Case study by Louise Dudley, Hermes Investment Management

General Mills faces significant exposure to water risk through its supply chain and own operations. It is therefore necessary for the company to manage water, which is critical to its long-term business success. ESG considerations are embedded throughout Hermes Global Equities’ investment process. We have developed a quantitative scoring system, the QESG Score, to assess companies.

Systematic analysis

The QESG Score is a ranking applied to each company, capturing the internal expertise of Hermes EOS and information from multiple external data sources to produce a single rating. It is weighted 50% to governance factors, and 25% to both environmental and social factors.

General Mills’ QSEG score was 87, ranking in the top decile of food products companies. Food products also rank better than other industry groups within consumer staples. Both rankings contribute to the overall company valuation and portfolio weighting decisions. Our optimistic view of General Mills from an ESG perspective positively impacts the corporate behaviour component of our valuation. From a fundamental perspective, the analysis confirms the company’s positive outlook and the investment decision is also consistent with our modelled conviction.

Qualitative research

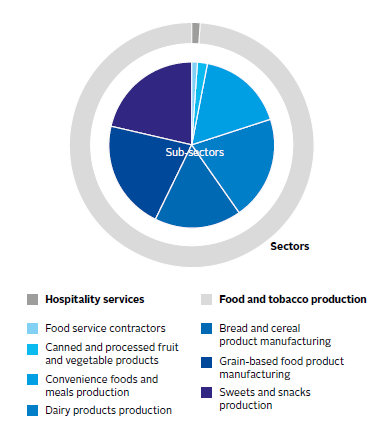

A fundamental bottom-up review of ESG issues complements the quantitative rating, leveraging our engagement with companies and providing a more recent profile of a company’s ESG performance. This sense check ensures that all relevant information is considered in the decision-making process. For environmental issues, including water, it is important to identify material issues based on industry exposure. We break down General Mills’ revenue exposure into seven business areas.

We then apply a framework identifying potential issues and key metrics.

Environmental risks/issues:

- Sustainable products

- Sustainable supply chain

- Sustainability of operations

- Management of risks associated with climate change (e.g. changes to water scarcity and effect on food sustainability)

Environmental metrics:

- GHG footprint and energy use

- Sourcing

- Waste

Water General Mills ranks better than peers across key metrics. This analysis is formulated with Hermes EOS, external data sources68 and from engagement meetings with the company.

Engagement meetings support our confidence in the company fs efforts to address water risk as a material business issue. The complexities of its water strategy and work to reduce risk to its business model from water stress was discussed. The company has developed in-depth assessments and measurement techniques for relevant watersheds, prioritising those that reduce water risk in its supply chain, such as in Mexico. Progress has been positive and we will continue to monitor performance.

Through a governance lens, the company shows leadership in water through:

- Top-level commitment: The company states that the leadership team is accountable for the global responsibility programmes and performance, meeting regularly and receiving input from internal and external experts.

- Policy commitment: The company has a water policy to respect ”safe and clean drinking water and sanitation as a human right that is essential for the full enjoyment of life and all human rights”, and to recognise the essential role of water to its business. It highlights water stewardship as integral to reducing operational environmental impact.

- Transparency and accountability: The company identified 10 priority ingredients for its sustainability strategy, accounting for over 40% of its annual spend on raw materials. Progress towards 100% sustainable sourcing for these ingredients is reported on annually.

Progress and success to date

The company is regarded as a sector leader across sustainability issues. Despite being named an AgWater Steward, General Mills’ disclosure to CDP Water scored a B for 2016. Areas for improvement are around water discharge and its manufacturing supply chain. Overall, notwithstanding recent price weakness, we have a positive outlook for the company. It is attractive based on free cashflow and future margin growth expectations as well as trading at a significant discount to peers. The company has also delivered sustained dividend growth, which is expected to continue.

Download the full report

-

Investor guide on water risks in agricultural supply chains

March 2018

Growing water risk resilience: an investor guide on agricultural supply chains

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

Currently reading

Currently readingCase study: Integrating water stewardship - General Mills

- 12

- 13

- 14

- 15

- 16

- 17