This section considers ESG engagement trends among fixed income investors before giving guidance on the practical aspects of bondholder engagement.

As well as the recommendations below, suggestions on developing an active ownership policy, assessing external managers and service providers, and disclosure can be found in the PRI’s Practical Guide to Active Ownership in Listed Equity.

Engagement trends among fixed income investors

PRI signatories are required to report annually on their responsible investment activities to ensure their accountability to the Principles as well as to the PRI initiative as a whole. A review of PRI reporting data from 422 investors who reported in 2017 indicates that, while fixed income engagement is still a nascent practice, it is growing in popularity. Many signatories engage, but they typically do so in relation to a small proportion of their total fixed income holdings. A much smaller number of signatories engage systematically across a large proportion of their fixed income portfolios.

In summary:

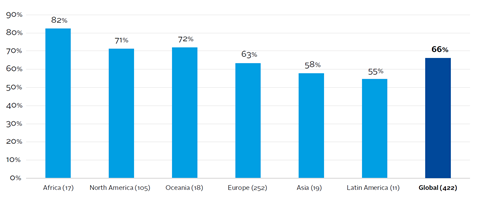

- 66% (or 279 signatories) of those 422 investors investing directly in fixed income markets and reporting on their responsible investment activities report that they engage with at least one type of issuer in their portfolios (see below).

- 71% and 63% of North American and European investors respectively report that they engage . more than any other region. Numbers for other regions are too small to draw meaningful conclusions.

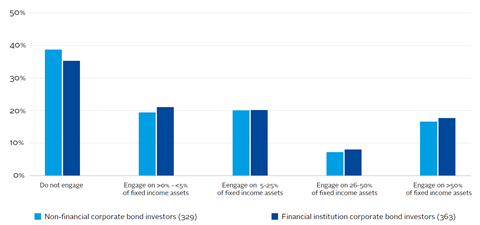

- 45% of North American investors and 40% of European investors concentrate their engagement efforts on up to a quarter of their total non-financial corporate bond holdings, compared with 19% and 23% respectively for engagement on over a quarter of assets (see Figure 3).

- 52% of North American investors and 60% of European investors engage on up to a quarter of their total financial institution bond holdings, compared to 27% and 17% respectively for engagement on over a quarter of assets.

Download the full report

-

ESG Engagement for Fixed Income Investors

April 2018

ESG engagement for fixed income investors

- 1

- 2

- 3

Currently reading

Engagement trends among fixed income investors

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12