| ORGANISATION DETAILS | |

|---|---|

| Name | Carmignac |

| Signatory type | Investment manager |

| Region of operation | Europe |

| Assets under management | €30bn |

| COVERED IN THIS CASE STUDY | |

|---|---|

| Sector | Utilities, technology, industrials |

| Geography | Global |

| Asset class | Equities |

| Environmental objective | Mitigation |

| Economic activity |

The fund as a whole encompasses all the activities listed on the taxonomy. However, this case study focuses on manufacturing of low carbon technology, centralised water treatment, production of electricity from wind power, production of heat/cooling from bioenergy, production of heat/cooling from gas and transmission & distribution of energy. |

Carmignac launched a fund in May 2020 to support solutions for climate mitigation while actively engaging with companies to transition their business models and operations to a lower carbon paradigm. One of the investment objectives of the fund is alignment with the EU taxonomy: “The fund seeks to invest at least 60% of its assets in companies contributing to climate change mitigation according to EU taxonomy standards”.

We are fully supportive of the EU taxonomy framework because it focuses on capital allocation to solutions for climate mitigation and adaptation, employing appropriate metrics, supporting transition and curbing investment in harmful activities. We have adopted a bottom-up approach, analysing companies’ management of risks across the value chain. The taxonomy should be instrumental in changing the investment mindset, encouraging positive action while ensuring industries are not excluded. Investors benefit from corporate clarity and transparency, and their recognition of areas for improvement.

Taxonomy implementation

Principles, criteria, thresholds

Step 1: Are these companies involved in any NACE activities?

We leveraged Bloomberg’s WATC EUTAX tool, to understand BICS mapping against the ten NACE categories. The Bloomberg data allocates the percentage of a company’s revenue associated with a NACE activity.

This helped scaled our process of identifying companies whose activities may be aligned to NACE based on their reported revenue.

Step 2: Verification of NACE activities and substation contribution

Bloomberg data relies on the allocation of revenue to the BICS code which is then categorised into NACE. Though the BICS code is relatively accurate, our analysis shows that some revenue may have been placed in unsuitable categories. We looked at company annual reports to better understand the business’ operations and product use. At this stage, we only considered revenue, unless capex data was available:

a) Analyse business segment revenue breakdown

b) Identify use of products and services

c) Review against ability to meet the threshold established in the taxonomy substation contribution

d) Revise % contribution to NACE

Do no significant harm assessment

Step 3: Controversies related to DNSH identified within NACE?

We leveraged Bloomberg and other ESG data providers like ISS ETHIX to individually verify controversies in terms of the significance of issues, whether they remain outstanding, whether they are material and how they relate to specific NACE DNSH. As each controversy has distinct characteristics and must be linked to a particular NACE specification this process was challenging.

Step 4: Does the company have policies and standards in place that reflect DNHS?

Companies must submit minimum safety standards corresponding to DNSH to NACE. We reviewed companies’ annual reports, sustainability reports, 10K filings, Global Reporting Initiatives (GRI) and product brochures to ascertain whether activities, products and services met these standards. European industry standards predominate, though they may not apply to companies that do not sell into Europe.

Social safeguards assessment

Step 5: Does the company violate international business norms, including OECD Guidelines for Multinational Enterprises?

We employed an ESG data provider to screen “severe” companies (red or high amber). We then leveraged our in-house business norms exclusion framework to determine if the issue was due to the company negligence, if it remained outstanding, and whether steps were taken to mitigate the violations.

’Red’ companies that failed the test were excluded from our investments. However, we actively engaged with “high amber” companies that failed the test before potential exclusion.

Turnover/capex/opex alignment

Due to data limitations we only considered turnover for this exercise. However, we made use of capex data, when available, to understand the outlook of renewables companies, particularly for those transitioning their business model.

We have also requested corporates to share their capex/opex information that aligns with the taxonomy.

Additional comments

Our in-depth knowledge of the three companies in this case study has allowed us to make some assumptions at this stage of the implementation process. We have adopted a mixed approach to reasoning — at times conservative, at other times ambitious.

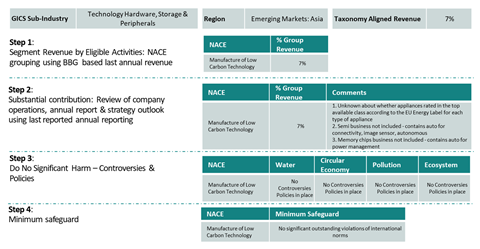

Company 1 - An electronics company whose overall strategy includes making microprocessor chips, crucial in the production of electric vehicles (EV). It was not clear to what extent the chips were exclusively installed in EVs, as opposed to non-electric vehicles. Therefore, we did not consider this part of their business. Moreover, we were not able to make out whether all their electrical appliances met the EU energy standard. The more robust approach we adopted was based on our understanding of the company and its focus on meeting the highest energy efficiency standards in order to remain a market leader.

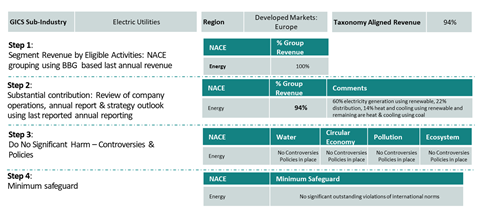

Company 2 – We reverse engineered the percentage of revenue from clean energy as the company, despite reporting on the heat output from thermal energy, lacked transparency in terms of its revenue reporting.

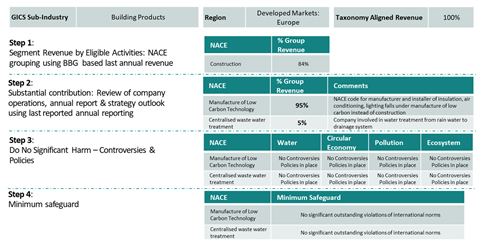

Company 3 – We believe the company’s sole product, insulation, does not correspond to NACE activities for buildings, as this encompass both building design and service. We were required to adapt the NACE activities, as insulation is a better fit for a low-carbon manufacture.

Alignment results

The Bloomberg framework was a good place to start. Our initial screen identified that 50% of our fund holdings corresponded to NACE activities. Further detailed analysis of the value chain and business segments increased this figure to 70%, in line with our expectations.

Due to the way NACE activities have been drafted we were required to reclassify certain activities from Bloomberg’s initial output.

Analysis overview

This is a section of the spreadsheet that captures our analysis. It shows our green investment universe of more than 600 companies globally across the value chain. We aim to continue to enhance our EU Taxonomy data.

| COMPANY NAME | GREEN ENERGY | GREEN BUILDING | GREEN MOBILITY | CIRCULAR ECONOMY | GREEN AGRICULTURE | ESG RATING | SHARE PRICE (lLOCAL) | BBG NACE | SUBS CONTR | DNSH | MIN SAFEGUARD PASS? | EU TAXONOMY COMPLIANT (MIN CONTRIBUTION) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Electronics company | Y | BBB | 46,200 | 7% | N | Y | Y - 7% | |||||

| Construction company | Y | AA | 57 | 84% | N | Y - 100% | ||||||

| Utilities | Y | AAA | 787 | 100% | N | Y - 94% |

Detailed analysis of the three companies

Taxonomy case 1

Taxonomy case 2

Taxonomy case 3

Challenges and solutions

| NO. | CHALLENGE | SOLUTION |

|---|---|---|

| 1 | Companies do not report like-for-like when matching to the taxonomy threshold, with a lack of information on individual products and final use. | Analysed the outlook of the company from recent capital markets performance, leveraging insight from analysts and company engagement. |

| 2 | Although Bloomberg NACE is a good place to start, there is a lack of clarity about the classification of some business activities. This could lead to variations in the approach of different financial market participants. | As above |

| 3 | DNSH information is challenging to locate. For example, an electronic appliances company did not report that all electronic appliances sold in a reporting year met the specific EU standards detailed in the NACE. | We made an assumption based on company size and geography of business revenue. However, this was a broad assumption; companies may also need to adhere to other standards, though this will be cost-dependent. |

| 4 | Not all NACE activities analyse the full value chain, such as materials, where some components for key green technologies are omitted. | We excluded materials, but included components in the calculation. However, were required to infer to what extent components were exclusively used in green technology. |

| 5 | Companies that do not sell into Europe or that operate outside of Europe are not usually required to meet EU standards for products, i.e. the requirement to report on the threshold specified in the EU Taxonomy. | We engaged with companies to verify whether their products and services met the standards. We also encouraged companies to reference the EU taxonomy and consider it for future reporting. |

Recommendations

Given the immaturity of reported data, we believe it is best to adopt a bottom-up approach. It is important to not only analyse the company’s annual report but to look individually at its product specifications to determine whether they meet specific EU standards. This is advisable not only from a taxonomy standpoint, but also in terms of product positioning. Products that do not meet these standards, or companies that are not transitioning to more efficient products, will lose market share to competitors.

It is a good idea to engage with companies, including those outside Europe, in relation to EU taxonomy reporting, drawing their attention to the importance of Account Managers (AM). For competitive reasons, companies are not always able to provide detailed individual product reports in terms of CAPEX or turnover. In these cases, a comprehensive understanding of the company and its market share is important.

Companies should be encouraged to talk about their challenges, i.e. DNSH does not only envisage reporting the positives, but also risks. Indeed, ESG awareness is about understanding how well a company is managing its stakeholders across the entire value chain.

There is value in nurturing an understanding of a company’s culture, regulatory environment and the industry in which it operates. This will avoid overburdening companies to report information that may not add value to the investment process.

Finally, as analysts, we should be equipped to make certain assumptions concerning companies’ operations.