By Hamish Stewart, Senior Associate, Climate Change, PRI

The PRI introduces the Investor Climate Action Plans Expectations Ladder in advance of an upcoming webinar with expert guidance from UNEP FI and Asset Owner Alliance members who have already started their decarbonisation journey. for the webinar on 20 July and read on for a preview of what the Expectations Ladder offers investors.

Net zero investor pledges and calls to action continue to increase in ambition and volume every week as we head towards COP26. Turning these ambitions into reality will require focused leadership across the financial sector. The necessary leadership to turn pledges into action is beginning to emerge. The Net Zero Asset Owner Alliance, pioneers in the push for bolder action, now has over 40 members, while the Net Zero Asset Managers Initiative (NZAMI) has 129 signatories with $43 trillion in assets under management. Last month, over 450 investors managing more than US$41 trillion in assets issued a bold letter to governments on the need for climate action. As more forward-looking global investors pledge to align their portfolios and stewardship activities with the Paris Agreement, many are working to understand how these bold commitments can be achieved in a structured way across asset classes.

A systematic transition to net zero emissions requires change

Operationalising climate targets is challenging for all investors and therefore, the Investor Agenda has developed the Investor Climate Action Plans (ICAPs) Expectations Ladder. The ladder is inclusive and meant for all investors wherever they are at on their climate change journey. It also provides a summary of actions identified over four tiers, enabling all investors to benchmark their progress. The four tiers are designed for use by investors who may be beginning to consider climate aligned strategies (Tier 4) and also by those who are already setting the global best practice standard for portfolio and real economy decarbonisation in line with Paris Agreement pathways (Tier 1). The process of creating and implementing these strategies will support all investors to take meaningful steps to decarbonise their portfolios and the real economy.

The ICAPs Expectations Ladder defines opportunities for investor action across four interlocking areas - investment strategy, corporate engagement, policy advocacy and investor disclosure, and also examines governance. It provides a framework for investors who want to create a comprehensive climate action plan that enables progress on their net zero targets, such as those agreed upon by the Net Zero Asset Owners Alliance and the Net Zero Asset Managers Initiative. Significantly, the ladder identifies the need for lobbying alignment and for investors to consider how their own public affairs engagement and trade association interaction with governments can have a transparent and positive impact on progress towards high-level decarbonisation goals.

No new fossil fuel investments

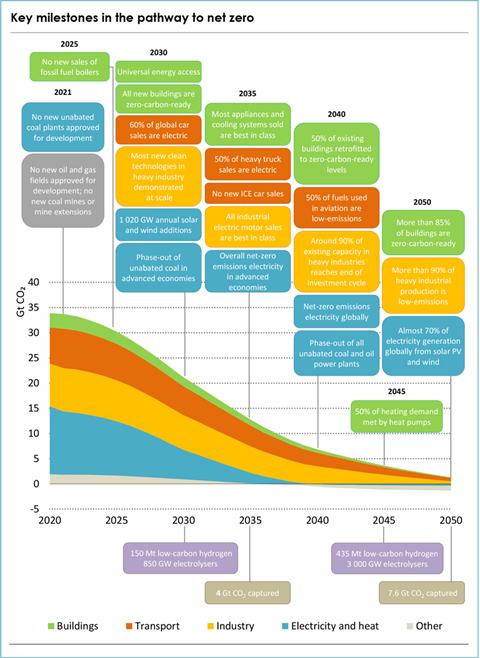

An accelerated transition to net zero implies stark choices for investors. The ICAPs Expectations Ladder provides a structured framework about goal setting and the application of net zero investment principles across the four areas depicted in Figure 1. A structured approach will be necessary to guide investors through an historically unprecedented energy transition. The IEA is clear about the scale of change from business as usual that a net zero transition requires:

“Beyond projects already committed as of 2021, there are no new oil and gas fields approved for development in our [Net Zero] pathway, and no new coal mines or mine extensions are required. The unwavering policy focus on climate change in the net zero pathway results in a sharp decline in fossil fuel demand, meaning that the focus for oil and gas producers switches entirely to output – and emissions reductions – from the operation of existing assets.”

- Net Zero Roadmap report, International Energy Association (IEA)

The IEA’s Roadmap and other asset owner-led frameworks are clear that the net zero transition pathway will require a ramping up of investor stewardship activities to ensure that companies in energy intensive sectors are adjusting capital allocation and operational planning in line with these targets.

Forceful stewardship to enable the net zero transition

Stewardship and engagement are key in ensuring that investor climate goals are reflected in the real economy. Only a handful of companies dominate the global energy, transport and materials sectors and these sectors are a good place to start. Work by Climate Action100+ to request management teams to provide net zero business transition plans is raising the ambition for action. This extends to investor requests to bring in new board expertise as seen at Exxon Mobil’s AGM this year. Due to the Exxon vote, investor demands for board refreshment and new climate expertise to guide company-level transitions in line with net zero goals are expected to ramp up. As investor stewardship becomes more forceful, benchmarking progress will require clear metrics and near-term timelines, such as the Net Zero Asset Owner’s Alliance 2025 target-setting protocol. A combination of stewardship that empowers companies to act on the net zero transition and clear metrics on issues such as carbon price stress-testing of business models can enable real progress. The ICAPs are a useful tool for operationalising this process across large global investment organisations in a timely manner and are designed for use by asset owners and asset managers in partnership with service providers.

The ICAPs will be presented via a webinar on 20 July with expert guidance from UNEP FI and the Net Zero Asset Owner Alliance members who have already started their decarbonisation journey. Register here to learn how investors can use the ladder to reinforce existing efforts and scale up a systematic approach to climate action across an organisation.

This blog is written by PRI staff members and guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase some of our research and other work that we undertake in support of our signatories.Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.If you have any questions, please contact us at [email protected].