Case study by Futuregrowth Asset Management

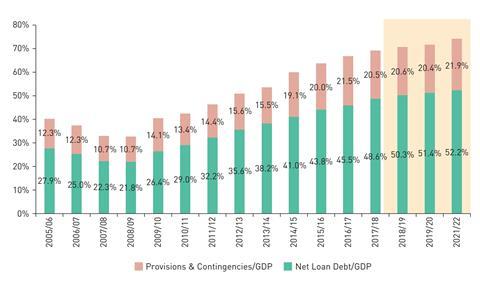

Futuregrowth Asset Management has been a substantial funder of national development through its investment in the debt issued by many of South Africa’s state-owned enterprises (SOEs). SOEs, by their very nature as publicly funded entities, are not subject to the same market discipline or shareholder oversight as other entities. Recent corporate failures (African Bank Limited, Steinhoff International Holdings NV), as well as serious allegations of malfeasance at certain SOEs (as revealed by South Africa’s Public Protector), have demonstrated the need for appropriate and strong governance checks and balances—applied equally to both public and private companies. In addition, the assessments of S&P Global Ratings (a subsidiary of Standard & Poor’s Financial Services LLC) and Fitch Ratings Ltd., which place South Africa’s sovereign debt at one level above a rating of junk, have raised concerns that the government debt guarantees to SOEs (which totaled ZAR467 billion at the end of March 2017) pose significant risks to South Africa’s deficit and economic and ratings outlook (see Figure 1).

At the end of August 2016, Futuregrowth made a public statement that it would suspend lending to some South African SOEs until an in-depth governance due diligence could be concluded. Following the lending suspension, we initiated a self-imposed embargo on the listed instruments of the six SOEs until we better understood the governance at these entities and were able to formulate a forward-looking investment view. We have subsequently lifted our lending suspension on the Land and Agricultural Development Bank of South Africa (Land Bank), the Industrial Development Corporation of South Africa Limited (IDC), the Development Bank of Southern Africa (DBSA), and the South African National Roads Agency SOC Ltd. (SANRAL) (conditional) upon finalizing our reviews. Although the yields in the named SOEs did not materially increase, we noted that certain SOEs had difficulty accessing the local capital markets following our suspension.

Incorporating corporate governance into credit analysis

Futuregrowth worked with the six largest SOEs in South Africa (Land Bank, DBSA, IDC, SANRAL, Transnet SOC Ltd., and Eskom Holdings SOC Ltd.) to conduct a detailed governance due diligence for each entity. We recognize that good governance is a key factor in ensuring that public entities (mostly funded with public money) are sustainably managed for the long-term and are able to deliver on their developmental mandates.

Figure 1: sovereign debt and contingent liabilities

Source: National Treasury

During the governance due diligence process, we assessed various criteria through a combination of:

- conducting onsite due diligence, including meeting with key members of the board and management to verify processes; and

- reviewing board minutes, policies, charters, terms of reference, and other documentation to assess evidence of good governance in action. We found that at present, the governance reporting is remarkably vague and should be vastly improved so that investors can make informed decisions and allocate capital to sustainable, well-managed entities.

Futuregrowth’s due diligence process highlighted certain flaws in the markets and our approach to understanding SOE governance, and showed the need for our analytical approach to evolve to consider these aspects more explicitly. Corporate governance of SOEs is better understood as a “web” of oversight by various stakeholders (e.g., shareholders, directors, employees, regulators, suppliers, financiers, auditors, and corporate secretaries) as well as a range of policies, practices, protections, and disclosures. We realized that a central focus on the board of directors in our governance reviews was not appropriate because the governance of SOEs also relies on parliament and the executive authority (i.e., the ministry responsible for that SOE).

Some of the key learnings outlined below, arising from extending our focus to “beyond the board of directors” to the legislative governance framework in which each SOE operates, meant that we also considered the layer of governance that exists between the board and its executive authority. One key challenge in looking beyond the board of directors to the overarching legislative framework is the concern of instances where the law is inconsistent with governance recommendations (which are voluntary by nature). In our view, the board of directors of the SOEs is best placed to advocate for a stronger alignment of its enabling legislation with corporate governance best practice.

Governance improvements: Land Bank

Futuregrowth identified many areas for improvement across the SOEs we analyzed. We share here some of these governance recommendations and improvements with regard to Land Bank, the first SOE we cleared following the lending suspension. Our engagement with Land Bank was fruitful and positive. In the months since the completion of our due diligence, Land Bank has been able to access the capital markets successfully, raising longer-term funding at lower interest rates and in greater amounts than they were previously able to (Figure 2).

Some outcomes of the governance negotiations included improvements to board decision-making structures and processes, and changes to legal agreements.

In principle, we agreed with Land Bank with regard to the inclusion of specific legal protections in any future bilateral loan agreements, and possible changes to its Domestic Medium Term Note Program documentation. A key focus of these protections is to maintain the stability of the relationship with the current Executive Authority.

Figure 2: Land Bank pricing and issuance trends

| LAND BANK | ||||||||

|---|---|---|---|---|---|---|---|---|

| Source: Futuregrowth; bank auction outcomes. Abbreviations: bn, billions; bps, basis points; m, millions. |

||||||||

| MARCH 2017 | AUGUST 2017 | MARCH 2018 | ||||||

| 3-YEAR | 5-YEAR | 1-YEAR | 3-YEAR | 5-YEAR | 1-YEAR | 3-YEAR | 5-YEAR | |

| VOLUMES | ||||||||

| Target issuance size | ZAR750 m | ZAR750 m–ZAR1 bn | ZAR1.5 bn–ZAR2 bn | |||||

| No. of participating bids | 11 | 9 | 12 | 22 | 33 | 9 | 6 | 12 |

| Bids received (ZAR, m) | 553 | 283 | 1,199 | 1,337 | 2,553 | 1,138 | 614 | 1,270 |

| Bids allocated (ZAR, m) | 523 | 233 | 331 | 243 | 426 | 500 | 245 | 1,270 |

| Bid cover (×) | 1.06 | 1.21 | 3.62 | 5.50 | 5.99 | 2.28 | 2.51 | 1.00 |

| SPREADS | ||||||||

| Pricing guidance (bps) | 180-195 | 270-285 | 120-130 | 165-175 | 240-255 | 90-120 | 130-150 | 190-230 |

| Clearing spread (bps) | 190 | 285 | 115 | 155 | 255 | 110 | 149 | 215 |

Increased public disclosure and transparency

As part of our engagement with Land Bank, we have agreed with the board and management that they will undertake regular public reporting on key matters in a bid to facilitate monitoring and transparency (see Figures 3 and 4). We recognize that governance is a dynamic process, the monitoring of which requires ongoing vigilance and engagement with management and shareholders. To this end, we have agreed with the other SOEs that they will also undertake regular public reporting on similar key matters (see Figures 3 and 4).

Key learnings

We have identified some key learnings and broad categories for governance improvements that asset managers could apply when assessing SOEs and listed corporate entities that access funding through the capital markets.

The “who” matters

An organization can have all the trappings of governance (e.g., a board, committees, and policies), but if it has corrupt or ill-intentioned shareholders or leaders, then the corporate policies and practices are at risk. Improving governance means improving the selection and appointment process for individuals on company boards and board subcommittees, and for executive management positions. In the case of SOEs, attention to the “who” also implies improving the selection process of shareholder representatives (e.g., the ministers and their advisers). Thus, one has to look at the nomination and appointment processes for board and executive management members.

- Does the candidate vetting process incorporate detailed fit-and-proper background and other probity checks?

- Are candidates vetted for personal or political connections or conflicts?

Board of directors and board committees

The composition of the board must be appropriate.

- Are the quorum requirements and voting thresholds sufficient?

- How are conflicts of interest dealt with? Are members recused appropriately?

- Are the disclosure and management of conflicts appropriate and adequate?

Governance policies

Organizations should have governance policies that cover their major business areas (e.g., procurement, lending) as well as key risk areas (e.g., dealing with politically exposed persons [PEPs], conflicts of interest). The details of these policies should be investigated for suitability.

- Can a single board member or executive alone approve a high Rand-value Rand transaction?

- Under what circumstances can the company do business with a PEP?

- How are transactions with PEPs reported, managed, and disclosed?

Figure 3: outcomes of governance negotiations (part 1)

| Source: Futuregrowth; bank auction outcomes. Abbreviations: bn, billions; bps, basis points; m, millions. |

||||||||

| LAND BANK | DBSA | IDC | SANRAL | |||||

|---|---|---|---|---|---|---|---|---|

| DID THEY ALREADY HAVE THIS? | DID THEY AGREE TO IMPLEMENT THIS? | DID THEY ALREADY HAVE THIS? | DID THEY AGREE TO IMPLEMENT THIS? | DID THEY ALREADY HAVE THIS? | DID THEY AGREE TO IMPLEMENT THIS? | DID THEY ALREADY HAVE THIS? | DID THEY AGREE TO IMPLEMENT THIS? | |

| AMENDMENTS TO LEGAL DOCUMENTATION | ||||||||

| DMTN amendment to protect the stability of the relationship with the shareholding ministry | ☒ | ☑ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ |

| BOARD STRUCTURE AND COMPOSITION | ||||||||

| Appropriate board size | ☑ | n/a | ☑ | n/a | ☑ | n/a | ☒ | ☒ |

| Balanced and appropriate mix of skills on the board and subcommittees | ☑ | n/a | ☑ | n/a | ☑ | n/a | ☒ | ☒ |

| Sufficient members on the ARC (including people with specific auditing skills) | ☑ | n/a | ☑ | n/a | ☑ | n/a | ☒ | ☒ |

| Staggering of director terms | ☒ | ☑ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ |

| A nominations committee | ☒ | ☒ | ☑ | n/a | ☑ | n/a | ☒ | ☒ |

| BOARD DECISION MAKING | ||||||||

| Appropriate quorum and voting thresholds for board and subcommittees | ☒ | ☑ | ☒ | ☒ | ☒ | ☑ | ☑ | n/a |

| Regular public reporting on changes to key policies, terms of reference for board and subcommittees | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ |

| Regular public reporting of all conflicts of interest of board members and management | ☒ | ☑ | ☑ | n/a | ☒ | ☑ | ☒ | ☒ |

| Annual disclosure of the number and quantum of deals approved at the various credit and investment committees | ☒ | ☑ | ☑ | ☑ | ☒ | ☑ | n/a | n/a |

Figure 4: outcomes of governance negotiations (part 2)

| Source: Futuregrowth | ||||||||

| LAND BANK | DBSA | IDC | SANRAL | |||||

|---|---|---|---|---|---|---|---|---|

| OUTCOMES | DID THEY ALREADY HAVE THIS? | DID THEY AGREE TO IMPLEMENT THIS? | DID THEY ALREADY HAVE THIS? | DID THEY AGREE TO IMPLEMENT THIS? | DID THEY ALREADY HAVE THIS? | DID THEY AGREE TO IMPLEMENT THIS? | DID THEY ALREADY HAVE THIS? | DID THEY AGREE TO IMPLEMENT THIS? |

| Limitations to the delegated authority of particular credit, investment, and procurement committees | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ |

| Timely and public reporting (via the website, Integrated Annual Report, and SENS) of all changes to the board and subcommittees terms of reference, mandate, and authority levels | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ |

| CONFLICT MANAGEMENT | ||||||||

| A conflicts-of-interest policy that prevents current directors (directly or indirectly via their investments or projects) from transacting from the SOE | ☒ | ☑ | ☒ | ☑ | ☑ | ☑ |

n/a |

n/a |

| An appropriate PEP policy | ☑ | n/a | ☑ | n/a | ☒ | ☑ | ☒ | ☑ |

| Disclosure of all transactions with PEPs in the Annual Integrated Report and/or website | ☒ | n/a | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ |

| A cooling-off period restricting former directors from conducting business with the SOE | ☒ | ☒ | ☒ | ☒ | ☒ | ☑ | ☒ | ☑ |

| GOVERNANCE REVIEWS | ||||||||

| Third-party governance assessments, the results of which are made public | n/a | n/a | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ |

| RELATIONSHIP WITH EXECUTIVE AUTHORITY | ||||||||

| Public reporting of KPIs, shareholder compact, and targets | ☒ | ☑ | ☒ | ☑ | ☒ | ☑ | ☑ | n/a |

Disclosure and reporting

The SOEs and corporate entities that raise capital on the Johannesburg Stock Exchange (JSE) limited stock exchange (a public capital market) are bound by the South African JSE Debt Listings Requirements (DLR). The disclosure and reporting requirements detailed in the DLR are weak and need to be improved (e.g., these could include all changes to the board and subcommittees, conflicts and PEPs, loans and procurement).

- Disclosure on the Stock Exchange News Service at the time of the event:

- all board and subcommittee member changes and reasons (including new appointments);

- details of resumé and experience;

- any identified conflicts; and

- results of probity checks.

- Current and previous director and executive dealings with the company.

- Annual disclosure (website, integrated annual report):

- board and subcommittees: nomination and appointment processes and who the decision makers are; and

- charter, terms of reference, mandate, quorum, decision-making requirements and authority levels and changes.

- Conflicts of interest policy and PEP policy:

- application thereof, deviations, remedial action, and any changes.

- Lending:

- loans made to PEPs, directors, and management.

- Procurement:

- contracts concluded with PEPs, directors, and management.

Conclusion

Being a responsible investor implies that Futuregrowth makes decisions to allocate capital to those sectors and entities that adopt transparent, sustainable policies and practices. We recognize that good governance is a key factor to ensure that public entities—mostly funded with public money—are sustainably managed for the long term and are able to deliver on their developmental mandates. Through this case study, we demonstrated how we assess SOEs, illustrated the impact of poor governance in terms of the future outlook for those SOEs, strove to raise awareness about these issues, and highlighted the questions investors should be consistently asking of all entities that access funding in the public capital markets.