By Mark Fulton, Project Director - Inevitable Policy Response (IPR) & Founder - Energy Transition Advisers

Ambition, acceleration and just transition

The Inevitable Policy Response (IPR) is a climate forecasting consortium that helps the financial sector and investors by modelling how the interaction of policy and technology can drive the climate transition. IPR climate scenarios integrate both, land and energy systems across all key geographies.

The thesis is simple: the science shows the impacts that necessitate an acceleration of policy response - that acceleration is ‘inevitable.’ Exactly what, when, where the policies form and their structural impacts on markets and investors is another matter.

IPR has developed two scenarios based on the assumption that policy will form to mitigate what the science describes. This ongoing analysis has been led by Vivid Economics.

1. A Forecast Policy Scenario (FPS) 2021 is IPR’s current assessment of what is anticipated to happen, in terms of future policy developments, the subsequent impact on emissions reduction and temperature outcomes leading to a 1.8°C outcome[1].

2. A 1.5°C Required Policy Scenario (RPS) which targets a rapid pathway to 1.5°C[2] with minimal Carbon Capture and Storage (CCS) and Negative Emission Technologies (NETs). This RPS Scenario is IPR’s current assessment of future policy developments needed to accelerate emissions reduction and hold global temperature increase to a 1.5°C outcome.

The IPR FPS demonstrates that getting below 2°C is possible. Although still a significant challenge for policy makers, we believe they can achieve this. Meanwhile, the 1.5°C RPS exemplifies that the stretch to a 1.5°C net zero 2050 outcome is another level of challenge, requiring even greater ambition, even sooner.

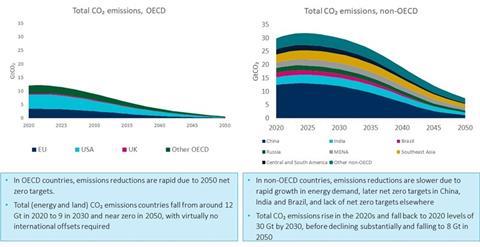

OECD and non-OECD emissions to 2050

When looking at the geographic outcomes of both IPR scenarios, it is no surprise that OECD nations will have fewer emissions to reduce than emerging and developing countries.

This reality has been evident from the start of the UNFCCC process and is illustrated in the IPR FPS 2021 forecast emissions pathways for OECD and non-OECD displayed in Figure 1 below.

Emissions and the 1.5°C challenge

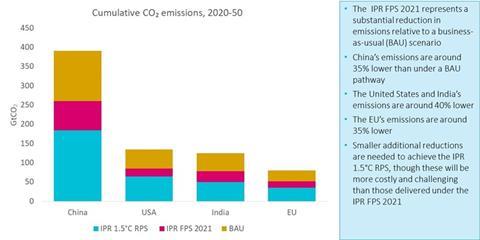

Looking at key countries and regions in Figure 2 below, we measure cumulative emissions reductions from a Business-as-Usual baseline[3] relative first to the FPS 2021 (yellow bar) and then from the FPS to the 1.5°C RPS red bar. Blue is what is permitted under 1.5°C RPS.

In the progression towards net zero, reductions in the US are the most significant in the OECD while the EU has already made substantial reductions. The importance of China and India stand out amongst non-OECD nations. Indeed, Figure 2 shows the IPR forecast itself is ambitious.

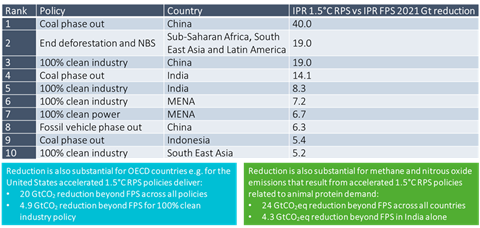

Taking this further, in Figure 3 below we have looked at the difference between the FPS 2021 and 1.5°C RPS in more detail by specific key policies in different regions.

Again, in terms of impact, China and the emerging market countries stand out in energy related policy. The criticality of China’s phase out of coal, ICE vehicles and industry transition is visible. The importance of the land sector is also evident. Failure to end deforestation, commence mass afforestation and adopt Nature Based Solutions (NBS) is not an option.

Economic growth and equity – a just transition

The countries where policy action creates the greatest emissions reduction impact are clear in Figure 3 above. But is it fair for them to carry the greatest load?

This question has dogged COPs since Copenhagen. In IPR analysis, we have included consideration of the imperative for a just transition and assume that its principles underpin many of our policy options. This immediately suggests ‘green finance’ and the challenge of shifting trillions in investable capital based in OECD countries to fund low carbon and sustainable growth paths in developing nations.

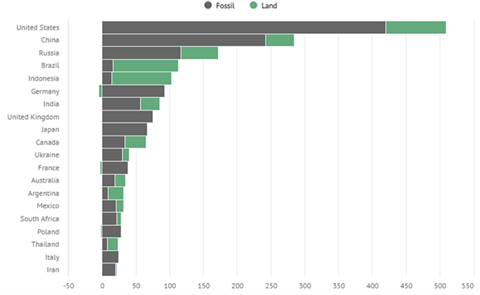

It is certainly worth remembering the history of the carbon budget in this context, see Figure 4 below.

The US is a clear leader in terms of historic source of emissions. However, BRICs and Indonesia from the developing world are in the top ten. The challenge remains to get everyone working together to move beyond the past in order to tackle the future emissions challenge in an equitable way.

Certainly, the cost of doing so in terms of economic transformation in the emerging and developing world has fallen so far that some commentators think it is turning to a net benefit.

Previous IPR analysis showed that long-term GDP growth impacts are small compared to other drivers[4], and lower than the long-run impacts of climate change itself[5]. This should be seen as a key factor for optimism.

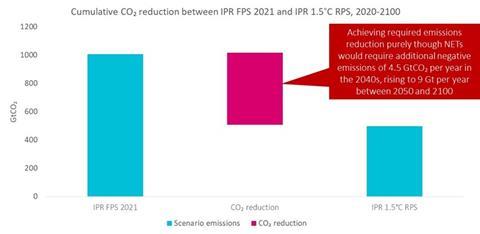

Negative Emission Technologies (NETS) - the final backstop?

As a final note, the ultimate ‘backstop’ has to be more significant utilisation of Negative Emissions Technologies in both planning and execution. Global inability to implement the type of policies laid out in 1.5°C RPS leaves this as the other approach. The extreme position of closing the gap between the FPS 2021 and the 1.5°C RPS utilising NETs is set out in Figure 5.

Ambition, climate policy acceleration and investment

At its most basic, IPR anticipates a climate policy acceleration, driven in part by investor, corporate and civil society pressure around net zero, climate impacts and low-carbon technology cost developments.

But without even higher ambition and intensification by policy makers, temperature increases will not be held to Paris goals. Simultaneously, the principles embedded in just transition provide a bridge to address the different emissions paths evident between the OECD and non-OECD nations.

Ambition must continually drive towards the 2025 ratchet, and investment then flow for emissions curves in the developed and developing world to bend towards net zero by 2050.

More information on IPR 2021 Forecast Policy Scenario (FPS) and 1.5C Required Policy Scenario (RPS) can be found here.

This blog is written by PRI staff members and guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase some of our research and other work that we undertake in support of our signatories.Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.If you have any questions, please contact us at [email protected].

References

[1] 50% probability

[2] 50% probability

[3] Based on IEA STEPS

[4] See Inevitable Policy Response, “Impacts of the Inevitable Policy Response across asset classes,”(2019) https://www.unpri.org/download?ac=11652

[5] See Network for Greening the Financial System (NGFS), “NGFS climate scenarios for banks and supervisors,”(2021) https://www.ngfs.net/sites/default/files/media/2021/08/27/ngfs_climate_scenarios_phase2_june2021.pdf