By Darwin Choi, Zhenyu Gao, and Wenxi Jiang, The Chinese University of Hong Kong Business School

Beliefs about global warming

The majority of scientists (97%) agree that humans cause climate change, but Yale Climate Opinion Maps 2019 show that only 67% of adults in the US think global warming is happening. One reason for the discrepancy between scientific findings and aggregate beliefs is that people focus on attention-grabbing events. Climate change is a long-term trend and its effect may not be immediately visible; people are likely to revise their beliefs about climate change based on current local temperatures, which affect them personally, but contain little information about the long-term average global temperature. Our paper tests this notion by estimating people’s opinions in 74 cities around the world with major stock exchanges and studying their follow-up actions, revealed by how investors trade on their beliefs and move stock prices.

Attention depends on local temperatures

We first show that when a city has an abnormally warm month (when the average daily temperature is higher than the 10-year historical average temperature of the same calendar month), Google search volume for global warming in the city goes up. People pay more attention to climate change and seek more information about it if their location has a relatively higher abnormal temperature, compared to other places in the same month. The result is stronger when the abnormal temperature is in the city’s highest quintile, as the weather experience is the most noticeable. We share our historical temperature data for future research.

The effect of local temperatures on stock prices

Then we examine the effect on stock prices. We classify all firms into high and low carbon emissions according to the list of major emission sources provided by the Intergovernmental Panel on Climate Change (IPCC). There are five major industry sectors: energy; transport; buildings; industry (such as chemicals and metals); and Agriculture, forestry, and other land use (AFOLU). Each sector is further divided into subcategories. We match these subcategories with the industry names in DataStream, a financial database.

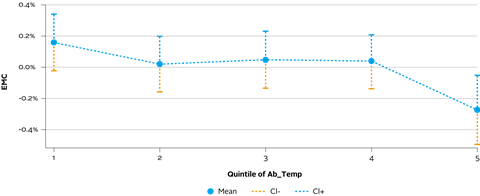

In each month, we form an emission-minus-clean (EMC) portfolio for each stock exchange. The EMC portfolio is an equal-weighted portfolio that buys stocks of high-emission firms and sells stocks of low-emission firms in the same exchange. Figure 1 shows the average monthly returns of the portfolio, adjusted for year-month fixed effects, across different abnormal temperature quintiles in our sample of 74 cities during 2001 – 2017.

When the exchange city is in the warmest abnormal temperature quintile, the average EMC return is negative and is statistically significantly below zero, meaning that stocks of high-emission firms underperform those of low-emission firms. We confirm this finding in a regression analysis, which also establishes a negative relationship between EMC portfolio returns and local abnormal temperatures. From the regression estimates, the EMC return is 48bps lower in a month that is in the abnormally warmest quintile, compared to the city’s coolest abnormal temperature quintile. The pattern is observed in energy and non-energy sectors and is robust to firm-size adjustments; but it is absent from an analysis of an earlier sample period, 1983 to 2000, when global warming was less of an issue. We achieve similar overall results if we define high- and low-emission firms using MSCI Carbon Emission Scores, which capture individual firms’ emission levels relative to their industry peers.

The underperformance of carbon-intensive firms is consistent with our Google search results. When people experience unusually warm weather, they pay more attention to climate change and revise their beliefs about global warming upward. The EMC return is lower because investors trade on the revised beliefs: as they become more aware of climate risks, investors buy stocks of cleaner firms and sell stocks of carbon-intensive firms.

Who reacts to local temperatures?

We further analyse the trading behaviour of local blockholders (who hold 5% or more of the total number of shares), local institutional investors, and retail investors (the majority of which are local). These investors are exposed to the same local temperature. We find that among the three types, only retail investors, who are most likely to suffer from limited attention and react to extreme weather conditions, significantly decrease their equity holdings of high- emission firms (or increase low-emission firm exposures) when the exchange city is unusually warm. Since they are the least informed about firms’ fundamentals, our evidence of stock return underperformance is not driven by adverse effects on firms’ operations.

In a series of tests, we also show that the return underperformance of high-emission firms is not a result of investors adjusting their beliefs about future cashflows. We conclude that retail investors seem to avoid holding climate-unfriendly firms as they recognise the effect of global warming, similar to the avoidance of sin stocks (which involve in producing alcohol, tobacco, and gaming).

Concluding remarks

Even though local temperatures contain negligible information about the global long-term temperature trend, they are more noticeable and serve as “wake-up calls” that alert investors to climate change. People experience local weather events first-hand and the impact is amplified through communication channels and the media. To increase the efficacy of climate campaigns and policies, governments and environmental organisations should bridge the information gap between the scientific community and the general public. Our findings suggest that methods relating to personal and salient experiences (e.g., simulated extreme weather events, maps of potential sea-level rise) will be more effective.

Although our results show that institutional investors do not react to local temperatures, changes in retail investors’ beliefs and the resulting return and trading patterns are relevant for them, especially for funds whose clients are socially responsible. As retail investors shun climate-unfriendly products in abnormally warm weather, these funds may see predictable flow patterns. This may become more important in the future, when climate risk is more eminent and socially responsible investors are increasingly aware of its impacts.

Read the full paper here.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].