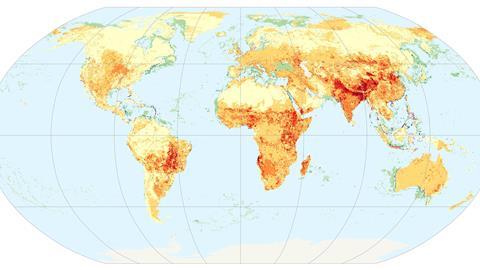

The PRI and UNEP-WCMC have developed maps to showcase hotspots of relative natural capital depletion on a global scale, available for visualisation in ENCORE – an interactive, online tool that highlights how businesses may be exposed to accelerating environmental change.

The concept of natural capital risk has been gaining traction within the finance sector. As natural capital is depleted, it loses its capacity to support the ecosystem services upon which businesses, economic activities and broader society depend. Through responsible stewardship of natural capital, businesses have opportunities to reduce those disruptions and associated risk in regions in which they operate. Financial institutions are in turn exposed to, and have a role in facilitating, both negative and positive outcomes associated with natural capital.

ENCORE

ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure) helps users better understand and visualise the impact of environmental change on the economy. By focusing on the goods and services that nature provides, and which enable economic production, it guides users in understanding how businesses across all sectors of the economy depend and impact on nature, and how such dependencies and impacts can represent a business risk.

The PRI has published an accompanying test case, providing an example how investors can use the ENCORE tool to identify potential portfolio exposure to natural capital depletion.

Explore the tool Read the test case

The interactive maps that the PRI and UNEP-WCMC have developed can help investors identify potential portfolio exposure to natural capital depletion. When using the maps, investors should consider the risks that hotspots present to businesses in two particular instances:

- When a large proportion of an ecoregion or habitat overlaps with a hotspot of natural capital depletion, it threatens the ecological balance and the ecosystems’ ability to deliver services. This is particularly relevant if a business depends on the natural capital asset for which the hotspot has been identified, as the business activities will be at higher risk. However, there would also be the opportunity to mitigate the depletion of those assets.

- When hotspots of all four types of natural capital asset overlap, it increases the risk of disrupting ecosystem services. A wider range of business activities will be affected in these areas.

A briefing note summarises the methodology behind the maps.

The PRI/UNEP-WCMC analysis covers four terrestrial natural capital assets:

Four terrestrial natural capital assets:

- Atmosphere

- Water

- Soil and sediment

- Biodiversity

Atmosphere

Hotspots are found in:

- Eastern Europe

- South/South-East Asia

- the Middle East

Water

Hotspots are found in:

- sub-Saharan Africa

- the Indian subcontinent

Soil and sediment

Hotspots are found in:

- the Amazon basin

- the horn of Africa

- Scandinavia and Russia

- the Indian Subcontinent

- South-East Asia

Biodiversity

Hotspots are found in:- the Great Plains in North America

- the Southern cone of South America

- Southern Africa

- Central Asia and Australia

The analysis also compares the location of marine natural capital assets with the location of cumulative human pressures that may deplete those stocks:

Location of marine natural capital assets

including:

- marine sediment carbon

- coral reefs

- cold corals

- seagrasses

- mangroves

- saltmarshes

- tidal flats

- seamounts

- cold seeps

- hydrothermal vents

Hotspots of human pressure

including:

- land-based pollution

- fishing

- climate change

- commercial shipping

- invasive species

Potential depletion of marine natural capital

Hotspots are found in:

- in South-East Asia: the South China Sea, Sunda Shelf, Indonesian through-flow, Andaman, Bay of Bengal, Western Coral Triangle

- the Red Sea

- in the Caribbean: Tropical North-western Atlantic, Inter American Seas

- the Northern European Seas

As natural capital is depleted, so is its capacity to deliver ecosystem services upon which businesses and economic activities depend. Changes in natural capital, such as declines in soil quality and provision of freshwater, as well as the loss of biodiversity, create risks and outcomes for businesses. Businesses both depend on, and impact, natural capital, and are therefore inherently linked to the depletion, maintenance and regeneration of natural capital.

The 2020 World Economic Forum Nature Risk Rising report shows that over half of the world’s total gross domestic product is moderately or highly dependent on natural capital.

Through ENCORE, financial institutions can understand their impacts and dependencies on natural capital through the sectors they invest or lend to.

Downloads

Mapping natural capital depletion - test case

PDF, Size 0.33 mb