Evaluating portfolio exposure to climate change risk and opportunity, and reviewing portfolio emissions, are practical starting points for addressing climate change.

Climate change risk and opportunity refers to how well-positioned the investment portfolio is for risks such as water scarcity, and for investment opportunities such as energy efficiency. Portfolio emissions refer to the actual or estimated emissions of companies held within the investment portfolio. There are different approaches for assessing exposure including:

Sector analysis

How can it help?

This can identify exposure to high-carbon sectors and assess individual company performance on an absolute and relative basis, as well as on their ability to manage climate change-related risk. Sector analysis focused on physical climate risk would evaluate risks associated with the physical impacts from climate change that could impact companies. For example, these could include operational risks and the costs of physical damage from wildfires, significant flooding or drought.

UNEP FI and WRI’s 2015 publication, Carbon Asset Risk Discussion Framework12, focuses on three carbon risk factors: policy and legal, technology and market/economic:

- Policy and legal risk: policies or regulation could impact the operational and financial viability of companies an asset owner invests in.

- Technology: development in the commercial availability and cost of alternative and low-carbon technologies could impact a company fs choice of technology and costs, for example.

- Market and economic: changes in market or economic conditions, could impact companies, such as changes in consumer preferences or in fossil prices.

As a practical example of sectoral analysis, a portfolio manager interviewed for this paper explained that in fixed income analysis, she considers how well sectors are positioned to withstand or respond to:

- Physical impacts of a changing climate on business operations or strategy;

- Impacts on prices of resources e.g. energy, water, raw materials;

- Product development incorporating low carbon opportunities;

- Regulation impacting on business operations in specific markets; and

- Impacts on the cost of capital or ratings of issuers and on company reputations.

Stranded assets analysis

How can it help?

Applied to fossil fuel companies, this can assist in analysing the implications of not adjusting investment in line with what is needed to limit global warming.

The Carbon Tracker Initiative’s definition of stranded assets is: ”fossil fuel energy and generation resources which, at some time prior to the end of their economic life (as assumed at the investment decision point), are no longer able to earn an economic return (i.e. meet the company’s internal rate of return), as a result of changes in the market and regulatory environment associated with the transition to a low-carbon economy”.

Stranded risks include regulatory stranding due to change in policy or legislation; economic stranding due to a change in relative costs/prices; and physical stranding due to flood or drought. Asset owners can work with portfolio managers or providers to analyse exposure to stranded asset risks.

Portfolio emissions and clean footprinting

How can it help?

A portfolio carbon footprint, the sum of a proportional amount of each portfolio company’s emissions (proportional to the amount of stock held in the portfolio), can quantify emissions associated with portfolio holdings.

It enables an asset owner to compare portfolio emissions to global benchmarks, identify priority areas for reduction including the largest carbon emitters and most carbon intensive companies, and track progress. It can be used as a tool for engaging with portfolio managers and companies on emissions risks and reporting. It can also be used to inform further action on climate change.

There are limitations, as unlisted assets are not yet fully covered, companies do not sufficiently disclose data including forward-looking information, scope 3 emissions may be excluded and different estimation methodologies exist. Therefore, it needs to be complemented by discussion with portfolio managers and companies, particularly where data is less reliable.

For a full evaluation and asset owner case studies of use and disclosure, see the carbon footprinting section in the phase 1 discussion paper of this project.

In 2015, Dutch healthcare pension fund PFZW, committed to increasing sustainable investments fourfold to 12% of assets and reducing the carbon footprint of its entire portfolio by 50% by 2020. Sustainable investments will include direct investments in green energy, clean technology, food security and water access. The footprint will be halved by comparing companies in each sector, picking the best performers and divesting from companies with the highest CO2 emissions. The fund will also engage with companies to lower their CO2 emissions.

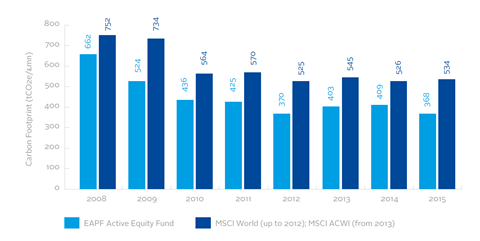

ABP, the Dutch civil servants’ pension fund, has in 2015 committed to a 25% reduction in greenhouse gas emission and doubling of investment in renewable energy and environmentally friendly technologies by 2020. The UK’s Environment Agency Pension Fund has reduced the fund’s carbon footprint by 44% on the combined active equities since it began carbon foot printing in 2008 (31% less than the benchmark for 2015). The fund has also reduced its active corporate bond carbon foot printing by 42%15 since starting to measure it in 2011 (48% less than its index for 2015). See the figure below.

The Montreal Carbon Pledge and the Portfolio Decarbonization Coalition

Two initiatives focused on understanding portfolio emissions are the PRI Montreal Carbon Pledge and UNEP FI’s Portfolio Decarbonization Coalition:

The Montreal Carbon Pledge commits signatories to measuring and disclosing a portfolio carbon footprint, with over 100 investors and US$8 trillion in AUM having endorsed the pledge to date.

The Portfolio Decarbonization Coalition commits members to two interconnected targets: measuring and disclosing the carbon footprint of US$500 billion of assets under management and committing US$100 billion to decarbonization. There are nearly 20 coalition members. The Montreal Carbon Pledge is the delivery mechanism for the carbon footprinting component of the Portfolio Decarbonization Coalition. Both initiatives are open to asset owners and investment managers.

Low-carbon exposure

Low carbon investments can be considered as “hedge” against high carbon investments. Low carbon investments can involve risk though, including policy and technology change, which needs to be evaluated. Asset owners can work with portfolio managers or providers to identify companies in the portfolio that derive a significant portion of revenues from, for example, clean tech, energy efficiency and green buildings.

Quantitative investment modelling: Risk assessment can draw on quantitative investment modelling incorporating climate change, including asset class sensitivity over 35 years, as in the modelling provided by Mercer in its 2015 study, Investing in a Time of Climate Change. This study looks at risk factors associated with technological developments, resource availability, the impact of a changed climate and policy decisions. It includes consideration of scenarios, as well as sensitivity of regions, assets and sectors.

The UK Environment Agency Pension Fund’s 2015 Policy to Address the Impacts of Climate Change is an example of an asset owner using risk analysis, carbon footprinting, low-carbon exposure and investment modelling. The policy commits to ensuring the investment portfolio and processes are compatible with 2°C. It includes a target of 15% of the fund invested in low carbon, energy efficient and other climate change mitigation opportunities. It also includes a decarbonisation target for the fund’s equity portfolio; reducing the fund’s exposure to “future emissions”* by 90 per cent for coal, and 50 per cent for oil and gas by 2020 (compared to the exposure in the underlying benchmark as at 31 March 2015).

Download the full report

-

Developing an asset owner climate strategy

November 2015

Developing an asset owner climate change strategy

- 1

- 2

Currently reading

Step one: measure

- 3

- 4

- 5

- 6

- 7