By Shipeng Yan and Juan (John) Almandoz, University of Hong Kong; and Fabrizio Ferraro, IESE Business School

The financial sector has a unique ability to shape corporate behaviour, and investors are increasingly trying to tackle climate change.

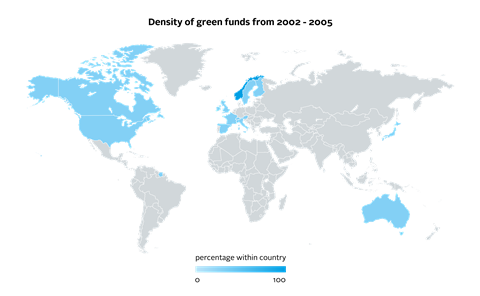

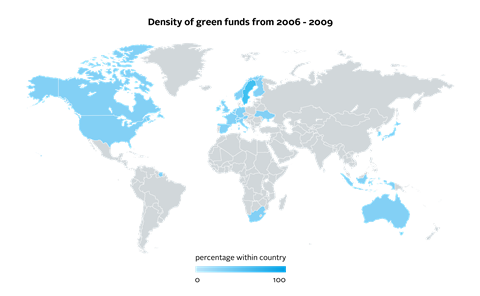

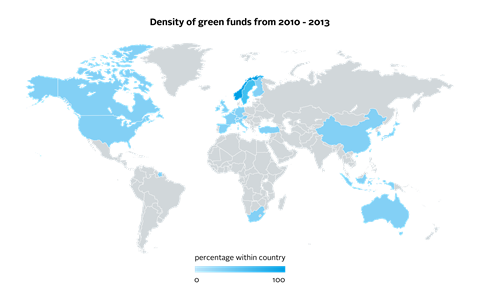

Market-based solutions such as green investment funds, which have been around for several decades already (see Figures 1- 3 below), offer one way to influence corporate behaviour.

But how do such solutions interact with traditional state-driven regulatory approaches to addressing environmental challenges, and how do they both affect corporate environmental performance?

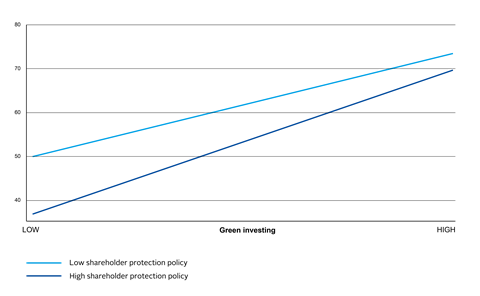

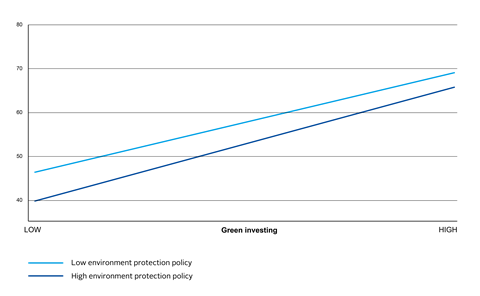

The answer to this question is nuanced – in our paper, we find that strong environmental protection policies would weaken the positive association between green investing and corporate environmental performance, while strong shareholder protection policies would strengthen it.

Methodology

We study whether the density of green investing, measured as the proportion of green funds in a country in terms of the number of funds and assets, could affect corporate environmental performance and how state policies could influence – i.e. boost or dampen – such an impact, using institutional logics to examine whether green investing and state policies are complementary.

Institutional logics are societal-level cultural forces that shape values, norms, and practices. For example, financial logic prescribes self-interest behaviours and profit maximising, environmental logic is oriented towards preserving the planet, whereas state logic focuses on nation building and collective interest. Concrete practices are usually a blend of different logics.

Thus, green investing can be understood as a combination of financial and environmental logic, in which the former serves as a means to fulfil the end goals of the latter. In a similar vein, we consider state environmental and shareholder protection policies as examples of how state logic serves to promote the end goals of environmental preservation (environmental logic) and profit maximisation (financial logic), respectively.

Green investing and corporate environmental performance

The very presence of green investing in the financial sector is like a canary in the coal mine, anticipating a wider trend of environmental cultural norms and values. At the macro level, it helps challenge long-held assumptions within corporations about the costs of environmental practices and highlights their potential business benefits.

We found that the proportion of green investment funds in a country’s financial sector had a positive relationship with firms’ environmental performance there.

A one-standard-deviation increase in our measure of green investing is associated with an increase in corporate environmental score of 6.17 (where a full score represents 100). For example, South Korea in 2007 can be characterised as an average country in terms of green investing. It had 4,736 funds, 16 of which (0.34 percent) were green funds. With a one-unit increase in the proportion of green investing (from 0.34 to 0.91 percent, from 16 to 43 funds), South Korea would move up four places, from 9th to 5th, in the 2007 ranking of average corporate environmental performance among all countries in our sample.

We also demonstrate that such a positive effect between green investing and environmental performance would be strengthened by the existence of social investment forums (SIFs), which operate as channels connecting the financial and environmental community. They enable green investors to make a business case for green investing and environmental performance. By coordinating financial, corporate, and environmental stakeholders and gathering resources, information, skills, and influence, SIFs bridge environmental and financial logics.

Our results showed a strengthened positive effect between green investing and corporate environmental performance when a SIF was present in the country.

State policies and green investing: Twists and turns

Strong shareholder protection policies are likely to have a negative effect on corporate environmental performance. Nations that have enacted stringent laws and regulations to protect shareholders are imbued with shareholder value-maximising principles.

With these legal policies, market interests may trump environmental concerns as shareholders seek to safeguard their rights and benefits. We found that firms’ environmental performance was weaker in countries where shareholder protection laws were stronger.

While shareholder protection policies alone may become an obstacle towards firms’ environmental performance, its interaction with the influence of green investing adds more nuance to the story. We found that the positive relationship between the proportion of green investing and firms’ environmental performance was strengthened in countries where shareholder protection laws were stronger.

A strong shareholder protection policy endows shareholders with prerogatives that could boost the influence of green investing. Green funds may be emboldened to act from their position as shareholders, accentuating environmental concerns, and how receptive companies become to those concerns.

Even though green funds can lead shareholder proposals and legal threats when they are direct shareholders of a firm, given the small size of their holdings in most companies, we suggest that their main influence is normative or cultural rather than coercive or legal.

We find that the influence of green investing on corporate environmental performance is stronger when strong state shareholder protection policies exist. From the perspective of institutional logics, shareholder protection policies are hybrid practices, leveraging the state logic of regulation as means in support of the ends of financial logic (i.e., shareholders).

In countries with strong shareholder protection policies, green investors find that the financial logic is stronger, which reinforces the means of green investing, resulting in comparatively better corporate environmental performance – the end goal of green investing.

On the other hand, the state’s active involvement in environmental protection may have the opposite effect. In themselves, environmental protection laws should be positively associated with companies’ environmental performance.

State interventions through taxes and mandatory environmental standards are critical drivers for corporate environmental performance. Not surprisingly, we found a positive relationship between the strength of a country’s environmental protection laws and firms’ environmental performance.

Nonetheless, strong environmental protection policies may negatively moderate the influence of green investing. In countries where the state environmental protection policies are dominant, companies and the wider public are more prone to believe that the state is the legitimate actor to set environmental standards, and thus limit themselves to compliance with legal standards.

Such belief may leave less space for private practices like green investing, while implementing voluntary practices to enhance environmental performance may be viewed as unnecessary or confusing.

We found that the negative moderation effect of environmental protection policies on the relationship of green investing with corporations’ environmental practices dampened over time, however. This implies that green investing has become increasingly legitimate in countries with stronger environmental protection laws as legal standards become a taken-for-granted lower bar.

In those countries, a space may develop for the environmental influence of business and financial actors. Indeed, attention to green investing and ESG incorporation has grown with exuberance after our window of observation closed in 2013. It is not unthinkable that green investing and the business case for environmental practice may eventually become complementary rather than competitive with the regulatory case.

Towards a truly green financial sector

As climate concerns mount, it becomes more essential to identify effective governance solutions to environmental protection. Our study finds that both the state and the private sectors are critically important.

Our results about the moderation effect of environmental and shareholder policy suggest that the effect of state intervention is nuanced. They suggest that the state, besides playing a dominant role in environmental protection, could contributes through a peripheral route. For instance, it can provide material support to hybrid practices, such as green investing, that are closer to the problem.

It could do so by introducing regulatory changes favouring an environmental transition in the financial sector. Multiple measures taken by the EU Sustainable Finance Action Plan are concrete examples that might point the way in other regulatory environments.

There is still a long way to go in the battle against climate change, which challenges scholars and practitioners alike to contribute with their ideas to the biggest debate of the next decades: how to change our institutions to tackle the climate crisis.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected]