Organisation details

Name: Fidelity International

Signatory type: Investment manager

HQ country: Bermuda

AUM: US$880 billion

Covered in this case study

Asset class(es): Real estate

Geography: Europe

Fidelity has been investing in real estate in Europe since 2006, providing an array of products, from core to value-add. In 2021, we published our Net Zero Carbon Roadmap and subsequently launched our climate impact capability, focusing on acquiring ‘brown’ assets and transitioning them to net zero carbon within an accelerated timeframe while meeting impact and financial objectives.

Why we focus on climate impact

The built environment accounts for 39% of total greenhouse gas emissions,1 while a staggering 91% of existing EU commercial real estate stock still requires renovation to align with international climate targets.2 It is evident that adhering to a business-as-usual approach in real estate will only exacerbate the climate crisis; as such, real estate managers have a crucial role to play in addressing climate change.

To achieve these targets, we must focus on making the best use of our existing resources. Currently, 80% of the buildings destined for existence in 2050 have already been constructed,3 and 95% of current buildings are set to remain in use by 2050.4 Therefore, the primary challenge lies in retrofitting and refurbishing existing stock to achieve net-zero emissions by 2050. This approach is preferred over constructing new green buildings because it produces lower levels of embodied carbon i.e., the total GHG emissions and removals associated with materials and construction processes throughout the whole lifecycle of an asset.5

The financial benefits of such endeavours are equally as compelling. Despite the initial higher costs associated with creating green buildings, the anticipated future cash flows, including increased rent, improved financing terms, reduced occupancy costs and heightened exit value, can offer significantly higher returns on investment. This underscores the value of embracing sustainability in real estate practices.

How we do it

To ensure transparency and measurability in our approach to delivering impact, we have developed a comprehensive climate impact framework for the refurbishment of assets in our climate impact funds. This framework is designed to align with external frameworks and certifications, including the EU Taxonomy, to leverage existing industry standards where possible.

The framework comprises 21 holistic impact metrics. These metrics extend beyond the building itself to also encompass the occupier and supplier, ensuring long-lasting impact. Our progress against these metrics are reported on a quarterly basis to investors, banks, and verified by auditors.

Our primary focus is to reduce the energy demand and carbon emission footprint of existing buildings through sustainability-focused improvements. The goal is to achieve Operational Net Zero (Scope 1 & 2 emissions) by 2035, and Material Net Zero (includes Scope 3 emissions) by 2050.

Our refurbishment efforts prioritise energy efficiency and consumption reduction. We aim to eliminate on-site GHG emissions, reduce overall energy demand through the installing efficient mechanical and electrical technology and LED lighting, and substitute with on-site green energy production, as well as procure decarbonised electricity, including tenant-sourced electricity (scope 3) where feasible and controllable.

We then employ Primary Energy Demand6 as a foundational metric to measure these impacts. This approach not only aligns with established definitions in EU regulations but also provides a simple mathematical calculation (KWh/m2) that is easily understandable and quantifiable for occupiers, valuers, investors, and future owners. It is essential to not only consider the level of carbon reduction but also the pace of that reduction to truly maximise impact.

Example: refurbishment and fit-out of the ‘Odissy’ building in Paris

The recent transformation of a 6,500m² office building (Odissy) in south-west Paris has been awarded BREEAM Outstanding accreditation for its refurbishment and fit-out – one of only three such buildings in France. The refurbishment also has served as a proof of concept, validating the strategic direction and objectives of our newer climate impact funds.

Having recognised the potential to maximise the building’s leasing potential and unlock value, discussions with tenants and local brokers revealed that there was significant interest from companies in search of sustainable office spaces. Office tenants, driven by their own ESG policies and regulatory pressures, are seeking out green buildings while also aiming to optimise operational costs amidst the escalating price of non-green power.

The building boasted a sturdy structure and fundamental specifications, yet lacked modern energy efficiency credentials and featured an outdated layout. The refurbishment program centred on eliminating natural gas usage, upgrading systems to maximise energy efficiency, and installing state-of-the-art equipment for heating, ventilation, and air conditioning. A highly efficient LED network and a new heat pump were installed. The refurbishment prioritised on-site material reuse and achieved an impressive 90% recycling rate to minimise waste.

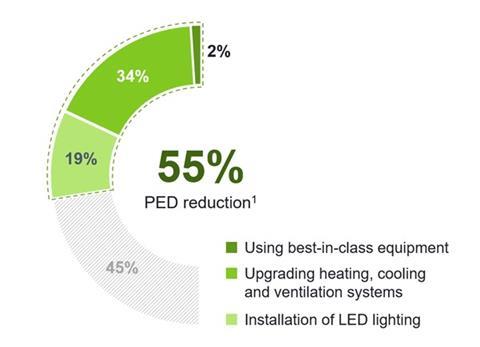

As a result, primary energy demand fell by 55%, attributed to enhancements in lighting, heating, cooling, and ventilation systems, as noted in the breakdown below.

The building has already surpassed 2050 standards for energy consumption and 2042 targets for carbon emissions. The refurbishment also placed a strong emphasis on occupier wellbeing and wellness, incorporating an open-plan layout to enhance the sense of light and space. Innovative design features were integrated to encourage the use of stairs over lifts, promoting physical activity and energy conservation. The building’s leasing agreement includes green targets to align with its sustainability objectives, encouraging tenants to source energy from green sources, such as wind. Smart metering monitors and analyses energy usage, fostering discussions with tenants to raise awareness of the building’s climate impact.

The refurbishment is expected to deliver substantial cost savings, with operating costs anticipated to decrease per square metre from approximately €90 to around €30. This reduction is expected to benefit both tenants and landlords, even with a green premium of approximately 7% to the rent. Furthermore, the refurbishment is projected to elevate the building’s value by approximately 50%, with an estimated 8% attributed to the green premium demanded by the most sustainable assets. The building has the potential to achieve net-zero operations, contingent upon the occupants securing renewable and/or lower-carbon electricity contracts.

PRI disclaimer:This case study aims to contribute to the debate around topical responsible investment issues. It should not be construed as advice, nor relied upon. It is written by a guest contributor. Authors write in their individual capacity – posts do not necessarily represent a PRI view. The inclusion of examples or case studies does not constitute an endorsement by PRI Association or PRI signatories.

References

1 International Energy Agency (2019), Global Status Report for Buildings and Construction 2019

2 RICS (2020), Energy efficiency of the building stock in the EU

3 World Economic Forum (2022), Urban Transformation: To create net-zero cities, we need to look hard at our older buildings

4 European Environment Agency (2022), Building renovation: where circular economy and climate meet

5 LETI (2023), Carbon Definitions for the Built Environment, Buildings & Infrastructure

6 Primary Energy is defined as energy from renewable and non-renewable sources that meets the energy demand associated with a typical use of the building, including, energy used for heating, cooling, ventilation, hot water and lighting. We use Primary Energy Demand for theoretical assessments of how much energy a building uses as a proxy measure for the energy use intensity of a building