By Martin Stavenhagen, Policy Specialist, EU Climate and Transition, PRI

Although the EU elections may have shifted power to the right, the results will not derail the ongoing transition to a net zero economy. However, policy certainty, finance and social considerations will be crucial to ensure the necessary pace for implementation. This is the main conclusion of a PRI and IIGCC panel with policy makers and signatories organised at the EU Sustainable Energy Week in Brussels to discuss how to increase net zero investments.

The economic crisis, security and defence issues, and growing concerns about inequality and the rising cost of living dominated voters’ interests. But the next EU mandate is also crucial to achieve the 2030 Green Deal targets.

The political centre holds despite a shift to the right

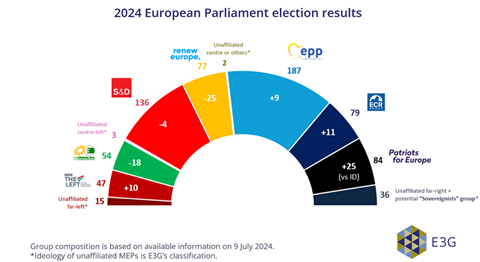

In early June, EU citizens voted to elect Members of European Parliament for the next five-year political cycle. Despite significant gains for far-right parties, the new Parliament will maintain a majority of pro-European parties that support the EU Green Deal agenda, even though the Greens lost seats in comparison with the previous green wave in the previous election. As all four centrist groups are generally supportive of the EU Green Deal, it will likely be reframed with a focus on competitive sustainability, industrial policy, security and resilience, and social cohesion.

Ursula van der Leyen, who made the Green Deal the central political project of her mandate in 2019, is the Council’s choice for a second term to head the Commission. But this will also depend on securing a majority in Parliament with a smaller centrist coalition, potentially supported by the Greens if climate policy remains high on the agenda.

Source: E3G

What do the elections mean for the EU Green Deal?

The success of the far-right political parties will likely affect support for new climate legislation but will not derail existing EU Green Deal policies. The EU Climate Law from 2021 set a mandatory -55% emission reduction target for 2030, and almost all files from the Fit for 55 package to achieve this target have now been adopted. Last month, EU member states managed to organise a majority for the Nature Restoration Law, another crucial part of the EU Green Deal that had previously stalled in the Council. This demonstrates the political support for environmental objectives inextricably linked to climate goals.

In the mandate leading into 2030, implementation at Member State level will be more important than new legislation. But existing policies will need to be adapted to achieve 2040 targets currently being discussed. Policy makers’ main focus will be shifting towards competitiveness and industrial policy, security and defence, and economic resilience in an environment of growing geopolitical tensions. Investing in public goods and attracting a skilled workforce for green technologies from abroad while providing more training in the EU may cause issues for conservative, and especially far right parties.

Another priority will be addressing voters’ concerns about their cost of living and social inequality. Citizens want the transition to be fair, and to have a say in decisions that will affect their lives. Policy makers will need to make good on their election promises to “leave no one behind” as part of a fair Green and Social Deal. This deal would strengthen compensation for higher energy costs or jobs lost in carbon-intensive sectors and provide more benefits to vulnerable households and communities.

The necessary transition investments need more finance, and fast. According to the Commission, the financing gap is €620 billion of additional investment each year until 2030. Most of it will have to come from the private sector.

Financing the transition: three key elements

To address this financing gap, PRI and IIGCC hosted a panel session with investors, policy makers and energy experts on transition policy and finance approaches to discuss how to boost private investments in the green transition.

Three key elements must drive net zero investments: transition policy, public finance and sustainable investments. All three must work together as different pieces of the net zero puzzle.

- For transition policy, investors need to know what to expect in the future. EU-wide sectoral roadmaps can outline decarbonisation plans. National energy and climate plans should include data relevant to investors, including investment needs and public funds allocation. And robust climate targets for 2040 create long-term investment security. Fit for 55 files that have been adopted need to be implemented, swiftly, effectively, and fairly, in a way that empowers citizens and protects vulnerable households.

- Public finance can help de-risk green investments. It can leverage and crowd-in capital through blended finance, guarantees, green public procurement, and other financial instruments like InvestEU to support key technologies for the net zero industry.

- The EU sustainable finance framework continues to provide transparency to investors. They appreciate the Taxonomy defining sustainable investments aligned with the EU Green Deal, which is already leading to consistently increasing green capex expenditures. But the framework needs to better streamline corporate and financial disclosure regulations. The PRI’s EU 2030 Policy Roadmap provides recommendations addressing how to improve the useability and where to fine-tune its coherence across different disclosure standards.

Investors’ role in boosting the transition

Panel participants discussed policy reforms for net zero investments across all three key elements.

- Public budgets are increasingly strained. Policy makers agree that phasing out fossil subsidies and reforming energy taxation will be necessary to free public resources for effective energy grids, critical infrastructure, and a skilled workforce. This will also ensure financial incentives support green investments, instead of perpetuating carbon-intensive production patterns.

- Crowding in private finance and removing regulatory burdens will be a priority to accelerate the net zero economy, as most clean technology investments will need to come from the private sector. But investors need regulatory certainty for their long-term planning horizon beyond 2030, and further de-risking of innovative technologies and business models.

- Investors shared policy examples that help guide portfolio decisions, for example better energy efficiency standards for buildings within real estate. Policy engagement from investors is crucial to help building an enabling environment.

- The EU sustainable finance framework is seen as particularly useful. At its heart, the EU Taxonomy helps investors to identify sustainable economic activities that support the Green Deal objectives and provides the transparency to better understand and manage transition risks and opportunities. Sustainable finance disclosures and transition plan requirements widen the investment horizon and enable long-term planning. But they need to be harmonised to be effective and actionable by investors and their regulatory capacities.

- For de-risking, blended finance and public sovereign guarantees can help crowd in transition investments. EU-wide sectoral decarbonisation plans and national energy and climate plans should provide clearer technology pathways and financial data to better plan transition investments into 2040 and beyond. Sustainable investments in emerging markets can make the EU a global leader in green technology.

Next steps for net zero

This next EU mandate can make “competitive sustainability” a key driver for EU leadership in green technologies and climate action. A calibrated “competitive”, “industrial” and “fair” Green Deal can act as a global locomotive for the net zero economy and strengthens the EU’s position as an international climate leader.

Many investors, IIGCC members and PRI signatories, are already investing sustainably and want to increase their impact even further. They stand ready to inform and support policies that help them to increase finance for a rapid transition.

Watch the full panel discussion.