A Cambridge Institute for Sustainability Leadership (CISL) report shows that up to half of the losses from shifting market sentiment to climate change can be offset through asset allocation, but that the remaining half is unhedgeable at the investor level, leaving investors exposed unless system-wide action is taken.

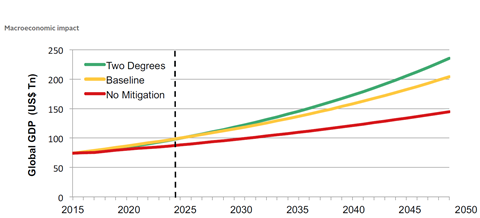

The report also demonstrates that for the global economy overall, action to limit global warming to below 2o C will, despite a short-term negative impact, lead to higher long-term growth than if no action is taken.

Unhedgeable Risk – How Climate Change Sentiment Impacts Investment, Prof. Douglas Crawford-Brown, Jennifer Copic, Dr Aideen Foley, Dr Scott Kelly, Dr Eugene Neduv, Prof. Daniel Ralph, Dr Farzad Saidi and Jaclyn Zhiyi Yeo. The study design and editorial process was led by Dr Jake Reynolds (Director, Sustainable Economy, CISL), Rob Lake (independent consultant) and Clarisse Simonek (Programme Manager, Investment Leaders Group, CISL).

The model: scenarios and shocks

The research team modelled the impact of three climate change scenarios:

| Two degrees | Baseline (status quo) | No mitigation |

|---|---|---|

|

|

|

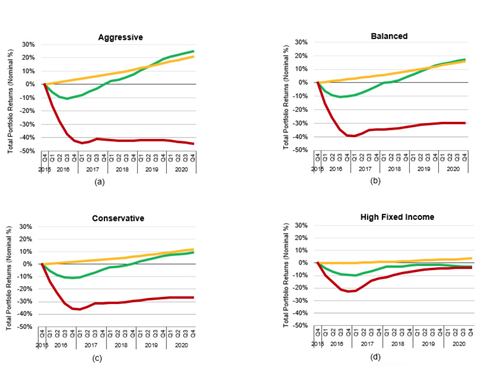

Within each scenario, the impact of various “sentiment shocks” was modelled, caused by triggers such as disruptive technology, significant new climate-related policy, asset stranding and extreme weather events. The shocks were introduced into the model at Q1 2016, and their impact was mapped progressively over five years, along with the cumulative macroeconomic long-term impact at 2050. The magnitude of the most severe confidence shock is approximately half the size of the shock that led to the 2008 financial crisis.

Portfolio impact

The model was applied to four example portfolios, three representative of different types of pension funds (Conservative, Balanced and Aggressive) and one of insurance companies, containing a very high proportion of fixed income investments (High Fixed Income). The shocks introduced were based on varying levels of carbon taxation, energy investment, green investment, energy and food prices, energy demand, market confidence and housing prices.

The Aggressive portfolio performs worst of all the portfolios in the No Mitigation scenario, losing around 45% within the first year and never recovering. Under the Two Degrees scenario, however, the portfolio again suffers the largest initial loss, but recoups its losses by the end of year two and overtakes the Baseline scenario in year four.

The authors then analysed sectors in developed and emerging markets to examine the hedging potential of cross-industry diversification and investment in sectors with low climate risk. Under the No Mitigation scenario, 47% of the negative impacts of climate change across industry can be hedged through industrial diversification and investment in industries that exhibit few climate-related risks. Similarly, shifting from an aggressive equity portfolio to one with a higher percentage of fixed-income assets makes it possible to hedge 49% of the risk associated with equities. The effects of each strategy are not cumulative, however, and no individual strategy offsets more than half the risk.

In the No Mitigation scenario, the economy suffers an economic loss that continues indefinitely, while in the Two Degrees scenario, the economy performs worse than Baseline for about the first decade, but eventually recovers and outgrows it by 4.5% in the long-term.

Next steps

CISL concludes that constructive dialogue between investors, governments and regulators is needed to examine the conditions necessary to build more resilient financial markets under unprecedented environmental change.

Download the issue

-

RI Quarterly vol. 9: Investing in a low-carbon world

December 2015

RI Quarterly vol. 9: Investing in a low-carbon world

- 1

- 2

- 3

Currently reading

Currently readingClimate risk: the unhedgeable half

- 4

- 5

- 6