance metrics, to allow investors to scrutinise how funds are spent.

At the same time, investors should also carefully assess labelled muni bonds that are verified by an external reviewer: even if the process that accompanies these bonds is more rigorous, it is neither a prerequisite for, nor a guarantee of, positive environmental or social outcomes. Whether the bonds are self-labelled or carry an external review, investors should encourage greater reporting on the use of proceeds or regular progress towards adequately ambitious sustainability targets.

Engagement has a big role to play for thematic investors in either labelled or unlabelled bonds. By engaging with issuers, investors can convey their expectations and secure enhanced data disclosure. At the same time, issuers can reduce their cost of funding if better transparency and openness to dialogue make their bonds more attractive.

Going forward, the PRI will work to create more opportunities for investors and issuers to meet on ESG topics in the muni market. The PRI also plans to explore the extent to which its research on the US sub-sovereign market applies to countries outside the US.

CREDITS | Authors: Jasper Cox, Carmen Nuzzo | Editor: Casey Aspin | Designer: Will Stewart

Downloads

Thematic ESG Approach in US Municipal Bonds

PDF, Size 1.51 mb

References

[1] As of first quarter 2022 according to SIFMA (2022) US Municipal Bonds Statistics

[2]As of first quarter 2022 according to SIFMA (2022) US Municipal Bonds Statistics

[3]Data compiled using Federal Reserve data series ROWMLAQ027S and BOGZ1FL893062005Q, as of second quarter 20222

[4]Invesco (2020) A source of diversification in US Infrastructure: US Municipal Bonds for European Insurers

[5]Morningstar (July 2021) Green Muni Bonds Are Blooming Slowly

[6]VanEck (September 2021) VanEck Launches New Active Municipal Bond ETF (SMI) Focusing on Sustainable Development; VanEck VanEck HIP Sustainable Muni ETF

[7]Morgan Stanley Institute for Sustainable Investing (2021) Sustainable Signals: Individual Investors and the COVID-19 Pandemic

[8]Climate Bonds Initiative (2021) North America State of the Market 2021

[9]The Bond Buyer (November 2021) A $550-billion first step on the road to rebuilding; HilltopSecurities (November 2021) House Passed $1.2 Trillion Infrastructure Plan on Friday, Boosting What We Deemed (in March) as the Golden Age of Public Finance

[10]O rrick (2022) Inflation Reduction Act Levels Renewable Energy Playing Field for Tax-Exempt Entities

[11]Destin Jenkins (2021) The Bonds of Inequality: Debt and the Making of the American City; Activest Our Story

[12]Activest (May 2021) Flint Water Settlement Bonds: A Fiscal Justice Analysis Brief; ICE (August 2021) ICE and risQ Introduce Social Impact Scores

[13]Utah State Treasurer et al. (March 2022) Letter to MSRB; Pensions&Investments (May 2021) Texas bill puts state pension funds at odds with fossil-fuel divestment; Bloomberg Quint (October 2021) The Fight Between Texas and Wall Street Is About to Get Bigger; Politico (February 2022) Climate investing ‘boycott bills’ flood state capitals

[14]Activest (2021) Social Justice Bonds: A New Model for Equitable Infrastructure Investment; Planet Tracker (September 2021) Do US municipal bonds finance petrochemicals & plastics instead of schools?; Financial Times (April 2021) Barclays criticised for underwriting US private prison deal

[15]Institutional Investor (July 2015) Municipal Tobacco Bonds: Seeking Value in the Ashes

[16]For example as issued by Mississippi and West Virginia: Fitch Ratings (March 2021) Fitch Affirms Mississippi Gaming Revenue Tax Bonds at ‘A+’; Revises Outlook to Stable; (November 2021) Fitch Affirms West Virginia Lottery and Excess Lottery Rev Bonds at ‘A+’; Outlook Stable

[17]For example as issued by Montgomery County, Maryland: Montgomery County (May 2021) Official Statement; Disclosure for Fiscal Year 2020

[18] US Department of the Interior Natural Resources Revenue Data How revenue works / Gulf of Mexico Energy Security Act (GOMESA)

[19]MuniOS $29,000,000 LOUISIANA LOCAL GOVERNMENT ENVIRONMENTAL FACILITIES AND COMMUNITY DEVELOPMENT AUTHORITY Revenue Bonds (City of New Orleans GOMESA Project) Series 2021 (Green Bonds)

[20]Mass Green Bonds (February 2018) Final Investor Impact Report

[21]ICMA (2021) Green Bond Principles; Social Bond Principles; Sustainability Bond Guidelines

[22]S&P Global Ratings (February 2022) U.S. Municipal Sustainable Debt Issuance Could Surpass $60 Billion In 2022

[23]“Muni Green Pricing Dynamics – Are Investors Paying a ‘Greenium’?” in Refinitiv (2021) Is the Municipal Market Pointing Green?; Morningstar (July 2021) Green Muni Bonds Are Blooming Slowly

[24]Climate Bonds Initiative (2021) North America State of the Market 2021; Refinitiv Ibid

[25]Climate Bonds Initiative Ibid

[26]IRS Tax-Exempt Governmental Bonds; Refinitiv Ibid

[27]S&P Global Ratings (February 2022) U.S. Municipal Sustainable Debt Issuance Could Surpass $60 Billion In 2022

[28]Bloomberg (as of May 2021)

[29]Climate Bonds Initiative Ibid

[30]Artemis (April 2020) New York MTA to renew MetroCat Re parametric cat bond. Launches $100m deal

[31]Tacoma Public Utilities 2021 Investor Roadshow Presentation; Fitch Ratings (August 2021) Fitch Rates Tacoma, WA’s $145MM Electric System Rev Bonds ‘AA-’; Outlook Stable; MuniOS (September 2021) CITY OF TACOMA, WASHINGTON $121,855,000 Electric System Revenue Bonds, Series 2021 (Green Bonds)

[32]MuniOS (September 2021) $89,900,000 MASSACHUSETTS HOUSING FINANCE AGENCY Single Family Housing Revenue Bonds, Series 222 (Non-AMT) (Social Bonds)

[33]Environmental Finance (May 2021) Sustainability-Linked Debt in 8 metrics report

[34]Buffalo Sewer Authority (June 2021) Buffalo Sewer Authority Issues Largest-Ever U.S. Environmental Impact Bond; The Bond Buyer (June 2021) Buffalo Sewer Authority closes on largest U.S. environmental impact bond; MuniOS (June 2021) $49,160,000 BUFFALO SEWER AUTHORITY Sewer System Environmental Impact Revenue Bonds, Series 2021 (Green Bonds)

[35]Arizona Industrial Development Authority (March 2022) $200 MILLION BOND ISSUE TO FINANCE FOREST RESTORATION PROJECT IN NORTHERN ARIZONA; MuniOS (February 2022) $199,691,759 ARIZONA INDUSTRIAL DEVELOPMENT AUTHORITY Revenue Bonds (NewLife Forest Restoration, LLC Project)

[36]DC Water DC Water’s pioneering Environmental Impact Bond a success; DC Water Comprehensive Annual Financial Report Fiscal Years Ended September 30, 2016 and 2015; Qualified Ventures (July 2021) Environmental Impact Bonds on Leading Edge of ESG Bond Market Evolution; (October 2018) Sharing Risk, Rewarding Outcomes: The Environmental Impact Bond; The Environmental Finance Center at the University of North Carolina at Chapel Hill (July 2020) Environmental Impact Bonds: Where are they now?

[37]Foreign Policy (February 2021) The Death of the Carbon Coalitio