The 13 US companies investors selected for engagement in 2014 ranked in the lower 50% of all S&P100 company performance on nominations processes when assessed against indicators included in the commissioned research.

After engagement with investors, five of these companies had moved out of the lower 50%. The most commonly raised questions by investors were related to:

- proxy access, closely followed by;

- disclosure of board performance evaluations’ results.

Proxy access

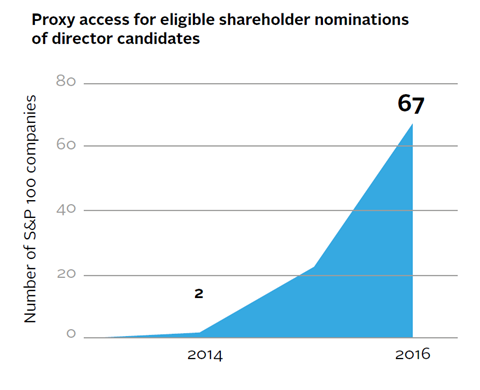

Nine of 12 companies targeted by the group adopted proxy access during the period of engagement. This was owing to much broader momentum in the US focussed on the issue. ISS data shows 67 of 100 companies adopted proxy access (compared with two companies in the 2014 study), demonstrating the extent to which shareholder engagement can affect corporate governance norms in a whole market.

There is huge scope for shareholder engagement to affect corporate governance norms

About proxy access

Proxy access may be written into company bylaws to allow shareholders to suggest nominees for board election via the company proxy card.

The general market approach has been to allow longterm investors or investor groups of up to 20 holders owning stocks for at least three years, to suggest nominations for 20-25% of the board, if they own in aggregate more than 3% of the company’s shares.

The thresholds applied to proxy access may vary across companies, and some of them have adopted proxy access bylaws that require 5% or higher ownership threshold. However, this has been argued as unviable for shareholders, given that few investors would be able to surpass this hurdle. Some companies have also been more restrictive on the number of board members who may be nominated, have set limitations on aggregation of shareowners and restricted re-nominations when a nominee fails to be voted in. The Council of Institutional Investors (CII) best practice guide on proxy access favours a less restrictive approach in order to ensure that the provisions do not limit or impair the ability to use proxy access once implemented.

In 2017, some shareholders may look to amend specific features of adopted bylaws that they believe limit the ability of shareholders to use proxy access effectively.

Proxy access in practice

Shareholder proposals on proxy access saw an unprecedented increase during the study period. Particularly noteworthy here is the Board Accountability Project launched by the New York City Comptroller Scott Stringer and the New York Pension Funds in November 2014, which actively progressed dialogue on this issue.

Investors’ approaches and the extent to which they exercise the right to proxy access will vary, but for the most part, they have not exercised proxy access rights written into company bylaws. Even though they may not choose to use it, proxy access provides meaningful ways of protection for shareholders, and improves board accountability. It is hoped that this will also prompt companies to better articulate their position on board composition, skills and diversity, and to provide a wellconsidered view of how a nominee will contribute to the mix of skills and qualifications needed to deliver their business strategy.

Board performance evaluations

Disclosure of board performance evaluations provides a critical assurance that the skills and effectiveness of the board are monitored.

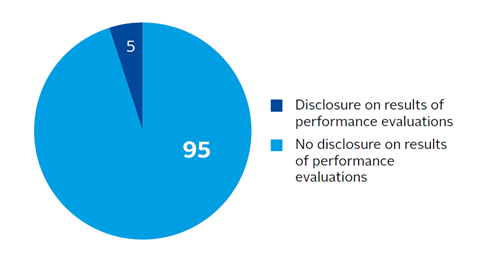

Four of seven US companies engaged by the PRI group and questioned about this began to disclose the results of their assessment after dialogue with investors. This shows that only after flagging the importance of this disclosure for investors do companies move towards sharing this information. This reflects ISS broader market analysis that 95 companies in the S&P100 do not publicly offer the results of periodic board performance evaluations in annual reports or proxy statements.

Disclosure by one of the companies investors spoke to in the PRI engagement, Bank of America, offers a positive example for investors seeking disclosure from other companies on board evaluation.

Companies engaged tended to undertake self-evaluation, mirroring trends in the S&P100 universe where only 11 companies used an external firm to do so, according to the ISS research. Only one company in the S&P100, General Electric, disclosed information on results of the board’s evaluation and stated that an external firm may undertake the review of the board’s performance.

Overall, there has been increased engagement in the US and some meaningful changes seen in both boardroom appointments and disclosure practices. Despite this, reviews of board composition are still lagging for US companies. Investors should continue to push for further disclosure on this issue.

Download the full report

-

Engaging on director nominations

June 2017

Skills

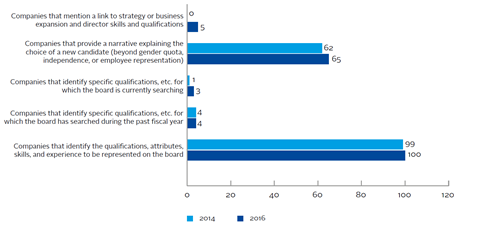

Companies that elaborate on board skills provide valuable insight for investors on the spread of expertise and how they can be supplemented through board renewals. While nearly all companies complied with US disclosure rules by referencing the specific experience, qualifications, attributes and skills for their new nominees, some boards exceeded their regulatory mandate by explaining why they chose particular candidates for directorships in their public disclosures, with reference to specific desired skills, experience and the level of independence that they bring.

Companies involved in the PRI-coordinated engagement demonstrated a clear vision of skills and experience that they were seeking from candidates, in line with this broader trend. One of the companies, in giving precedence to skills over experience, appointed two new board members with no previous board experience. They did, however, have cyber security and supply chain expertise. A couple of companies made clear that lack of previous board experience was not a barrier to appointment. Engagement dialogue was particularly constructive in drawing out boards’ careful thought processes around the need to balance these factors, something that investors may find valuable to explore in future engagements.

That said, very few companies in the S&P100 disclose the skills that they desire in board candidates. Only 4% of companies identified specific skills and attributes they have looked for retrospectively when appointing directors in the past year, and only 3% of companies elaborated on the specific skills and qualifications for which the board is currently searching in future appointments.

Similarly, companies trail in demonstrating how board capabilities can assist in the implementation of their business strategy. Last year, however, five companies in the S&P100 dataset demonstrated best practice in establishing the link between their business strategy and their director appointments, something not seen in the US market before.

Disclosure about why a candidate is chosen and how they could add value to the board can provide greater clarity for investors

More specific disclosure about why a particular candidate is chosen and how they will add most value to the board and business strategy can provide more clarity for investors on board effectiveness and ensure better informed voting decisions.

Board diversity

While nearly every company engaged mentioned the need to consider diversity in the director selection process, none of them publicly disclosed a diversity policymaking reference to specific goals and targets. During the PRI-coordinated engagement, some investors encouraged companies to make this disclosure, stating that they encourage high-level statements in proxy materials to be substantiated more concretely through a policy.

Although companies have begun to report on representation of women across career levels, including an indication of their commitment to gender diversity, they do not disclose voluntary targets at the board level.

Unlike in countries such as France, Spain and Norway, there are no quotas for female board representation in the US. However, the investor community has mobilised support to remedy the lack of diversity in company boardrooms. For instance, the 30 Percent Coalition has filed shareholder resolutions and engaged with public companies with no women on their board.

These engagement efforts appear to have been met with some success. Nineteen of the S&P100 boards had at least 30%of their seats filled by women directors in 2016 compared to 14 in the 2014 study. Progress beyond this 30 percent threshold was glacial, however, as the number of boards where women occupied more than one third of the seats rose by just one—from six boards in 2014 to seven in 2016—and the number of boards where women held at least one third of the directorships remained stuck at ten over the study period.

On a more optimistic note, the following case studies illustrate good examples of policies and diversity targets for hiring across the workforce, a nod towards some positive developments in company reporting on this issue.

Download the full report

-

Engaging on director nominations

June 2017

Engaging on director nominations

- 1

- 2

- 3

Currently reading

Results from US engagement

- 4

- 5