Climate (or climate-aligned) bonds refer to labelled and unlabelled bonds for which proceeds are intended to finance projects and activities that contribute to a low-carbon and climate-resilient economy.

Green bonds refers to explicitly labelled bonds for which the proceeds will be exclusively used to finance, or re-finance (in part or in full) new and/or existing eligible green projects within four core components (use of proceeds; process for project evaluation and selection; management of proceeds; reporting)13.

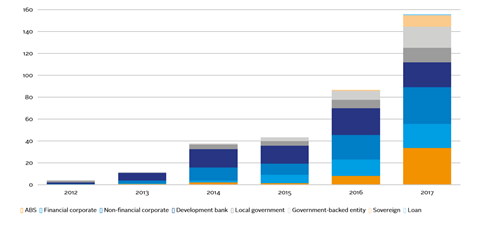

According to the Climate Bonds Initiative (CBI) State of the Market Report 2017, more than 3,000 bonds have been issued across seven climate themes (transport, energy, multisector, water, buildings and industry, waste and pollution, agriculture and forestry). A few facts about the universe:

- The climate-aligned bond universe featured US$895 billion outstanding at the end of 2017, representing an increase of US$201 billion from the 2016 figure. This total is comprised of unlabelled climate-aligned bonds at US$674 billion and labelled green bonds at US$221 billion.

- Low-carbon transport was the largest single sector, accounting for US$544 billion (61%), followed by clean energy at US$173.4 billion (19%).

Issuers

As well as development banks and corporate issuers, sovereign issuers have also entered the fray over recent years (including France, Belgium, Hong Kong, Indonesia, Poland, Nigeria and Fiji), contributing to a general widening and deepening in the opportunity set available for fixed income investors across developed and developing markets (see below).

Green and climate-aligned - what’s the difference?

Labelled green bonds: Bonds labelled as green by the issuer and are financing green assets and projects and form the basis of green indices.

Climate-aligned bonds: This label is increasingly used to refer to bonds that are financing green/climate assets that help enable a low-carbon economy but have not been labelled as green by the issuing entity.

Labelled green bonds are primarily issued by diversified companies, whereas the unlabelled portion of the climate-aligned universe is mostly pure-play issuers.

Source: Climate Bonds Initiative, State of the Market, 2017

Investment characteristics

While the issuance size is still small compared to broader market issuance, the market is deep enough to have supported the emergence of a number of dedicated green bond funds. While it is too early to assess the return performance and climate-related impacts of these funds, rating agency Fitch observed that nine of the first green bond funds will reach a three-year track record in 201815. Some of the typical characteristics of these funds are summarised below.

Investment characteristics of green bond funds

| Investment objectives | “Return on investment, through a combination of capital growth and income…where the proceeds are used to fund projects with direct environmental benefits.” |

|---|---|

| Investment horizon | Five+ years |

| Regions | Global, typically around 10% allocated to developing markets |

| Benchmarks | Examples include Barclays Global Green Bond 100%, Barclays MSCI Green Bond Index, BofA Green Bond Index |

| Fees | Typical of other bond funds |

| Credit rating | Predominantly investment grade, average AA2 |

| Number of holdings | >50 |

| Maturity | Five - seven years |

| Sectors | Dominated by agencies, supranational, utilities, financial institutions |

| Risk indicators | Most funds assess the risks at 3 on a scale of from 1 (low) to 7 (high) |

| Link to mitigation of climate-related risks and capturing new opportunities |

In accordance with the ICMA Green Bond Principles, green bond funds do not need to demonstrate a specific link to climate mitigation, although there is a commitment to demonstrate direct environmental benefits. Some funds provide a breakdown on environmental projects as part of their reporting at a high level16. This highlights the need for investors to support the labelling of green bonds to evaluate alignment with the low-carbon transition in a way that can more precisely be linked to climate mitigation outcomes. This would also support investors in their efforts to seek transparency and disclosure in line with the TCFD recommendations |

Examples

- World Bank/International Finance Corporation and Amundi green bond fund attracts institutional investment. The largest green bond fund to date raised US$1.4 billion, including investments from development banks, investment managers, insurance companies and pension funds (Alecta, AP3, AP4, APK Pensionkasse and Vorsorgekasse, ERAFP and Credit Agricole Assurances).

- Public pension funds CalSTRS, AP2, AP3, UNJSPF and California State Treasurer were early supporters of green bond market. The 2008 World Bank (IBRD) green bond of US$130 million attracted public sector pension funds including the US pension fund CalSTRS, Swedish pension funds AP2 and AP3 and the United Nations Joint Staff Pension Fund. Since the first bond, these and other investors have participated in purchasing green bonds from other issuers as the market has grown.

- Zurich Insurance Group invests more than US$2 billion in green bonds. Nearly 30% of the group’s investment portfolio is in government or supranational bonds. Zurich hopes that its contribution can have the additional benefit of developing scale and liquidity in the green bond market and encourage new issuers to come to market, while promoting robust and transparent project selection and the reporting standards for impact.

- US firm Bank of America Merrill Lynch joins in corporate green bond issuance and sets ten-year goal to reach US$50 billion of environmental business. The proceeds are used to finance renewable and energy efficiency projects via loans and credit lines. Investors include State Street Global Advisors, TIAA-CREF, CalSTRS and AP4.

How to invest in the low-carbon economy

- 1

- 2

- 3

- 4

- 5

Currently reading

Currently readingGreen and climate-aligned bonds

- 6

- 7

- 8