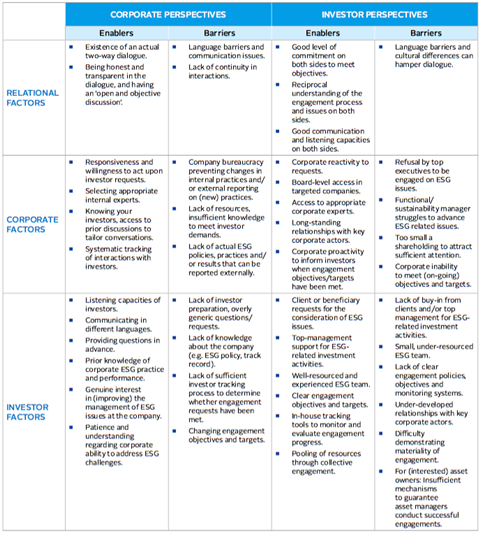

We identified common enabling factors and barriers to successful engagements, from corporate and investor perspectives.

These factors could be straightforwardly classified into company-related factors, investor-related factors, and relational factors (i.e. factors that characterise the interactions between corporations and investors).

The relational factors identified by companies and investors mirror each other. In both cases, the capacity of participants to conduct a dialogue that is actually a ‘two-way street’, is regarded as a crucial enabler. Corporate actors emphasise the need to conduct such a dialogue in a transparent and honest manner, whereas investors insist on the need to clarify expectations and the understanding of positions, on both sides, to enhance the quality of the dialogue.

Cultural and linguistic barriers may prevent such high-quality dialogues from taking place, and soft, communicative skills, though not necessarily explicitly mentioned, seem to play an important role in overcoming such barriers. Several corporate respondents in the sustainability function suggest that the competencies they acquired through engaging in dialogue with activists, NGOs, governments or other stakeholders, are also relevant in managing their relationship with institutional investors.

Both corporations and investors regard the timeliness of responding to requests, and the presence of a tracking system to record prior ESG-related interactions, as important factors enabling successful ESG engagement. On the other hand, bureaucratic burdens (such as the difficulty to collect the relevant ESG information for investors) and a lack of resources in terms of time and ESG expertise, were commonly mentioned as barriers to successful engagement.

Some differences emerge, however, regarding perceptions of corporate- or investor-related factors, because of the specific context within which each type of organisation operates. Accordingly, corporate interviewees insist on the importance of getting ‘the right person in the room’, by which they mean that appropriate and knowledgeable corporate experts should be involved in the engagement process, to provide investors with a direct insight into what is going on internally in relation to a given ESG issue.

One sustainability expert at a European-based mining company, said their firm aims to collect questions before a face-to-face meeting “to make sure that we have the right people in the room to provide information.” Rather than charging one individual with collecting information and reporting back to investors, as some companies do, “we try to let our experts speak for themselves because then you can have a much more direct conversation,” he/she adds.

From the investor viewpoint, enabling factors are related to the level of corporate access they have (board-level access can expedite ESG requests, for example), the existence of pre-existing, long-term relationships with key corporate actors, and the presence of strong ‘buy-in’ from top management or clients/beneficiaries for ESG engagement.

On the other hand, investors identify the following barriers to successful engagement: an overly patronising approach to dialogue with companies; a lack of a sufficient shareholding to attract company management’s attention; a lack of internal resources dedicated to engagement or the absence of a formalised engagement process (for example the lack of a monitoring system and/or measurable outcomes to assess progress); and the disempowerment of sustainability experts on the corporate side. For corporations, it is mainly the lack of preparedness of investors, either in terms of knowledge of the ESG issues or of the corporate context (e.g. business model, industry drivers or company ESG performance track record), that are likely to undermine an ESG engagement process and its ultimate success.

Table 4. Contrasting Perceptions of the Enablers and Barriers to Engagement Success

Download the full report

-

How ESG engagement creates value for investors and companies

April 2018

How ESG engagement creates value for investors and companies

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9Currently reading

Enablers and barriers

- 10