The Dai-ichi Life Insurance Company Limited

- Signatory type: Asset owner

- Asset owner type: Insurer

- HQ country: Japan

Human rights have become an important issue affecting the corporate value of investee companies. It is also important to manage human rights properly to minimise harm. As a Japanese life insurance company and responsible investor, we recognise this in our Dai-ichi Life Group Human Rights Policy. This case study describes how we analyse human rights in corporate activities and factor this into our investment decisions and engagement.

Why we consider human rights in our investments

Nations, investors and consumers are increasingly conscious of human rights issues. In Europe, a series of laws mandating human rights due diligence were adopted, and in Japan, a National Action Plan on Business and Human Rights was announced in October 2020, requiring companies to strengthen their human rights efforts. In addition, due to the growth in social networks, no matter where a human rights violation occurs within a company’s activities, it is quickly disseminated around the world, making the company more vulnerable to social sanctions, such as boycotts.

Companies that neglect human rights in their business activities will face a significant impact on their business performance and shareholder value. For example, Japanese apparel manufacturers saw their stock prices fall as they were subject to an import ban from North America due to suspected forced labour of Uyghurs picking cotton in Xinjiang. Scrutinising the human rights efforts of investee companies and appropriately incorporating this information into investment decisions is becoming an essential part of fulfilling our fiduciary responsibility. In 2021, we selected human rights as an important theme of ESG integration alongside climate change issues, and we are incorporating them into investment decisions. Unfortunately, Japanese companies tend to lag behind compared to European and US companies in understanding and tackling human rights issues. This is broadly reflected in the Corporate Human Rights Benchmark’s (CHRB) assessment of investee businesses across geographies and sectors. Therefore, we strive to promote human rights initiatives by engaging with investee companies.

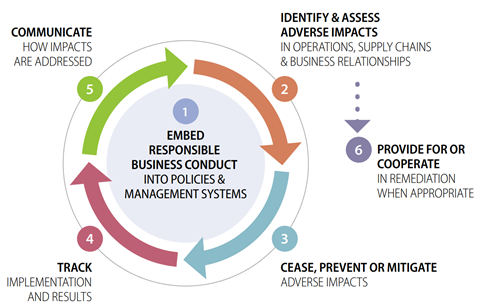

Figure 1: Our human rights due diligence process (Source: OECD)

How we consider human rights in our investments

Human rights vary widely depending on the industry, region, and business model. For this reason, in 2021, we first identified five sectors, including apparel, food and mining, where human rights risks are perceived as relatively high (referring to benchmarks such as CHRB and Know The Chain) and conducted intensive research on 60 companies in these sectors, where we have high market value holdings. While we believe that human rights risks exist in other sectors, we think that those with relatively high risks should be examined first.

Referring to the Guiding Principles on Business and Human Rights (UNGPs), we focus on three main points that companies should address:

1. Formulating human rights policies;

2. Implementing human rights due diligence; and

3. Establishing grievance mechanisms.

With regards to point 1, we confirm whether not only human rights policies but also the related governance system have been established. In terms of the due diligence process, we also review how companies respond to identified human rights risks (point 2) and confirm the specific process for victim relief and information received by engaging directly with stakeholders who have experienced harm (point 3). In addition, since there are efforts that we cannot fully understand through disclosed information alone, we engage with companies on human rights specifically.

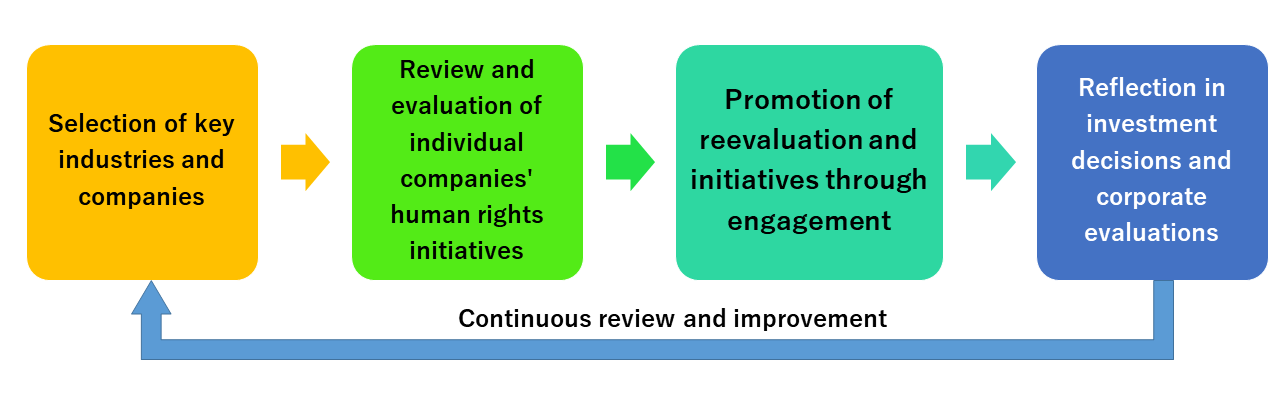

We use information obtained through disclosure and engagement for internal corporate value evaluations and investment decisions after comparing them to their peers. As global trends in human rights are moving rapidly, and companies’ disclosures and requests from stakeholders are expected to fluctuate, we will continuously improve how we evaluate companies.

Figure 2: Our human rights activities flowchart

Example: Assessing high-risk investee companies

After examining the 60 companies in five higher-risk sectors, we found that none of three points we focus on had been fully implemented. While many companies have developed human rights policies, the due diligence appeared not to have been carried out. Companies that lag behind in these efforts are likely to be unaware of the human rights risks lurking in their supply chains, and they face a relatively high risk that human rights incidents will occur in the future, significantly undermining corporate performance, stock prices and corporate value. We focus on these companies to promote efforts to address human rights issues through engagement and adopt human rights risks into our investment decisions and corporate evaluations.

For example, we investigated Company A, a vehicle manufacturer, and discovered it had not established a human rights policy or implemented human rights due diligence. Automobiles are made up of approximately 30,000 parts; there are a large number of parts suppliers, and many of them have factories in emerging markets where human rights problems such as forced labour and overwork are more likely to occur. If Company A fails to take appropriate control and care, there is a risk that the problem will surface (as has been pointed out by local workers and human rights NGOs). In the worst-case scenario, the company will be forced to suspend the plant’s operation. Since the company’s main sales and production bases are in emerging markets, it is essential to identify, prevent and mitigate human rights risks through human rights due diligence. As human rights issues have not yet surfaced at Company A, there is a high possibility that they are not aware of the existence of human rights risks. Therefore, we intend to increase their understanding through engagement and encourage them to promptly formulate human rights policies.

Although human rights risks tend to be a tail risk factor, and there are still issues regarding how to quantitatively reflect them in internal ratings, we are going to reflect them in our investment decisions by comparing with other companies in the same industry.

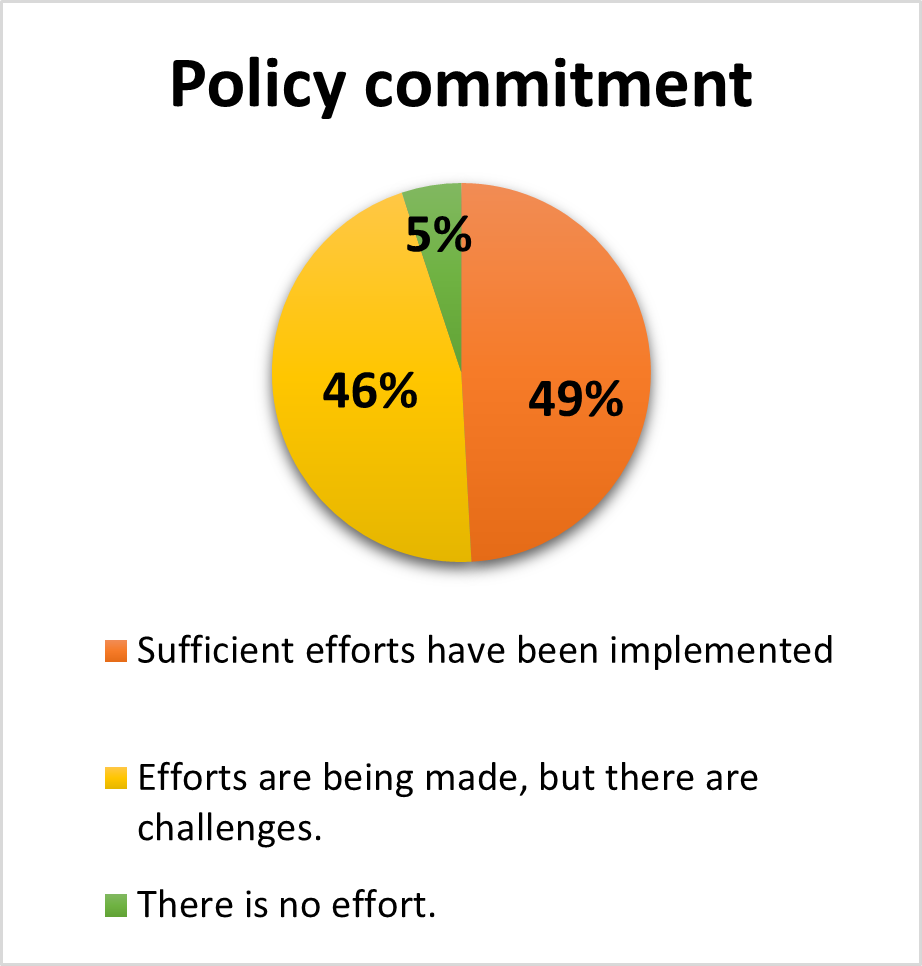

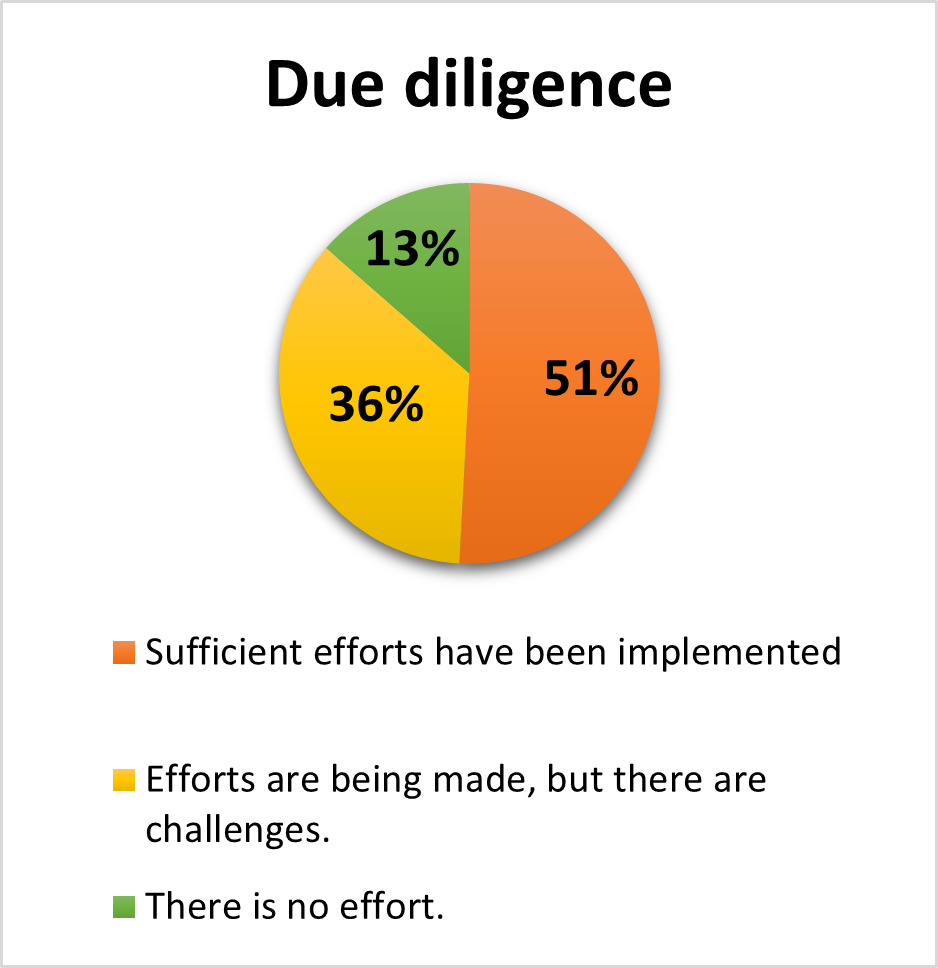

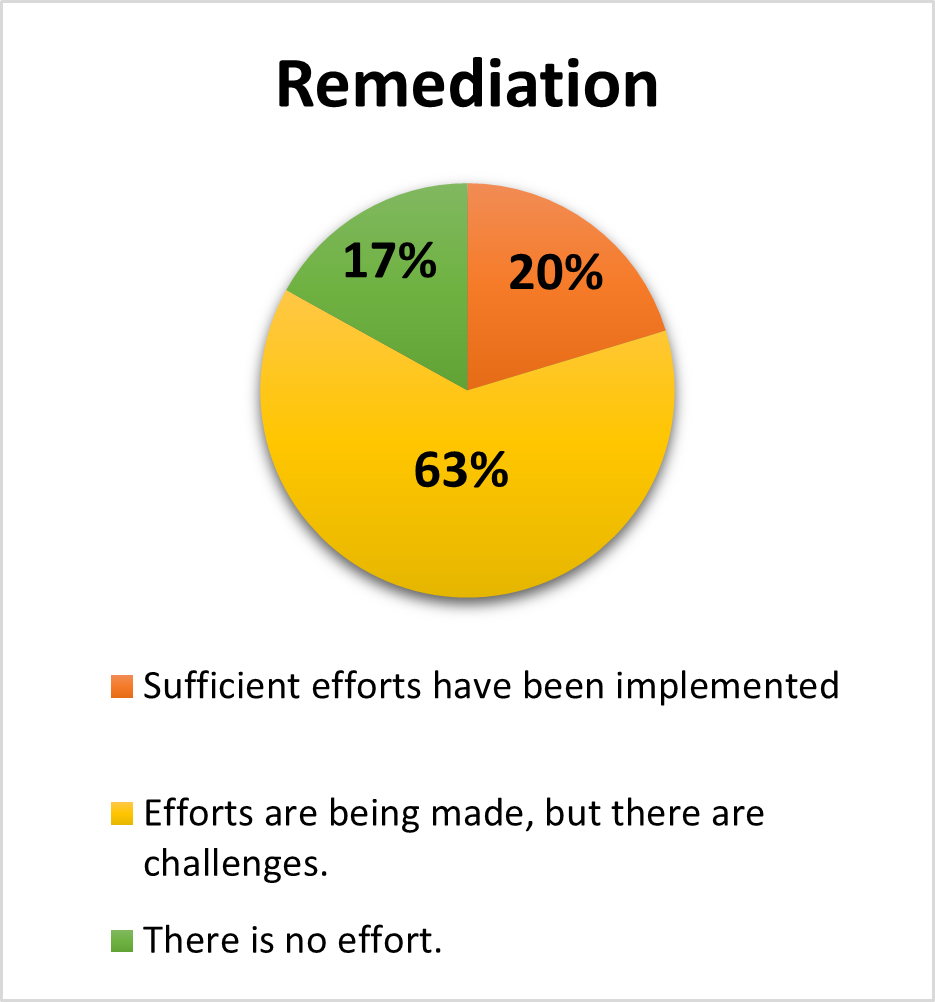

Our analysis showed that many companies do not have suitable human rights policies and processes in place, especially when it comes to remediation, although many are working on establishing them.

Figure 3: Percentage of enterprises assessed implementing human rights initiatives