By Vaishnavi Ravishankar (@vaishnavi_rr), Research Manager, the PRI

Executive remuneration remains a contentious issue across different markets; however, there is one point where there is widespread consensus: it needs a rethink. Over the years, concerns around pay levels, structure, disclosure and oversight have been shared and debated widely. Within academic literature, CEO pay has been relatively well-explored, and public and regulatory interest on this topic is far from waning.

There is also significant interest around executive pay in the investment community. Our signatory survey last year found that 40% of asset owners consider executive pay a priority topic. However, the recent BEIS report on executive rewards finds there is more to be desired from investors and states “that primary responsibility for changing the environment on executive pay rests with asset owners”. Regulations such as the Investor Disclosure File also introduce a greater onus on financial market participants on remuneration.

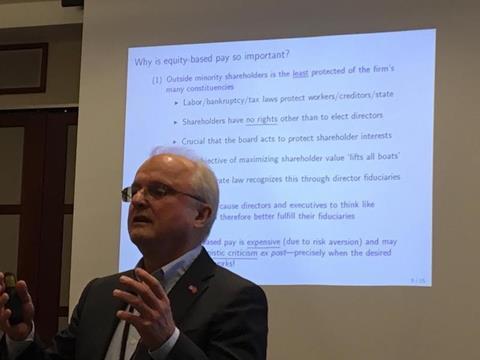

The PRI will be initiating a project on executive pay and commission academic research on the topic. To scope out this programme, we brought together investors and academics in London and Boston to share their insights. We had academic presentations from well-renowned experts: Prof. Alex Edmans, London Business School; Prof. Caroline Flammer, Boston University; Prof. Espen Eckbo, Dartmouth College, and Prof. Jesse Fried, Harvard Law. This was followed by a roundtable discussion among the participants. Three takeaways below:

Addressing concerns around quantum of pay

Peer benchmarking and the fear of losing talent to competitors are seen to have put executive pay on an upwards trajectory. The difficulties in calculating the marginal productivity and the value a CEO is creating, adds to the problem. High CEO pay levels have made headlines time and again, particularly when returns are on a downward trend. We have seen a few instances recently where investors have expressed strong opposition and managed to curtail pay rises.

At the Boston roundtable, some participants thought the rising pay levels are symptomatic of broader problems with the pay structure and the focus should be on asking companies to justify remuneration by drawing a link to business and sustainability strategy and performance. Some investors were in favour of pay caps and disclosure of pay ratios to moderate executive pay levels (more so in the European market), acknowledging however, that these mechanisms must be considered in addition to rigorous assessment of the pay structure.

At the Boston roundtable, some participants thought the rising pay levels are symptomatic of broader problems with the pay structure and the focus should be on asking companies to justify remuneration by drawing a link to business and sustainability strategy and performance

Integrated thinking on ESG and pay

There is a strong case for companies to integrate sustainability factors into executive pay: extra-financial factors are material to their businesses and executives should be incentivised to produce long-term sustainable value. The attendees indicated that over recent years, they had seen an increase in large companies linking ESG factors to pay.

However, some of these factors were not easily quantifiable and corporate disclosures did not discuss their weighting or their materiality to business. These points are consistent with the findings of the 2016 PRI report on ESG and pay that reviewed companies in the extractives and utility companies and undoubtedly present a risk that the ESG portion of pay could almost become guaranteed and therefore, failing to incentivise positive actions on sustainability. The attendees welcomed further analysis to assess trends and identify examples of good practice. Another good point was made about considering ESG issues in an integrated fashion. There seem to be open questions about the inter-relatedness of E, S and G measures and how they should be weighed when integrating into executive remuneration (for instance, when companies do well on the environmental side but perform poorly on social metrics).

The possibility of unintended consequences of introducing ESG metrics was also discussed – for example, via introducing even more metrics and therefore further complexity into the pay structure. Prof. Alex Edmans has proposed a solution to this through payment of cash and shares with a long-term horizon in place of LTIPS and bonuses as his research finds that long-run stock price captures both shareholder and stakeholder value. Another example was in relation to selection of targets – oil companies switching to natural gas will see their emissions go up in the first year given that they are holding two assets at the same time. So, if components of executive pay were linked to a target for emissions reduction that could disincentivise an executive to implement transition plans despite positive future implications.

Boards must do more

There was consensus at both roundtables that boards needs to step up on pay – the participants called for greater board scrutiny on business activities. Interestingly, some participants felt that private boards do a better job of monitoring the management of companies and providing advice due to the members’ in-depth knowledge of the industry. Generally, there appeared to be an increase in interest in executive pay at private companies (but limited data to identify trends and therefore smaller number of academic studies). Comments were also made about the role of the remuneration committees. The attendees agreed that remuneration committees should play a more active role in embedding sustainability in the pay strategy, potentially throughout the company.

Overall, the roundtables paved the way for a rich discussion between investors and academics. The feedback will help frame how the PRI pursues further work in this area.

Join the academic network online to stay tuned for a call for research on this topic in April

This blog is written by PRI staff members and guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase some of our research and other work that we undertake in support of our signatories.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].