Case study by BCI

- Signatory type: Investment manager

- Region of operation: Canada

- Assets under management: CAD$171bn

Why ESG is vital for boosting long-term value

Asset allocation is the main determinant of a fund’s overall risk and return and, therefore, is the most important decision that our clients make. As long-term investors, our clients need to consider many factors when selecting a strategic asset mix that will achieve the investment objectives. Internal factors such as contribution rates and member demographics, as well as external market implications such as expected returns and potential stress events must be considered. With over CAD$171bn in assets managed on behalf of 31 clients that include public sector pension plans and insurance funds, BCI partners with our clients to ensure the most relevant and up-to-date information is factored into these SAA decisions. This includes considering long-term systemic risks such as climate change.

Incorporating environmental, social, and governance (ESG) considerations into our approach is an essential part of who we are and what we do. Our clients share our belief that companies who employ robust ESG practices are better positioned to generate long-term value. We also believe improving the sustainability and integrity of global capital markets creates favourable economic conditions that benefit our clients over many years. Long-term sustainability is the driving force behind our investment approach, and it starts with the evaluation of relevant ESG issues for the asset-liability reviews (ALM) that we conduct with clients.

How we use climate change scenarios to test asset liability modelling

Coinciding with the release of our Climate Action Plan in 2018, we began incorporating ESG into the ALM process. We conducted climate change scenario analysis to identify macro-economic climaterelated risks and opportunities that could impact our clients’ investment returns. BCI used the climate change scenarios as an input into the ALM conducted on clients’ portfolios. We continue to revise and add additional updated climate change scenarios to our evaluations over time.

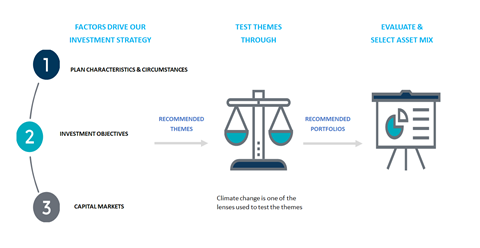

The purpose of the ALM is to select a new asset mix (or confirm the current mix) with the goal of increasing the likelihood of meeting the fund’s key investment objectives. The following steps provide an overview of our ALM process:

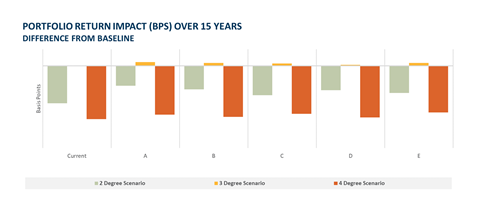

We first began integrating climate scenarios into the ALM using a model based on Mercer’s Climate Change Risk Assessment Research Package. We customised the model to measure climate change impacts on our private market holdings which better reflects the unique geographic and sector exposures of those portfolios. We evaluated three climate change scenarios; a two, three, and fourdegree global warming future. We continue to refine and develop new capabilities to test alternate climate change scenarios and incorporate up-to-date information as it becomes available.

A key component of the addition of climate change scenarios to the ALM and SAA discussions was education. We provide client trustees with education on the background of climate change science, the translation of that science into economic impacts, and the resulting narrative that each scenario describes. We also provide all the necessary context to help clients make decisions based on the variety of potential future outcomes, which is helped by using scenarios but keeping in mind that the scenarios are not forecasts. In all cases, we align as much as possible with the Taskforce on Climaterelated Financial Disclosures (TCFD) recommendations and provide education to clients on the importance of the TCFD framework. We officially endorse the TCFD framework and produce an annual TCFD disclosure (which is included in our ESG annual report) to implement and align with each of the TCFD recommendations.

Example: the impact of climate scenarios on annual returns

Using client long-term strategic asset allocation targets, we found that the two- and four-degree climate scenarios would both create an expected drag of approximately 0.15% in average annual returns over the 15-year forecast horizon, relative to the base case scenario. The three-degree scenario impacts were found not to be material on an aggregate total fund level. The total portfolio impacts were partially mitigated by the diversification across sectors where some holdings performed positively under the scenarios which mitigate the negative impacts in more exposed sectors in the portfolio.

Beneath the total fund aggregate impacts, asset class performance varies significantly depending on which scenario unfolds. In the four-degree scenario, real assets are more likely to suffer from the rising risk of physical impacts. In contrast, in a two-degree scenario, the performance of developed market public equities is expected to be impacted as companies exposed to traditional energy assets, such as oil, likely experience valuation adjustments.

We also evaluated results over several timeframes to understand the impacts over the modelled horizon used in the ALM, as well as more long-term horizons where the impacts of climate change become much more pronounced. This added step of providing scenario results to clients allows for the most informed analysis of the current and potential future impacts from climate change on each of the modelled portfolios.

Example client results:

The result of this analysis has led to different results and discussions for each client. Some clients found exposures in their portfolio that had a high concentration of climate change risk. This information was evaluated and, along with all the other scenarios, stress tests and modelling done for the ALM, led to a decision to reduce exposure to that area of the portfolio and diversify into areas with lower climate change risk. This information assisted in the selection of the portfolios that BCI is now implementing on behalf of those clients.