Diversity, equity and inclusion (DEI) have a clear basis in human rights. This is reflected in the Universal Declaration of Human Rights as well as in the International Labor Organisation (ILO) standards. The PRI’s 2020 report, Why and how investors should act on human rights, clarifies how the UN Guiding Principles on Business and Human Rights set expectations for investors to act on human rights, including those related to DEI.

It is clear that DEI and financial performance are related (as outlined in this paper). However, efforts to address DEI are not widespread across industries and geographies, and inequalities have been further exacerbated by the Covid-19 pandemic.

One of the key obstacles is social bias. Efforts focused solely on diversity – defined as a difference of identities or characteristics, such as gender, race and sexual orientation, among others – assume a level playing field based on meritocracy: that as long any person works hard, they will be able to reap the benefits. Consideration of equity and inclusion, alongside diversity, is needed to ensure not just equal opportunity but also equal outcomes for people.

Investors have a very important role in advancing DEI efforts for all groups in society, including indigenous communities, women, people of colour, religious minorities, and others. To act on DEI, investors need to seek to shape inclusive corporate cultures, business models and societies.

This paper outlines how and why investors can contribute to equity for all and provides the case for integrating DEI into investment and ownership decisions. It also outlines how investors can lead by example and address DEI within their own organisations.

Our work was developed through interviews with investors and other stakeholders, research on investor practices and a literature review on the current DEI landscape within investment activities. The paper can be used by asset owners, investment managers and service providers globally to develop their approach to DEI.

Human rights is the overarching umbrella for our work on social issues. Alongside this work on DEI, we are developing a position on the decent work agenda, which will cover four pillars, including equity, opportunity and treatment, as well as living wage and social protections which are connected to the right of non-discrimination. Our objective is for investors to consider these issues holistically rather than in isolation.

PRI-commissioned research: DEI and voting practices

Mentions of DEI in signatories’ proxy voting policies have more than doubled from 6% in 2017 to 21% in 2020. Mentions of DEI within the PRI’s Reporting Framework have also been growing steadily between 2014 and 2019. However, the overall number of investors mentioning or working on DEI in their proxy voting polices is still low, which does not match the increasing public commitment from investors to work on these issues – notably following the 2020 global Black Lives Matter protests.

COVID-19 and inequality: A crisis

The COVID-19 crisis has exacerbated inequalities. McKinsey & Co calculated that by June 2020 women’s jobs were 1.8 times more vulnerable to the crisis than men’s jobs, and that although women made up 39% of the global workforce, they accounted for over half of overall job losses.[1]

The current pandemic has also highlighted the inequity in health and wellbeing amongst different groups. In the US, African American people make up 13% of the total population but constitute 33% of COVID-19 hospitalisations.[2] In Brazil, indigenous people who contract the virus die at nearly double the rate of the general population. In the UK, people of colour are at 10-15% higher risk of death due to COVID-19 compared to their white counterparts.

The terms diversity, equity and inclusion are often used interchangeably. It’s important to note that each term has a unique and significant meaning.

Diversity

Diversity can be defined as the presence of difference within a given context, such as an organisation. The term can refer to a diversity of identities, or characteristics, such as gender, race and sexual orientation. Diversity refers to a group, rather than an individual. However, a person can bring additional diversity to a company or group.

Inclusion

Inclusion can be described as the actions taken to understand, embrace and leverage the unique strengths and facets of identity for all individuals so that they feel welcomed, valued and supported. It goes beyond representation. It is the level of empowerment and participation individuals have within a given setting. Inclusion is not a natural consequence of diversity. American activist and DEI thought leader Verna Myers stated that “[d]iversity is being asked to the party. Inclusion is being asked to dance”.

Equity

Equity means people have fair access, opportunity, resources and power to thrive. The goal is to move beyond historical and systemic barriers to achieve greater fairness of treatment and outcomes. Equity is often confused with equality. Equality means that all people are treated identically, without consideration for barriers and disadvantages that exist for particular groups. Studies referenced often use the terms ‘equity’ and ‘equality’ interchangeably.

The focus of DEI efforts will vary depending on the type of organisation and corporate culture. For example, some organisations may focus more on diversity of thought or cognitive diversity, whereas other organisations may focus more on individual characteristics, such as gender, race, disability, age, sexual orientation, gender identity, religion or belief, care-giving responsibilities, socio-economic background and linguistic groups. The specific solutions or interventions will depend on the area of focus.

Driving DEI beyond diversity and gender

Until recently, investors have focused largely on gender and diversity, such as the percentage of female representation on company boards, rather than on broader issues of inclusion and equity and on characteristics beyond gender.

From diversity to inclusion and equity

For investors, diversity could be considered one of the clearest ways to measure and evidence progress. This has been a good starting point for DEI; however, investors need to look beyond diversity and address equity and inclusion as well. Inclusion is key to ensure different groups in society can access positions with decision-making power. This work also needs to be coupled with efforts aimed at equity, by ensuring everyone in society enjoys fairness of treatment and outcomes.

Inclusion drives diversity at all levels of the workforce. An inclusive company will likely find it easier to hire and retain employees, especially employees from underrepresented groups.[3] Focusing solely on quotas at board level may have a detrimental effect in generating a larger pipeline of potential female executives.[4] When talking about gender diversity, a recent report from MSCI shows there has been a steady improvement in the percentage of women on boards (currently at 20.6% for the MSCI ACWI).[5] However, looking more closely at women in positions of influence, which is more linked to inclusion and equity, the report shows that only 4.8% of the MSCI ACWI constituents have a female CEO.

From gender to all groups in society

Gender diversity does not necessarily lead to other types of diversity. Even though we have seen an increase of women in senior positions – for example a study from McKinsey & Co shows that women make up 21% of C-suite positions in the US in 2020, an increase of 3.7% from 2015 – the number of women of colour remains low, representing only 3% of those positions.[6]

These facts highlight the importance of intersectionality, where the effects of multiple forms of discrimination (such as racism, sexism, and classism) combine, overlap or intersect, especially in the experiences of marginalised individuals or groups.[7] For example, it would be beneficial to seek information on the turnover of Black women at an organisation, rather than looking at women and Black employees separately. This information could provide greater insight into how groups are treated in the workforce and the barriers that groups face when they have more than one identity which typically experiences inequity or a lack of inclusion.

For example, the most recent Stonewall Top 100 Employers benchmark shows a decrease in levels of engagement for LGBTIQ+ employees with disabilities and non-binary respondents compared to those who identify as gay and lesbian.[8] The latest Disability Equality Index shows that one in four Americans have a disability but they are twice as likely to be unemployed compared to those without disabilities.[9]

Legal and regulatory developments

Governments around the world are increasingly introducing legislation to ensure that businesses and investors are delivering social value. Many countries already have national legislation that addresses DEI explicitly, for example, the Canadian Business Corporation Act requires federally distributing corporations to disclose information on the representation of four designated groups: aboriginal peoples; women; members of visible minorities; and persons with disabilities. They are also required to disclose their diversity policies to increase representation among board directors and senior management or explain the absence of these policies before shareholders during every annual meeting. Some additional examples are below.

| Country / market | Regulation | Commentary |

|---|---|---|

|

Chile |

Chilean Labour Code (Law No.21,275) |

Companies are obliged to adopt measures to include employees with a disability. |

|

Finland |

Non-Discrimination Act 1325/2014 |

This Act requires any authority, education provider or employer that regularly employs at least 30 employees to establish an equality plan. It also prohibits discrimination, harassment, and denial of reasonable accommodation. |

|

Iceland |

Act on Equal Status and Equal Rights Irrespective of Gender, No. 150/2020 |

This Act aims to prevent discrimination on the basis of gender and to maintain gender equality and equal opportunities for the genders in all spheres of society. |

|

India |

The Rights of Persons with Disabilities Act, 2016 |

The Act replaces the 1995 law on disability. The Act is in line with the principles of the United Nations Convention on the Rights of Persons with Disabilities and encourages establishments to have an accessible and discrimination-free workplace. |

|

Portugal |

Social Balance Law 7/2009 |

This legislation requires all companies to maintain a five-year record of the registration of their recruitment processes, professional training and promotion, and working conditions, with a breakdown by sex. |

|

South Africa |

Broad-based Black Economic Empowerment Act |

This act includes a mandate for incentive schemes to support Black-owned and managed enterprises. It seeks to deracialise all aspects of the South African economy and bring marginalised communities into the mainstream. |

|

Spain |

Organic Law 3/2007 for the effective equality of women and men |

This law encourages companies to promote equality between men and women. Article 45 states that companies with over 250 employees must formulate and implement an equality plan. |

|

United Kingdom |

The UK Gender Pay Gap Reporting Act |

From 2017, mandatory gender pay gap reporting requires public disclosure of overall, mean and median gender pay gaps across the workforce for companies with 250+ employees. |

|

US, State of California |

California Corporations Code, as amended by Assembly Bill 979 |

This law requires corporations to have at least one director from an underrepresented community by the end of 2021. It also requires corporations with five to eight directors to have at least two directors from underrepresented communities, and those with more than eight directors to have at least three directors from underrepresented communities by the end of 2022. Non-compliance with the law will incur an initial financial penalty of $100,000. |

Besides national and regional legislation, financial regulators are also pursuing disclosure rules around DEI. For example, Nasdaq Stock Exchange recently submitted a proposal to the US Securities Exchange Commission to change the listing rules to include disclosures around board diversity. There have also been developments of voluntary frameworks for investors with the Chartered Financial Analyst (CFA) Institute developing a voluntary code to guide DEI in the investment industry for the US and Canada. The CFA plans to expand this code to other geographies.[10]

Risks and opportunities

Whilst many studies determine a correlation between DEI and financial performance, there are a handful of studies which explore the causal relationship.[11] Strong DEI within a company can positively affect decision-making, levels of employee engagement, reputation amongst stakeholders, innovation and access to untapped markets. There are also significant risks in failing to improve or ignoring DEI: for example, studies in the US show high incidences of sexual harassment can impact market performance, profitability, as well as staff productivity and turnover.[12]

Shifting demographics are important to note here. A recent survey shows that 47% of millennials are actively looking for diversity in the workplace when sizing up potential employers.[13] In addition, in countries such as the US, most workers will soon be people of colour.[14] It therefore becomes increasingly important for companies to consider how DEI features in their employee base and in their search for new talent.

Decision-making

Diversity within companies brings different perspectives and can reduce groupthink, which can help to strengthen decision-making.[15] This cognitive diversity can lead to solving problems faster,[16] strengthened risk management,[17] more accurate predictions[18] and increased innovation. One study found that companies with more diverse management teams have 19% higher revenues due to innovation.[19]

DEI in investment teams

Specifically, within investment organisations, DEI can strengthen decision-making. A diverse and inclusive culture within the investment team is also crucial to ensure it is working to represent and understand the end beneficiaries. According to Willis Towers Watson, investment teams with diversity, in particular ethnic diversity, tend to generate better excess returns.[20]

There is also a growing body of research to suggest that diverse teams can strengthen performance on other ESG issues. One study finds that diversity of skills, gender and age could accelerate the integration of climate-related issues by investors and boards of directors.[21] Gender diversity is also said to lead to better identification of key ESG issues as critical to corporate strategy by the board.[22] Diversity within investment organisations can also reduce conduct risk;[23] prevent risky overinvestment decisions;[24] result in fewer instances of fraud[25] and fewer financial reporting mistakes and controversial business practices.[26]

Employee engagement

Beyond the benefits of cognitive diversity, there is significant evidence to suggest that DEI can strengthen a company’s ability to recruit[27] and retain[28][29] employees.

It’s important to note that these benefits are only fully realised when inclusion (as well as diversity) is part of the organisation’s culture.[30] Put differently, being more diverse does not guarantee performance improvements, unless the experiences of individuals are positive.[31]

A sense of inclusion can also lead to greater attendance at work;[32] improved performance, productivity,[33] creativity and a better assessment of consumer interest and demand.[34]

Brand value and market opportunities

A diverse and inclusive workforce can help companies to understand and recognise the needs of different stakeholder groups.[35] Most notably, DEI within an organisation can strengthen its reputation and increase its client or customer base.

Consumers are increasingly looking for products that are accessible to everyone and can be used by a diverse range of people with different identities.[36] In addition, consumers want to see commitments and evidence of action on DEI – companies that are slow to progress on DEI risk losing business.[37]

Example: Fenty Beauty and inclusive beauty products

Fenty Beauty was launched in 2017, with the aim of offering make-up for all skin tones and ensuring that “every woman felt included in this brand”. The brand celebrated inclusivity in their make-up campaigns and put a spotlight on the need for a diverse range of beauty products.

Within 40 days of the launch of Fenty Beauty, it generated USD$100 million in sales. TIME also named Fenty one of the 25 best inventions of the year. In response, several brands have broadened their offerings to serve a more diverse customer base. Some have called this the “Fenty Effect”.

Beneficiary preferences

Many beneficiaries have preferences related to their investments’ DEI performance. For example, pension provider PensionBee found that 57% of its savers expect companies in their pension to publish ethnicity pay gaps.[38]

Asset owners should consider beneficiaries’ sustainability preferences as critical to building trust and maintaining their social licence to operate as fiduciaries. It is also an opportunity to increase the satisfaction and pride that beneficiaries feel regarding their savings and who is managing them.[39]

Therefore, asset owners are showing more interest in understanding the different expectations and needs that different beneficiary groups may have of their investments and how investment managers are addressing DEI, in their own organisations and through their investment activities.

Asset Owner Diversity Charter

In 2021, the Asset Owner Diversity Charter was formed with a set of actions that asset owners can take to improve diversity across the investment industry.

The charter has two key components. The Asset Manager Diversity and Inclusion Questionnaire aims to standardise complex diversity metrics, beyond gender, and to improve disclosure. The questionnaire results will feed into a progress report to inform engagement on improving diversity and inclusion.

The second component is the Asset Owner Charter Toolkit, which helps signatories to implement the Charter and includes critical topics such as manager monitoring and selection.

DEI as a systemic issue

Diversified investor returns rely on overall economic performance, meaning investors are incentivised to look beyond the interests of their individual investees and more broadly on systemic issues, support broader sustainability outcomes and well-functioning financial markets.[40] For this reason, investors have an interest in the overall DEI performance within an economy. A just, equitable and fair society where everyone can participate and reach their full potential is the social capital that societies, companies and investors rely on to prosper. There is a large body of evidence (set out in this section) to suggest country-level and global inequalities (including across gender and race) can be detrimental to the economy.

Inequalities in wealth and education and broader discrimination can lead to occupational barriers where disadvantaged groups are less likely to pursue careers despite having ability, resulting in a misallocation of talent and inefficiencies in the economy.[41] These barriers, specifically impacting African Americans over the last 50 years, have cost the US economy up to 40% of aggregate productivity and output.[42]

Inequality can also cause political, economic and financial instability. A recent IMF study found that longer spells of economic growth correlate with greater equality, and in the long term, reduced inequality and sustained growth may be two sides of the same coin.[43]

By enabling the full economic potential of all people, the size and skills of the workforce may grow, productivity may increase, and long-term economic growth may be boosted. One study finds that by 2050, the US stands to realise an USD$8 trillion gain in GDP by closing the US racial equity gap. It was also found that by raising the average earnings of people of colour in the US to match those of white people (by closing gaps in health, education, and opportunity) this would generate an additional USD$1 trillion in earnings, a 15% gain.[44] Additionally, it is suggested that in Britain, GBP£24 billion could be added to the economy by realising the full potential of Black and minority ethnic individuals.[45]

Economic inclusion of women also strengthens the economy’s ability to grow. If women’s participation in the global economy were equal to men’s, the global annual GDP would be boosted by USD$28 trillion by 2025.[46] This potential is noticeable in emerging markets, where better opportunities for women to earn and control income could contribute to broader economic development.[47]

Economic inclusion is also shown to boost global innovation. If women, people of colour, and people from low-income families were to invent at the same rate as white men from high-income families, there would be 4.04 times as many inventors in the US.[48] Research shows that there is a direct link between diversity, equality and innovation. It was found that innovation was six times greater in the most equal cultures than in the least equal ones.[49]

Reducing inequality and increasing economic inclusion of disadvantaged groups would no doubt have positive effects. For example, for families of disadvantaged groups, businesses that depend on them as customers and employees, and societies that rely on their health, well-being and tax contributions.[50]

Labour, alongside capital stock and technological advancement, is an input for growth and the social and economic development of countries. Countries’ business environment and DEI performance will have an impact on labour participation rates and on composition of the labour force. By enabling increased labour participation of various groups with different skill sets in society, DEI action could directly boost economic growth.[51]

The connection between DEI and other systemic issues, such as inequality, has led to increasing expectations from regulators, clients and beneficiaries for investors to consider the sustainability outcomes of their investments. By acting on DEI, investors help to drive changes that lead to positive and sustainable outcomes for people in line with, among other frameworks, the SDGs and the Universal Declaration of Human Rights.

To achieve progress on DEI, investors should take meaningful action. Change will not be bought about by minimal adjustments to existing policies and processes or making commitments and statements. It will require a unified, holistic approach, pulling together a variety of voices — individuals, community groups, policy makers, corporations and investors — and putting those most impacted at the heart of the conversation.

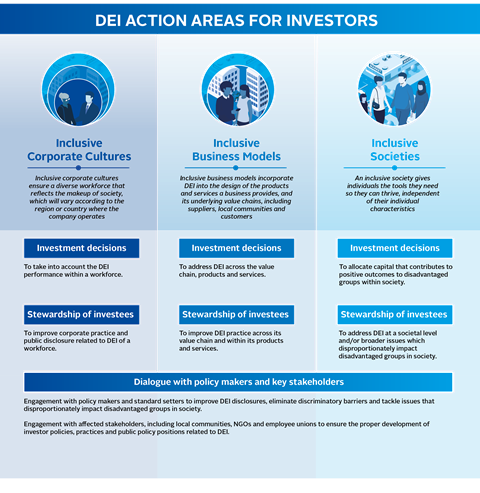

Institutional investors can act across three areas: inclusive corporate cultures; inclusive business models; and inclusive societies, noting that these can overlap. For example, access to education (inclusive society) may impact the diversity of candidates for recruitment (inclusive corporate culture).

Inclusive corporate cultures

Inclusive corporate cultures ensure a diverse workforce that reflects the makeup of society, which will vary according to the region or country where the company operates. Employees are empowered because structural barriers are recognised and addressed. Currently, many initiatives are focused on diversity at leadership or board level; however, attention should be paid to all employees, as well as to different workplace processes including recruitment, retention, development and promotion. This action area on corporate culture focuses on direct employees of investors and investees.

Inclusive business models

Inclusive business models incorporate DEI into the design of the products and services a business provides, and its underlying value chains, including suppliers, local communities and customers. For example, for investors, an inclusive business model means using DEI as criteria for the selection, appointment and monitoring of external investment managers and other service providers.

Inclusive societies

An inclusive society gives individuals the tools they need so they can thrive, independent of their individual characteristics. This action area refers to broader societal issues which disproportionally impact disadvantaged groups and requires interventions that go beyond the efforts of just companies and investors. To realise economic and productivity gains, coordinated and comprehensive change is required across a range of policy areas, as well as investor engagement to influence change across all industry sectors.

Investor internal efforts

Alongside driving DEI through their own portfolios, investors should address DEI within their own internal activities which requires action across recruitment, retention, development and promotion practices, including pay policies. Investors should look at the effectiveness of DEI efforts across different levels and teams within the organisation, including investment committees and fund teams.

Example: Old Mutual

As part of Old Mutual’s transformation efforts, it runs an investment analyst programme to develop and retain Black employees to become high-quality investment analysts, and in so doing, the company is building a strong Black talent pipeline. There is also formal training to further develop technical and interpersonal skills, as well as sponsor professional studies. This is a comprehensive programme including mentorship, on-the-job assignments, and assessments.

Investors should also consider DEI issues in relation to other stakeholders beyond employees, such as local communities, contractors and the rest of their supply chains.

Investor levers for action

- Investment decisions

- Stewardship of investees

- Dialogue with policy makers and key stakeholders

Investment Decisions

Engagement with beneficiaries

Beneficiaries may feel the impact of DEI beyond their investment returns, in their role as employees, consumers and citizens. Therefore, investors should consider engaging with beneficiaries and clients to understand their broad values to guide investment activities related to DEI. In addition, investors can assess and understand the expectations that different beneficiary groups may have of their investments (i.e. faith-based finance).

Screening

Investors can apply DEI-related filters to potential investees to rule out the worst performers or include those investees and engage with them, demonstrating leading practice. Screening criteria for potential investees may include disclosure on DEI metrics, a diversity policy or a minimum level of diversity within the workforce, as well as disclosure and resolution of DEI-related grievances (such as lawsuits for pay/promotion discrimination and sexual harassment cases). Investors will need to develop clear screening criteria matched to their set objectives on DEI.

For passive strategies, investors can consider how the overall exposure to a particular DEI factor is reduced or increased by adjusting the weights of constituents, dependent on ESG factors. This may be reflected in a bespoke index.

Investment selection in private markets

For those investors with higher controlling stakes, an initial screening against DEI expectations could prompt further investigation during due diligence or lead to abandoning the investment entirely. The due diligence process typically involves investigating legacy issues, but also identifying future risks and opportunities that will become the focus of DEI management efforts during the holding period.

Investors can consider the actual and potential outcomes of investees’ business models for external stakeholders such as consumers, communities and suppliers. Investors should develop clear screening criteria to match their own values and DEI objectives.

Financial products

Even though investors should consider DEI across all portfolios, they can also consider developing specific financial products, such as ETFs and mutual funds, that use diversity as the main weighting criteria.

Investors can also consider gathering DEI data on beneficiaries and clients (i.e. current and future savers) to assess whether existing financial products and services cater to their needs and expectations, and to understand how the diversity of their own staff may need to change to better align with their client base. In this way, investors could enter new markets.

Example: Unipol Gruppo

Unipol Gruppo, an asset owner based in Italy, focuses on developing products and services that help to solve pressing social issues that have come about due to growing inequalities and lower social protection.

For example, Unipol offers zero-interest rate funding, designed to safeguard the purchasing power of the most vulnerable sections of society.

The company is currently analysing the breakdown of its clients to consider how its products (including pension funds and insurance) can be developed to serve different groups.

Example: BMO Real Estate Partners

In 2020, BMO Real Estate Partners, the pan-European property investment and asset management specialist that is now part of Columbia Threadneedle Investments, announced the first round of funding for its newly developed UK housing strategy.

The aim of the new fund is to address a distinct gap in the UK housing market by offering high quality, sustainable, community-based rental property, targeted at low to middle income households whose needs are not currently being met and where a real growth opportunity exists, given the UK housing market fundamentals. Investment will be governed by a social agenda, aligning with ESG and impact investment objectives.

The fund will use a range of criteria to evaluate the ESG credentials of a scheme including:

- Affordability and provision

- Societal change

- Quality of property management and governance

- Environmental impact – local

- Environmental impact – surroundings

- Resilience

The fund has developed defined objectives and conditions which must be achieved to demonstrate additionality.

External investment managers and other service providers

Asset owners can include DEI in due diligence questionnaires to external managers and other service providers. It’s important to ask specifically about investment teams, which historically have lacked diversity, rather than just the organisation as a whole. These teams will also be directly responsible for implementing any directives around DEI into investment decisions and engagement with investees. Investors should also embed requirements into legal documentation and identify minimum reporting disclosures.

Investors can also ask about inclusion and the culture within an external manager/fund – including questions around whistleblowing, harassment and discrimination policies.

Example: ILPA DDQ

In 2018, ILPA published an expanded version of its DDQ to advance diversity and inclusion within the private equity industry. It contains questions to understand a General Partner’s policies and procedures in areas such as harassment, discrimination, workplace violence and misconduct.

Capital allocation

Supporting growth of business owned by underrepresented groups

Access to financial capital can be an obstacle for businesses owned by underrepresented groups and this is a missed opportunity for investors. Small and medium-sized companies can be considered riskier for investors. However, investors can consider alternative vehicles such as venture capital, growth equity and/or private venture debt without having to increase the risk profile of other investments and therefore still comply with their fiduciary duty.

Whilst venture capital is a significant engine for job creation and plays a material role in funding the next generation of business leaders, it has not provided proportionate or equivalent funding to underrepresented groups such as women and people of colour. In geographies where private market options, such as VC, are limited (i.e. Latin America),[52] investors can consider alternative financial vehicles such as social or impact bonds, which can provide funding to underrepresented groups, particularly SMEs or people who participate in the informal economy.[53]

Supporting businesses that drive equity and inclusion

Investors should consider identifying key social outcomes focused on inclusion and equity and shaping those outcomes through investments and across investors’ portfolios. Examples of possible actions are investing in companies or sectors that contribute to increasing access of all groups in society to services such as health and sanitation as well as finance, education, affordable housing and justice.

This includes investment in the wide range of products and services that will drive positive impacts for specific groups and address actual or potential adverse human rights outcomes of investees.

Spotlight: DEI and the decarbonisation of Europe’s built environment

A recent report from the Institute for Human Rights and Business encourages investors and policy makers to look at how they can finance the decarbonisation of Europe’s built environment.

The report explains that socio-economic and geographic disparities are closely linked to racial and ethnic disparities and that decisions about where we invest, including those deemed green investments, directly correlate with how and what parts of the city are developed, who benefits, and who is left behind.

Therefore, within their investment decision and capital allocation process, investors need to understand whether any existing or future green investments could exacerbate social inequalities, while making sure that investment also flows to areas that have traditionally been excluded.

Spotlight: Transition to the low-carbon economy and indigenous peoples’ rights

The mining sector is key in the transition to a low-carbon economy. According to the Transition Minerals Tracker, demand for minerals such as lithium, cobalt, copper and nickel is expanding as “companies race to produce the technology needed to support the energy transition, from electric vehicles to solar panels to wind turbines.”

However, human rights allegations in the sector are also growing at an alarming rate, and investors need to consider the social implications of the increase in demand alongside the environmental benefits.

For example, in South America, almost a fifth of the allegations tracked by this initiative relate to indigenous peoples’ rights, including violations to free, prior and informed consent. Another report for the Washington Post shows that indigenous communities report not being properly compensated for the exploitation of their ancestral lands, nor receive the promised economic benefits that derive from mining activities, while companies operating locally provide very limited public information about their relation with indigenous communities or economic compensation.

Stewardship of investees

Investors can use their influence over current and potential investees across all asset classes to improve corporate practices, outcomes and public disclosure related to DEI.

Investors should consider engaging with end beneficiaries and clients to understand their broad values to guide stewardship activities related to DEI. For example, an asset owner may consider explicitly addressing racial diversity in their voting policy/principles where this is a priority issue for beneficiaries.

While continuing efforts to promote high standards globally, investors should consider adjusting their stewardship objectives depending on the size, region and sector of the investee as every company is different. For instance, it may be unreasonable to expect a high level of racial diversity in a company based in a country with a low level of racial diversity, such as Japan. Investors should also consider legal requirements which may prevent investees from meeting investor expectations on DEI (for example, French law prohibits the collection of any data based on race, ethnicity or religion).

Corporate engagement

Engagement on public disclosure

Where public disclosure will improve transparency within the market or provide investors with information to support engagement and decision-making, investors should consider engaging with companies to disclose information related to its workforce DEI across several characteristics. To capture a clearer picture of the organisation, investors should consider pushing for information on DEI across all levels within the organisation and within different departments. Investors should also consider pushing for disclosure of data on groups which have more than one identity and typically experience inequity or a lack of inclusion.

Investors can also encourage companies to disclose inclusion metrics and look at the treatment of staff across the recruitment, retention, development and promotion employee lifecycle, and how this is broken down across different characteristics and identities. Metrics may include the return rate from parental leave for men and women and the average turnover rate for LGBTIQ+ employees.

Engagement on company practice

Engagement with companies may start with high-level discussions on issues such as a diversity policy, setting diversity targets and assigning senior leadership (with a sufficient level of expertise on DEI) to oversee company efforts and progress. This can evolve into more detailed discussions on company practice, such as development opportunities offered to underrepresented groups, fair recruitment processes and family leave policies. Investors should also consider engaging with companies on broader issues which intersect with DEI, such as whistleblowing.

Investors can also engage with investees on DEI issues connected to stakeholders beyond employees, such as consumers, local communities and contractors. For example, investors can influence investees to research, develop or enhance products across asset classes to better service specific groups in society, or at a minimum, prevent disproportionately negatively impacting specific groups.

Example: Investor statement on facial recognition

In 2021, CANDRIAM coordinated an investor statement which calls on companies involved in facial recognition technology to increase disclosure, demonstrate awareness of the impact on human rights and adopt ethical practices. This was in response to the rapid deployment of facial recognition technology and major concerns about the impact on privacy, data protection and civil liberties. The statement highlights the potential risk of racial and gender bias in facial recognition systems and calls for this technology to be monitored.

Further, specific groups often disproportionately make up a large proportion of a company’s supply chain, for instance 30% of the full-time supply chain workforce are people of colour in the US, and therefore investors can encourage investees to ensure their DEI efforts and policies extend to contractors and people in their value chain.

Voting

Listed equity investors can use their position (and legal rights) as partial owners of companies to influence how companies address DEI.

Investors can adopt or amend their voting policy, guidelines or principles to reflect their position on DEI and how they would vote at AGMs, considering beneficiary preferences and an analysis of associated DEI risks to the portfolio as well as outcomes caused by or linked to the portfolio overall.

For example, investors may state that they will support shareholder resolutions that seek to improve DEI-related public disclosure or practice within a company.

Spotlight: DEI shareholder proposals in 2021

In 2021, a record number of DEI-related shareholder proposals were filed and supported, including requests that companies conduct racial equity audits, issue reports on their DEI efforts and develop policies to disclose relevant data.

One shareholder resolution filed at Union Pacific Corporation requested greater disclosure on quantitative, comparable data to understand the effectiveness of the company’s DEI programmes. This included the board’s process for assessing the effectiveness of its DEI programmes, as reflected by any goals, metrics and trends related to the promotion, recruitment and retention of protected classes of employees. The resolution received 81.4% support by shareholders.

Investors can also use their voting rights to address board diversity. For example, investors may determine a minimum acceptable level of diversity on a company board, and when this level is not met, use their voting rights to take appropriate action, such as appointing and removing members of a company board and nominating director candidates for inclusion in the election process. Investors can also vote against the chair or members of the nomination committee where there is a lack of board diversity.

Beyond voting, where a company is slow to make progress, investors can also consider filing a shareholder resolution, requesting action or disclosure on the issue (in jurisdictions where this is possible).

Example: Shareholder resolution on reconciliation and indigenous relations

In 2021, a shareholder resolution was filed at TMX Group, requesting that the company report on its work to:

- develop internal programmes and policies on DEI, including those that encompass current and prospective indigenous employees and relationships with indigenous communities;

- review procurement from indigenous-owned businesses, and those owned by other underrepresented groups, and establish appropriate disclosure practices and objectives; and

- engage with indigenous and other organisations to support this work so that these programmes meet standards that are appropriate for the company and, wherever possible, aligned with commonly used frameworks. Also, to report this work in a way that supports investors’ ability to determine the breadth, depth and content of these programmes.

The resolution received 98% votes in favour by shareholders.

Stewardship to address systemic issues

Investors should consider stewardship activities that improve social outcomes and influence change at an economic or sectoral level, rather than at an individual holding level. This may include collaborating with other investors to engage with the largest companies that have international, sector-wide influence to improve their practices. It can also involve engagement with stakeholders beyond investee companies, such as policy makers.

Investors should also consider engaging with investees to address broader issues which may be connected to DEI, or disproportionately impact disadvantaged groups, for example, decent work and environmental justice[54] (including the just transition, climate justice and deforestation).

Spotlight: Living wage

Although Black workers make up only 11% of the workforce in the US, 38% of Black workers receive the minimum wage. Therefore, urging the largest companies to pay the living wage would help to address the racial wage gap and improve the standards of living for Black workers.

Example: Investor engagement on living wage

One initiative focused on living wage is the Platform Living Wage Financials (PLWF). PLWF is an alliance of 11 financial institutions representing over EUR€2.3 trillion in assets under management.It was founded in September 2018 and uses its financial leverage to engage investee companies to address the non-payment of a living wage to workers in their global supply chains.

See Active Ownership 2.0 for more information on using stewardship to address systemic issues.

Escalation

Where engagement with an investee has been unsuccessful, or the investee is slow to make progress, investors may consider increasing their influence by collaborating with peers. Alternatively, investors may take escalatory steps, such as filing a shareholder resolution, speaking out publicly (such as an op-ed in the media) to draw attention to a company’s practice or DEI in general, or taking legal action, where it is believed that a company has not acted in shareholders’ best interests.

Example: Alphabet sexual harassment shareholder lawsuit

In 2019, AP7, a Swedish pension fund, sued Alphabet based on reports of sexual misconduct at Alphabet and the board’s perceived mishandling of the situation.

Alphabet reached a settlement with AP7. Alphabet agreed to eliminate mandatory arbitration and limit Google’s use of non-disclosure agreements while prohibiting Google from “providing severance to any employee, including a senior executive, terminated for sexual harassment, sexual misconduct, or retaliation”. Alphabet also committed USD$310 million to fund and create a diversity, equity and inclusion advisory council comprised of outside experts.

AP7 stated that legal action is one of its four measures of engagement for sustainable and responsible asset management.

Dialogue with policy makers and key stakeholders

Achieving DEI will require engagement with key stakeholders beyond corporates such as policy makers and civil society.

Engagement with policy makers and standard setters

Investors can encourage rules that strengthen DEI disclosures. Mandatory and standardised disclosure on DEI will allow investors to have more complete information on company performance and practices. Such disclosures should go beyond gender and include other characteristics relevant to the country of disclosure and include measurements around inclusion (e.g. data on the promotion, recruitment and retention rates of different employees) that cover the whole organisation and not just the board or C-suite.

Investors can also encourage and support standards, policy and legislation that promote inclusion and equity by eliminating discriminatory barriers and implementing policies that support work, homeownership, entrepreneurship and well-being for all groups in society. Investors, collaborating with other stakeholders, can seek to input to policies and standards, including through responding to consultations.

Investors should also consider focusing efforts on policy development to tackle issues that can disproportionally impact disadvantaged groups in society, such as modern slavery, living wage, freedom of association, equal opportunities, protection of cultural heritage, health equity, and the just transition.

Engaging with policy makers and standard setters on broader sustainable investment policy may also help to strengthen DEI. For example, the inclusion of DEI in stewardship codes clarifies investors’ expectations in addressing systemic issues related to achieving an inclusive society and can provide a framework for addressing DEI in different asset classes.

See the PRI and World Bank Group’s Toolkit for Sustainable Investment Policy and Regulation for more information on engaging with policy makers.

Engagement with affected stakeholders

Engagement with affected stakeholders, including local communities, NGOs and employee unions is integral to the proper development of investor policies, practices and public policy positions related to DEI.

The PRI is setting out a multi-year work programme on this topic to support investor action on DEI. We will:

Share best practice

- Provide case studies highlighting good practice by investors.

- Provide guidance, where appropriate, on DEI across geographies and asset classes.

Provide guidance on stewardship

- Provide investors with guidance on stewardship to drive DEI across their investees, as well as the inclusion of DEI in the selection, appointment and monitoring of managers.

- Identify policy measures that investors can support to drive progress around DEI as well as enhance their own stewardship activities.

- Provide guidance and support for investors on how to engage with affected stakeholders for the appropriate development of DEI policies as well as monitoring the effectiveness of such polices.

Identify data points

- Support increased data availability from companies and investors to define key outcomes and indicators for data collection and allow country-level comparison.

Support asset owners

- Support standardisation efforts in the development of DDQs to aid asset owners to include DEI in the selection, appointment and monitoring of managers.

Downloads

Diversity, equity & inclusion

PDF, Size 5.06 mb

References

[1] McKinsey & Company (2020), COVID-19 and gender equality: Countering the regressive effects

[2] PolicyLink (2020), Center Racial Equity

[3] Forbes (2020), How Inclusion Improves Diversity And Company Performance

[4] Adams & Kirchmaier (2012), Barriers to Boardrooms

[5] MSCI (2020), Women on boards: 2020 progress report

[6] McKinsey & Company (2020), Women in the Workplace

[7] Crenshaw (1989), Demarginalizing the Intersection of Race and Sex: A Black Feminist Critique of Antidiscrimination Doctrine, Feminist Theory and Antiracist Politics

[8] Stonewall (2020), Top 100 Employers 2020

[9] Disability:IN (2021), Disability Equality Index

[10] CFA Institute (2021), Diversity, Equity, and Inclusion Code (USA and Canada)

[11] Forbes (2020), How Inclusion Improves Diversity And Company Performance; Harvard Business Review (2018), The Other Diversity Dividend; BCEC (2020), Gender Equity Insights 2020: Delivering the Business Outcomes; Brigitte Rohwerder, Institute of Development Studies (2017), Impact of diversity and inclusion within organisations; Mission Investors Exchange (2019), Racial Equity: The Economic and Business Case for Change

[12] Au, Dong & Tremblay (2019), Employee Sexual Harassment Reviews and Firm Value

[13] Weber Shandwick (2016), Millennials At Work: Perspectives On Diversity & Inclusion

[14] PolicyLink (2012), America’s Tomorrow: Equity is the Superior Growth Model

[15] Ruffer (2020), Why diversity matters in investment

[16] Harvard Business Review (2017), Teams Solve Problems Faster When They’re More Cognitively Diverse

[17] Young Zik Shin, Jeung-Yoon Chang, Keyeongmin Jeon, and Hyunpyo Kim (2019), Female directors on the board and investment efficiency: evidence from Korea

[18] Page (2017), The Diversity Bonus: How Great Teams Pay Off in the Knowledge Economy

[19] BCG (2018), How Diverse Leadership Teams Boost Innovation

[20] Willis Towers Watson, 2020, Diversity in the asset management industry

[21] PRI blog (2021), Can diversity accelerate the integration of climate-related issues by investors and boards?

[22] Loop & DeNicola (2019), You’ve Committed to Increasing Gender Diversity on Your Board. Here’s How to Make It Happen

[23] PRI blog (2020), Can gender-diverse boards reduce bank misconduct?

[24] Shin, Chang, Jeon & Kim (2019), Female Directors on the Board and Investment Efficiency: Evidence from Korea

[25] Wahid (2019), The Effects and the Mechanisms of Board Gender Diversity: Evidence from Financial Manipulation

[26] Fan, Jiang, Zhang & Zhou (2019), Women on Boards and Bank Earnings Management: From Zero to Hero

[27] Bright Network (2018), WHAT DO GRADUATES WANT?

[28] Ruffer (2020), Why diversity matters in investment

[29] Catalyst (2019), Getting Real About Inclusive Leadership

[30] Shoreibah, Marshall, & Gassenheimer (2019), Toward a Framework for Mixed-Gender Selling Teams and the Impact of Increased Female Presence on Team Performance: Thought Development and Propositions

[31] Forbes (2020), How Inclusion Improves Diversity And Company Performance

[32] Harvard Business Review (2019), Why Inclusive Leaders Are Good for Organizations, and How to Become One

[33] Black British Business Awards, The Business Case for an Investor-led Diversity Movement

[34] International Labour Organization & Women in Business and Management (2019), The business case for change

[35] Banahan & Hasson (2018), Across the Board Improvements: Gender Diversity and ESG Performance

[36] Zallis (2019), Inclusive ads are affecting consumer behavior, according to new research

[37] Black British Business Awards, The Business Case for an Investor-led Diversity Movement

[38] PensionBee (2021), Pension savers expect ethnicity pay gap reporting and diverse business leaders

[39] PRI (2021), Understanding and aligning with beneficiaries’ sustainability preferences

[40] Quigley (2020), Universal Ownership in Practice: A Practical Positive Investment Framework for Asset Owners

Hawley and Lukomnik (2018), The Long and Short of It: Are We Asking the Right Questions? Modern Portfolio Theory and Time Horizons

[41] Hsieh, Hurst, Jones & Klenow (2019), THE ALLOCATION OF TALENT AND U.S. ECONOMIC GROWTH

[42] The New York Times (2020), Racism Impoverishes the Whole Economy

[43] International Monetary Fund (2011), Inequality and Unsustainable Growth: Two Sides of the Same Coin?

[44] W.K.Kellogg Foundation (2018), Business Case for Racial Equity

[45] HappyMaven (2020), The Business Case for Diversity and Inclusion in the Workplace

[46] Catalyst (2017), The Ripple Effect: Working Women Grow Economies

[47] International Monetary Fund (2013), Women, Work, and the Economy: Macroeconomic Gains From Gender Equity

[48] Bell, Chetty, Jaravel, Petkova & Reenen (2019), Who Becomes an Inventor in America? The Importance of Exposure to Innovation

[49] Accenture (2019), Getting to Equal 2019: Creating a culture that drives innovation

[50] PolicyLink (2014), The Equity Solution: Racial Inclusion Is Key to Growing a Strong New Economy

[51] Lagarde & Ostry (2018), The macroeconomic benefits of gender diversity

[52] McKinsey&Co, (2020), A New Decade for Private Markets

[53] Inter-American Development Bank, (2021), Social Impact Bonds in Latin America: IDB Lat’s Pioneering Work in the Region: Lessons Learnt

[54] NRDC (2016), The Environmental Justice Movement; Columbia Center on Sustainable Investment, Equitable Origin, Business & Human Rights Resource Centre and Sustainable Development Solutions Network (2019), Mapping the Renewable Energy Sector to the Sustainable Development Goals: An Atlas (p. 84); UN environment programme, What is an “Inclusive Green Economy”?