Speakers

- James Robertson, Head of Asia (ex-China & Japan), PRI

- Daniel Gallagher, Senior Lead, Climate Change, PRI

- Mark Fulton, Founding Partner, Enger Transition Advisors

- Emily Simso, Manager, Sustainability and Impact, New Forests

- Tomoaki Fujii, Co-CIO and Head of ESG Investment, Nissay Asset Management Corporation

Why is climate risk a financial issue?

This thought-provoking question opened the first in a series of webinars for PRI’s APAC signatories around the topical theme for investors of climate risk capacity building.

To address this question, James Robertson, PRI Head of Asia (ex-China & Japan) and session host, introduced Daniel Gallagher, PRI Head of Climate Risk and Net Zero Implementation to discuss the Taskforce on Climate-Related Financial Disclosures (TCFD) framework. Daniel outlined the classification of risks into physical (e.g. extreme weather and rising sea levels) and transition risks, along with opportunities for investors, companies and organisations.

Policy shifts were identified as the strongest motivator for investors in APAC to commit to aligning their portfolios with net zero goals. Gallagher noted: “It’s now well established that climate change is a financial risk, and has material implications for companies, for investors.” He also noted that governments are taking active steps through policy and regulation to promote an orderly transition to a low-carbon economy, and many investors are acting now to address transition risks.

Inevitable Policy Response

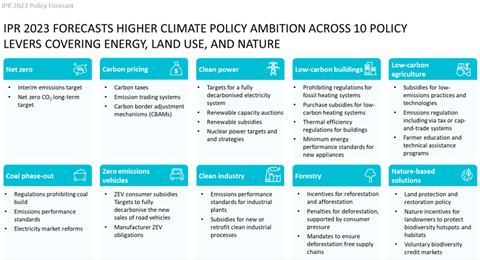

Mark Fulton, Founding Partner of Energy Transition Advisors, spoke on the Inevitable Policy Response (IPR), a forecasting consortium designed to help institutional investors understand the portfolio risks and opportunities linked to anticipated policy responses addressing climate change.

Fulton discussed IPR’s 2023 forecast, including projections on increased climate policy ambition, particularly in APAC markets. “Phasing out coal is absolutely critical”, he noted, and shared insights into the likely timing of this phase-out across the APAC region.

Investors adapting governance & risk management to address climate risk

Before hearing from PRI investor signatories directly around their approaches to climate risk, Daniel Gallagher stressed the importance of a unified approach to climate risk within organisations at all levels, including the Board, senior management, specialists and individual business lines.

Tomoaki Fujii, Co-CIO and Head of ESG Investment at Nissay Asset Management Corporation, shared how their organisation manages climate risk, noting a target to achieve net zero for 60% (representing equities and credit assets) of its approximately USD 256 billion in assets under management (AUM).

Fujii-san highlighted Nissay’s involvement in initiatives including the Net Zero Asset Managers initiative (NZAM), CA100+ and GFANZ since 2021. They also employ a Plan, Do, Check, Action methodology for managing climate risk.

Direct engagement with high greenhouse gas (GHG) emitting companies was also identified as an important strategy for achieving its net zero target. Their efforts have reduced the portfolio’s carbon footprint by over 25% from 2019 to 2021.

Emily Simso, Manager, Sustainability & Impact, New Forests, an asset manager focused on forestry and land-based assets with USD 7.2 billion in AUM, said New Forests’ vision is ”to see investment in land use and forestry as central to the transition to a sustainable future”. They actively work to mitigate physical and transitional risks associated with land-based assets by integrating risk management into investment management processes, including acquisition evaluation, annual asset strategic planning, establishing baseline information, and process changes.

Simso noted that it is an iterative process, drawing on lessons learned. Similar to Nissay Asset Management Corporation, New Forests engages directly with investors and is also a member of NZAM; New Forests has set interim net zero targets under the Net Zero Investment Framework methodology, which are publicly- available.

Reflecting on the session, James Robertson thanked the speakers and noted: “For investors, it’s increasingly apparent that mitigating this risk – including physical and transition risks – is becoming a business imperative. We look forward to further insights in future sessions in the series.”

Presentation PDFs

- PRI presentation - session 1

- New Forests presentation

- Nissay Asset Management Corporation presentation

- Inevitable Policy Response presentation

Climate Risk Series (APAC) replays and dates:

- Governance and risk (8 February)

- Strategies and scenarios (29 February)

- Metrics and targets (14 March)

- Net zero initiatives and implementation (20 March)

- Net Zero Transition Plans (22 April)