Executive summary

Investors in sovereign debt have traditionally incorporated environmental factors into their analysis only in certain circumstances, for example when countries are particularly vulnerable to extreme weather events, or dependent on soft commodities or tourism. But they are increasingly taking a more systematic approach to climate risk analysis and outcomes for the following reasons:

- the increasing severity and frequency of weather events and their disruptive effects on economies, including on supply chains;

- an expansion in regulations requiring investors to account for their exposure to, and mitigation of, climate risks;

- heightened interest in sustainability considerations among retail investors and asset owners (with a high proportion of government bonds in the latter’s portfolios);

- improved access to tools and data that facilitate analysis of sovereigns’ climate-related risks.

This report adds to the suite of PRI publications on ESG considerations in sovereign debt analysis and those on environmental issues more broadly. Drawing on input from SDAC members and desk-based research, it focuses specifically on climate change and does not address other environmental topics, such as deforestation and biodiversity, although it recognises the interlinkages between such issues.

It aims to lay the foundations for future work by helping investors think about how to frame climate change considerations in sovereign debt assessment. Many financial market participants, especially asset owners, are only just starting the process.

The first section of the report covers how to approach climate change as a risk to sovereign debt investments. It defines and distinguishes between three types of risk: physical risk, transition risk, and risk related to a country’s policy response, although these categories are not mutually exclusive. This section also covers data challenges and opportunities.

The second section of the paper discusses linking sovereign bond investments to positive climate outcomes, examining both use-of-proceeds labelled bonds and the emerging sovereign sustainability-linked bond market. This section concludes with opportunities and recommendations for improving alignment with these positive outcomes.

The target audience includes asset managers, asset owners and investment consultants. To facilitate discussion of climate risk among these market participants, we have developed a set of questions to help delineate risks and validate action (see Figure 1). The report is also relevant for sovereign debt issuers seeking to understand investors’ perspectives and objectives on climate.

Figure 1: Questions for asset owners (AO), asset managers (AM) and investment consultants (IC)

| Question | Applicable to |

|---|---|

|

Risks |

|

|

Why do you consider climate-related investment risks and opportunities? |

All |

|

How do you incorporate climate risk considerations into your investment process? |

All |

|

Would you want to reduce exposure to some countries on the basis of climate risk? |

All |

|

Outcomes |

|

|

What is your approach to outcomes in sovereign bond investments? |

All |

|

What is your approach to labelled sovereign bonds? |

All |

|

Are you prepared to pursue real-world climate outcomes as distinct goals, even if this hinders financial returns? |

AO |

|

What are your views on the income bias – the idea that considering ESG factors in sovereign debt can disadvantage poorer countries? |

All |

|

What are your views on the just transition when considering ESG factors in sovereign debt? |

All |

|

Investment process |

|

|

Do you engage with sovereign bond issuers or other stakeholders on climate? |

All |

|

What mechanisms are in place to ensure alignment between ESG analysts and portfolio managers if they are in separate teams? |

AM |

|

Targets, benchmarks and reporting |

|

|

How would you formulate climate targets for sovereign bonds? |

IC |

|

What approach should be taken if managers fail to meet an agreed climate target? |

IC, AO |

|

What is the best way to measure carbon emissions in sovereign bond portfolios? |

All |

|

What is your approach to indices/benchmarks when incorporating climate considerations? |

All |

|

Do you or the investors you work with have reporting or regulatory requirements related to climate? |

All |

Framing climate risk

Fixed income investors can approach responsible investment with different objectives. For some, optimising risk-adjusted returns is the sole objective. Others also put emphasis on driving real-world sustainability outcomes.[1] These goals often go together – for example, many investors would regard a sovereign’s successful climate transition as beneficial for their portfolio as well as for citizens. Investors’ focus on climate change is increasingly to the fore due to pressure from regulators, asset owners and investment consultants.

The economic relevance and materiality of climate change is clear to many sovereign debt investors and some academic research has already shown linkages between climate factors and sovereign bonds. A selection of this research is summarised below.

John Beirne, Nuobu Renzhi and Ulrich Volz (2020) Feeling the heat: Climate risks and the cost of sovereign borrowing: shows that sovereign bond yields increase with higher climate vulnerability, and to a lesser extent lower climate resilience (based on whether an economy has measures in place to address exposure to climate risks).

Julia Bingler (2022) Expect the worst, hope for the best: The valuation of climate risks and opportunities in sovereign bonds: shows that for longer-dated government bonds issued by higher-rated countries, lower yields are associated with higher climate transition performance, lower transition risk exposure and higher transition opportunity. This is particularly the case since the 2015 Paris Agreement. For lower-rated countries, lower preparedness to manage physical climate impacts is associated with higher yields.

Hannes Boehm (2022) Physical climate change and the sovereign risk of emerging economies: finds that for countries that are warm and have a lower quality of institutions, sovereign debt performance worsens with temperature deviation from a historical average.

Serhan Cevik and João Tovar Jalles (2020) This Changes Everything: Climate Shocks and Sovereign Bonds: finds that climate resilience (here defined as capacity to address the consequences of climate change) helps lower the cost of borrowing, while climate vulnerability increases borrowing costs.

Sierra Collender, Baoqing Gan, Christina Sklibosios Nikitopoulos, Kylie-Anne Richards and Laura Simone Ryan (2022) Climate Transition Risk in Sovereign Bond Markets: among other findings, suggests that higher carbon dioxide emissions are associated with higher sovereign yields and also sovereign spreads against US Treasuries.

However, quantifying the exact impact of climate change on sovereign debt yields or returns is very difficult. In particular:

- Bond yields depend not just on credit risk but also on inflation, interest rates, term structures and currency risk.

- Some climate risks – and the policies to address them – play out over a time horizon that is too long to be relevant for short-dated sovereign bonds.

- Countries differ in their ability to withstand climate risk: for example economies that are larger and more diversified can absorb these physical and transition risks more easily. The strength of a country’s finances and of its institutions also matters here.

Climate risk encompasses different components: physical risk, referring to the effects of a changing climate, either acute (for example extreme weather events) or chronic (for example sea level rise); and transition risk, referring to the shift to a low-carbon economy and related dislocations and opportunities.

Unlike corporates, governments set and enforce policies and regulations for entire national economies. In this context, it is instructive to add a third component: risks related to a country’s policy response to climate change factors.

This section aims to frame how climate risk is relevant to sovereign debt investments as a basis for future work. It will explore each component of climate risk in turn (physical, transition and policy response) and cover sources of data and related challenges and opportunities. It will also present brief, non-exhaustive case studies of two emerging market countries, South Africa and India, and one developed market country, Australia.

Physical risk

Physical risk resulting from climate change can be split into two types, both with potential consequences for sovereign debt:

Acute events: Sovereigns’ economies are normally large enough to be resilient to isolated extreme weather events. However, small or poor countries are potentially vulnerable, partly due to weaker governance and lack of financial resources. Recurring disasters may also weigh on economic growth over time. This in turn can lead to lower revenues and higher public expenditures, and ultimately raise the risk of default.

Research also demonstrates a link between extreme weather events and inflation rates, although the direction and magnitude of the effect on inflation varies depending on the weather event and the time horizon, with droughts and hot summers particularly inflationary.[2]

Chronic hazards: Longer-term changes in the climate, such as rising sea levels, rising temperatures and altered precipitation patterns, may have various effects of relevance for sovereign debt, including:

- changes in economic activity, for example making certain soft commodity sectors more or less economically feasible, or changing tourism patterns;[3]

- migration within and between countries due to land becoming inhospitable;

- increased government expenditure, for example on flood defences.

A significant share of adaptation and mitigation costs are likely to be borne by national governments rather than the private sector. This brings about the risk of a vicious cycle where the most vulnerable sovereigns face the highest bills but also pay the highest climate risk premium on their borrowing costs, in turn hindering investment.

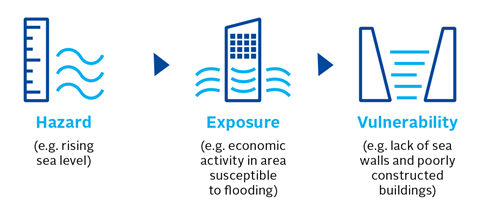

Untangling physical risk

A country’s level of physical risk depends not just on a location’s exposure to a hazard but also on the vulnerability of its infrastructure, economic activity or people, as demonstrated in Figure 2. The distinction between the presence of the hazard itself, exposure and vulnerability is important for investors assessing data on physical risk.

Figure 2: Hazard, exposure and vulnerability relationship

Source: Understanding Risk What is disaster risk?

For example, the Netherlands and Vietnam are both highly flood-prone. However, Vietnam has greater physical vulnerability to floods. This is because the Netherlands controls the spread of floods through resilience technology, such as floodgates and dykes, and has a robust public financing strategy for future-proofing flood defences.[4] Dutch cities are well-adapted to deal with flooding, while countries that are less developed do not have the same level of planning and build quality.[5]

Transition risk

With each severe disruption arising from climate change, the possibility grows of governments, companies and the public moving decisively to reduce carbon emissions. To the extent that such shifts occur, economies will face significant changes. Sectors with high carbon footprints may face reduced demand and greater policy restrictions, while cleaner sectors may expand and thrive. Even countries that do not implement transition policies will be exposed through their interactions with governments and companies that do. The ripple effects on sovereign debt will take many forms, including:

- Public finances: For a given country, any decline in high-carbon industries or fall in international demand for exports may harm its fiscal position. In addition, governments may choose to use fiscal resources to subsidise or stimulate low-carbon sectors.

- Interest rates: Central banks will adjust interest rates in response to trends in economic growth and inflation – trends that may be affected by the climate transition. For example, countries well positioned for the transition may experience higher economic growth in the long-term than they would otherwise. Meanwhile, energy is an important component of inflation, so factors such as fossil fuel prices and renewable supply may increasingly matter.

The trajectory of the transition is inevitably bound up with government policy. There may be many consequential second-order effects, which are discussed in more detail in the policy response section.

The following section will explore various carbon emissions metrics that investors may consider within their analysis. These metrics are important for investors as an indication of how much countries need to adjust to reach net zero and to track how their portfolios perform against climate goals (including over longer time horizons, for example in relation to transition pathways and scenario analysis).

Carbon emissions metrics

There are different ways to measure emissions footprints across an entire economy, most notably by using production-based (or territorial) data versus consumption-based data:

- Production-based data accounts for all carbon emissions generated within a country’s border: this is the most common approach at the national level and is more timely.

- Consumption-based data is adjusted for trade: emissions metrics better reflect where the products that created the emissions are consumed rather than produced.

The choice matters. Australia, a commodity exporter, has lower consumption emissions than production emissions, while for many European countries it tends to be the other way around.[6] Many developed economies can effectively outsource production emissions elsewhere – particularly to emerging economies – as their industries transition away from fossil fuels (a process known as carbon leakage).[7]

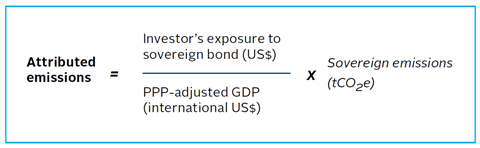

The Partnership for Carbon Accounting Financials (PCAF) offers the following calculation to attribute emissions from sovereign debt investments, with GDP adjusted for purchasing power parity (PPP):[8]

The fraction approximates the investor’s exposure to the issuer, as a proportion of the latter’s overall value. For corporates, value can be measured through enterprise value including cash (EVIC). But EVIC is inappropriate for sovereigns, which do not have the same type of equity value. Using debt on its own as a proxy for value would be misleading as countries also fund themselves through tax revenues. Therefore, PCAF uses a measure of the country’s output (PPP-adjusted GDP). As a data source for this, PCAF suggests the World Bank’s figures (based on current international dollars).[9]

It can also be informative to measure a country’s carbon-emissions intensity. PCAF recommends the following metrics:

These various carbon metrics can greatly affect country rankings.[10] If the process for constructing a sovereign debt index or portfolio is based on countries’ emissions, the choice of metric can affect capital allocation.

Policy response risk

When it comes to the policy response to climate risks, investors need to judge the credibility of a sovereign’s plans, targets and claims. In addition, government action will have far-reaching effects for economies and societies, in some cases unintended. This should also form part of sovereign analysis. Both areas are explored below.

Evaluating climate policy response

Much of the focus so far on governments’ climate policy relates to the pledges they have made to cut emissions. These commitments are important, but often have a timespan of decades. It is also important to analyse interim targets and progress on the implementation of policy.

As for the response to physical risk, investors can check adaptation and disaster-risk-reduction policies using a country’s National Adaptation Plans (NAPs). They can consider specific characteristics of NAPs, including the presence of monitoring and evaluation systems. Additionally, disaster-risk-reduction policies and financing strategies can indicate what financial resources a country has access to and how well it is able to build adaptive capacity to reduce the impact of physical hazards.[11]

Questions that could be used to evaluate sovereigns are listed in Figure 3. These could form the basis of an investor’s research and/or engagement efforts, whether individual or collaborative. Unlike with corporate engagement, investors can engage with a wide range of entities for any one sovereign.[12]

Where there are significant unfulfilled promises, clear inconsistencies in approach, or difficult political or institutional environments in terms of incentives and accountability, this constitutes a policy response risk for investors.

Figure 3: Questions for evaluating climate policies

| Question |

|---|

|

Physical risk |

|

What is the public sector’s capacity and willingness for capital spending? |

|

Are there adaptation plans in place? |

|

Transition risk |

|

How innovative is the private sector when it comes to climate technology? |

|

Are a government’s investments (including subsidies) congruent with its public climate pledges? |

|

Climate action |

|

Are there interim or sector-specific net-zero targets; if not, what would realistic targets be? |

|

Can the national government be held accountable for its actions (or lack thereof) on climate change? |

|

Is there a carbon tax regime that is aligned with international standards? |

Second-order effects

Government policies to mitigate the risks of climate change – for example cutting fossil fuel production or building infrastructure adapted to extreme weather events – bring their own consequences for economic growth and social cohesion. By their nature, these second-order effects are difficult to predict in advance. However, some areas for investigation include:

Energy transition: Rapidly transitioning away from fossil fuels to low-carbon energy sources is likely to have significant second-order effects, for example:

- A failure to manage the transition in a way that ensures reliable, affordable energy supplies could be economically damaging and cause social and political upheaval.

- Inflationary or disinflationary effects of transitioning to a low-carbon economy (for example inflation from a rise in the prices of key materials for the transition, or disinflation as a result of a cheaper marginal cost of energy generation from renewables[13]) may become embedded in other parts of the economy.

Just transition: As carbon-intensive sectors adapt or decline during the transition, workers and geographic communities reliant on those sectors may struggle without government support. From a sovereign perspective, this could increase social unrest, create budgetary pressures and also undermine support for climate-friendly policies.

Industrial strategy: Government efforts to promote sectors and technologies that help reduce emissions will have wider implications across the economy, and also perhaps push other jurisdictions into taking similar actions. As an emerging potential example of this, at the time of publication European countries were grappling with how to respond to the US’s Inflation Reduction Act.[14] Climate-related industrial strategy may affect trade, competitiveness and ultimately rates of economic growth and tax revenues.

Geopolitical developments. As climate change becomes an increasingly important topic in diplomacy, it may contribute to geopolitical shifts. Geopolitical developments can affect trade patterns and financial flows, and sometimes lead to economic sanctions: all relevant when assessing sovereign bonds. In addition, calls for greater support for vulnerable sovereigns from the largest emitters have grown in recent years, culminating in the establishment of a Loss and Damage Fund at COP27, in the context of climate change disproportionately affecting certain countries. Commitments to developing countries are a form of contingent liability, while recipients stand to improve their fiscal position. This may affect funding costs.

Data and information sources

Investors need data to assess and frame climate risk for sovereign bonds. This data can come from a range of sources and it may not be intended primarily for investors’ use. It could be produced by governments themselves (for example, national statistics offices), by NGOs, by multilateral organisations like the World Bank or by for-profit third parties.

Some examples of freely available data and information sources include:

- Building Resilience Index: This gives location-based information on natural hazards and building resilience.

- CLIMADA: This tool from ETH Zurich is a modelling platform for natural hazards.

- Climate Action Tracker: This tracks countries’ climate targets and policies.

- EDGAR: The Emissions Database for Global Atmospheric Research gives estimates of greenhouse gas emissions.

- IMF Climate Change Indicators Dashboard: This presents a range of climate-related country data, including on carbon emissions, policy and the economy.

- Inevitable Policy Response forecasts: These can be used to form policy expectations across countries. In particular, the Quarterly Forecast Tracker provides investors with a comprehensive and timely assessment on relevance, credibility and impact of key climate developments against the IPR Forecast Policy Scenario and 1.5°C Required Policy Scenario.

- Global Carbon Atlas: This contains data on countries’ carbon emissions, showing various options for weightings and different types of emissions measurement.

- Global Footprint Network’s Open Data Platform: The platform provides the carbon footprint of consumption for more than 180 countries.

- ND-GAIN Country Index: This assesses vulnerability in the categories of food, water, health, ecosystem services and infrastructure, and assesses readiness by looking at factors of political, economic, and social stability.

- Net Zero Tracker: This explores coverage of net zero plans.

- NGFS climate scenarios: The Network for Greening the Financial System (NGFS), which comprises central banks and financial supervisors, has created scenarios for physical and transition risk, depending on how the transition evolves.

- Our World in Data – CO2 emissions: This provides data on carbon emissions by country.

- World Bank Sovereign ESG Data Portal: This presents a range of indicators, along with tools to visualise and compare trends.

- WorldRiskIndex: This shows the risk of disasters from extreme events and climate change, calculated as the geometric mean of exposure and vulnerability indicators.

Many commercial providers of financial data have started offering data and products, such as risk ratings, scores and portfolio assessment tools, that investors can use to analyse climate risk. However, only recently has their coverage grown to include sovereign issuers. The PRI explored this topic in a workshop with investors and climate data providers.

Despite the array of information sources, challenges remain when analysing ESG data for sovereign debt:

- Data is lacking for some countries, particularly in emerging and frontier markets.

- A lag of as much as several years in data availability makes forward-looking analysis difficult. In general, data is backward looking whereas the future trajectory is often more important for investors.

- Indicators demonstrating country-level climate risk do not necessarily imply financial risks for sovereign bonds.

- More-complex scores encompassing climate information, such as ESG scores, may contain embedded assumptions that investors want to change.

As investors and others have increasingly recognised the importance of analysing climate risk in sovereign debt and the broader country context, solutions have started to develop. These include:

- Plans to evaluate emissions pathways and climate policies. The ASCOR project, for example, aims to help investors understand sovereign exposure to climate risk and how governments plan to transition to a low-carbon economy.

- More work on a standard for measuring carbon emissions financed by sovereign debt, such as the metric devised by PCAF. Third-party providers have also contributed open source, PCAF-aligned datasets.[15]

- Work on sustainability reporting in the public sector. The International Public Sector Accounting Standards Board (IPSASB), for example, is increasing efforts to develop sustainability reporting standards and guidance for the public sector.[16]

Data is also important for constructing climate-related sovereign debt indices. Many investors use indices to shape their investment decisions. Better and more transparent index products related to climate could help sovereign bondholders manage climate risks. These issues were explored further in a workshop the PRI hosted with sovereign debt investors and index providers.

Case studies

Australia

Physical risk

Even in developed economies like Australia, changing climate patterns and extreme weather events are negatively affecting quality of life, asset values and infrastructure.

The agriculture sector, which employs one in 40 Australians and accounts for 55% of land use[17], is particularly exposed. The 2019-2020 Black Summer bush fires were estimated to have cost 6%-8% of the value of national agricultural output over the period, with damage to health, farm property and infrastructure.[18] Bushfires can have broader effects on tourism and consumer confidence.[19]

Australia is also subject to prolonged periods of low rainfall, such as the Millenium drought between 2001 and 2009. As well as harming agriculture, research suggests that droughts also trigger significant costs tied to potable water infrastructure, for example, and health issues in rural areas.[20] Excessive rain is also a risk, with heavy flooding in 2022.[21]

Transition risk

Australia is a large carbon emitter on a per capita basis, based on production and consumption figures.[22] Fifty-three percent of electricity generation comes from coal, with another 21% from oil and natural gas.[23]

The Australian Energy Market Operator has warned that the country could face electricity shortages by 2027 without an increase in electricity production as older coal plants are retired.[24] Maintenance work and outages at coal plants raised the risk of blackouts in 2022.[25]

Meanwhile, as an exporter of metallurgical and thermal coal, liquefied natural gas and oil, some of Australia’s industries are vulnerable to falls in foreign demand as other countries progress towards net zero. However, the country contains large amounts of critical minerals, and export revenue from lithium, base metals and their raw material inputs is predicted to almost match that from coal by 2027-28.[26]

Policy response risk

Following a change in government, in 2022 Australia increased its ambitions to reduce carbon emissions, committing to a 43% reduction below 2005 levels by 2030 before reaching net zero by 2050.[27] But in an August 2022 update, Climate Action Tracker scored the country’s efforts as insufficient towards a 1.5°C goal (the most common rating among the countries assessed).[28]

Other policy responses include committing A$23bn to updating the electricity grid and granting concessional loans and equity for transmission infrastructure investment.[29] The Climate Change Authority’s responsibilities have also been expanded.

However, moving domestic energy supply away from fossil fuels is proving challenging, with large-scale renewable energy construction stalling. Construction of new power lines that are likely needed to improve the grid and allow integration of remote renewable energy generation has also proved controversial.[30]

According to the Organisation for Economic Co-operation and Development (OECD), in Australia’s favour are high-quality institutions to back research into renewable energy and commercialisation of low emissions projects. On the other hand, it says environmental innovation has declined recently.[31]

Consequences for investors

Australia is a large carbon emitter and fossil fuel exporter and this could pose a risk to it as global climate indices develop: capital flows may be diverted to more progressive peer countries.

Meanwhile, the need for mitigation and adaptation measures, such as more resilient buildings and infrastructure, could have significant implications for the government’s balance sheet.

At the same time, the country has a strong, developed economy and is generally regarded as having robust governance standards. It also has significant opportunities to benefit from a global transition away from fossil fuels, such as its critical minerals industry and the potential establishment of green hydrogen, green ammonia and green iron production.

While engagement with developed market sovereign debt issuers on ESG topics has been relatively rare up to now, the PRI-led Collaborative Sovereign Engagement on Climate Change pilot initiative is engaging with Australian governmental bodies on the topic of climate change.

The initiative is aiming to help Australia take all possible steps to mitigate greenhouse gas emissions and build resilience towards climate change damage, in line with the Paris Agreement and stabilising average global warming to 1.5°C. Sub-working groups each engage with different parts of the sovereign system:

- the federal government

- national regulators and authorities (including the Reserve Bank of Australia and the Australian Office of Financial Management, which issues Australia’s sovereign bonds)

- sub-sovereigns

South Africa

Physical risk

Droughts have become more common since the 1980s.[32] This affects agriculture, which accounts for 2.8% of GDP[33] and is predominantly rainfed.

Drier conditions in the rural areas are also likely to contribute to migration to urban areas: this may offer citizens better job opportunities, but puts pressure on housing, land management and infrastructure.[34] Yet urban areas are not immune from drought: water supply in Cape Town fell to crititical levels in 2018.[35]

Other risks from the physical effects of climate change include disease: high-emission scenarios will lead to a greater proportion of the population at risk of dengue, Zika and malaria. Sea-level rise and storm surges pose risks to coastline infrastructure.

Transition risk

South Africa’s production-based emissions per capita are high compared with other African countries and with countries with a similar GDP per capita, such as Brazil or Indonesia.[36] Eighty-eight percent of South Africa’s energy generation comes from coal,[37] presenting a challenge for the energy transition.

Over the period 2013-2035, South Africa is exposed to transition risk in certain sectors, particularly coal exports, totalling more than US$120bn in present value terms, according to a 2019 estimate from the Climate Policy Initiative.[38]

The coal industry may face a decline in offshore demand as economies move towards greener sources of power, threatening jobs. The energy sector has a great degree of state ownership, meaning the government’s balance sheet bears risk more directly than it would otherwise. Pressures from the transition may also weigh on the government through reduced tax revenues, greater spending on unemployment benefits and struggling municipalities, and an increase in non-performing loans at state-owned financial firms.

Policy response risk

In its October 2022 update, Climate Action Tracker rated South Africa’s efforts as insufficient towards a 1.5°C goal (the most common rating among the countries assessed).[39]

At COP27, the government’s Just Energy Transition Investment Plan outlined investment opportunities (following the launch of an internationally supported Just Energy Transition Partnership at COP26) to help de-risk and catalyse transition. A coalition of France, Germany, the UK, the US and the EU agreed to mobilise an initial US$8.5bn.[40] This plan will potentially mitigate some transition risks through, for example, the development of the green hydrogen industry.

As for physical risk, South Africa’s national climate change adaptation strategy lays out priorities to achieve adaptation and resilience, building on other legislation and policy.[41] Overall, the policy response faces implementation risk as well as the risk of inadequate financing.

Consequences for investors

South Africa’s weak carbon emissions profile presents a risk that over time capital flows weaken, exacerbating economic challenges.

Transition risk may weigh on South Africa’s sovereign credit rating and the government’s ability to finance its economic and social development objectives. Changing the energy sector will require overhauling longstanding, powerful systems and vested interests in coal, while addressing an ongoing power crisis and socio-economic challenges.[42]

More positively, South Africa has relatively strong institutions and is one of the few countries to have conducted a national, social dialogue to help develop a vision for a just transition.

Investors can engage with South Africa on various topics that relate both to tackling climate change and to investment risk: these include improving the financial profile of state-owned enterprises, enhancing transparency in public procurement, and growing the share of renewables in the total energy mix.

India

Physical risk

India’s geographical location subjects it to weather extremes: even compared with neighbours, it is particularly exposed to physical risk from wildfires, floods, storms and sea level rise.[43] Vulnerability is heightened by poverty: the country’s GDP per capita is relatively low compared with other major global economies.

By 2030, India will lose an estimated 5.8% of working hours to heat stress, according to estimates from the International Labour Organization (ILO) based on a scenario of 1.5°C of temperature rise by the end of the century. [44] That figure is an increase from 4.3% of lost working hours in 1995, with agriculture and construction particularly affected. The ILO estimates heat stress would erode 6% of the country’s GDP, with India one of the most affected in the region.

The nature of physical risk varies across the country. For example, Odisha, with its agriculture, fishing, tourism and port activities, is vulnerable to floods and cyclones; Maharashtra, where many residents farm, is threatened by droughts and floods.[45]

Transition risk

India emits less per capita than BRICS peers Brazil, Russia, China and South Africa, and other large countries in the region, such as Thailand and Indonesia (on a production basis).[46] This indicates an opportunity to shift energy consumption to green sources while per capita emissions are still relatively low, with less disruption. Yet in absolute terms, India is the third largest emitter on a production basis, behind only China and the US.[47]

Coal accounts for more than 70% of energy generation,[48] representing a significant transition risk. However, India has been focused on developing renewable energy and is pushing for green hydrogen, which if successful could be instrumental to the decarbonisation of its industrial sector.[49]

Social transition risks are unevenly distributed: Madhya Pradesh, Jharkhand, Chhattisgarh, Uttar Pradesh, Bihar, Odisha, Telangana and Rajasthan are states particularly vulnerable to threats to livelihoods in a low-carbon transition, according to a CDC Group paper.[50] Seven of these eight states are dependent on coal. Five currently have additional vulnerability to energy access constraints in a shift away from fossil fuels.

Policy response risk

In its July 2023 update, Climate Action Tracker rated India’s climate actions as highly insufficient for a 1.5°C temperature limit.[51] The country’s target to reach net zero by 2070 is relatively lax and efforts are undermined by plans to construct additional coal power capacity between 2027 and 2032.

At the same time, India has a target to derive half of its cumulative electric power installed capacity from non-fossil fuel-based resources by 2030. It is well on track to achieve this target, according to Climate Action Tracker.

As for adaptation policy, India has a national water mission and policies targeting increased resilience of vulnerable communities, such as the Indian Himalayas Climate Adaptation Programme.[52] Disaster-response systems have improved in recent times but more focus on adaptation and resilience is needed, according to a report from PwC and the Observer Research Foundation.[53]

Consequences for investors

Physical risk may disrupt key sectors, in turn hampering economic activity, and adaptation will be crucial. Meanwhile, managing a transition away from coal in a way that ensures social cohesion will be challenging. India’s credit profile, currently driven by high economic growth but a high debt burden, could shift accordingly.[54]

Despite a low per capita emissions profile, India’s weak net-zero commitments may hamper its attractiveness among international investors seeking to meet climate goals.

Sovereign debt investors can engage with the government on its relatively weak commitments to net zero and phasing out coal, and how it intends to achieve the commitments it has made. They may also coordinate approaches with corporate bondholders. Investors can engage with quasi-sovereign and corporate issuers that would need to play a significant role in tackling the country’s carbon emissions.

Driving climate outcomes

The contribution sovereign bonds make to mitigation or adaptation of climate risk is increasingly coming to the fore for investors seeking to drive positive climate outcomes. Sovereign bonds can play a role within outcome-driven investing due to central governments’ responsibility for mitigation and adaptation projects, policy-making and rule-enforcement.

While most sovereign debt remains in the form of traditional (vanilla) bonds, labelled bonds have received increased attention as a channel for producing positive climate outcomes or helping to reduce negative ones.[55] Labelled sovereign bonds help investors focus on governments’ climate action because they can link funding to environmental expenditure and/or targets.[56]

This section will discuss climate-related labelled bonds issued by sovereigns and explore the two main types: use-of-proceeds bonds and sustainability-linked bonds. It will then explore opportunities and offer suggestions that would strengthen investors’ ability to use sovereign bonds to drive climate outcomes.

Labelled bonds

Labelled bonds tie a sovereign issuer’s debt funding programme to environmental and/or social projects or objectives, such as those related to climate, with various advantages and disadvantages for bondholders and sovereign borrowers (see Figure 4).

Figure 4: Pros and cons of climate-related labelled bonds for sovereign debt issuers and investors

| Advantages | Disadvantages | |

|---|---|---|

|

Issuers |

|

|

|

Investors |

|

|

*This could include central banks and other official institutions who are greening their portfolios, for example the European Central Bank, which has suggested it will tilt public sector bond holdings towards green bonds.[57]

Labelled bonds fall into two categories:

- Use-of-proceeds bonds: Here, the issuer commits to spending an amount equal to the proceeds of the bond on green projects, which address environmental issues, or social projects, for example housing or support for low-income families. In terms of nomenclature, green bonds relate to green projects, social bonds to social projects, and sustainability bonds to a combination of green and social projects. Of the three types, by its nature this paper focuses mainly on green and sustainability bonds.

- Sustainability-linked bonds (SLBs): These are performance-based instruments where the bonds’ contractual features link to whether the issuer meets sustainability targets, most notably through a coupon adjustment. At the time of writing, just two countries have issued SLBs; both have targets related to climate.

Sovereigns do not have to choose between these two types of bonds as both can play a role within the overall issuance programme. Countries already issue a great variety of debt instruments, including short-dated debt, bonds with ultra-long maturities, inflation-linked bonds and bonds aimed at retail investors. Debt management offices can apply the sustainable labels across the spectrum.

When it comes to evaluating the climate-related characteristics of labelled sovereign bonds, investors have different requirements and perspectives, so will make divergent judgements. However, considerations could include:

- the overall profile of the sovereign on climate change, for example its level of carbon emissions;

- how coherently the labelled bond fits within the government’s broader climate change strategy (for example whether expenditures or targets link to wider plans);

- the ambition of the bond (e.g. the strength of targets or the quality of the projects funded);

- whether there is a third-party review and what it says – this may be particularly important for newer labelled bond issuers;[58]

- the governance structure for use of proceeds or targets – for example, if there is an impartial committee to check how proceeds are spent;

- for use-of-proceeds bonds, the percentage of proceeds financing new projects and, for refinancing old/existing projects, how old they are (known as the length of the look-back period);[59]

- the strength of post-issuance reporting, including impact reporting (this could be the expected quality of reporting if investors are buying the bond at new issue);

- compliance with standards from the International Capital Markets Association or the Climate Bonds Initiative;

- compliance with any emerging regulatory standards, such as the European Green Bond Standard, or treatment under sustainability regulations for investors.

Use-of-proceeds bonds

In theory, investors can use use-of-proceeds bonds to finance specific projects rather than contributing to a government’s broader budget, therefore gaining visibility and confidence in how their capital is being deployed. In practice, proving “additionality”, i.e., that without the bond a project would not have been completed, is challenging, and therefore some consider unlabelled and labelled bonds to be essentially interchangeable.

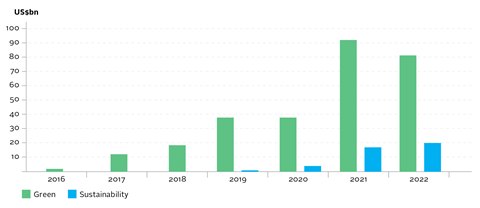

This segment of the labelled bond market has grown rapidly since Poland issued the first green sovereign bond in 2016 (see Figure 5), with green bonds more common than sustainability bonds. Countries across regions have now issued green and sustainability bonds, with the funding mechanism having been most popular in Europe (see Figure 6).

Figure 5: Issuance volume of sovereign green and sustainability bonds over time*

Source: Climate Bonds Initiative Interactive Data Platform

*In 2016, $800m green bonds were issued; in 2019 the first sovereign sustainability bonds were issued at a volume of $500m

Figure 6: Map of sovereigns that have issued green or sustainability bonds*

Source: PRI, ICMA Sustainable Bond Market Data

*According to ICMA’s database exported on 30 June 202

For use-of-proceeds bonds with funding earmarked for climate-related projects, the most commonly used voluntary standards are ICMA’s Green Bond Principles and Sustainability Bond Guidelines. The four key criteria for alignment with these relate to:

- use of proceeds

- process for project evaluation and selection

- management of proceeds

- reporting

Issuers can seek second-party opinions to confirm the bonds adhere to these standards.

Post-issuance, best practice is for issuers to report annually on projects to which proceeds have been allocated, including amounts and expected impact; in certain cases this can be presented in generic or aggregated terms.[60] ICMA has a handbook entitled Harmonised Framework for Impact Reporting, which gives principles and recommendations for reporting on eligible projects.

Based on conversations with the SDAC, investors noted that the timing of annual post-issuance reporting by sovereigns can lag and the publication date of reports is not always clear. In many cases, impact reporting is of a high standard. However, some additional measures to improve practice are suggested in the Opportunities section below.

One challenge facing bondholders may be a lack of legal recourse if there is greenwashing or poor governance. Investors can do the following:

- Decline to invest in the bond and/or sell existing holdings. One difficulty is that investors may have fewer substitute issuers available in sovereign debt compared with corporate debt.

- Engage with the sovereign. This is likely to be more effective if the sovereign plans to issue labelled bonds frequently in the future.

| Sovereign green bond example | |

|---|---|

|

Issuer |

Germany[61] |

|

Type |

Green bond |

|

Size |

€6.5bn |

|

Date of issuance |

2020 |

|

Context |

Germany issued 10-year green bonds (followed later by five-year bonds) that were twinned with conventional bonds with otherwise identical characteristics. Under the twin-bond system, investors can swap the green bonds for the vanilla ones at any time, thus removing any illiquidity disadvantage. In theory, this gives a cleaner indication of any pricing discrepancy between identical green and non-green bonds. This structure has generally confirmed the existence of a greenium. |

|

Use of proceeds |

Germany’s impact report in September 2022 documented a number of allocations. Some of the biggest were:

|

Sustainability-linked bonds

While small at present, the sovereign SLB market has attracted considerable interest. It may be particularly useful for smaller sovereigns that would find it hard to identify enough projects to issue a viable use-of-proceeds bond.

As with use-of-proceeds bonds, ICMA has developed standards through its Sustainability-Linked Bond Principles. It is difficult to comment on post-reporting practices, given how recent the first SLB sovereign issues have been.

Chile and Uruguay are the only countries to have issued SLBs as of September 2023. Figure 7 compares their issuances from March and October 2022, respectively. The main distinction between the two is that Chile adjusts the bond’s coupon rate using a step-up mechanism, which penalises poor performance against targets, while Uruguay’s bond includes step-up and step-down mechanisms providing for both penalties and rewards.

Figure 7: Features of two sovereign sustainability-linked bonds

| Chile | Uruguay | |

|---|---|---|

|

Issuance date |

March 2022 |

October 2022 |

|

Size |

US$2bn |

US$1.5bn |

|

Coupon |

4.34% |

5.75% |

|

Maturity |

2042 |

2034 |

|

Adjustment type |

Step-up |

Step-up or step-down |

|

Adjustment effective from |

2034 |

2027 |

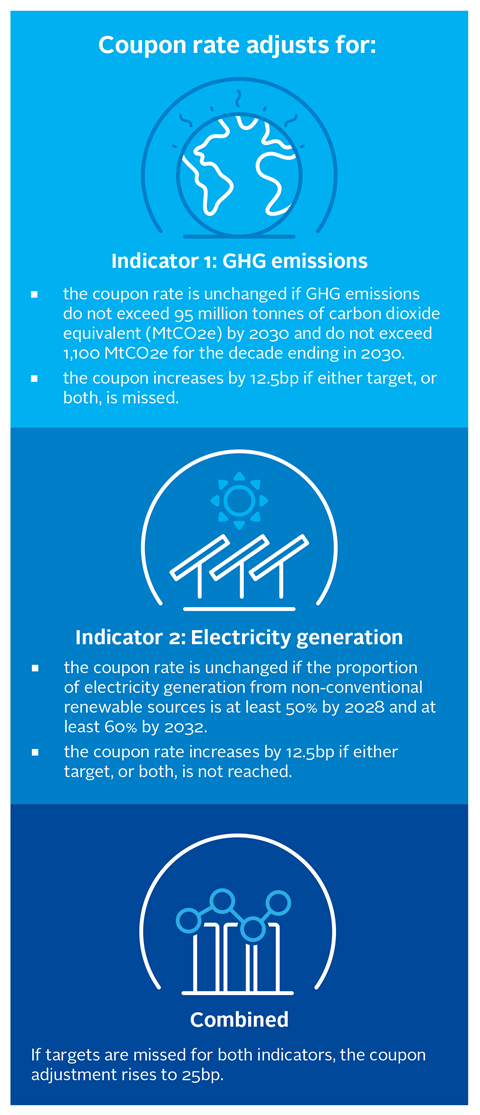

The structure of Chile’s bond allows for coupon adjustments tied to two indicators: greenhouse gas (GHG) emissions and the proportion of electricity generated from renewable energy sources (see Figure 8).

Chile has since added to its framework a social key performance indicator relating to the percentage of women on corporate boards of directors. Chile issued new SLBs that replace the renewables coupon adjustment with the social KPI.[62]

Figure 8: Chile’s SLB structure

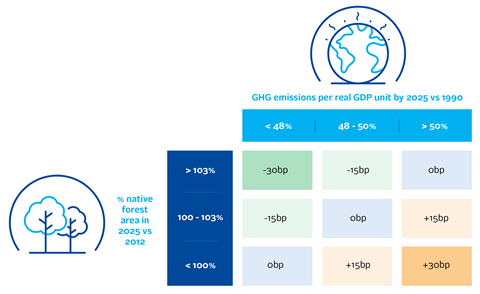

Uruguay’s SLB also has two performance indicators, one for GHG emissions and the other measuring percentage of native forest cover. As Figure 9 shows, there are three performance bands for each KPI. The coupon adjustment ranges from a 30bp reduction to a 30bp increase, depending on how the country performs relative to the two KPIs.

Figure 9: Uruguay’s SLB structure

Sources for figures 7, 8 and 9: AFII (2022) Chile sustainability-linked bond: Optionality analysis; AFII (2023) Understanding dynamics between sustainable and traditional debt; Fitch Ratings (2022) Fitch Rates Chile’s USD 2042 Sustainability-Linked Bond ‘A-’; Ministerio de Economía y Finanzas (2022) Global issuance of a new Sovereign Sustainability-Linked Bond (SSLB) in U.S. dollars with final maturity in 2034; Ministerio de Economía y Finanzas (2022) Uruguay’s Sovereign Sustainability-Linked Bond Framework (SSLB / BIICC); S&P Global Market Intelligence (2022) World’s 1st sovereign sustainability linked bond issued by Chile

Opportunities

Sovereign debt issuers and investors have opportunities to improve and clarify the climate-related outcomes of sovereign funding programmes, as explored below.

Ensuring a holistic approach

Sovereigns can create a coherent climate strategy that encompasses all bonds they issue, which would give weight to arguments that their entire debt programme is sustainable given their public purpose. The proceeds from, or targets embedded within, labelled bonds should link to broader governmental climate objectives.

The growing use of climate budget tagging allows sovereigns to categorise climate-relevant spending across departments. The PRI explored this topic at a roundtable held with sovereign debt investors and issuers and the World Bank.

In terms of the relevance for sovereign bonds, climate budget tagging can:

- help investors track progress at the issuer level;

- help quantify costs of climate commitments;

- link to labelled bond issuance programmes by identifying eligible expenditures and facilitating tracking, monitoring and reporting.

However, at present the countries that use climate budget tagging implement it in differing ways. Definitions of climate expenditure can vary and tagging may be selective in coverage, for example sub-national budgets may be excluded. This makes cross-country comparisons more difficult for investors; greater harmonisation would help.

Meanwhile, the ASCOR project could help in providing targets for SLBs, given that the framework uses a number of climate-related indicators.

Adopting ambitious and relevant objectives

When consulted on sovereign labelled bonds, investors should push for ambitious structures. For example, SLBs should use stretching targets rather than ones that are very easy to achieve, and the size of penalty and/or incentive should be significant and kick in well before maturity.

Labelled bond structures should also focus on the most relevant and material themes to a sovereign’s climate profile. For example, a country with poor public transport could fund better infrastructure with use-of-proceeds bonds; a country with high levels of deforestation could tie SLB targets to reforestation rates.

Tracking and reporting meaningfully

Investors should ask issuers to commit to regular, timely and detailed reporting when issuing labelled bonds. This will mitigate the risk of greenwashing. Standardising labelled bond monitoring and reporting across the market could help. The Green Bond Transparency Platform, which is free of charge, is one initiative in this area. Further suggestions for issuers of labelled bonds include:

- making data easily available online, published in an Excel file rather than a pdf;

- providing impact reporting at the level of the International Securities Identification Number (ISIN), allowing a link to be made to each individual bond issue.

Exploring new financial structures

Innovative financial solutions are emerging to help sovereigns access climate-related spending and/or mitigate climate risk.

Debt-for-climate swaps could be structured in a similar way to debt-for-nature swaps, where creditors reduce the country’s debt burden in exchange for spending or policy commitments related to nature.[63] The economics of these transactions can be facilitated by multilateral development banks and NGOs, for example in the form of grants and political risk insurance. However, these instruments are likely to be outside the scope of standard sovereign debt investment mandates.

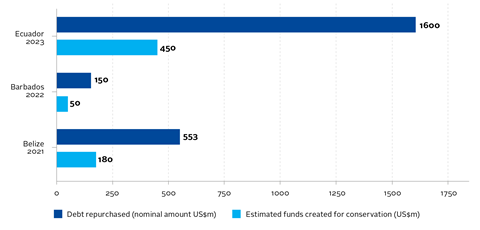

Countries that have used debt-for-nature swaps so far include Ecuador, Barbados and Belize. Belize and Barbados’s deals relate to ocean conservation work, including putting 30% of each country’s ocean in protection areas: in Belize’s case this is a commitment; in Barbados’s it is an objective. Ecuador’s deal – the largest debt-for nature swap to date – relates to marine conservation work around the Galapagos Islands (see Figure 10).

Figure 10: Deal size of selected debt-for-nature swaps

Sources: Global Green Growth Institute (May 2023) Ecuador Debt-for-Nature Swap in the Galapagos Islands Launched; IDB (2023) Fact sheet: debt-for-nature conversion Ecuador (Galápagos); Reuters (May 2023) Ecuador seals record debt-for-nature swap with Galapagos bond; The Nature Conservancy Case Study: Barbados Blue Bonds for Ocean Conservation; The Nature Conservancy Case Study: Belize Blue Bonds for Ocean Conservation

In addition, catastrophe risk pools, catastrophe bonds and other insurance-linked securities act as an insurance policy for sovereigns in case of extreme weather events by passing certain risks onto third parties and enabling quick and automatic receipt of funds after a disaster.[64] However, this asset class is not generally considered part of sovereign debt and conventional government bond investors are unlikely to be able to participate in transactions.

Meanwhile, sovereign bonds can also contain natural disaster clauses, allowing countries to postpone interest and principal payments if there is a natural disaster.[65]

Working towards the just transition

Incorporating consideration of the just transition in labelled bonds would help sovereigns combine environmental and social outcomes. ICMA’s Social Bond Principles already include some key areas of the just transition, such as education and vocational training, affordable housing, employment generation and socioeconomic advancement and empowerment. But it is not just social bonds where this type of thinking can apply; the UK reports on social “co-benefits” of expenditure from its green financing programme.[66]

Next steps

The PRI will continue to produce guidance for investors on considering climate risks and opportunities in sovereign bond investments. The PRI will also explore further opportunities to bring together asset owners, investment managers and investment consultants. Engagement between issuers and investors is essential. Collaborative initiatives can be a useful facilitator, for example the new PRI-coordinated Collaborative Sovereign Engagement on Climate Change.

As for other ESG themes, researching biodiversity will be important as a future step, in part due to its link to climate factors.

CREDITS | Authors: Jasper Cox, Noah Wescombe | Editor: Casey Aspin | Design: Christopher Perrins

Downloads

Considering climate change in sovereign debt

PDF, Size 2.03 mbPrendre en compte les changements climatiques dans la dette souveraine (French)

PDF, Size 2.12 mb

References

[1]PRI (2022) Fixed income investing: delivering returns and achieving outcomes

[2]IMF (2022) How Persistent are Climate-Related Price Shocks? Implications for Monetary Policy; ECB (2021) Feeling the heat: extreme temperatures and price stability

[3]Food and Agriculture Organization of the United Nations Agriculture on the proving grounds: damage and loss

[4]Government of the Netherlands Delta Programme: flood safety, freshwater and spatial adaptation

[5]Journal of Flood Risk Management (2021) Understanding and assessing flood risk in Vietnam: Current status, persisting gaps, and future directions

[6]Our World in Data (October 2019) How do CO2 emissions compare when we adjust for trade?

[7]Grantham Research Institute on Climate Change and the Environment (December 2021) What is carbon leakage? Clarifying misconceptions for a better mitigation effort

[8]PCAF (2022) Financed Emissions 2nd Edition (2022)

[9]World Bank GDP, PPP (current international $)

[10]EMSO (2022) Another way of looking at a country’s carbon footprint: A tale of Switzerland and South Africa

[11]Leiter (2021) Do governments track the implementation of national adaptation plans?

[12]PRI (2020) ESG engagement for sovereign debt investors

[13]IEA (May 2022) Critical minerals threaten a decades-long trend of cost declines for clean energy technologies; Isabel Schnabel (March 2022) Speech: A new age of energy inflation: climateflation, fossilflation and greenflation

[14]E3G (2022) The Inflation Reduction Act & the EU: The need to strengthen the transatlantic trade relationship; IMF (June 2023) Green trade tensions

[15]OS-Climate (December 2022) OS-Climate Publishes PCAF Sovereign Carbon Footprint Datasets

[16]IPSASB Sustainability Reporting

[17]Australian Government Department of Agriculture, Fisheries and Forestry (2023) Snapshot of Australian Agriculture 2023

[18]WWF-Australia (2021) Fire On The Farm: Assessing The Impacts Of The 2019-2020 Bushfires On Food And Agriculture In Australia

[19]The Guardian (January 2020) Economic impact of Australia’s bushfires set to exceed $4.4bn cost of Black Saturday

[20]David Fleming-Muñoz, Stuart Whitten and Graham Bonnett (2023) The economics of drought: A review of impacts and costs

[21]United Nations Environment Programme (March 2022) Australia: After the bushfires came the floods

[22]Our World in Data Per capita CO₂ emissions; Our World in Data Consumption-based CO₂ emissions vs. population share, 2020

[23]IEA Energy Statistics Data Browser – Energy generation by source – Australia

[24]ABC News (February 2023) AEMO warns parts of the country to face electricity shortages without immediate investment in the sector

[25]Reuters (June 2022) Australian power crisis eases as coal-fired plants crank up; The Guardian (November 2022) Blackouts feared in Queensland after coal-fired power station is taken offline

[26]The Conversation (May 2022) Australia has rich deposits of critical minerals for green technology. But we are not making the most of them … yet; Australian Government Department of Industry, Science and Resources Office of the Chief Economist (2023) Resources and Energy Quarterly March 2023

[27]Prime Minister of Australia (June 2022) Stronger Action On Climate Change

[28]Climate Action Tracker Australia

[29]Australian Office of Financial Management (2023) Australian Government Climate Change Commitments, Policies and Programs

[30]ABC News (August 2023) Australia will fall well short of 82 per cent renewable energy by 2030, analysts predict, as problems mount; Pincent Masons (August 2023) ‘Rewiring the nation’: upgrading Australia’s electricity grid

[31]OECD (2021) OECD Economic Surveys: Australia 2021

[32]Water Research Commission (2015) Background to current drought situation in South Africa

[33]CIA South Africa - The World Factbook

[34]Institute for Security Studies (2021) Shelter from the storm: climate-accelerated urbanisation in South Africa

[35]G20 Climate Risk Atlas South Africa

[36]Our World in Data Per capita CO₂ emissions; Our World in Data CO₂ emissions per capita vs. GDP per capita, 2018;

[37]IEA Energy Statistics Data Browser – Energy generation by source – South Africa

[38]Climate Policy Initiative (2019) Understanding the impact of a low carbon transition on South Africa

[39]Climate Action Tracker South Africa

[40]Foreign, Commonwealth & Development Office, Prime Minister’s Office, 10 Downing Street and Rishi Sunak (November 2022) South Africa Just Energy Transition Investment Plan: joint statement

[41]Forestry, Fisheries and the Environment Department Republic of South Africa (2020) National Climate Change Adaptation Strategy

[42]Financial Times (November 2022) The cost of getting South Africa to stop using coal

[43]S&P Global (2022) Weather Warning: Assessing Countries’ Vulnerability To Economic Losses From Physical Climate Risks

[44]ILO (2019) Working on a warmer planet: The impact of heat stress on labour productivity and decent work

[45]PwC and Observer Research Foundation (2023) Climate, community, cooperation: An Indian approach to adaptation in the Global South

[46]Our World in Data Per capita CO₂ emissions

[47]Our World in Data Annual CO₂ emissions

[48]IEA Energy Statistics Data Browser – Energy generation by source – India

[49]IEA (January 2022) India’s clean energy transition is rapidly underway, benefiting the entire world

[50]CDC Group (2021) Towards a Just Transition Finance Roadmap for India: Laying the foundations for practical action

[51]Climate Action Tracker India

[52]G20 Climate Risk Atlas India

[53]PwC and Observer Research Foundation (2023) Climate, community, cooperation: An Indian approach to adaptation in the Global South

[54]Moody’s (August 2023) Moody’s affirms India’s Baa3 ratings; outlook stable

[55]PRI (2023) Mapping the role sustainable bonds play in the fixed income market

[56]BIS (2022) Sovereigns and sustainable bonds: challenges and new options

[57]Isabel Schnabel (January 2023) Speech: Monetary policy tightening and the green transition

[58]World Bank Green Bond Symposium

[59]World Bank Green Bond Proceeds Management & Reporting

[60]ICMA (2021) Green Bond Principles

[61]CEPS (2020) Germany’s inaugural green bond… not so green after all; Climate Bonds Initiative (September 2021) Greenium Remains Visible in Latest Pricing Study; Environmental Finance Green bond of the year – sovereign: The Federal Republic of Germany; European Central Bank (January 2023) Monetary policy tightening and the green transition; Federal Ministry of Finance Green federal securities; Federal Ministry of Finance (2022) Green bond impact report 2020; Financial Times (September 2020) Investors pounce on Germany’s first green bond sale

[62]Ministerio de Hacienda (2023) Debt Management Strategy, Labelled Bonds & Updated SLB Framework; AFII (2023) Offi-Chile the largest sovereign SLB issuer

[63]International Monetary Fund (2022) Debt-for-Climate Swaps: Analysis, Design, and Implementation

[64]IMF (2022) Staff Climate Notes: Sovereign Climate Debt Instruments: An Overview of the Green and Catastrophe Bond Markets

[65]Cleary Gottlieb (2021) Sovereign Debt Evolution: The Natural Disaster Clause

[66]HM Treasury, NS&I and United Kingdom Debt Management Office (2023) UK Green Financing: Allocation and Impact Report