Mirabaud Asset Management

Signatory type: Investment manager

HQ location: Switzerland

AUM: CHF 9.7bn as at FYE 2021

Covered in this case study

Asset class: Fixed income (and equity from 2022)

Sector: Electric utilities

Sustainability has always been an integral part of Mirabaud Asset Management’s investment decision-making, building on over 200 years of taking the long view. We strive to offer our clients sustainable and risk-adjusted returns by interweaving financial and extra-financial considerations.

Why we invest in energy-intensive companies

Decarbonisation has become an important theme for investors wanting to invest capital in sustainable, long-term assets. We firmly believe the optimal asset allocation strategy to support the energy transition is to invest in energy-intensive companies that demonstrate a willingness to shift their business models and develop alternative energies. The business models of high emitters are directly linked to the persistent high levels of greenhouse gas (GHG) emissions released in the atmosphere; these companies will inevitably play a key role in the transition to a low-carbon economy. Therefore, when setting our net-zero strategy, we believe in engagement with high emitters rather than divestment.

How we manage energy-intensive investments through engagement

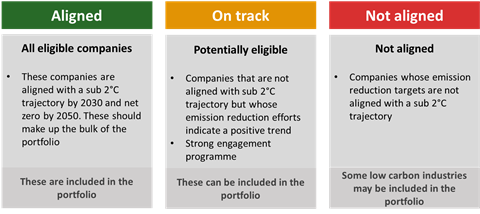

The company assessment and engagement approach described below has been used in the management of the Mirabaud – Global Climate Bond Fund. The fund takes a hybrid approach by investing not only in labelled green bonds, which make up more than half the portfolio, but also in transition bonds. Issuers of transition bonds are assessed based on their emissions pathways and alignment with the Paris Agreement. The screening is undertaken by combining data from service providers, internal research and industry organisations. We use the Trucost Paris Alignment Dataset (S&P Global) which aggregates the emissions pathways of portfolio holdings based on their climate targets and historical emissions pathways. Insights from market industry leaders, such as the Science-Based Targets initiative (SBTi), Transition Pathway Initiative and CDP, are factored into the analysis of portfolio holdings. Based on the results, we assign an overall temperature alignment status: Aligned, On track, and Not aligned (Figure 1).

Figure 1: Temperature alignment status

Companies with aligned pathways or verified climate targets make up the bulk of the portfolio. The emissions pathways of on track issuers are between 2 and 3°C, or above 3°C, but with considerable emissions or intensity reduction over the last five years. On track issuers are high emitters showing efforts to align and can be included in the portfolio with a systematic engagement programme. Not aligned, carbon-intensive companies where we see no prospect for meaningful engagement cannot be invested in. This category also includes companies in low carbon industries that do not require significant decarbonisation. Their eligibility in the portfolio is considered case by case.

Our portfolio managers invest in transition bonds issued by companies operating in carbon-intensive sectors that have credible ambitions to reduce their carbon emissions and environmental impact over time. Alongside the SRI team, portfolio managers engage in dialogue with these high emitters to understand how climate change is integrated into their business strategies.

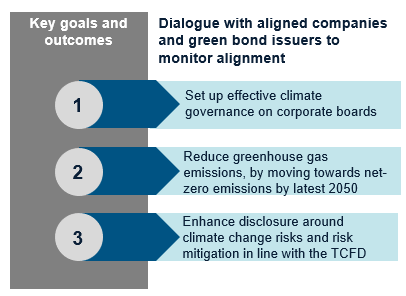

A dedicated engagement programme is in place to track and monitor the 2°C alignment of the portfolio. We use engagement as a platform to share expectations with companies and understand their climate change management strategies and how these can be improved. We prioritise dialogue with energy-intensive companies, seeking to encourage these issuers to set up effective climate governance, reduce GHG emissions, and enhance disclosure.

Figure 2: Engagement pillars

An internal climate scorecard (Figure 3), as currently used in the Mirabaud – Global Climate Bond Fund) allows us to monitor the progress of on track issuers and informs our engagement framework. Relevant KPIs that we assess include target validation with the SBTi and historical GHG emission trends. Based on the results, issuers are assigned a final score that determines the extent to which they are on track to meet the Paris Agreement target of keeping temperature increases to well below 2°C compared to pre-industrial levels. The scorecard is reviewed to integrate new climate solutions, taxonomy alignment, nature-based climate impacts and other climate-related issues.

Figure 3: Excerpt from a climate scorecard

| Sector: Electric Utilities Date of assessment: August 2022 | |||

|---|---|---|---|

| Criteria | Assessment | Notes and comments | |

| 1 | Forward looking emissions data | ||

Has the Company adopted emission reduction targets covering Scope 1, 2 and 3 emissions consistent with below 2C of warming?

|

1.5-2°C | The company aims to achieve the Paris net-zero emission targets by 2050 | |

| 2 | Has the Company adopted interimediate emission reduction targets in line with Paris Agreement? Or has interim plans to increase its green revenues share?

|

Partial | The company is re-configuring its generation fleet by developing renewable projects. For the first time, the company has also disclosed quantifiable climate targets. |

| 3 | Has the Company committed to aligning climate targets to the SBTi? | Yes | In August 2022, the company announced their commitment to validate their climate targets with the Science-Based Targets initiative. |

| 4 | Have Company climate targets obtained SBTi validation? | No | No validation obtained to date. |

| 5 | Historical data | ||

| Has the company experienced significant emissions reduction since 2012? (Scope 1 & 2) | Yes | 45% reduction in emissions between 2016 and 2020 | |

| 6 | Latest CDP Score (2021) | CDP Score F | We are lead investors for the 2022 CDP Non-Disclosure campaign and asked the company to submit a response to the CDP climate change questionnaire. The company has confirmed their intention to do so in the 2022 reporting window. |

| 7 | Climate change awareness and accountability | ||

| The issuer has a public note/policy/statement on climate change that commits them to addressing the issue, or to reducing or avoiding their impact on climate change (e.g. to reduce emissions or improve their energy efficiency). | Yes | The company’s climate strategy has been updated in 2022. | |

| 8 | Clear board or board committee oversight of climate change, or if they have a named individual/position responsible for climate change at board level | Yes | The company has created a new Sustainability Department, which reports to the board. A sustainability committee has also been established, with representation from top management. |

| 9 | The issuer details how they incorporate climate change risks and opportunities in their strategy (mitigation, new products, R&D, etc.), and if they disclose the impact of climate change risks and opportunities on financial planning (OPEX, CAPEX, M&A, debt) | Yes | CAPEX plans to increase renewable fleet generation. Climate scenario analysis to be disclosed in 2022. |

| 10 | The issuer aligns climate performance with executive pay and remuneration | No | No climate KPIs disclosed to date in executive variable pay schemes |

| TOTAL ASSESSMENT | On Track | ||

As companies develop energy transition plans, we will continue to hold regular dialogue with transitional bond issuers and high emitters to ascertain how their climate trajectories are evolving in line with emissions pathways published by GEVA (Greenhouse Gas Emissions per Value Added) and SDA (Sector Decarbonization Approach, by SBTi). Through the engagement program, we will keep monitoring the robustness of climate strategies. Over time, using data from our service providers and assessing outcomes of engagement meetings, we will be in a better position to identify those issuers with appropriate commitments to align themselves with a just and sustainable transition.

From 2022, and as part of our net-zero target setting, we are scaling our climate engagement framework across our full range of products, including fixed income, equities and convertibles. The augmented engagement process will consider KPIs currently monitored through our climate scorecard to support energy-intensive companies in aligning their emissions pathways and achieving a sustainable low-carbon economy.

Example: Engagement outcomes in electric utilities

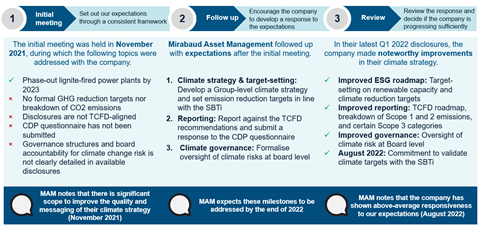

As part of our engagement framework, we engaged with a southern European utility held in the Mirabaud – Global Climate Bond Fund. The issuer was categorised as on track given its significant emission reductions between 2016 and 2020 – a 45% decline in tonnes of CO2 equivalent. During the engagement process, the company demonstrated a strong willingness to develop low-carbon roadmaps and forward-looking metrics.

Based on the assessment conducted in 2021, we noted that the company could improve the quality and messaging of its climate strategy. Climate disclosures in its sustainability report indicated that the company was behind other industry peers in managing climate risk. Relevant shortcomings included no breakdown of Scope 1, 2 and 3 emissions nor TCFD alignment, no climate targets, and no board oversight of climate risk.

After the engagement meeting, we followed up with the issuer to set out expectations and tackle material shortcomings. We were pleased to observe an above-average responsiveness to our demands; the latest sustainability report – released in Q1 2022 – showcased noteworthy improvements (Figure 4), which are in line with the Mirabaud – Global Climate Bond’s engagement pillars (Figure 2). As a result of the improvements listed below, the company’s rating in our climate scorecard increased.

Improved ESG roadmap: As part of the 2022-2026 business plan, the company is developing renewables projects and decommissioning lignite units. For the first time, it committed to reducing CO2 emissions by 40%, 57% and 78% by 2022, 2023 and 2024 respectively (2019 baseline).

Improved reporting: For the first time, the company published TCFD-aligned disclosures and Scope 1 and 2 emission figures. Reporting on indirect Scope 3 emissions will be completed in the near future. Materially significant Scope 3 categories for utility companies, including fuel and energy-related activities, have been disclosed.

Improved governance: The company created a sustainability department that reports to the board. A Sustainability Committee has also been established, with representation from top management.

Figure 4: Climate engagement outcomes at a southern European utility

Going forward, we will keep reviewing how the company sets intermediate milestones to achieve its climate targets. For instance, we encouraged the company to provide CDP data and were pleased to see their first submission of the CDP climate change questionnaire in the 2022 reporting window.