Taking a deep dive into our 2023 signatory reporting data, we analysed how more than 3,700 PRI signatories – specifically asset owners and investment managers – are implementing human rights standards across global markets.

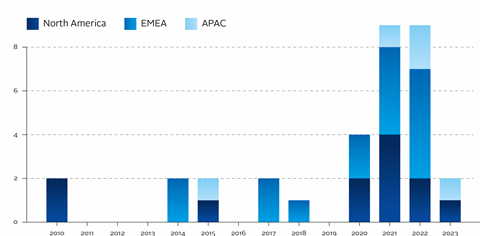

In the last four years, we have seen a sharp rise in legislation covering human rights and social issues. The European Parliament’s Corporate Sustainability Due Diligence Directive is the most significant recent example; however, this regulatory trend is taking place on a global scale.[1]

Figure 1: Rise in number of mandatory due diligence laws since 2010, by region

Source: S&P Global Ratings

Beyond direct regulatory risk, investors are asking themselves certain questions linked to broader social trends:

- How do we evaluate and respond to the systemic risk of rising economic inequality?

- How do we pre-empt or mitigate potential portfolio impacts of local and geopolitical conflict?

- Which sectoral risks and opportunities will be brought on by AI and how will they change the relationships between companies and their stakeholders?

- How do we manage the inherent supply chain risks of the low-carbon transition?

In other words, investors are increasingly concerned with the financial risks – legal, reputational, operational – as well as opportunities related to the human rights and social performance of their portfolio companies.

Taking a deep dive into our 2023 signatory reporting data, we analysed how more than 3,700 PRI signatories – specifically asset owners and investment managers – are implementing human rights standards across global markets. It’s perhaps no surprise that we found a sharp rise in investor action on human rights as a means to navigate a challenging investment context.

In recent years, we, in close collaboration with signatories, have delivered guidance and tools to help investment organisations strengthen their human rights governance and due diligence.

Our guidance, and our signatory reporting framework, are based on recognised international human rights frameworks, for example, the UN Guiding Principles on Business and Human Rights (UNGPs) and their three-part requirement: policy commitment, due diligence and access to remedy.

Key findings

Findings from the 2023 reporting cycle indicate that human rights and social issues are increasingly important to institutional investors, and signatories are taking more action to shape real-world outcomes.

- Over half of signatories have responsible investment (RI) policy commitments that include guidelines on human rights, and 78% of RI signatory policies have broader guidelines on social issues – increasing from 69% in 2021. A higher percentage of signatories in Europe and Oceania incorporate these guidelines and make them publicly available.

- A total of 2,251 signatories, representing 60% of signatories that reported in 2023, indicated that they use one or more human and labour rights frameworks to identify the intended and unintended sustainability outcomes connected to their investment activities. Of these frameworks, the UN Sustainable Development Goals (SDGs) were the most commonly used, followed by the UNGPs and the OECD Guidelines for Multinational Enterprises (OECD Guidelines).

- Adoption of the UNGPs and the OECD Guidelines has increased most significantly among investment managers (increasing from 18% to 30% of signatories across two years). A larger percentage of asset owners continue to identify human rights outcomes using these frameworks. A total of 950 investment managers and 235 asset owners reported using these frameworks, representing USD$61.8 trillion and USD$13.2trn in assets under management (AUM*) respectively. Adoption of these frameworks remains largely a European phenomenon, with 71% of the signatories using these frameworks coming from this region.

- Approximately 11% of signatories reported enabling access to remedy, of which 8% provided access to remedy via engagement with investees, and around 3% provided access to remedy directly themselves.

Although more signatories are adopting human and labour rights frameworks, only a minority (9%) of PRI signatories takes action across all three pillars outlined by the UNGPs (policy commitment, due diligence and access to remedy).

*AUM figures may include an element of double counting. For example, an investment manager managing the funds of an asset owner where both are PRI signatories is double counted. The total AUM reported by signatories in 2023 amounts to US$141.5trn. However, the PRI global AUM, adjusted to exclude double counting, is US$128.4trn.

Download the full report below.

Downloads

References

[1] S&P Global (2024), Labor: A critical component of supply chains under growing pressure