Speakers

- James Robertson, Head of Asia (ex-China & Japan), PRI

- Daniel Gallagher, Senior Lead, Climate Change, PRI

- Amy Krizanovic, Head of ESG, Magellan Asset Management Ltd

- Liza Jansen, Head of Responsible Investment, Prudential Plc

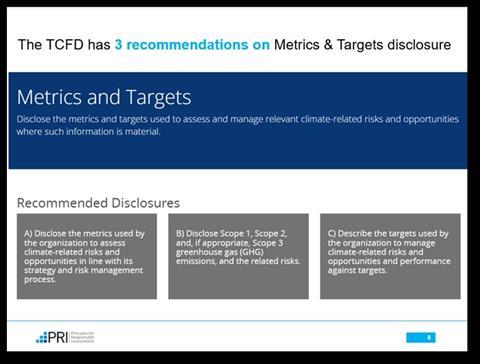

The disclosure of metrics and targets by investors is one of the TCFD’s four pillars of recommendations around climate-related risk, noted Daniel Gallagher, Senior Lead, Climate Change, PRI, in opening the session. Outlining the TCFD’s seven broad categories for cross-industry metrics, Gallagher then reflected on the state of play for investors.

“Without meaningful metrics, it is difficult for investors to assess the progress made toward stated targets,” he noted, before highlighting different types of metrics investors can find useful including engagements, net zero alignment and climate financing.

Amy Krizanovic, Head of ESG, Magellan Asset Management Ltd, discussed the evolution of the organisation’s approach to climate and metrics, noting it has been guided and supported by investor groups and responsible investment organisations. Alongside the broad array of climate metrics used, Krizanovic also gave a frank assessment of the challenges around some measures. Across metrics, targets and resources, she noted the importance of using a broad range of sources to inform decisions and actions.

“Just get started,” was Krizanovic’s advice to investors considering the use of climate metrics and targets, before reflecting on the process of investment strategy integration at Magellan. This included three short case studies of how engagement from Magellan helped investee companies to progress performance around climate.

Liza Jansen, Head of Responsible Investment, Prudential Plc, highlighted the organisation’s commitment to sustainability, including its net zero targets. She charted the asset owner’s TCFD milestones in recent years, along with the process taken around metrics and targets: review metrics; monitor internally; report externally; and target setting. Jansen provided a case study around a key metric used and reported externally by Prudential PLC, namely the Weighted Average Carbon Intensity (WACI) of the investment portfolio.

Jansen also shared lessons learned during the process including: monitor market standards but choose metrics and targets that work for your organisation; unintended consequences of metrics (what gets measured gets managed); build an external narrative; and raise awareness around target setting that the world is not on target to meet the goals of the Paris agreement.

Echoing a theme shared by Krizanovic, Jansen noted that the most important thing is simply to get started! “Harnessing experience empowers you to meaningfully exert power on stakeholders,” she concluded.

Session host and moderator James Robertson, Head of Asia (ex-China & Japan), PRI, thanked speakers and reminded participants of replays of recent sessions and dates for future sessions in the Climate Risk Series for APAC, which are noted below.

Climate Risk Series (APAC) replays and dates on BrightTalk:

- Governance and risk (8 February)

- Strategies and scenarios (29 February)

- Metrics and targets (14 March)

- Net zero initiatives and implementation (20 March)

- Net Zero Transition Plans (22 April)