- Organisation: Schroders

- Signatory type: Investment manager

- HQ country: United Kingdom

Overview

The foundation for investing has evolved from two core elements – risk versus return – to three: risk versus return versus impact. Schroders originally developed its SustainEx tool in 2019 to estimate the social and environmental impacts, in dollar terms, of over 16,000 companies. Recognising that all investments, not just companies, generate positive and negative impacts, in 2021 Schroders extended the scope of SustainEx to capture impacts at the country level.

SustainEx estimates previously unaccounted social and environmental costs and benefits to individual companies and countries. It aligns social and environmental impact with investment risk by viewing these, together with current profits, through a common monetary lens.

The result is an aggregate estimate of risk (or opportunity), a dollar cost or benefit which is comparable across companies, countries, portfolios and indices. This provides a forward-looking measure of potential risk, representing the extent to which companies’ and countries’ reported income would be affected if the externalities they create are crystallised into financial costs or benefits. At an aggregate level, we find that negative externalities far outweigh the positives. Of the 16,000-plus companies assessed, total net externalities reach a cost of over US$2trn.

Why this approach?

By examining both current profits and potential externalities through a common monetary lens, SustainEx aligns social and environmental impact with investment risk. As a result, it can help Schroders’ analysts, fund managers and clients identify the potential threats and opportunities companies face from social and environmental trends before they become financial costs.

Most existing approaches to impact measurement compare portfolios with their benchmarks across a few discrete indicators, such as carbon footprint or workforce diversity, that are widely disclosed by public companies. That approach allows comparisons across fund managers and can be valuable for investors.

However, those measures can’t provide meaningful conclusions on companies’ overall impact, the relative importance of different measures or the financial risks companies face. SustainEx overcomes those shortfalls by translating companies’ potential social benefits or costs into economic terms.

How SustainEx works in practice

If companies were given a bill for the potential costs they impose or benefits they accrue, how large would it be? This is no longer a theoretical question, as advances in regulation are attempting to internalise these costs, with companies facing carbon pricing, sugar taxes, minimum wage legislation and a raft of other policies and regulations that will turn more of those social impacts into financial costs. SustainEx aims to address this question through identifying and measuring the associated risks.

To ensure comparability between companies, the measures Schroders selected are:

- Quantifiable, so costs and benefits can be measured and compared objectively;

- Attributable, to ensure impacts can be sensibly allocated between companies;

- Disclosed widely enough that comparison between global companies is possible; and

- Transparent, so users can understand their meaning.

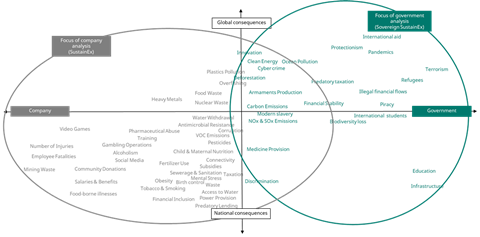

The selection process resulted in 36 initial impacts being incorporated into the tool. As new information emerges, Schroders continues to expand the number of impacts and deepen SustainEx’s existing analysis. Including those specific to countries, the tool now comprises over 60 impacts, as illustrated in Figure 1.

Figure 1 : Impacts measured by SustainEx

Source: Schroders, December 2021. Illustrative purposes only.

Recognising that externalities are created and behave in different ways, SustainEx uses four core approaches to quantifying the costs and benefits of such externalities, as illustrated in Figure 2. We realise that a systematic model distilling multifaceted externalities into dollar values for individual companies or countries cannot fully reflect the complexity of the issues involved, individual positions or the nuances regarding which actors in value chains should bear the burden of those impacts. It is deliberately blunt, forces values on activities that are not typically priced and aggregates very different activities into a single monetary figure. Nonetheless, the analysis provides a valuable insight into companies’ and countries’ exposures.

Figure 2: Four approaches to quantifying impacts

| Global value | Estimated annual global social burden/benefit (e.g. alcohol production, medical equipment) | Define activity responsible for impact | Share global cost or benefit between companies/countries based on activity |  |

| Monetary value | Cost estimated directly based on the monetary value of actions (e.g. education spending) | Determine relationship between benefit or cost and spending | Calculate cost or benefit based on spending on that activity |  |

| Geographically defined | Impacts which vary between locations (e.g. tax payments) | Calculate baseline requirement based on company/country exposure | Compare actual contribution to required baseline |  |

| Unit value | Estimated impact of individual actions (e.g. tax payments) | Quantify or estimate level of activity for each company/country | Calculated burden associated with company/country actions |  |

Source: Schroders

The SustainEx model identifies, quantifies and systematically examines the impacts of individual companies or countries. It represents an annual cost or benefit based on the company’s activity during the year, rather than the “pent-up” impact of their resources or assets. For instance, ownership of unexploited fossil fuel reserves is not included, whereas annual CO2 emissions are counted.

Examples

In cases where social and environmental costs or benefits are most reliably estimated at a global level, we attribute that total cost or benefit to individual companies in proportion to their market share of the activity responsible for the impact, or to individual countries based on their share of the relevant activity (for example, share of global medical patents).

We examine as many credible academic and industry studies as possible, quantifying the scale of the damage or benefit created by each activity. Those studies are based on analysis of different countries and different years. For each estimate:

- We translate regional or national cost estimates into global equivalents;

- We rebase historical cost estimates into 2020 terms; and

- We remove extreme estimated outliers and use the average of the remaining values to estimate the global cost of that externality.

Insofar as most academic studies focus on societal or economic costs or benefits, irrespective of who caused them, we also estimate the share of that global cost or benefit attributable to publicly traded companies or to sovereigns, by combining estimates of:

- The contribution of the corporate sector to each impact;

- The proportion of the corporate sector’s output attributable to listed companies; and

- The contribution of sovereigns to global social costs, recognising that numerous actors contribute to externalities.

For example, virtually all cigarettes or tobacco products are produced by companies. Following a review in 2021 of academic studies, we estimate that listed companies represent approximately 40% of the world’s share of cigarette production, and the global social cost of tobacco has been estimated at US$1.7trn. Costs are currently attributed to producers rather than retailers or others in the value chain. As we continue to evolve SustainEx, we intend to enhance the allocation of those impacts to companies.

Another example, on the sovereign side, is medical equipment. We attribute the social benefit of medical innovation to countries using patent data. Academic research estimates a global social benefit of US$185bn, of which we attribute 50% to sovereigns. We then attribute these benefits in proportion to each country’s share of global medical-related patents.

What are some of the key findings?

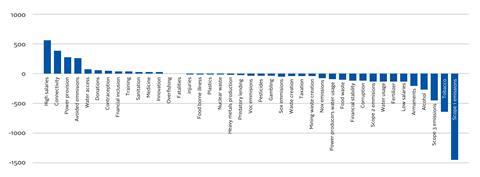

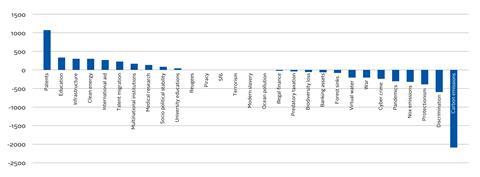

Schroders’ analysis highlights the growing costs arising from externalities created by listed companies and the rising importance of considering the risks those externalities pose to future earnings. The output from the tool suggests that the US$4.1trn earnings that listed companies generate for shareholders would fall by 55% to US$1.9trn if all of the social and environmental impacts Schroders’ research identifies crystallised financially. One third of companies would become loss-making. The risk to profit pools and competitive positions is clear. A summary of positive and negative impacts and their associated financial values are illustrated in Figure 3 and Figure 4.

Figure 3: Listed companies’ social and environmental externalities by measure, in US$ billion

Figure 4: Countries’ social and environmental externalities by measure, in US$ billion

What are the next steps?

Schroders’ initial research when launching SustainEx examined over 400 academic studies to quantify the financial costs and benefits of externalities examined for around 9,000 companies worldwide. Over the last 12-18 months, SustainEx’s analytical capability has been strengthened and extended, now drawing from over 700 academic studies and covering around 16,000 companies, through further research and a significant subsidiary-mapping project for equity and fixed income instruments.

Going forward, Schroders will continue to evolve SustainEx to deliver a deeper, holistic understanding of the potential social and environmental impacts of companies and countries. Leveraging its data science capabilities, it plans to use alternative and web-sourced data to find new company measures which could allow Schroders to quantify impacts which it was previously unable to measure. Schroders will continue to identify new metrics for potential inclusion in SustainEx calculations, and strengthen the analysis of existing metrics, as new sources of information emerge.