When asked about the pros and cons of individual as opposed to collective forms of engagement, few corporate interviewees could clearly differentiate between the two forms, as in both cases, a lead investor may be charged with approaching them.

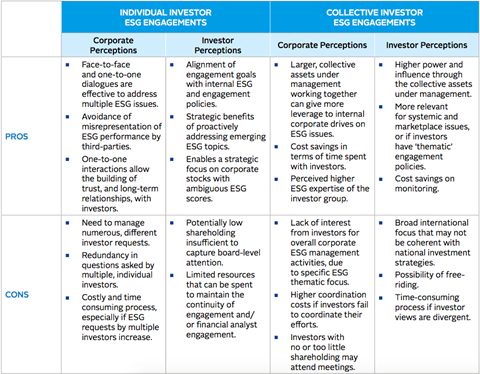

However, the subset of corporate interviewees who experienced both forms of ESG engagement, and are able to clearly discriminate between them, provided clear insights about the pros and cons of each type. Table 3 summarises these results, while contrasting them with insights gathered from prior interviews with investors.

We found, companies usually favour individual forms of ESG engagement, because they make the tailoring of the engagement process to the specific needs of a given investor a lot easier. Investors’ specific ESG interests and needs can be more easily identifiable for one investor than for a group of investors. An appropriate internal expert (e.g. health and safety or climate change expert) can be involved in the engagement, depending on the sophistication and degree of knowledge of the investor.

In addition, one-to-one, and ideally face-to-face, dialogues were regarded as more productive by several corporate interviewees, because they allow them to explain how ESG issues are related to each other and to their corporate strategy, and can support the development of long-term relationships with institutional investors. These meetings were viewed as being easier to organise with one single investor.

However, the same interviewees also identified a potential drawback with individual engagement in terms of cost and redundancy of demands, particularly in a scenario where the same request was received from numerous investors. For instance, in the event of a controversy, investor demands can peak all at once and become hard to manage.

In contrast, corporate interviewees noted that collective forms of engagement can save time and reduce costs by avoiding consecutive engagements with individual investors. “Frankly, it’s helpful to be able to speak to multiple investors in one day as opposed to the individual conversations that otherwise might happen,” noted a sustainability practitioner at a US food processor and retailer.

By and large, collective engagement is also seen as more likely to provide opportunities for relationship building and give more traction to ESG issues within companies, given the total amount of assets under management usually involved in such processes. Some corporate interviewees commented that the collective nature of engagement is also likely to enhance the quality of investors’ knowledge of ESG issues, providing more potential for ESG learning opportunities discussed above.

However, a number of interviewees expressed concern that not all investors involved in collective engagements may have the same interest in the company, nor a significant holding and, as a result, they may lack the level of commitment needed to truly understand the investee company and the specific ESG challenges it faces. In addition, coordinating with a group of investors makes it difficult, if not impossible, to organise the real-time, face-to-face interactions that can be deemed highly valuable by interviewees. These corporate perceptions of the differences between individual and collective forms of engagement, thus suggest that both forms of engagement are potentially useful and value-creating, even though they each come with their own limitations.

“One-on-one conversations can get into the very specific detail that the investor is interested in. When it’s a group, there’s more of a discussion, with the benefit of different views. We’re therefore happy to do both. The people who tend to join a collective engagement are those who are less specifically interested, but have more of a general interest; they want to hear what other people are saying, rather than coming with a long list of questions.”

SD, Aerospace, UK

Table 3 contrasts the pros and cons of individual and collective engagement as outlined by companies, compared with those reported by investors. Investors also see distinct benefits and limitations in both forms of engagement. For instance, individual engagement can be used strategically to clarify the ESG status of a stock that has received divergent ratings in an internal investors’ scoring system. Such an engagement for the sake of updating internal ESG scoring, may strategically loose its importance if conducted collectively, but may be difficult to conduct for a single investor with a low shareholding in the targeted company.

Conversely, collective engagement can encourage investee companies to respond to investor ESG requests by bringing more weight to the engagement in terms of collective investor assets under management. Moreover, all investors involved can share the improved knowledge of the corporate context. However, the increased number of participants can increase coordination costs of engagement, as well as potentially allowing some participants to free ride on the efforts of others (Gond & Piani, 2013).

The comparison set out in Table 3, suggests that engagement practices should be adapted to balance the trade-offs of individual and collective forms of engagement. This could be the case, for example, when several investors delegate part of their engagement activity to a third-party advisor (diminishing the cost of collective engagement for investors), who can then leverage this collective effort (mobilising the total size of investors to influence corporations) to engage a long-term relationship with the corporation (more beneficial to corporate actors); in order to advance the engagement process. This also suggests that companies and investors should search for optimal resource allocation between both forms of ESG engagement.

Table 3. Contrasting Perceptions of Individual and Collective Forms of Engagement

Download the full report

-

How ESG engagement creates value for investors and companies

April 2018

How ESG engagement creates value for investors and companies

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8Currently reading

Individual versus collective engagement

- 9

- 10